Bitcoin dormant coins have emerged as a significant topic of discussion in the cryptocurrency landscape, particularly as millions of them have recently reactivated, impacting the Bitcoin price and overall market dynamics. As of 2025, an astonishing 4.64 million BTC that had been lying idle in inactive wallets have suddenly returned to circulation, drawing the attention of traders and analysts alike. This revival raises intriguing questions regarding dormant BTC’s influence on cryptocurrency trends and market behavior, especially in light of recent market analysis. Onchain analytics have revealed that this substantial movement from previously dormant wallets is noteworthy, as it points to a potential shift in investor sentiment and strategy. With Bitcoin firmly established in the market, these developments underscore the need for continuous monitoring of how dormant coin activity shapes future price trajectories and trading patterns.

The phenomenon of previously inactive Bitcoin holdings awakening has sparked considerable interest among investors and market watchers alike. These idle cryptocurrencies, often referred to as dormant BTC, have been dormant for extended periods before their unexpected movement back into the market. As Bitcoin enthusiasts delve into these shifts, they explore various implications for the broader financial landscape and what it means for future cryptocurrency trends. The reactivation of these digital assets not only signifies a potential change in investor behavior but also invites scrutiny from analysts analyzing the current Bitcoin market conditions. Understanding the nuances behind these dormant coin activities can provide valuable insights into the overall cryptocurrency ecosystem and inform strategies for navigating this evolving terrain.

Understanding the Dynamics of Bitcoin’s Dormant Coins

In recent years, the phenomenon of Bitcoin dormant coins has gained significant attention from both investors and analysts. As Bitcoin’s price experiences fluctuations, reactivating these dormant BTC can have major implications for the overall cryptocurrency market. Dormant coins, or those that have not moved in years, can drastically influence market dynamics upon reentry. This reactivation often leads to further scrutiny of Bitcoin’s price trends and can indicate shifting investor sentiments, potentially pushing prices up or down.

Onchain analytics has revealed fascinating insights into these dormant BTC, demonstrating that substantial amounts of Bitcoin have remained untouched for extended periods. For instance, the significant movement seen in 2025, with over 4.64 million BTC awakening from dormancy, illustrates just how much dormant wealth exists in the market. This could suggest that holders are now more willing to engage with the market, possibly motivated by the need to cash in on profits or to reinvest in other cryptocurrency trends.

The Role of Market Analysis in Bitcoin Dormancy

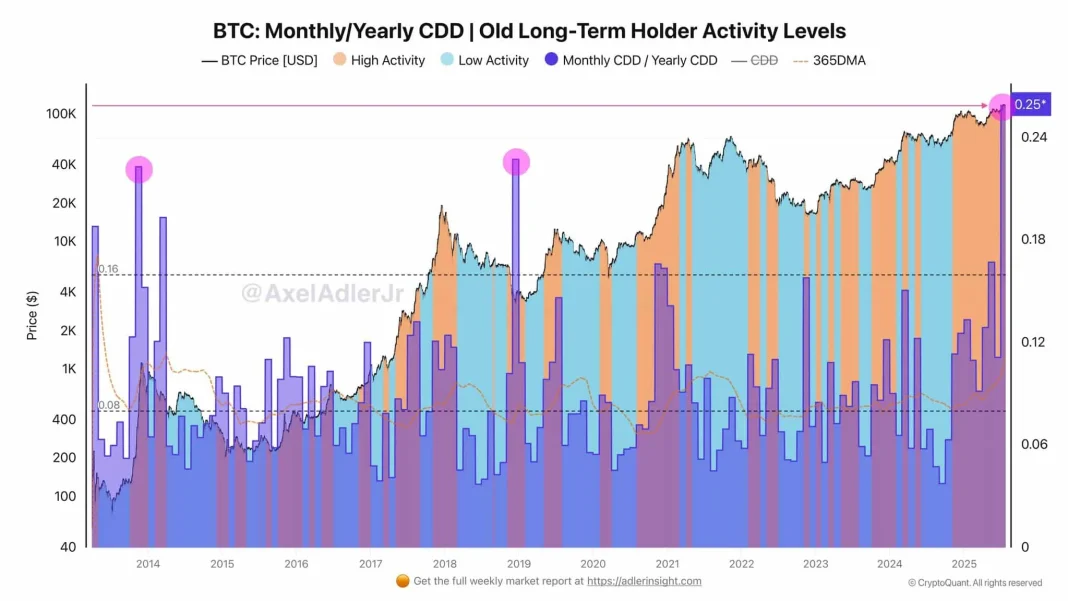

Bitcoin market analysis plays a crucial role in understanding the broader implications of dormant coins reactivating. Analysts like James Check provide in-depth assessments that unravel the complexities behind the reactivation trends observed in 2025. With various categories of dormant coins, particularly those between six months to three years, contributing significantly to market movements, it becomes apparent that market manipulation and strategic profit-taking could be influencing factors. Investors who interpret these patterns can better strategize their own actions in line with Bitcoin optimal trading behaviors.

