Bitcoin all-time high prices have captivated traders, investors, and enthusiasts alike, especially in the volatile world of the cryptocurrency market. As of October 20, 2025, Bitcoin is trading at an impressive $110,815, yet it still remains 11.9% shy of its previous record peak of approximately $126,000 reached on October 6, 2025. This recent all-time high has sparked renewed interest not only in Bitcoin but also in other major players like Ethereum and XRP, as they strive to reach their own historic marks. While Bitcoin’s rise signifies strength in the market, the fluctuating values of top crypto coins, including Dogecoin and BNB, continue to paint a complex landscape for investors. As we explore the highs and lows of these digital assets, the question remains: will Bitcoin reclaim its all-time high and lead a resurgence across the Bitcoin ecosystem?

The peak price of Bitcoin has become a topic of intrigue among financial pundits and crypto aficionados, igniting debates within the broader cryptocurrency sphere. Known for its thrilling ascents and dramatic declines, Bitcoin’s performance often sets the tone for the entire market, influencing other cryptocurrencies like Ethereum and Dogecoin. Observers closely monitor the market dynamics, hoping to uncover Bitcoin and Ethereum all-time high potentials while considering various price predictions for XRP and other notable coins. As we dissect the price analysis of leading cryptocurrencies, it’s clear that the pursuit of these lofty highs fuels traders’ aspirations. Ultimately, the evolution of digital currencies remains an unpredictable yet exhilarating journey, with many eagerly anticipating significant milestones ahead.

The Bitcoin All-Time High: Analyzing Recent Trends

As of October 20, 2025, Bitcoin (BTC) is trading at approximately $110,815, representing an 11.9% drop from its recent all-time high (ATH) of $126,272 reached on October 6, 2025. The volatility in the cryptocurrency market is a familiar pattern, often driven by both external economic pressures and internal market dynamics. Factors such as regulatory news, technological advancements, and macroeconomic trends significantly influence the price movements of Bitcoin, leading to rapid ascents and occasional pullbacks. This particular downturn highlights the fierce nature of crypto trading, where market sentiment can shift dramatically in just days or hours, affecting even the most established coins of the space.

Bitcoin’s ATH serves not only as a benchmark for price performance but also as a psychological milestone for investors. The anticipation to reclaim this peak is palpable as traders watch key indicators and market behaviors closely. Indicators like resistance levels and trading volume can influence how quickly BTC returns to its ATH. Thus, understanding the trajectory of Bitcoin, its relationship with other top crypto coins, and market sentiment provides a clearer picture of its road ahead.

Despite the current dip, many analysts remain bullish on Bitcoin’s long-term potential, attributing its resilience to strong fundamentals and growing acceptance as a digital asset. Increased institutional investment and broader adoption of cryptocurrency payments are essential factors contributing to Bitcoin’s market stability. Keeping a close eye on Bitcoin price predictions can provide insights on future trends, essentially preparing investors for potential market fluctuations. Furthermore, as Bitcoin leads the market, its price movements often set the tone for other cryptocurrencies, reinforcing its status as the bellwether of the entire industry.

Comparative Analysis: Ethereum and Its ATH Journey

Ethereum (ETH) currently trades at $4,036, positioned significantly below its all-time high of $4,946. The journey of Ethereum reflects the complexities of the cryptocurrency market as it navigates through scalability issues and competition from emerging layer-1 solutions. Although ETH’s underlying technology—smart contracts—remains robust and revolutionary, the pressures of network congestion and high gas fees have drawn criticism. These challenges have led to fluctuations in Ethereum’s price, necessitating strategic reforms within its infrastructure, notably the move towards Ethereum 2.0 and proof of stake, which aims to enhance scalability and reduce energy consumption.

As Ethereum strives to reclaim its ATH, factors such as Ethereum price predictions and overall market sentiment play a crucial role. BTC’s recent ascent triggered a wave of optimism in altcoins, including ETH. If Ethereum developers successfully implement ongoing enhancements, including the scaling solutions promised by Layer-2 technologies, ETH might regain its status and drive towards new heights. Investors are advised to stay informed about Ethereum’s development roadmap and potential impact on future price trajectories.

