This past week marked a troubling chapter for Bitcoin and Ether ETF losses, as both experienced significant outflows that are raising alarms among investors. Bitcoin ETFs suffered a staggering $367 million in redemptions, while Ether ETFs lost $232 million, reflecting a broader trend of retreat in crypto-linked funds. With heavy selling dominating the markets, this marked one of the toughest weeks for ETFs trading in digital assets since summer, eroding investor sentiment in crypto. Notably, BlackRock’s IBIT was at the forefront of these losses, showcasing how quickly fortunes can shift in the volatile world of cryptocurrencies. As traders watch the unfolding scenario, the question remains: will there be a rebound, or does a deeper correction await?

In recent trading activity, both Bitcoin and Ether exchange-traded products have faced significant declines, signaling a bearish outlook among investors. The outflows from these crypto ETFs have raised concerns regarding the broader market dynamics and investor confidence. With prominent funds like BlackRock’s BIT and ETHA experiencing heavy withdrawals, the overall sentiment within the digital asset community appears to be shifting. As we observe the current landscape of crypto ETFs, it becomes crucial for stakeholders to stay updated with market trends and investor behavior, as these elements will dictate the future direction of cryptocurrency investments.

Bitcoin ETF Performance: A Deep Dive into Recent Losses

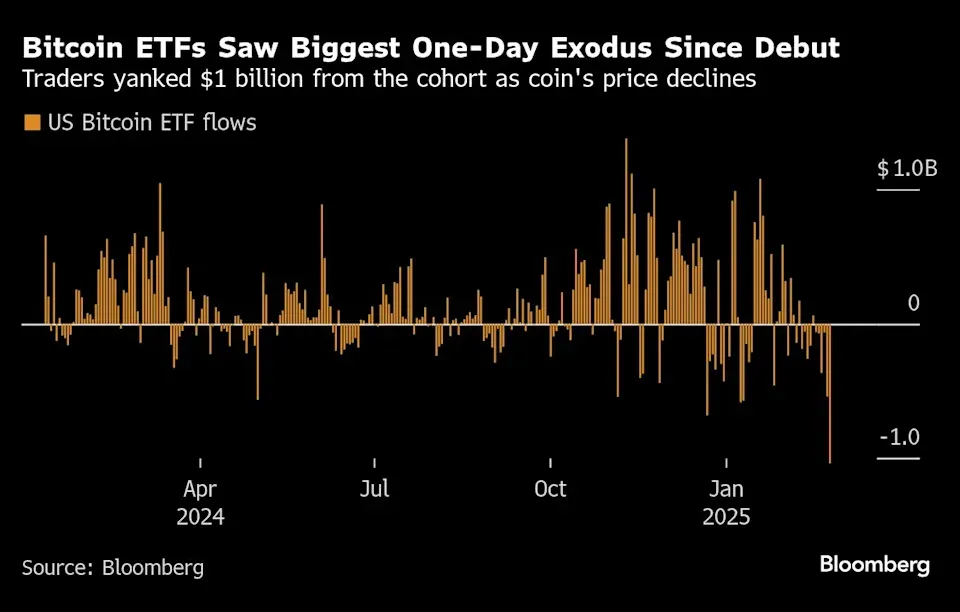

The performance of Bitcoin ETFs has taken a significant hit in recent weeks, culminating in heavy losses as we close out the trading week. The outflows have been particularly alarming, with total redemptions reaching around $367 million. This marks a concerning trend as investors continue to reassess their exposure to crypto-linked funds amid increasing market volatility. Notably, the withdrawals were disproportionately high from key players like BlackRock’s IBIT, which alone accounted for a staggering $268.81 million of the total outflows. This sustained selling pressure has left many investors questioning the future viability of Bitcoin ETFs.

Amid the turmoil, trading activity remained strong at $8.20 billion. Yet, the growing caution among investors is evident from the substantial decrease in net assets, which now stand at $143.93 billion. Such a sharp drop, despite significant trading volumes, highlights an evolving sentiment in the market. Investors are enthusiastically looking forward to potential recovery signs, but the extent and persistence of the outflows signify a shift in investor confidence toward Bitcoin ETFs.

