Bitcoin ETF outflows have sent ripples through the cryptocurrency market, challenging the resilience of the world’s leading digital asset. As Bitcoin neared the crucial $100,000 support level, the sharp withdrawals from exchange-traded funds have raised concerns among investors, highlighting the delicate balance of demand and supply in the crypto arena. Contributing to this turmoil, macroeconomic conditions, including the impact of Federal Reserve policies, have intensified uncertainty, creating a perfect storm for risk assets. Investors are now keenly watching Bitcoin price analysis, as fluctuations can significantly affect overall market sentiment. With these ETF outflows, the potential for recovery hinges on both regulatory clarity and a bullish shift in market dynamics.

Recent trends in Bitcoin investments show marked withdrawals from exchange-traded funds, raising alarms in the digital currency ecosystem. As traditional market forces clash with evolving investor sentiment, the stability of Bitcoin’s price is tested against pivotal economic indicators. Macro challenges and shifts in central bank policy are at the forefront, influencing how traders navigate this volatile landscape. Investors and analysts alike are keenly observing alternative metrics and financial tools to assess Bitcoin’s trajectory amid this turmoil. Understanding these shifts through comprehensive price analysis and macroeconomic context will be essential for predicting future movements in the cryptocurrency market.

Bitcoin ETF Outflows Impact on Market Sentiment

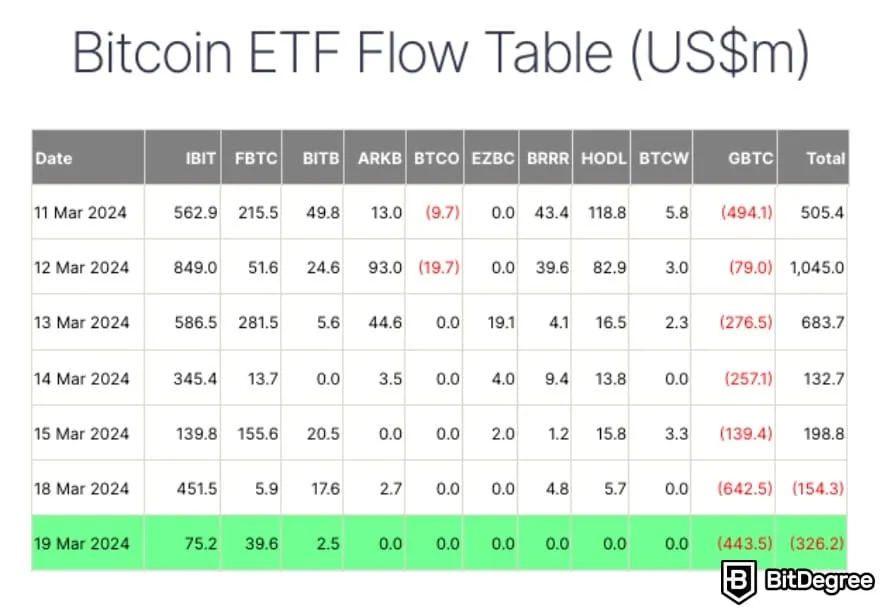

Over the past week, Bitcoin faced significant selling pressure due to substantial ETF outflows amounting to around $1.3 billion. This trend not only highlights the shifting investor sentiment but also underscores the critical role that exchange-traded funds play in the Bitcoin ecosystem. As institutional investors withdrew funds from these vehicles, fear and uncertainty spread through the cryptocurrency market, contributing to Bitcoin’s price decline. The outflows raise questions about the sustainability of recent bullish momentum and whether current macroeconomic conditions can support a rebound in price.

Investors are now more cautious, reflecting on the ramifications of these outflows. The combination of ETF withdrawals and sustaining economic uncertainties tied to Federal Reserve policies has instigated a risk-off sentiment in the broader markets. As traders closely monitor the Bitcoin price analysis, it’s vital to recognize that ETF inflows might serve as a vital indicator of market recovery. Should there be a trend reversal and renewed flows into Bitcoin-related ETFs, there could be a significant resumption in buying activity, fundamentally changing the trajectory of Bitcoin’s market performance.

Bitcoin Holds Key Support at $100K Despite Volatility

The $100,000 support level for Bitcoin has become a focal point for traders and market analysts amid turbulent market conditions. This critical price point is now considered a psychological barrier, essential for maintaining market stability. Following a recent test of this support, Bitcoin’s ability to bounce back to approximately $103,000 indicates resilience, suggesting bullish sentiment might remain if market conditions shift favorably. The technical indicators remain cautiously optimistic, contingent on maintaining this key support level.