The Ethereum ecosystem also significantly benefits from decentralized finance (DeFi) expansion, positioning ETH as a central player in the growing cryptocurrency markets. Many DeFi applications are built on the Ethereum blockchain, leading to increased utilization and demand for ETH tokens. As more liquidity flows into DeFi projects, it creates positive feedback for Ethereum’s price, making it ripe for potential rallies. The interconnectedness of Ethereum with popular protocols and DeFi products offers countless opportunities for growth and price appreciation, especially as confidence in the crypto market continues to recover post-corrections.

Dogecoin Price Analysis: The Journey from Meme to Market Player

Dogecoin (DOGE), initially created as a meme cryptocurrency, has transformed into a notable player in the cryptocurrency market. Current trading at $0.2003, it remains significantly below its all-time high of $0.7315 reached on May 8, 2021. This drastic decline of 72.6% underlines the inherent volatility in meme coins, where speculative interest often drives price peaks rather than fundamental utility. Dogecoin’s journey is emblematic of how sentiment-driven trading can catalyze rapid price changes, yet it also invites scrutiny regarding its long-term viability amid a sea of more functional altcoins.

The popularity of Dogecoin has surged during periods of market euphoria, often synchronized with celebrity endorsements and social media trends. However, as the market has matured, many in the crypto community advocate for a return to utility-driven cryptocurrencies. This has prompted DOGE holders and potential investors to speculate on whether Dogecoin can regain its former glory or if it will continue to languish as a secondary player compared to top crypto coins with more robust use cases. Upcoming developments and community initiatives may play a pivotal role in Dogecoin’s future price movements.

As Dogecoin navigates this challenging landscape, it remains crucial for investors to keep a close watch on the evolving narrative surrounding the coin. The key question for many is whether Dogecoin can establish a sustainable developmental roadmap, particularly in comparison to emergent layer-1 blockchains like Solana and Cardano. Should the community leverage its massive following towards developing partnerships, utility, and integrations within broader financial ecosystems, the potential for DOGE to rise again and challenge its all-time highs could become a realistic expectation in the near future.

Future Outlook for XRP: Price Predictions and Market Strength

XRP currently stands at $2.45, which is substantially lower than its all-time high of $3.65 recorded on July 18, 2025. As the crypto market evolves, XRP’s unique value proposition as a means for cross-border payments faces stiff competition, particularly from Bitcoin and Ethereum. The market remains optimistic about XRP’s potential resurgence, boosted by anticipated regulatory clarity and ongoing partnerships with financial institutions. As cryptocurrency regulations evolve, many believe XRP may emerge as a compliant digital alternative, further enhancing its use case and supporting potential price rallies.

XRP price predictions have often been intertwined with broader market trends and legal outcomes regarding its classification as a security. As the lawsuit against the SEC progresses, its outcome could have far-reaching implications on not just XRP but the entire cryptocurrency market. Should the winds of litigation shift favorably for XRP, it may well reclaim its former heights, paving the way for a bullish sentiment across cryptocurrencies, especially ALT coins like XRP that thrive on functionality and compliance within traditional finance.

Moreover, Ripple’s focus on developing its technology to enhance transaction speed and reduce costs positions XRP favorably against other cryptocurrencies in the market. As more enterprises recognize the efficiency of blockchain technology, Ripple could solidify its client base, ultimately driving demand for XRP. In a rapidly changing landscape, keeping an eye on both technological advancements and regulatory developments will be pivotal for predicting XRP’s future price movements and assessing its long-term potential in the market.

Solana and Cardano: The Race Toward New Peaks

As the cryptocurrency market evolves, both Solana (SOL) and Cardano (ADA) present unique cases of coins that have seen significant volatility while attempting to recover from previous all-time highs. Solana currently trades at $192, approximately 34.5% lower than its peak of $293 achieved on January 19, 2025, while Cardano lingers at $0.6657, which is an alarming 78.3% drop from its high of $3.09 in September 2021.

The landscape for Solana is shaped by its rapid transaction speed and lower fees, which appeal to developers and users alike. However, scalability issues and network outages have clouded its reputation, leading to a cautious market sentiment. Conversely, Cardano’s emphasis on a research-driven approach to blockchain technology positions it as a long-term player, though it too must prove its competitive edge against other networks. Investors remain keen to observe how these coins innovate going forward to regain momentum and recover lost ground in the ever-nuanced crypto economy.

