Bitcoin ETF inflows have been garnering significant attention as the digital asset market experiences a resurgence in investor enthusiasm. Recent data indicates that Bitcoin spot ETF inflows reached an impressive $166.56 million over just three days, leading the charge in a rare all-green performance among crypto exchange-traded funds (ETFs). This uptick in inflow not only signals a wave of renewed investor confidence in cryptocurrencies but also highlights a broader trend of recovery across the digital asset landscape. As Bitcoin continues to dominate the market, we also see promising performances from Ether and other assets, suggesting a vibrant and rejuvenated crypto environment. With the latest trends in Bitcoin and Ether ETFs, it’s clear that the crypto ETF performance is starting to mirror the optimistic sentiment sweeping across the sector.

The resurgence of capital flowing into Bitcoin exchange-traded funds (ETFs) signifies a crucial moment for the cryptocurrency landscape. This surge in assets reflects a growing trust among investors in digital currencies, marking an optimistic turn in the market’s dynamics. The parallel rise in interest for Ethereum and other prominent digital tokens also points towards a collective recovery, indicating that confidence in these financial products is on the upswing. As we navigate through this shifting terrain, the patterns emerging from Bitcoin and Ether ETF trends underscore the alignment of investor strategies with the overall market health. Such movements suggest that many are turning back to crypto investments, eager to capitalize on the revitalized digital asset ecosystem.

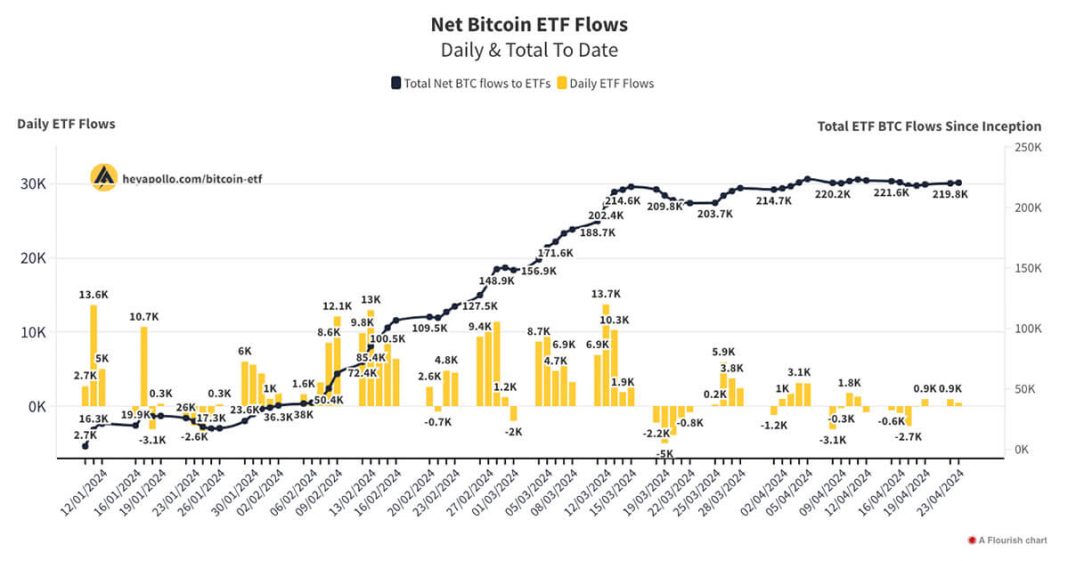

Understanding Bitcoin ETF Inflows and Market Dynamics

The recent surge in Bitcoin ETF inflows signifies a crucial turning point for the digital asset market, as institutional investors showcase renewed interest. Bitcoin ETFs, particularly the spot varieties, recorded an impressive influx of $166.56 million, indicating a robust confidence among traders and investors alike. This spike can be attributed to various factors, including the ongoing recovery of the digital asset market, which has seen Bitcoin maintaining its position as a market leader. When traditional investors observe significant inflows toward Bitcoin, it reinforces the perception of its stability and potential for growth after a turbulent market phase.

Furthermore, the performance of Bitcoin ETFs has demonstrated a strong correlation with the trading volume in the crypto space. The current trading activity, surpassing $3.38 billion, highlights a period of heightened investor enthusiasm and engagement. Such increasing interest can lead to higher asset accumulation, further strengthening investor confidence in cryptocurrencies overall. As a consequence, continued inflows into Bitcoin ETFs might invite more participants into the digital asset market, projecting an optimistic outlook for Bitcoin and its counterparts like Ether and XRP.

The Resurgence of Investor Confidence in Cryptocurrencies

The revival of investor confidence in cryptocurrencies is particularly evident as Bitcoin and its associated ETFs make headlines with significant inflows. After a prolonged period of market uncertainty, the collective performance of Bitcoin, Ether, XRP, and Solana ETFs closing higher represents a pivotal moment. Each of these assets has shown potential for recovery, with Bitcoin leading the charge through impressive inflows, showcasing a strong narrative of positive momentum across the crypto landscape. A synchronized rally among these major digital assets suggests that investors are beginning to see value amid fluctuating sentiments.

