Bitcoin derivatives and Bitcoin futures open interest climbed to a record level this week. Aggregate futures open interest reached about $91.59 billion, signaling rising risk appetite among traders. The derivatives market remains active, drawing liquidity from CME, Binance and other major venues. Bitcoin options skew has tilted toward calls, and BTC derivatives volume reflects bullish positioning. With spot hovering near $123,142, participants are hedging and positioning for potential volatility as the week unfolds.

Beyond the headline metrics, the crypto derivatives landscape centers on instruments tied to Bitcoin’s price. BTC futures and options markets offer hedging and speculative tools that reveal traders’ expectations for volatility. LSI-driven indicators like open interest trends and skew direction serve as barometers of sentiment. As liquidity migrates across exchanges and over-the-counter desks, liquidity dynamics can amplify moves when big positions unwind. Taken together, the Bitcoin derivatives market and related instruments reflect broader risk appetite and anticipate potential price shifts across the digital asset space.

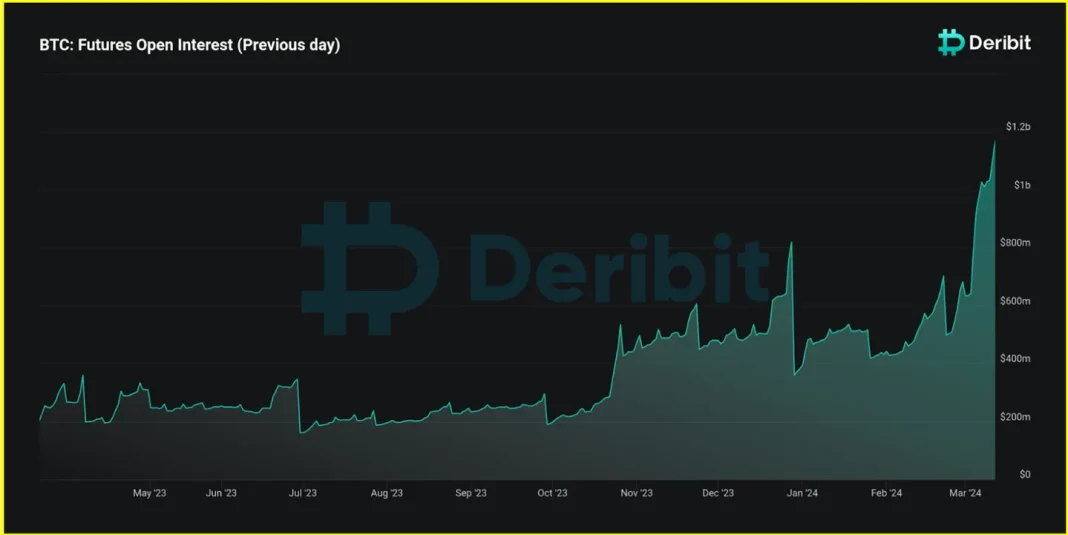

Bitcoin futures open interest Reaches Record High as Derivatives Activity Booms

Bitcoin’s futures open interest climbed to a record near $91.59 billion, rising 2.04% on the day as traders leaned into risk while spot stayed around $123,142 at 9:30 a.m. Sunday. This surge underscores a buoyant derivatives environment where market participants position aggressively, even as the underlier remains in a relatively tight range.

The spike in open interest reflects broad participation across the Bitcoin derivatives market, signaling heavy engagement from both hedgers and speculators. With spot price guidance and sentiment oscillating around the $123k level, traders are expanding leverage and building longer exposure, a pattern that often precedes increased liquidity and volatility in the near term.

Bitcoin derivatives market Participation Across Exchanges Reveals Broad Demand

CME continues to lead the pack with about $18.19 billion in OI, roughly 19.85% of the total, translating to exposure of around 147.8K BTC. Binance follows with $16.44 billion (17.94%), then Bybit at $10.13 billion (11.06%), and Gate at $9.44 billion (10.3%). Other major venues like OKX, Bitget, MEXC, WhiteBIT, BingX, and Kucoin round out the top tier. This distribution demonstrates a highly diversified liquidity pool within the Bitcoin derivatives market.

24-hour movers add color to the picture: Kucoin’s OI jumped 65.79%, Bitget rose 5.95%, and WhiteBIT added 4.25%, while Binance and OKX also posted gains. CME’s institutional lane edged higher by 0.89%, and several platforms eased slightly. The spread across exchanges indicates substantial cross-exchange hedging and speculative activity, reinforcing the broad participation characteristic of the derivatives landscape.

