Bitcoin arbitrage has emerged as a popular trading strategy, offering investors a way to capitalize on price discrepancies between different markets. As institutional investors previously flocked to the cash-and-carry trade, the allure of this approach is now diminishing due to tight bitcoin futures spreads. The evolving dynamics of the crypto derivatives market are reflected in plummeting annualized yields, which have dropped significantly in recent months. With yields falling from approximately 17% to around 5%, strategies based on bitcoin arbitrage are increasingly challenging to justify. As a result, traders are recalibrating their approaches and exploring alternative methods such as Ethereum trading strategies amidst this shifting landscape.

Engaging in Bitcoin arbitrage is a form of trading where market participants take advantage of price variances across disparate platforms. This practice, also known as basis trading, has traditionally attracted significant capital from hedge funds and institutional clients, especially with the rise of bitcoin futures. However, as the crypto derivatives market matures, the profitability of such trades appears to be waning, prompting traders to explore new avenues. Alternative strategies, including the burgeoning interest in Ethereum trading and complex hedging techniques, are becoming more favorable in response to tightening yields. As traders adapt to these changing conditions, the once straightforward method of arbitrage is evolving with the market.

Understanding Bitcoin Arbitrage: The Cash-and-Carry Trade Explained

Bitcoin arbitrage refers to the strategy of profiting from price discrepancies in the cryptocurrency markets, particularly through the cash-and-carry trade. This involves buying spot bitcoin—essentially purchasing the asset directly—and simultaneously selling futures contracts at a higher price. Investors can capitalize on the basis, or the difference between the spot and future prices, aiming to lock in returns that come from the convergence of these prices at contract expiration. Historically, this approach attracted significant inflows from institutional investors seeking to exploit this predictability in pricing.

However, as of 2025, the allure of bitcoin arbitrage via the cash-and-carry method has diminished, primarily due to tightening futures spreads. The once-robust yields that institutional traders relied upon are now eroded, as recent data indicates that annualized basis yields have plummeted from approximately 17% to around 5%. The implications of this narrowing yield spread are profound, signaling a shift away from straightforward arbitrage strategies as institutions adapt to a more competitive and mature crypto derivatives market.

Wall Street’s Retreat from Bitcoin Arbitrage Strategies

Wall Street’s engagement with bitcoin arbitrage, especially through cash-and-carry trading, has seen a marked decline. As institutional investors recalibrate their strategies due to a less favorable yield environment, many are stepping back from what was once a cornerstone approach in crypto trading. The Chicago Mercantile Exchange’s (CME) reported decrease in open interest, which fell below $10 billion from a prior peak of over $21 billion, reflects this retreat. This significant drop has highlighted the shift in sentiment among institutional players who are now questioning the viability of sustaining such trades under current market conditions.

Additionally, the trend indicates a broader move among institutional investors to diversify their portfolios beyond bitcoin. With enhancements in regulatory clarity and an increasing variety of investment options, these traders are now looking toward different assets like Ethereum and Solana. The surge in ether futures trading, which has seen average daily open interest rise dramatically from $1 billion to nearly $5 billion, underscores this migration away from traditional bitcoin arbitrage strategies to more complex trading methodologies.

The Evolution of the Crypto Derivatives Market

As the crypto derivatives market evolves, the dynamics of trading strategies are changing significantly. The previous reliance on straightforward arbitrage techniques is diminishing as the market matures and competition increases. With institutions pulling back after experiencing reduced returns from cash-and-carry trades, they are exploring more sophisticated alternatives such as options trading and decentralized finance (DeFi) opportunities. This shifts the focus from the relatively riskless profits of bitcoin arbitrage to strategies that demand deeper market insights and real-time analytics.