Despite the volatile swings in Bitcoin’s price, the macroeconomic landscape offers a silver lining. The ongoing economic expansion in the U.S. suggests that there are supportive conditions for risk assets, including cryptocurrencies. If the Federal Reserve provides clearer policy guidance and addresses current uncertainties, it could catalyze positive movements in Bitcoin’s price. Market participants are hopeful that any stabilization in ETF flows will also inject fresh capital into Bitcoin, reinforcing the $100,000 mark as a new baseline for future price movements.

Impact of Fed Policy on Bitcoin and Broader Cryptocurrency Market

The Federal Reserve’s monetary policy holds considerable sway over the cryptocurrency market, affecting investor behavior and decision-making processes. Recent developments indicate a pause in aggressive rate hikes, which could bolster risk appetite among investors. Lower interest rates and a steady economic expansion create a more favorable environment for Bitcoin and other cryptocurrencies. However, traders remain apprehensive; any sudden shifts in the Fed’s approach could spark renewed volatility across markets.

As Bitcoin navigates through these macroeconomic waters, understanding the influence of policy decisions becomes even more crucial. The interconnectivity between the crypto market and traditional finance underscores the importance of monitoring Federal Reserve actions. A supportive policy environment could breathe life back into Bitcoin prices, fostering an uptrend as institutional confidence returns. Investors should remain vigilant, as sudden changes can swiftly impact Bitcoin’s valuation and the overall sentiment in the cryptocurrency market.

Analyzing Bitcoin Price Dynamics Amidst Macro Economic Conditions

In the ever-evolving landscape of cryptocurrency, analyzing Bitcoin’s price dynamics in light of macroeconomic conditions is vital for forecasting future movements. Bitcoin’s recent dip to about $100,000 illustrates how external economic factors, like the strength of the U.S. dollar and inflationary pressures, can dictate market trends. The interplay between these macroeconomic variables and investor sentiment plays a pivotal role in shaping price behavior.

Furthermore, with the broader cryptocurrency market experiencing fluctuating trends, a thorough Bitcoin price analysis helps investors identify potential opportunities and risks. Recognizing the correlation between macro conditions and Bitcoin’s performance can empower traders to make informed decisions. As the investor landscape adjusts to economic indicators, those who can adeptly navigate these complexities will be better positioned to predict Bitcoin’s trajectory amidst ongoing uncertainty.

Future Prospects for Bitcoin: ETFs and Market Recovery

Looking ahead, the future prospects for Bitcoin hinge on the recovery of ETF inflows and the broader sentiment shift in the cryptocurrency market. The recent outflows serve as a reminder of the volatility that can ensue when investor confidence wanes, but they also highlight a potential buying opportunity for savvy investors who recognize the cyclical nature of asset flows. If Bitcoin can attract institutional capital through renewed ETF interest, it could ignite a robust rally, fostering a more bullish environment.

Moreover, the interplay between individual investor behavior and institutional participation will play a crucial role in determining Bitcoin’s price trajectory. As the market awaits clearer signals from the Federal Reserve and looks for resolution on key economic issues, the potential for a resurgence remains. Adaptive strategies geared towards capitalizing on these anticipated trends can position investors for success as Bitcoin navigates its next phase of growth.

Understanding Bitcoin’s Resilience in Adversity

Bitcoin has demonstrated remarkable resilience amidst economic turbulence and policy uncertainty. Despite facing challenges such as ETF outflows and macroeconomic volatility, Bitcoin’s ability to maintain its foothold above critical support levels speaks volumes about its strength against external pressures. Some investors view such testing times as an opportunity to accumulate more during pullbacks, reinforcing the bullish case for Bitcoin in a recovering market.

As the cryptocurrency market evolves, the underlying fundamentals supporting Bitcoin continue to attract attention. With a growing base of institutional adoption and increased public interest, Bitcoin’s long-term potential remains bright. The ability to bounce back from adverse conditions showcases its status as a viable asset in diversified portfolios. Market participants should remain vigilant, as understanding these resilience factors will be key to navigating future challenges and opportunities.

ETF Trends: Key Indicators for Bitcoin’s Investment Landscape

Monitoring ETF trends is essential for investors seeking insights into Bitcoin’s investment landscape. As ETFs have become a significant vehicle for engagement in the cryptocurrency sphere, tracking their inflows and outflows provides crucial data on investor sentiment. When ETF inflows increase, it typically signals renewed confidence in Bitcoin, while significant outflows, as recently experienced, can indicate more cautious or bearish approaches among institutional investors.