Both Solana and Cardano face the challenge of differentiating themselves from peers in a crowded ecosystem. To capture new users and retain existing investors, they must deliver functional products that showcase the benefits of their technology over traditional financial systems. Additionally, market dynamics, industry partnerships, and the overall health of the cryptocurrency market will influence their respective recoveries. Predictions suggest that should broader market conditions improve, the potential for both projects to ascend to their previous all-time highs is not entirely out of reach, but achieving success will require strategic developments and community support.

The Impact of Regulatory Developments on Crypto Prices

Regulatory frameworks continue to shape the cryptocurrency landscape, often influencing investor sentiment and the overall price dynamics of major cryptocurrencies, including Bitcoin, Ethereum, and others. As these regulations evolve, their implications on market stability and legitimacy cannot be underestimated. Investors are attentively monitoring approaching legislation that might define the framework under which cryptocurrencies will operate, particularly in the United States and Europe. Increased regulatory clarity could bolster market confidence, providing a conducive environment for cryptocurrencies to flourish, potentially helping them recover from losses seen over recent months.

Market participants are particularly keen on how regulatory advancements might affect operational aspects for cryptos like XRP, which, depending on the outcome of its legal battles, could influence its viability and price. The ongoing dialogue between traditional financial institutions and regulatory bodies might forge pathways for better integration of cryptocurrencies into mainstream finance. This could encourage more substantial investments, driving overall market recoveries and leading to new ATHs for various tokens.

The potential for regulatory developments to stabilize prices within the crypto market underscores the need for adaptive strategies among investors. Engaging in regulatory discussions and staying updated on global trends can help investors manage risks and seize opportunities. Such proactive approaches will be instrumental in navigating the tensions between innovation and regulation, ultimately determining the future pricing landscape of cryptocurrencies in the coming years.

Market Sentiment and Its Influence on Crypto Prices

Market sentiment plays a pivotal role in shaping the dynamics of the cryptocurrency landscape. As seen with Bitcoin’s recent ATH, emotional responses to price movements—whether euphoria during price surges or panic during corrections—significantly drive trading behaviors. The interconnectedness of social media and crypto trading platforms amplifies these emotions, often resulting in rapid fluctuations and confirming the inherent volatility of the market. Bitcoin’s trajectory is often mirrored by sentiment towards altcoins like Dogecoin, XRP, and others, demonstrating the impact of popular narratives across trading communities.

When the sentiment is positive, it fosters a bullish environment that can lead to increased buying pressure, while negative sentiment can result in broader sell-offs. Deciphering market sentiment through tools such as sentiment analysis platforms and monitoring social media activity can provide clues on potential price rallies or downturns. Hence, maintaining awareness of these emotional indicators can equip investors with the insights necessary to navigate through the often-chaotic crypto markets.

Furthermore, the dynamics of market sentiment extend beyond mere speculation. Institutional participation has changed the landscape, bringing an added layer of complexity to how sentiment manifests in the crypto economy. As more institutional funds begin to flow into cryptocurrencies, the market becomes influenced not just by retail sentiment but by significant capital movements from institutional investors. This trend highlights the increasing legitimacy of cryptocurrencies, potentially leading to longer-term price stability despite momentary volatility. Understanding these factors can empower investors to make informed trading decisions, aligning their strategies with the broader market sentiment as they navigate through the crypto landscape.