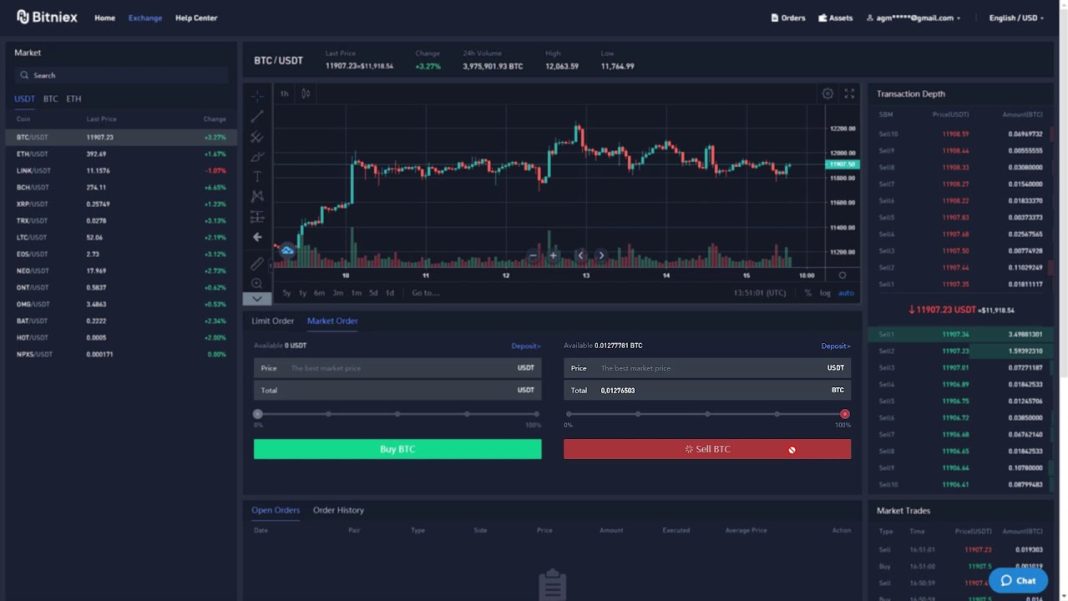

Moreover, the new landscape of cryptocurrency trading is characterized by the growing dominance of perpetual futures, which dominate trading volumes compared to traditional futures contracts. As per recent statistics, Binance’s open interest remains stable and significant, contrasting with CME’s declining figures. This evolution suggests that traders are adapting to changes in regulatory environments and technological advancements, leading to innovative trading strategies that can better capitalize on the inherent volatility and opportunities in the crypto space.

The Impact of Regulatory Changes on Bitcoin Trading

Regulatory developments have played a crucial role in shaping the cryptocurrency trading landscape, particularly for institutional investors. With clearer guidelines emerging in 2025, many institutions have become more confident in exploring assets beyond bitcoin, investing in crypto derivatives and expanding into various altcoins like Ethereum, XRP, and Solana. The regulatory framework not only legitimizes trading practices but also attracts a broader set of participants to the market, fostering increased liquidity and competition.

As institutional focus shifts, regulatory clarity has become a crucial element for long-term growth in the cryptocurrency sector. The transition from traditional bitcoin basis trading towards a more diverse range of strategies reflects the adaptive nature of traders in the face of changing regulations. Recognizing the importance of compliance can lead to sustainable investment decisions and enhance market stability, ultimately benefiting all participants in the cryptocurrency ecosystem.

Exploring Alternative Trading Strategies Beyond Bitcoin Arbitrage

With the decline of bitcoin arbitrage profitability, traders are now actively seeking alternative strategies that align with the evolving markets. One of the most notable shifts has been towards options trading, which allows for more flexible risk management and potential profit strategies. Unlike the cash-and-carry trade that depends heavily on spread contraction, options provide traders the ability to hedge against market volatility and obtain leveraged exposure without the necessity of holding the underlying asset.

In addition to options, many traders are venturing into sophisticated strategies within decentralized finance (DeFi) where they can yield farm or utilize liquidity pools. These strategies not only offer new avenues for returns but also transform how investors engage with the cryptocurrency market. As traders weigh the risks and benefits of these new opportunities, the landscape of crypto trading is likely to become increasingly innovative and intricate.

How Institutional Investors Are Shaping the Future of Crypto Trading

Institutional investors are increasingly seen as pivotal players shaping the future of crypto trading. Their significant capital and sophisticated approaches can influence market dynamics and trading strategies. As they pivot away from traditional bitcoin arbitrage towards a broader array of investment options, their buying patterns and interests guide the developmental trajectory of products offered by exchanges. This shift not only affects liquidity but also compels the market to accommodate these large-scale players with better solutions and more robust trading instruments.

Moreover, the growing presence of institutional investors has introduced a level of professionalism and enhanced scrutiny in the crypto sphere. With their focus on compliance, risk assessment, and strategic deployment of capital, they are helping to establish a more mature cryptocurrency market. As they continue to adopt advanced trading techniques and explore innovative solutions to navigate volatility, they can inspire confidence in retail traders, fostering a more inclusive trading environment.

Analyzing the Market Trends Shaping Bitcoin Futures Spreads

Current market trends indicate a significant compression in bitcoin futures spreads, which has transformed trader expectations and strategies. As market nuances evolve, the once lucrative model of profiting from the basis trade is now fraught with complexities that require in-depth analysis. Traders must now consider factors like liquidity, market depth, and shifts in open interest, all of which play critical roles in determining profitability in the futures markets. This analytical approach is essential for adapting to new market conditions, especially as spreads tighten.

Furthermore, the market’s structural enhancement indicates a shift towards a more competitive environment. Traders are now leveraging sophisticated analytical tools and models to navigate the complexities of bitcoin futures spreads. A keen understanding of these dynamics can provide traders with an edge, allowing them to capitalize on emerging discrepancies and maximize returns in a landscape that is less forgiving than in previous years.

Trapped in a Cycle: The Limitation of the Cash-and-Carry Bitcoin Trade

The cash-and-carry bitcoin trade has historically provided a seemingly risk-free arbitrage opportunity. The idea was simple: buy low in the spot market and sell high in the futures market while locking in profits from the basis difference. However, as institutional involvement has grown and market maturity has taken hold, this once-effective strategy has become increasingly limited and less viable. The narrowing yields compel traders to reconsider their positions, evaluating whether the risk-reward dynamic still holds up against the backdrop of rising execution costs.