The relationship between Bitcoin’s price movements and ETF dynamics offers traders pivotal analytical insights. Understanding this correlation can assist investors in anticipating price trajectories based on ETF trends. If the recent trend of outflows reverses and inflows begin to materialize again, it could potentially mark the start of another bullish rally, creating favorable conditions for Bitcoin’s recovery and growth in the long run.

Navigating the Crypto Market: Strategies for Bitcoin Investors

Amidst the fluctuating landscape of the cryptocurrency market, Bitcoin investors must adopt strategies that account for both macroeconomic conditions and market sentiment. A comprehensive approach entails staying informed about global financial trends, Federal Reserve announcements, and Bitcoin price analysis. Investors are encouraged to develop risk management strategies that encompass both short-term volatility and long-term investment horizons.

Additionally, diversifying investment portfolios to include a mix of assets can help mitigate risks associated with Bitcoin’s price fluctuations. Moreover, keeping an eye on technological advancements and enhancements within the Bitcoin network will further empower investors to make informed decisions. By being proactive and adaptive, investors can position themselves effectively in a dynamic market, capitalizing on Bitcoin’s growth potential while navigating the complexities inherent in the cryptocurrency landscape.

The Psychological Aspect of Bitcoin Trading: Market Sentiment Analysis

Understanding the psychological aspects of Bitcoin trading is crucial for investors navigating sentiment-driven markets. Investor sentiment can fluctuate wildly based on news cycles, economic indicators, and broader market trends. When Bitcoin approaches significant psychological levels, such as the $100,000 mark, traders’ behavior can shift dramatically, leading to heightened volatility. Recognizing these patterns can provide traders with strategic advantages in their decision-making processes.

Market sentiment analysis plays a vital role in anticipating potential price movements, making it essential for traders to remain attuned to prevailing attitudes within the market. By analyzing sentiment indicators and incorporating them into their trading strategies, investors can fine-tune their entry and exit points, optimizing their exposure to Bitcoin’s price dynamics. Culturally, Bitcoin’s investment ecosystem thrives on narratives, making sentiment analysis a critical tool in gauging the market’s pulse.

Frequently Asked Questions

How do Bitcoin ETF outflows impact the cryptocurrency market?

Bitcoin ETF outflows can lead to increased selling pressure in the cryptocurrency market, as investors withdraw funds from ETFs. This often results in price declines and heightened volatility, affecting overall market sentiment.

What are the implications of recent Bitcoin ETF outflows on Bitcoin’s support level?

Recent Bitcoin ETF outflows have tested the $100,000 support level, causing concern among traders. If outflows continue, this support may weaken, making it crucial for BTC to recapture and stabilize above this level to ensure a sustainable recovery.

How do macroeconomic conditions influence Bitcoin ETF outflows?

Macroeconomic conditions, such as Federal Reserve policy and economic growth, significantly influence investor sentiment. Uncertainty in these areas can trigger Bitcoin ETF outflows as investors seek safer assets amid risk aversion.

What role do ETF outflows play in Bitcoin price analysis?

ETF outflows serve as a critical factor in Bitcoin price analysis, highlighting shifts in investor confidence and potential bearish trends. Monitoring these outflows can provide insights into future price movements and market dynamics.

Can favorable Fed policies reverse Bitcoin ETF outflows?

Yes, favorable Federal Reserve policies can enhance market sentiment, potentially reversing Bitcoin ETF outflows. Clear guidance from the Fed may restore investors’ appetite for riskier assets like Bitcoin, leading to increased inflows into ETFs.

| Key Points | Details |

|---|---|

| Bitcoin’s Value Movement | Tested the $100,000 support level before rebounding to approximately $103,000. |

| ETF Outflows | Approximately $1.3 billion in outflows observed over four consecutive sessions. |

| Market Conditions | U.S. dollar strength and uncertainty surrounding Federal Reserve policy have pressured risk assets. |

| Importance of $100,000 Level | Seen as a critical line; further ETF inflows may determine sustainability of recovery. |

| Future Outlook | Reversal in ETF outflows and favorable Fed policy could spark a recovery. |

Summary

Bitcoin ETF outflows have significantly impacted the cryptocurrency market, contributing to Bitcoin’s recent decline towards the $100,000 support level. Despite this turbulence, the fundamental economic backdrop remains supportive, with the U.S. economy showing signs of steady growth. The future trajectory of Bitcoin will largely depend on the reversal of these ETF outflows and clearer guidance from policymakers, as investors look for signs of renewed risk appetite in the market.