This resurgence is not solely based on market strategies but also reflects fundamental shifts in how cryptocurrencies are perceived. With large institutional players like Ark Investment Management and Fidelity contributing massively to Bitcoin ETF inflows, there’s evidence that traditional finance is increasingly embracing the crypto sector. Positive news cycles and improved regulatory clarity around digital assets have further bolstered investor sentiment. Collectively, these factors contribute to the emerging trends of trust and reliance in crypto investments, promising sustained growth as broader acceptance continues.

Analyzing the Performance of Crypto ETFs

The recent performance of crypto ETFs has showcased a dynamic shift toward recovery, with Bitcoin ETFs leading the influx and overall market sentiment. The simultaneous gains across various categories of crypto ETFs have sparked interest among investors seeking diversified exposure to the digital asset market. Bitcoin—and particularly spot ETFs—have been front runners, reflecting both solid inflows and heightened trading volumes. This trend is supported by an overall strategic pivot toward assets that have demonstrated resilience despite market volatility.

Investors who closely watch crypto ETF performance note the implications for their portfolios. With Bitcoin leading the way, the additional interest in Ether, XRP, and Solana signifies a broader acceptance and growing confidence in crypto investments. The interaction between Bitcoin’s performance and its ETF inflows creates a ripple effect that can strengthen market fundamentals. Investors are keen on such trends as they may provide insights into the general direction of the cryptocurrency market, indicating how and where they should allocate their resources for maximum impact.

Spot ETF Trends: What Investors Should Know

The emergence of Bitcoin spot ETFs marks a significant innovation in the cryptocurrency investment landscape. These financial instruments allow investors to gain exposure to Bitcoin without needing to hold the asset directly. Recently, Bitcoin spot ETFs recorded remarkable inflows exceeding $166 million, indicating that they are fast becoming a favored method for institutional investing. This growing trend is not only reflective of improving market conditions but also highlights a strategic acceptance of Bitcoin as a legitimate asset class within larger portfolios.

Investors are now able to leverage Bitcoin spot ETFs to capitalize on price movements in a more regulated and potentially less volatile manner than trading Bitcoin directly. This evolution of market strategies corresponds with a shifting narrative surrounding cryptocurrencies, fostering an environment where institutional adoption appears not only viable but also advantageous. As this trend matures, market observers will be keen to analyze how spot ETFs influence overall investor behavior and the broader digital asset ecosystem.

The Effect of Trading Volume on Bitcoin and Ether ETFs

Trading volume plays a crucial role in understanding the health and momentum of Bitcoin and Ether ETFs in the broader cryptocurrency market. The recent trading activity showcases significant volume, with Bitcoin ETFs surpassing $3.38 billion. This surge in trading suggests that market participants are actively engaging with these financial instruments, giving insights into the general appetite for cryptocurrencies. High trading volumes often correlate with stronger price movements and increased volatility, providing traders with opportunities but also underscoring the risks associated with rapid market changes.

In the context of Ether ETFs, consistent net inflows of $13.82 million further illustrate that market players are diversifying their exposure, capitalizing on positive sentiment enhancements in the crypto sphere. With strong trading volumes fueling the competition among different digital asset classes, both Bitcoin and Ether ETFs are positioned to benefit from increased liquidity and interest. This dynamic interplay between trading volume and ETF performance will likely continue to shape investment strategies and overall market trends moving forward.

What the Recent Rally Means for XRP and Solana ETFs

The recent rally in the cryptocurrency market has propelled XRP and Solana ETFs into the spotlight, reflecting a growing divergence in the performance of various digital assets. With XRP ETFs experiencing inflows of $3.26 million—primarily driven by institutional investments—the renewed interest indicates a broader recovery trend that not only centers on Bitcoin but also encompasses significant gains for alternative cryptocurrencies. Solana, with net inflows of $8.43 million, exemplifies how diverse participation is reshaping investor strategies in the crypto space.

This shift away from Bitcoin-centric investment strategies enhances the prospects for a more balanced and inclusive digital asset market. Investors are increasingly looking beyond Bitcoin and Ether and recognize the potential in supporting assets like XRP and Solana. This diversification is not only beneficial to individual portfolios but also lends stability to the broader cryptocurrency market, fortifying it against risks that have historically led to volatility. Observing this trend can inform investment decisions as market players strive to balance their exposure to various digital assets.

How Digital Asset Market Recovery Influences ETF Flow

The overall recovery of the digital asset market has direct implications for the flow of capital into various crypto ETFs. With Bitcoin leading the charge in attracting significant inflows, the positive sentiment surrounding its recovery has created a cascading effect on other assets. As Bitcoin ETF inflows continue to rise, it reassures investors about the stability and growth potential of the entire market, prompting them to explore and invest in other ETFs such as those for Ether, XRP, and Solana. This interconnectedness among cryptocurrencies is significant to note as it illustrates how a recovery in one asset class can invigorate the entire sector.