Historical Comparisons: Crypto Performance and Future Potential

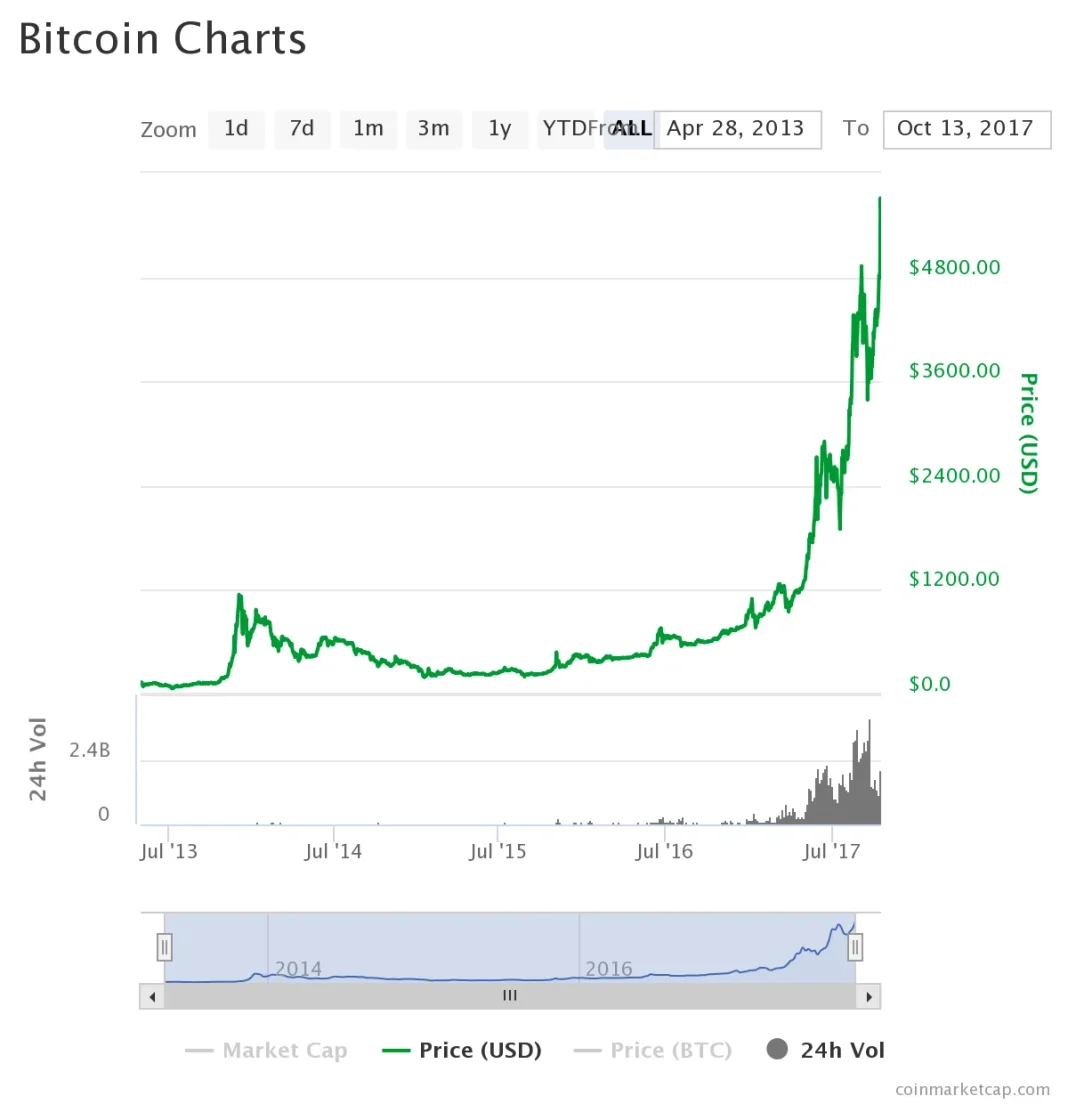

Looking at the history of the top cryptocurrencies provides valuable insights into potential future performance. Each cryptocurrency has unique circumstances that contributed to its peaks and troughs, revealing broader patterns within the market. Bitcoin and Ethereum have proven to be resilient, often bouncing back from significant downturns due to their strong fundamentals and adoption narratives. Meanwhile, coins like Dogecoin and XRP present interesting contrasts, showcasing how market trends and innovations can lead to different paths of growth and recovery.

By understanding the historical context of these cryptocurrencies, investors can better assess the factors that drive prices and identify opportunities for potential gains. Historical performance also allows for comparisons between periods of bullish and bearish trends, shedding light on the cyclical nature of crypto and helping forecast future price actions. Those who analyze these patterns can position themselves strategically in anticipation of the next run-up or correction.

The evolution of key cryptocurrencies serves as a reminder that while technology drives innovation, market cycles and human behavior play a significant role in cryptocurrency trajectories. Evaluating past trends in conjunction with current developments enables investors to form a more comprehensive investment strategy. Ultimately, those prepared for both the ups and downs of the market, informed by historical performance and future potential, are well-positioned to navigate the complexities of the cryptocurrency landscape ahead.

Frequently Asked Questions

What factors contribute to Bitcoin approaching its all-time high (ATH)?

Bitcoin’s approach to its all-time high (ATH) can be influenced by market demand, institutional investments, regulatory developments, and overall cryptocurrency market trends. As BTC prices rise due to positive sentiment or bullish momentum across top crypto coins, reaching previous highs becomes increasingly likely.