Bitcoin options skew Flips to Optimistic Sentiment as Calls Dominate

Options traders are leaning bullish, with calls making up 60.26% of options open interest versus 39.74% for puts. The past 24 hours skewed similarly, with calls accounting for 58.05% of volume. This call-heavy tilt suggests participants expect upside moves and are willing to pay premiums for higher strike exposure.

Upside strikes dominate the Deribit book, including the Dec. 26 $140,000 call and the Dec. 26 $200,000 call, which carry substantial open interest. Even December’s $120,000 and $150,000 calls attract notable attention. The combination of skew and elevated call OI signals a bullish tilt but also points to potential volatility if markets test those levels near expiry.

Bitcoin futures open interest Versus Volume Reveals Sticky, Long-Term Motives

The Bitcoin futures open interest-to-volume ratio stands around 2.47, a signal that positions tend to be longer-tenor and more committed than fleeting. This ratio implies traders are not merely playing near-term bumps but are building durable exposure that can amplify if the market trends higher.

Such a relationship between OI and volume suggests a market where hedging and speculative bets persist through short-term pullbacks. Investors should watch for shifts in this dynamic as month-end dynamics and strikes at higher levels can either reinforce or unwind these longer positions.

BTC derivatives volume Across Leading Venues Shows Liquidity Depth

Total BTC derivatives volume across major venues underscores deep market activity, with CME maintaining a sizable share and top platforms continuing to attract substantial liquidity. The breadth of platform participation correlates with tighter bid-ask spreads and more robust hedging channels for traders managing risk.

The 24-hour movers—Kucoin, Bitget, WhiteBIT, and others—highlight how liquidity and trading interest are distributed across exchanges. This multi-venue activity supports a resilient market structure where price discovery occurs through a wide network of counterparties, not a single venue.

Max Pain and Expiry Dynamics Shape Price Action For Bitcoin Options

Max pain clusters near six figures, with near-dated expiries gravitating toward $115,000 and later expiries hovering closer to $120,000–$125,000 on Deribit’s curve. These dynamics influence where option buyers and sellers exchange the most value as contracts approach expiry, often impacting short-term price behavior.

Deribit’s long-dated strikes, including the $120k and $125k range, attract chunky open interest, suggesting hedges and speculative bets are aligned around critical strike zones. Traders frequently adjust hedges ahead of expiries, which can contribute to choppy price action around key levels.

Spot Price Context: How Derivatives Activity Aligns with Near-Term Moves

With spot hovering around $123,000, dealers’ hedging flows tend to orbit key nodes, especially as month-end rolls near. The interplay between spot and implied levels from OI and skew can add short-term chop while maintaining a longer-term directional bias.

As derivatives exposure expands, hedging activity around essential strike nodes can influence short-term volatility. Yet the overall trend remains guided by the broader sentiment inferred from record futures open interest and call-davored options positions.

Hedging Flows and Market Choppiness Hit Month-End Roll Positions

The converging hedges around strike nodes near month-end can introduce additional price action as dealers rebalance risk. When hedging flows align with significant open interest concentrations, volatility can rise even if spot price remains relatively stable.

This period often magnifies the sensitivity to option expiries and futures rollovers. Market participants should expect continued choppiness as OI shifts across exchanges and strategies adjust to new levels of leverage.

Institutional Versus Retail Participation in the Bitcoin Derivatives Arena

The mix of platform shares and the steady rise in OI point to robust institutional involvement, particularly on CME’s lane, while retail traders contribute to a broad-based demand across venues. This blend supports a liquid, multi-party market with diverse hedging and speculation activity.

Institutional appetite for longer-tenor bets is evident in the sustained OI growth and heavy exposure on top venues. At the same time, retail participation helps maintain dynamic price discovery, contributing to the market’s overall resilience.

Bull and Bear Cases in the Current Bitcoin Derivatives Cycle

Bulls point to record futures open interest, a beneficial tilt in call-heavy options skew, and a max-pain band sitting just beneath spot, all of which can sustain upside momentum if buyers stay engaged. This combination suggests the potential for continued upside pressure in the near term.

Bears warn that crowded upside calls and a high OI stack may create squeeze risks if momentum reverses or liquidity tightens at critical strikes. The presence of large, concentrated positions means squeezes or rapid reversals are plausible if sentiment shifts or if macro conditions deteriorate.

What to Watch Next in Bitcoin Derivatives Trading

As expiries approach and open interest evolves, traders should monitor shifts in Bitcoin futures open interest, Bitcoin options skew, and BTC derivatives volume to gauge the next directional impulse. Changes on Deribit and other major venues can provide early signals of changing momentum.