Ether ETF Redemptions: Analyzing the Impact on the Market

Similar to their Bitcoin counterparts, Ether ETFs have not been immune to the recent sell-off, experiencing significant outflows that exceeded $232 million during the last trading week. Investors have been hastily withdrawing their funds, with prominent funds like BlackRock’s ETHA losing the most at $146.06 million. Other funds, including Fidelity’s FETH and Grayscale’s ETHE, also faced significant exit pressures. This sharp decline emphasizes the mounting nervousness surrounding Ether and its associated investment vehicles.

The increased outflows signal a broader market recalibration and reflect a change in investor sentiment within the crypto arena. Despite a robust trading volume of $2.49 billion for Ether ETFs, the net assets have diminished markedly to $25.98 billion. This contrast underlines the shift toward cautious investment strategies, urging a re-evaluation of market dynamics that previously favored inflows. The coming weeks could prove pivotal as investors hope for a stabilizing market that might restore confidence in Ether ETFs.

Frequently Asked Questions

What are the recent losses experienced by Bitcoin and Ether ETFs?

This week, Bitcoin and Ether ETFs faced significant losses, with Bitcoin ETFs suffering $367 million in outflows and Ether ETFs losing $232 million, marking a tough trading period for crypto ETFs.

Which Bitcoin ETF had the highest redemption rate this week?

Blackrock’s IBIT recorded the largest redemption rate among Bitcoin ETFs this week, with withdrawals totaling $268.81 million, showcasing strong investor sentiment against Bitcoin ETFs.

Were there any Ethereum ETFs that contributed significantly to the losses this week?

Yes, Blackrock’s ETHA led the Ether ETF market with a substantial loss of $146.06 million, contributing significantly to the overall decline in Ether ETF assets.

How do the recent outflows from Bitcoin and Ether ETFs affect investor sentiment in crypto?

The recent outflows from Bitcoin and Ether ETFs, combined with a fall in total net assets, indicate a cautious investor sentiment in crypto, prompting concerns over the stability of crypto ETFs moving forward.

What is the current state of trading activity for Bitcoin and Ether ETFs?

Despite the losses, trading activity for Bitcoin and Ether ETFs remained robust, with Bitcoin ETFs trading at about $8.20 billion and Ether ETFs showing a volume of $2.49 billion, albeit with significant outflows.

How are the net assets of Bitcoin and Ether ETFs impacted by recent losses?

The total net assets for Bitcoin ETFs dropped to $143.93 billion, while Ether ETFs fell to $25.98 billion, reflecting the impact of investor redemptions and associated market volatility.

What should investors consider for future Bitcoin and Ether ETF strategies?

Investors should closely monitor trends in outflows and overall market sentiment regarding Bitcoin and Ether ETFs, as recent losses may indicate a shift in investment strategies within the crypto ETF landscape.

| Key Points |

|---|

| Bitcoin and Ether ETFs suffered significant losses, totaling $367 million and $232 million, respectively, during a turbulent trading week. |

| The week ended with a total outflow, marking the third consecutive day of losses for both ETFs, a sign of ongoing investor caution. |

| Blackrock’s IBIT and ETHA were the primary funds responsible for the large redemptions, indicating a reduced appetite for these investments. |

| Trading volumes were strong, totaling $8.20 billion for Bitcoin ETFs, yet net assets for both types of funds ended up dropping sharply. |

| Investors are now watching for potential signs of recovery in the upcoming week after several days of declines. |

Summary

Bitcoin and Ether ETF losses have been significant this week, with both types of funds experiencing steep declines. Total withdrawals amounted to $367 million for Bitcoin ETFs and $232 million for Ether ETFs, amidst a week dominated by volatility and selling pressure. As major funds like Blackrock’s IBIT and ETHA led the exodus, investors remain cautious about the current state of the crypto market. The strong trading activity did not prevent a sharp drop in net assets, emphasizing the need for recovery signals in the days ahead.