As the markets adapt, traders face challenges in executing the cash-and-carry trade effectively. With open interest declining and fewer participants willing to engage in low-yield strategies, the liquidity available for such trades diminishes, further compressing potential profits. This entrapment in a cycle of declining yields requires traders to innovate and seek other avenues in the growing universe of cryptocurrency derivatives—a trend that is reshaping the industry as players adjust to new realities.

The Future of Ethereum Trading Strategies in a Post-Arbitrage World

As bitcoin arbitrage strategies face diminishing returns, Ethereum trading has emerged as a pivotal area of interest for many institutional investors. With an increasing number of decentralized applications and DeFi projects built on the Ethereum network, traders are exploring various approaches to capitalize on this vibrant ecosystem. Strategies focusing on liquidity provision, cross-chain arbitrage, and yield farming are gaining traction as traders seek alternatives to traditional bitcoin trading methods.

Moreover, the rise of Ethereum-based futures and options contracts signifies the growing recognition of Ethereum as a legitimate asset class. As institutional players continue to engage with Ethereum’s derivatives market, they can develop diverse trading strategies that leverage the unique characteristics of Ethereum compared to bitcoin. The future landscape of crypto trading will likely feature a blend of strategies focused on both leading cryptocurrencies, catering to varying market conditions and investor risk appetites.

Frequently Asked Questions

What is Bitcoin arbitrage and how does it work?

Bitcoin arbitrage involves exploiting price differences of Bitcoin across various exchanges to generate profits. Traders buy Bitcoin at a lower price on one exchange and simultaneously sell it at a higher price on another, capitalizing on the price fluctuations.

How has the tightening of Bitcoin futures spreads impacted Bitcoin arbitrage?

The tight Bitcoin futures spreads have significantly reduced the profitability of Bitcoin arbitrage strategies, particularly the cash-and-carry trade, as yields have dropped to around 5% from 17%, making arbitrage less appealing to investors.

What is the cash-and-carry trade in Bitcoin arbitrage?

The cash-and-carry trade in Bitcoin arbitrage involves buying spot Bitcoin and selling Bitcoin futures while capturing the price differential. However, the tightening spreads are leading to diminished returns for this arbitrage method.

How do institutional investors influence Bitcoin arbitrage opportunities?

Institutional investors significantly impact Bitcoin arbitrage by engaging in large-scale trades that can affect market liquidity and price discrepancies. Their recent retreat from high-yield basis trades indicates a shift in focus, further squeezing the arbitrage space.

Are Bitcoin arbitrage strategies still viable after recent market changes?

While Bitcoin arbitrage strategies remain viable, recent market changes, such as the compression of futures spreads and reduced yields, have made it increasingly challenging for traders to find profitable arbitrage opportunities.

What alternative trading strategies are being adopted instead of Bitcoin arbitrage?

In response to declining Bitcoin arbitrage yields, traders and institutional investors are shifting towards options trading, hedging strategies, and exploring new crypto derivatives in assets like Ethereum, XRP, and Solana.

What role does the crypto derivatives market play in Bitcoin arbitrage?

The crypto derivatives market provides a platform for traders to execute Bitcoin arbitrage strategies. However, recent changes in market dynamics, such as decreasing open interest in Bitcoin futures, are affecting the overall profitability and appeal of these arbitrage opportunities.

How has the approval of Bitcoin ETFs impacted arbitrage trading strategies?

The approval of Bitcoin ETFs initially boosted arbitrage strategies by creating new trading avenues. However, as market conditions evolved and yields shrank, the once lucrative cash-and-carry trade has become less profitable for institutional investors.

| Key Point | Details |

|---|---|

| Compression in Bitcoin Futures Spreads | The profitability of cash-and-carry trades has diminished as the differential has tightened, making the returns less appealing to investors. |

| Decline in Basis Yields | One-month annualized bitcoin basis yields have fallen to about 5% from 17% last year, considerably lowering the strategy’s appeal. |

| Decrease in Open Interest | Open interest in bitcoin futures on the CME has decreased below $10 billion, reflecting reduced participation from hedge funds. |

| Shift to Other Assets | Institutional investors are diversifying into assets like ether, XRP, and Solana as regulatory clarity increases, resulting in a shift away from Bitcoin-centric strategies. |

| Adoption of Alternative Strategies | With risks in basic arbitrage strategies, traders are increasingly engaging in options and other sophisticated trading techniques. |

Summary

Bitcoin arbitrage is becoming less viable as the profitability of traditional strategies decreases amid tighter futures spreads. The reduction in basis yields has prompted institutions and hedge funds to move away from cash-and-carry trades, reshaping the crypto derivatives market. As institutions pivot towards more diverse investment strategies, including ether and other cryptocurrencies, the landscape for Bitcoin trading is evolving, making it essential for traders to adapt and explore innovative approaches.