Bitcoin ETFs are currently experiencing a remarkable surge, recording their seventh consecutive day of inflows that total a staggering $876 million. This influx underscores a solid institutional demand for investment in Bitcoin, as evidenced by the remarkable $875.61 million captured in new inflows. With traders increasingly confident, this bullish momentum is not only lifting Bitcoin but also creating ripples through the crypto market trends. Notably, Blackrock’s IBIT, which alone contributed an impressive $899.42 million, is at the forefront of this extraordinary trend, solidifying its position in the market. As institutional investors pile into these funds, the prospect for Bitcoin ETFs seems brighter than ever, with net assets now soaring to $164.91 billion.

Recently, the landscape of cryptocurrency investment has been significantly enriched by the emergence of exchange-traded funds (ETFs) focused on Bitcoin. These innovative financial products have ushered in a wave of fresh capital, as evidenced by escalating inflows and a robust performance across various digital assets. The rising interest from institutional players is reshaping investment strategies and highlighting the growth potential within this dynamic sector. As more investors seek exposure to digital currencies through regulated platforms, the interplay of Bitcoin and Ether ETFs becomes a critical point for those monitoring the evolving market landscape. Emphasizing this trend reveals a shift towards mainstream acceptance of crypto assets, paving the way for broader adoption.

Understanding Bitcoin ETFs: An Overview

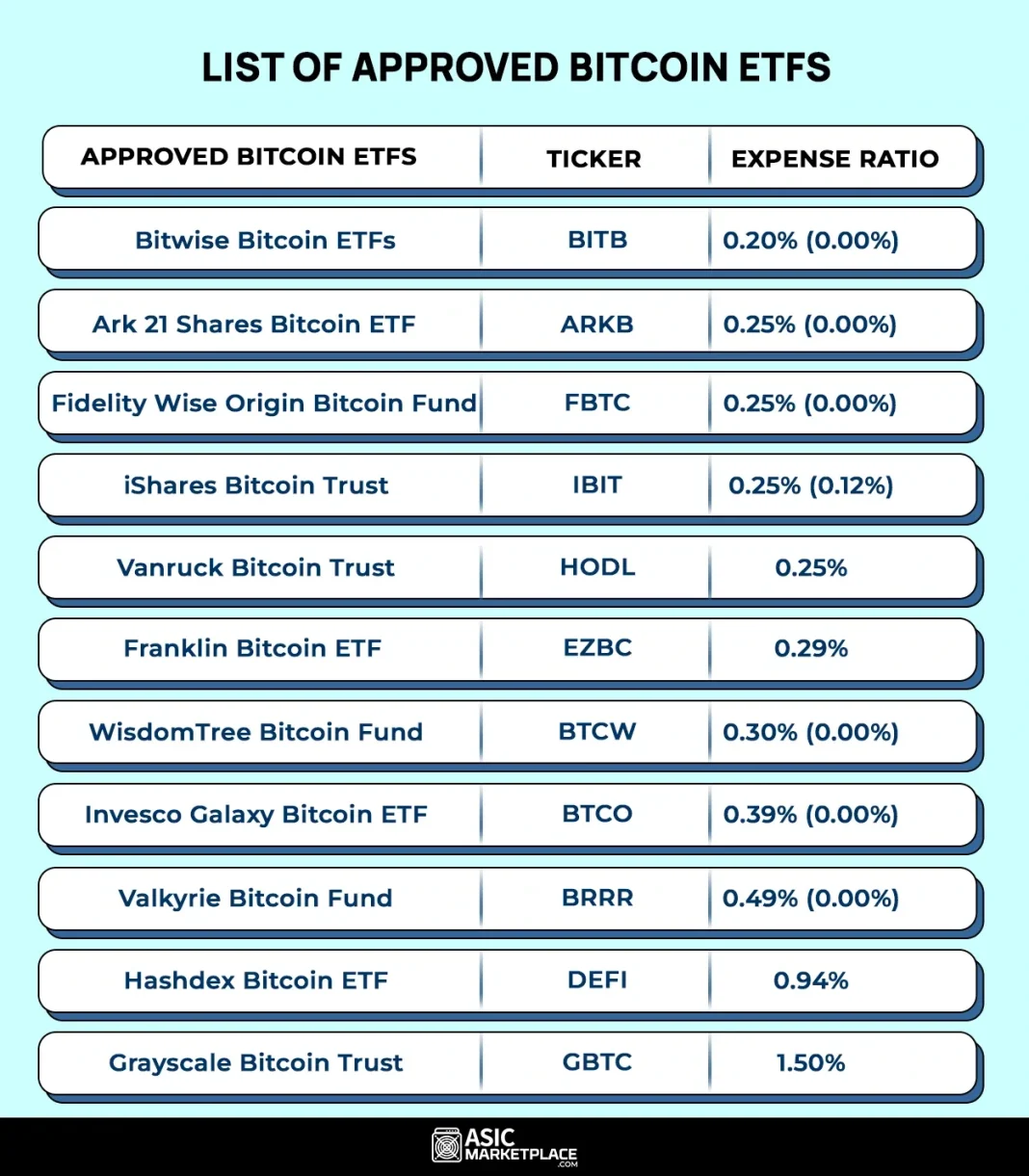

Bitcoin exchange-traded funds (ETFs) have become a prominent avenue for investors looking to gain exposure to the world of cryptocurrencies without needing to directly purchase and hold the assets. This investment vehicle has gained traction due to its regulatory approval, ease of trading, and potential for high returns. The recent surge in Bitcoin ETF inflows shows that institutional demand is stronger than ever, reflecting growing confidence in the crypto market’s long-term viability.

With Bitcoin ETFs attracting significant capital, particularly during the last week with inflows exceeding $875 million, it’s clear that institutional investors are watching crypto market trends closely. These inflows are being led by major players like Blackrock, which has contributed heavily to the positive momentum in the sector. As institutions seek to diversify their portfolios, Bitcoin ETFs provide a relatively safe exposure to digital currencies, prompting more significant investments.

Frequently Asked Questions

What are the current Bitcoin ETF inflows and what do they indicate?

Bitcoin ETF inflows have recently reached an impressive $875.61 million over a seven-day period, showcasing strong institutional demand for Bitcoin investments. This surge reflects a bullish trend in crypto market sentiment, as net assets for Bitcoin ETFs have grown substantially, crossing the billion-dollar threshold in multi-day totals.

How have Bitcoin ETFs performed compared to Ether ETFs in recent days?