Furthermore, the insights from onchain analytics demonstrate how renewed engagement from dormant coins could serve as indicators for broader cryptocurrency trends. As large volumes of BTC shift from dormant statuses, analysts can gauge potential market reactions based on historical data. This not only helps in shaping predictions but also provides important context for understanding current market stability. As we advance into the latter months of 2025, close monitoring of these dormant coin movements will undoubtedly be crucial for market participants.

Market Manipulation and Dormant Bitcoin Activity

Market manipulation is a concerning issue that often accompanies significant movements in Bitcoin’s dormant coins. The sudden reactivation of millions of BTC can lead to speculations about potential price impacts, which traders may exploit for profit. In essence, the awakening of these long-held assets can create a ripple effect, influencing market sentiment and potentially leading to significant price volatility. This has been a consistent narrative in prior market cycles, indicating that when dormant coins begin to mobilize, it can herald larger market maneuvers.

Moreover, the interplay between dormant bitcoin activity and market manipulation highlights the importance of transparent onchain statistics. Analysts exploit these data points to decipher patterns and understand whether movements signify genuine investment confidence or strategic market plays. Understanding these nuances can arm investors with the insights needed to navigate periods when dormant coins spring back into the market, especially when evaluating Bitcoin price forecasts?

The Impact of Dormant Wallets in Cryptocurrency Trends

Dormant wallets have far-reaching effects on cryptocurrency trends, particularly in the world of Bitcoin. As old coins reactivate, they can signal not just shifts in individual strategies, but collective market movements. For example, the recent trend of over 4.64 million dormant BTC reawakening suggests a potential trend of increased liquidity, which might entice new investors into the Bitcoin space. Observers note how these trends can indicate a transition in the cryptocurrency ecosystem, prompting discussions about market resilience and investor behaviors.

Additionally, as dormant wallets begin to see movement, the implications for market stability and growth cannot be underestimated. The correlation between dormant BTC activity and spikes in Bitcoin price demonstrates the interconnectedness of holder sentiment and market dynamics. Such insights gleaned through onchain analytics can guide current traders in formulating effective strategies. Ultimately, reactivated dormant wallets serve as a barometer of investor confidence in Bitcoin, shaping future cryptocurrency trends.

Analyzing Bitcoin’s Price Trends Amid Dormant Activations

As Bitcoin dormant coins awaken, they inevitably influence the landscape of Bitcoin price trends. The resurgence of dormant BTC in the past year illustrates a potential turning point for the market. Following periods of stagnation characterized by sideways price movement, such reactivations could signify a re-entry into bullish territory. This phenomenon deserves an in-depth analysis, especially since factors such as historical price benchmarks and investor behavior play pivotal roles in shaping Bitcoin’s future.

Market analysts remain vigilant, realizing that the price of Bitcoin is not only influenced by current trading activity but also by the movements of dormant coins. The psychology behind holding and spending dormant BTC reflects foundational elements of market trust. As traders reevaluate their strategies in light of these activations, they’ll likely draw upon both recent volatility and long-term market analysis to navigate this ever-evolving market landscape.

Questions Surrounding Bitcoin’s Current Market State

In light of Bitcoin’s current market state, numerous questions arise among traders and analysts alike. The resurgence of dormant coins begs the question: what external factors are driving long-holding investors to reactivate their holdings? Factors such as rising Bitcoin price projections and market stability may incentivize investors to cash out, or they may instead signal confidence in further market growth. The unpredictability surrounding these large transactions raises curiosity and caution in equal measure among traders.

Moreover, as Bitcoin prepares for the final months of the year, questions continue to circulate about the longevity of these market trends. Could the activation of dormant wallets signal the beginning of a broader market recovery, or are they merely a temporary spike in activity? How the market reacts to these movements will shape future forecasts and trading strategies, making it essential for interested participants to remain vigilant and informed.

The Future of Mobility in Bitcoin Holdings

Looking ahead, the future of mobility in Bitcoin holdings remains a topic of significant interest within the crypto community. As more dormant coins emerge from inactivity, users will need to balance their approaches to both holding and trading as market conditions evolve. This trend presents unique opportunities for investors eager to capitalize on price fluctuations while navigating the complexities of market sentiment. The interplay between dormant coin behavior and active trading volumes will effectively define how the market evolves.

Moreover, the manipulation of dormant BTC, often considered as indicators of market confidence, will continue to play a pivotal role in price movements. As onchain analytics continue to provide insights, investors must rely on these metrics to make informed decisions moving forward. Adapting to these changes will be crucial for sustaining growth and stability in a market characterized by its rapid change and innovation.