Moreover, a healthy digital asset market recovery fosters an environment conducive to further institutional investment and exploration of new financial products, like crypto ETFs. As liquidity increases and more players enter the market, it is plausible to see sustained inflows across various crypto ETFs, reinforcing market stability. This synergy between market recovery and ETF performance indicates that investors should pay close attention to broader market indicators, as they will likely influence ETF capital allocations and investor strategies moving forward.

Identifying Key Trends in Bitcoin and Ether ETF Inflows

Recent trends in Bitcoin and Ether ETF inflows highlight significant shifts in investor behavior and market preferences. Bitcoin’s inflows, amounting to $166.56 million, underscore an increasing institutional interest in this leading cryptocurrency, reflecting confidence in its long-term value proposition. While Ether also recorded commendable inflows of $13.82 million, the data illustrates how investor confidence is distributed across the major cryptocurrencies, encouraging diversification. Understanding these trends is vital for investors looking to navigate the complexities of the digital asset market effectively.

Furthermore, the performance of these ETFs can often act as a pivotal indicator of market prices and sentiment. As Bitcoin continues its upward trajectory, and as institutional support fortifies its position, it can be expected that Ether and other assets will follow suit if they can capture a fraction of that interest. This analysis suggests that investors keeping an eye on both Bitcoin and Ether trends may capitalize on potential profit opportunities while also assessing risks associated with their overall cryptocurrency investments.

Future Outlook for Crypto ETFs Amidst Inflows

With sustained inflows into Bitcoin and its associated ETFs, the future outlook for crypto ETFs appears increasingly optimistic. As their popularity continues to surge, more investors may seek to enter the market through these vehicles, which offer a regulated approach to gaining exposure without the need to directly manage digital assets. The promising performance across Bitcoin and Ether ETFs sets a precedent, indicating that there is significant room for growth in this investment class as traditional financial entities continue to embrace cryptocurrencies.

Moreover, the collective performance of crypto ETFs amid this period of growth suggests a developing trend that could lead to innovation in fund structures and offerings. As investors become more educated about the benefits and risks associated with cryptocurrency investments, financial institutions may respond by creating tailored ETF products specifically designed to capture unique market opportunities. This evolution poses a considerable advantage for investors, as it may further bolster investor confidence in cryptocurrencies and stimulate a broader acceptance that can foster long-term stability in the digital asset market.

Frequently Asked Questions

What influenced the recent Bitcoin ETF inflows?

The recent Bitcoin ETF inflows were influenced by a resurgence of investor confidence in cryptocurrencies, alongside a general market recovery for digital assets. This led to significant net buying in Bitcoin spot ETFs, marking the third consecutive day of inflows.

How significant were the Bitcoin spot ETF inflows?

The Bitcoin spot ETF inflows were significant, totaling $166.56 million across six funds, indicating robust market activity and recovery in the digital asset market.

Which cryptocurrencies contributed to the ETF inflows?

During this period, Bitcoin led the inflows with $166.56 million, followed by Ether with $13.82 million, XRP with $3.26 million, and Solana with $8.43 million. This highlights a broad recovery trend across major cryptocurrencies.

What does the performance of Bitcoin ETFs suggest about crypto market trends?

The performance of Bitcoin ETFs, particularly with the consecutive inflows and positive trading activity, suggests an overall positive trend in crypto markets, reinforcing growing investor confidence in Bitcoin and other digital assets.

What are the implications of the latest Bitcoin ETF inflows for investor sentiment?

The latest Bitcoin ETF inflows reflect a shift in investor sentiment, signaling renewed interest and confidence in cryptocurrencies, which could lead to further investments in digital assets as the market recovers.

Which Bitcoin ETF experienced the largest inflow recently?

The Bitcoin ETF that experienced the largest inflow recently was Ark & 21Shares’ ARKB, which attracted $68.53 million, indicating strong demand for this fund amidst the broader recovery in the digital asset market.

How do current Bitcoin ETF inflows compare to previous trends?

Current Bitcoin ETF inflows are showing a positive reversal compared to earlier trends, indicating improved investor sentiment and market recovery, as several funds posted significant inflows after a quieter period.

Are the recent Bitcoin ETF inflows sustainable?

While the recent Bitcoin ETF inflows indicate a strong recovery momentum, their sustainability will depend on ongoing market conditions, regulatory developments, and continued investor confidence in the cryptocurrency space.

| Cryptocurrency | Net Inflows | Major Contributors | Trading Volume | Total Assets |

|---|---|---|---|---|

| Bitcoin | $166.56 million | ARKB: $68.53 million FBTC: $56.92 million IBIT: $26.53 million Grayscale Mini Trust: $6.08 million Valkyrie BRRR: $4.86 million WisdomTree BTCW: $3.64 million |

$3.38 billion | $87.75 billion |

Summary

Bitcoin ETF inflows have shown remarkable strength with $166.56 million entering the market, leading a resurgent trend in cryptocurrency exchange-traded funds (ETFs). This broad growth signals renewed investor confidence, as multiple assets, including Ether, XRP, and Solana, also experienced positive inflows. The collective performance of these ETFs suggests a significant recovery in the digital asset space, highlighting the potential for sustained momentum in the coming days.