In a recent performance comparison, Bitcoin ETFs attracted $876 million in inflows, while Ether ETFs saw $421 million in new investments. This consistent inflow into both asset classes indicates a broader bullish trend in the crypto markets, highlighting growing institutional interest in Bitcoin and Ethereum exposure.

What is driving the institutional demand for Bitcoin ETFs?

The recent spike in institutional demand for Bitcoin ETFs can be attributed to increased investor confidence and bullish crypto market trends. The substantial inflows indicate a shift towards safer investments in cryptocurrencies, propelling Bitcoin ETFs to strong performance metrics and reaffirming their appeal among institutional players.

How do Bitcoin ETF inflows impact the broader crypto market?

Bitcoin ETF inflows significantly impact the broader crypto market by fostering confidence among investors and attracting new capital. As Bitcoin ETFs see increased inflows, this can lead to heightened market activity and positive price momentum, further encouraging investment in Bitcoin and other cryptocurrencies.

What role does Blackrock play in the Bitcoin ETF inflows?

Blackrock has emerged as a major player in Bitcoin ETF inflows, contributing a staggering $899.42 million in recent days. This single contribution from Blackrock’s IBIT exemplifies the firm’s influence and commitment to Bitcoin investments, reinforcing its position at the forefront of institutional demand in the crypto market.

Are Bitcoin ETFs currently experiencing any outflows and how does it affect the investment landscape?

While Bitcoin ETFs are primarily experiencing inflows, Grayscale’s GBTC did see a minor outflow of $28.62 million. Despite this setback, the overall investment landscape remains positive with strong inflows, indicating sustained interest in Bitcoin ETFs and a growing acceptance of these investment vehicles.

What does the trading volume of Bitcoin ETFs tell us about market sentiment?

The recent trading volume for Bitcoin ETFs surged to an impressive $7.79 billion, reflecting renewed investor confidence and optimism in the market. High trading volumes often precede price movements, suggesting that the current bullish momentum in Bitcoin ETFs may continue as more institutional investors enter the space.

| Category | Bitcoin ETFs | Ether ETFs |

|---|---|---|

| Total Inflows (Last 7 Days) | $875.61 million | $420.87 million |

| Leading Contributor | Blackrock’s IBIT: $899.42 million | Blackrock’s ETHA: $437.51 million |

| Other Notable Contributions | Valkyrie’s BRRR: $4.81 million Grayscale’s GBTC: -$28.62 million |

Grayscale’s Ether Mini Trust: $5.48 million 21shares’ TETH: $3.58 million Fidelity’s FETH: -$25.70 million |

| Trading Volume | $7.79 billion | $4.04 billion |

| Net Assets | $164.91 billion | $30.85 billion |

Summary

Bitcoin ETFs are gaining increasing recognition as institutional demand and positive sentiment drive significant inflows. With impressive figures reflecting resilience in the current crypto market, Bitcoin ETFs continue to outperform expectations, showcasing a compelling investment vehicle for both seasoned and new investors alike. The sustained momentum and the introduction of innovative products, like those from Blackrock, signal a strong future for the sector.