How does Bitcoin’s all-time high compare to other cryptocurrencies like Ethereum and XRP?

Bitcoin’s all-time high (ATH) is currently around $126,000, which is considerably higher than Ethereum’s ATH of approximately $4,946 and XRP’s ATH of $3.65. While Bitcoin leads the pack, other cryptocurrencies also aim to reclaim their peaks amid varying market dynamics.

When did Bitcoin last hit its all-time high, and what was the value?

Bitcoin last hit its all-time high (ATH) on October 6, 2025, with peak values reported around $126,272 on Bitstamp and $126,307 on Deribit, while Coingecko listed it at $126,080.

What percentage below its all-time high is Bitcoin currently trading?

As of now, Bitcoin is trading around $110,815, which represents an 11.9% decrease from its all-time high (ATH) reached on October 6, 2025.

How do Bitcoin’s price movements affect the broader cryptocurrency market?

Bitcoin’s price movements are critical as it often sets the tone for the entire cryptocurrency market. Major shifts in Bitcoin’s price can impact investor sentiment and trading activities across other coins, including Ethereum, XRP, and Dogecoin.

Does the performance of Bitcoin all-time high influence altcoin prices?

Yes, Bitcoin’s all-time high (ATH) can significantly influence altcoin prices. When Bitcoin reaches new peaks, it often attracts more investment into the cryptocurrency market, benefiting altcoins like Ethereum and XRP as well.

What can cryptocurrency investors learn from Bitcoin’s all-time high trends?

Investors can learn the importance of market cycles and volatility in cryptocurrencies from Bitcoin’s all-time high trends, understanding that corrections and adjustments are part of the ebb and flow in the crypto ecosystem.

Are all cryptocurrencies significantly affected by Bitcoin’s all-time high fluctuations?

While Bitcoin is a leading indicator, not all cryptocurrencies react the same way to its all-time high fluctuations. Each coin has unique market drivers, but generally, Bitcoin’s performance influences the sentiment towards the broader cryptocurrency market.

What recent trends indicate Bitcoin’s potential to reach a new all-time high?

Recent trends, such as increased institutional interest, positive regulatory news, and broader market recoveries, suggest Bitcoin has the potential to reach a new all-time high (ATH) in the near future.

Why do some cryptocurrencies remain far from their all-time highs while Bitcoin approaches its peak?

Cryptocurrencies like Dogecoin and Cardano remain far from their all-time highs due to varying factors such as changes in investor interest, market focus moving to Bitcoin, and differing utility or adoption rates across the cryptocurrency ecosystem.

| Cryptocurrency | Current Price (as of Oct. 20, 2025) | All-Time High (ATH) | Percent Below ATH | Percent Change Needed to Reach ATH |

|---|---|---|---|---|

| Bitcoin (BTC) | $110,815 | $126,272 (Bitstamp) / $126,307 (Deribit) | 11.9% | 11.9% increase |

| Ethereum (ETH) | $4,036 | $4,946 | 18.5% | 18.5% increase |

| BNB | $1,112 | $1,369 | 18.5% | 18.5% increase |

| XRP | $2.45 | $3.65 | 32.8% | 32.8% increase |

| Solana (SOL) | $192 | $293 | 34.5% | 34.5% increase |

| Tron (TRX) | $0.3229 | – | 25.2% | 25.2% increase |

| Dogecoin (DOGE) | $0.2003 | $0.69 | 72.6% | 72.6% increase |

| Cardano (ADA) | $0.6657 | $3.09 | 78.3% | 78.3% increase |

| Hyperliquid (HYPE) | $38.71 | $59.30 | 37% | 37% increase |

Summary

Bitcoin All-Time High remains a significant benchmark in the cryptocurrency market, especially as of October 20, 2025, when Bitcoin is trading at $110,815, approximately 11.9% below its recent peak of $126,272. This recent trading condition is reflective of the volatile nature of crypto markets, where prices fluctuate at rapid rates, impacting nearly all cryptocurrencies. While some altcoins, such as Ethereum and XRP, similarly grapple with steep declines from their respective all-time highs, it is clear that the overall crypto market, valued at $3.76 trillion, is in a state of transition. Investors are closely monitoring these trends, as the future of these cryptocurrencies could swing dramatically, allowing for potential recoveries or continued declines.