Key indicators to watch include OI distribution by exchange, the pace of new OI versus volume, and how spot price interacts with the skew and max-pain benchmarks. Staying attuned to these signals helps anticipate potential squeezes, hedging adjustments, or shifts in liquidity across the Bitcoin derivatives market.

Frequently Asked Questions

In the Bitcoin derivatives market, what does record Bitcoin futures open interest say about market activity?

A record near $91.59 billion in Bitcoin futures open interest signals rising risk appetite and strong participation in the Bitcoin derivatives market, with spot prices hovering around the $123k level, and major venues contributing to the aggregate exposure.

How does Bitcoin derivatives market activity relate to the current spot price movement of Bitcoin?

Derivatives activity surged even as spot prices moved through the $125,725 level to about $123,142, indicating traders are building and maintaining positions rather than exiting, as evidenced by persistent, record highs in futures open interest.

What does Bitcoin options skew reveal about trader sentiment in the BTC derivatives market and BTC derivatives volume?

Bitcoin options skew shows a bullish tilt: calls account for roughly 60% of options OI and about 58% of volume, suggesting traders expect more upside in the Bitcoin derivatives market, with notable appetite across BTC derivatives volume.

Which venues dominate BTC derivatives volume and open interest in the Bitcoin derivatives market?

CME remains the leader with about $18.19B in OI (roughly 19.85% of total), followed by Binance, Bybit, Gate, OKX, and others, highlighting a broad, institutionally active Bitcoin derivatives market.

What are the notable max-pain levels and strike concentrations in Deribit options within the Bitcoin derivatives market?

Max pain clusters around six figures, with near-dated expiries near $115k and later expiries around $120k–$125k, reflecting where option sellers and buyers may experience the least payoff in the Bitcoin derivatives market.

How might hedging flows and month-end activity affect Bitcoin prices in the Bitcoin derivatives market?

Hedging flows around key OI nodes can add chop as month-end rolls in, potentially heightening short-term volatility in the Bitcoin derivatives market.

What do bulls and bears emphasize about the Bitcoin derivatives market given the current indicators?

Bulls point to record futures open interest and a call-heavy options skew as signs of upside optimism in the Bitcoin derivatives market, while bears caution that crowded upside calls and high OI could lead to squeezes or sharp reversals.

| Aspect | Key Points |

|---|---|

| Bitcoin price action | Bitcoin traded around $123,142 after briefly testing $125,725; spot near $123k at 9:30 a.m. Sunday. |

| Aggregate futures open interest (OI) | Record near $91.59 billion; +2.04% on the day, signaling increased risk-taking. |

| Top exchanges by OI | CME $18.19B (19.85%), Binance $16.44B (17.94%), Bybit $10.13B (11.06%), Gate $9.44B (10.3%), OKX $4.96B (5.41%), Bitget $6.09B (6.64%), MEXC $4.04B (4.4%), WhiteBIT $2.94B (3.21%), BingX $1.78B (1.94%), Kucoin $1.24B (1.35%). |

| 24-hour movers | KuCoin OI +65.79%; Bitget +5.95%; WhiteBIT +4.25%; Binance +3.06%; OKX +2.83%; CME +0.89%; Bybit, Gate, BingX, MEXC down. |

| OI-to-volume ratio | CME’s OI-to-volume ratio around 2.47, indicating stickier, longer-tenor positions. |

| Options sentiment | Calls 60.26% of options OI vs puts 39.74%; call-dominant skew with 58.05% of volume for calls. |

| Largest options OI on Deribit | Dec 26 $140,000 call ~9,893.9 BTC; Dec 26 $200,000 call ~8,522 BTC; Oct 31 $124,000 call ~7,210.9 BTC; other chunky strikes at $120k and $150k. |

| Max pain and expiries | Max pain around six figures; near-dated expiries near $115,000; longer-dated around $120k–$125k. |

| Market dynamics | Spot around $123k; hedging flows near key nodes can add chop, especially with month-end rolls. |

| Bottom line | Derivatives activity shows broad participation and funded activity. Bulls point to record OI and call skew; bears warn about crowded upside and potential squeezes. Overall, derivatives are setting the stage for Bitcoin moves. |

Summary

Bitcoin derivatives command renewed market attention as futures open interest hits a record high, signaling elevated risk-taking. The data show broad participation across major venues, a tilt toward call-heavy options, and a max-pain band near the current spot, implying potential volatility and squeezes. Traders should monitor open interest trends, skew shifts, and hedging flows around month-end as derivatives continue to shape Bitcoin’s price dynamics.