Market Predictions: What Lies Ahead for Bitcoin?

As we glance forward to the remaining weeks of 2025, market predictions surrounding Bitcoin are inherently tied to the movements of dormant coins. Many experts suggest that as the current market stabilizes, we may witness an upsurge in Bitcoin’s overall valuation, a narrative linked to the recent $100,000 benchmark. The actions of dormant BTC holders will influence this narrative, as their reactivation could either cement newfound confidence or confuse market dynamics further.

In conclusion, the ongoing movement of dormant Bitcoins serves as a bellwether for future price phases. Market analysts will continue to adjust their strategies in accordance with these developments, exploring potential scenarios that could lead to significant market shifts. Understanding the intricate dance between dormant BTC and active trades will be essential as we approach the critical year-end trading period.

Frequently Asked Questions

What impact do Bitcoin dormant coins have on Bitcoin price fluctuations?

Bitcoin dormant coins significantly impact Bitcoin price fluctuations as the awakening of long-term held BTC can lead to increased market supply and sudden price volatility. These dormant coins returning to activity can create new trading dynamics, contributing to shifts in the Bitcoin market analysis.

How are dormant BTC coins determined in blockchain analysis?

Dormant BTC coins are determined through onchain analytics, which track the last transaction date of particular wallets. Coins are classified as dormant if they have not moved for a specified period, often years, helping analysts understand historical Bitcoin trends.

What are the recent trends regarding dormant Bitcoin wallets in 2025?

In 2025, a significant trend revealed that approximately 4.64 million dormant Bitcoin coins reactivated, surpassing $500 billion in value. This substantial movement from dormant wallets indicates shifts in investor behavior and potential profit-taking strategies in the cryptocurrency market.

How does the awakening of dormant coins correlate with cryptocurrency market analysis?

The awakening of dormant coins is closely monitored in cryptocurrency market analysis as it can signal changes in investor sentiment, market liquidity, and future price movement. Analysts pay attention to trends in dormant BTC to gauge potential upcoming volatility in Bitcoin prices.

What role do dormant Bitcoin coins play in the current market stagnation?

Dormant Bitcoin coins play a crucial role in the current market stagnation by affecting Bitcoin’s supply dynamics. The return of 4.64 million dormant BTC has contributed to the perceived stagnation, as it suggests long-term holders are either cashing out or redistributing their assets, impacting overall cryptocurrency trends.

How do theories like ‘silent IPO’ relate to Bitcoin dormant coins?

The ‘silent IPO’ theory suggests that long-term Bitcoin holders are treating their investments as if they have become public assets, akin to an IPO. This theory aligns with the recent awakening of dormant coins, as many investors are now selectively cashing out after seeing Bitcoin reach significant price benchmarks.

What historical context should we consider regarding dormant BTC movements?

Historical context regarding dormant BTC movements shows that past years, such as 2017, saw larger volumes of BTC change hands. While 2025’s 4.64 million dormant coins reactivated is significant, it still lags behind historical records, indicating a careful market analysis is necessary to anticipate future trends.

Which wallets are most affected by the reactivation of dormant Bitcoin?

In 2025, wallets aged six months to one year were the most affected, transferring nearly 1.98 million BTC. Additionally, other significant movements came from wallets aged one to three years, indicating targeted profit-taking efforts among different categories of dormant BTC holders.

| Key Point | Details |

|---|---|

| Bitcoin Price Decline | In November, Bitcoin’s price fell by 5.68%, following a 3.69% decline in October. |

| Dormant Coins Reactivated | 4.64 million BTC, worth over $500 billion, reactivated in 2025, primarily from inactive wallets. |

| Major Contributing Ages | The majority of movements came from coins dormant for 6 months to 1 year (1,979,864 BTC), followed by various other age groups up to 10 years. |

| Market Theories | Analysts speculate causes like market manipulation, ‘paper BTC’ effects, and a ‘silent IPO’ influencing Bitcoin’s performance. |

| Historical Context | While 2025 saw record U.S. dollar value for dormant spending, previous years recorded higher raw BTC movement, with 7 million in 2017 and 6.8 million in 2024. |

Summary

Bitcoin dormant coins are currently making headlines, as 4.6 million BTC have reactivated in 2025, sparking discussions in the crypto community. This significant movement indicates potential shifts in market trends and investor behavior following a prolonged period of stagnation. As onchain analyst James Check notes, the reactivation of such dormant coins may be a response to reaching new price milestones, signaling that holders are ready to realize profits. With market strategies and theories at play, including speculations of profit-taking and market manipulation, the events of 2025 remain a pivotal point for Bitcoin’s future direction.