Bitcoin hashrate plays a crucial role in the entire cryptocurrency ecosystem, serving as a measure of the computational power being utilized by miners to validate transactions. Recently, Bitcoin’s hashrate skyrocketed to an impressive 1,164 exahash per second (EH/s), reflecting the growing strength of Bitcoin mining operations. This surge in hashrate not only highlights the competition among Bitcoin miners but also boosts the overall network’s security and transaction efficiency. Additionally, rising BTC prices have contributed to a favorable environment for miners, making the hashprice—representing the profit derived from mining—incrementally attractive. As the latest hashrate statistics illustrate, the combination of increased mining power and favorable market conditions is paving the way for a bullish period in the world of Bitcoin.

The computational efficiency of Bitcoin’s network, indicated by its hashrate, is now more pivotal than ever as miners continue to push boundaries in cryptocurrency mining. The impressive milestone of achieving 1.164 zettahash per second reaffirms the commitment of Bitcoin miners to enhance their operational capabilities. With the transactional framework supported by robust hashrate values, the ecosystem stands resilient against challenges while adapting to market fluctuations. This increase in mining power also parallels the rising BTC value, linking profitability to the enhancements in hashrate statistics. As hashprice continues to rise, it invites both seasoned and novice miners to participate in this dynamic landscape, ensuring the ongoing evolution of Bitcoin mining.

Understanding Bitcoin Hashrate: Key Metrics and Trends

Bitcoin hashrate is a crucial metric that represents the total computational power used to mine Bitcoin and process transactions on the Bitcoin network. In recent times, Bitcoin’s hashrate achieved significant milestones, reaching an impressive level of 1.164 zettahash per second (ZH/s). This surge reflects the increasing efficiency and capability of Bitcoin miners as they utilize advanced hardware technology to enhance their mining operations. The hashrate statistics available from various sources signify not just the growing interest in mining Bitcoin but also the underlying stability of the network as more miners join and contribute their processing power.

With the mining sector continuously evolving, the hashrate serves as an indicator of the overall health of the Bitcoin network. A higher hashrate generally leads to improved security and faster transaction confirmations, as more miners compete to solve complex mathematical problems. For miners, understanding hashrate trends is vital for optimizing their operations and maximizing profitability—especially when combined with fluctuating BTC prices that can influence the viability of mining activities. The dynamic nature of the Bitcoin market means that miners must stay informed about hashrate movements and expected shifts in BTC price to make strategic decisions.

The Role of Mining Pools in Bitcoin’s Hashrate Landscape

The Bitcoin mining ecosystem is heavily influenced by mining pools, where multiple miners collaborate to increase their chances of finding new blocks and receiving rewards. Pools like Foundry USA and Antpool currently dominate the space, controlling nearly 46% of the total Bitcoin hashrate. These pools aggregate individual miners’ hashrate to form a more substantial collective power, enhancing the likelihood of successfully mining Bitcoin and distributing rewards among participants based on their contributed power. As Bitcoin mining becomes increasingly competitive, being part of a pool provides miners with a more stable income compared to solo mining efforts.

The competitive edge provided by these mining pools is significant, particularly as new miners enter the field and established operations expand their capabilities. Foundry, for example, showcases extraordinary performance with a leading hashrate of around 334.18 EH/s. This concentration of power can influence Bitcoin’s overall security and decentralization, a critical factor for the cryptocurrency’s integrity. While mining pools contribute to collective hashrate statistics, they also must navigate the challenges of ensuring fair payouts and maintaining a reliable operational structure to thrive within this ever-evolving space.

Exploring the Impact of Hashprice on Bitcoin Mining Profitability

As Bitcoin’s price volatility continues to play a pivotal role in mining profitability, the hashprice—the estimated value of hash power—has also been fluctuating. Recent statistics indicate that hashprice increased by 3.14%, rising from $46.51 to $47.97 per petahash per second (PH/s) within the last 24 hours. This rise in hashprice is critical for miners, as it directly affects their revenue from mining operations. When the hashprice is high, it not only incentivizes existing miners to continue their efforts but also attracts new miners to join the ecosystem, which will, in turn, contribute to the overall hashrate.

However, despite the recent uptick in hashprice, it remains approximately 6.89% lower than the levels observed on September 20, 2025. Miners must keep a close watch on these trends to align their strategies accordingly. A comprehensive understanding of both hashrate and hashprice statistics can enable miners to make informed decisions about investment in hardware, operational costs, and potential profitability. With the Bitcoin market dynamics constantly shifting, the relationship between mining activity, hashrate, and hashprice is more crucial than ever.

Bitcoin Miners and Their Contribution to Network Security

Bitcoin miners form the backbone of the Bitcoin network, ensuring that transactions are verified and recorded in the blockchain. Their contributions extend beyond mere transaction processing; they play a critical role in maintaining the security and integrity of the cryptocurrency. With the hashrate reaching impressive heights like 1.164 zettahash per second, the cumulative power provided by miners solidifies Bitcoin’s resistance to attacks and manipulation. The more computational power that is directed towards mining, the more secure the network becomes, ultimately fostering trust among users and potential investors.

For Bitcoin miners, balancing operational costs against revenue from block rewards is essential. In recent times, miners have been averaging revenues of 3.14 BTC per block, with a small fraction derived from on-chain transaction fees. As the Bitcoin price fluctuates, so too do miners’ earnings, which depend heavily on both hashrate and the current market dynamics. Miners’ ongoing dedication to maintaining the network’s health and resilience can be seen as a testament to the enduring appeal of Bitcoin amidst its challenges and competitive pressures.

Analyzing Hasrate Statistics: Historical Performance and Future Predictions

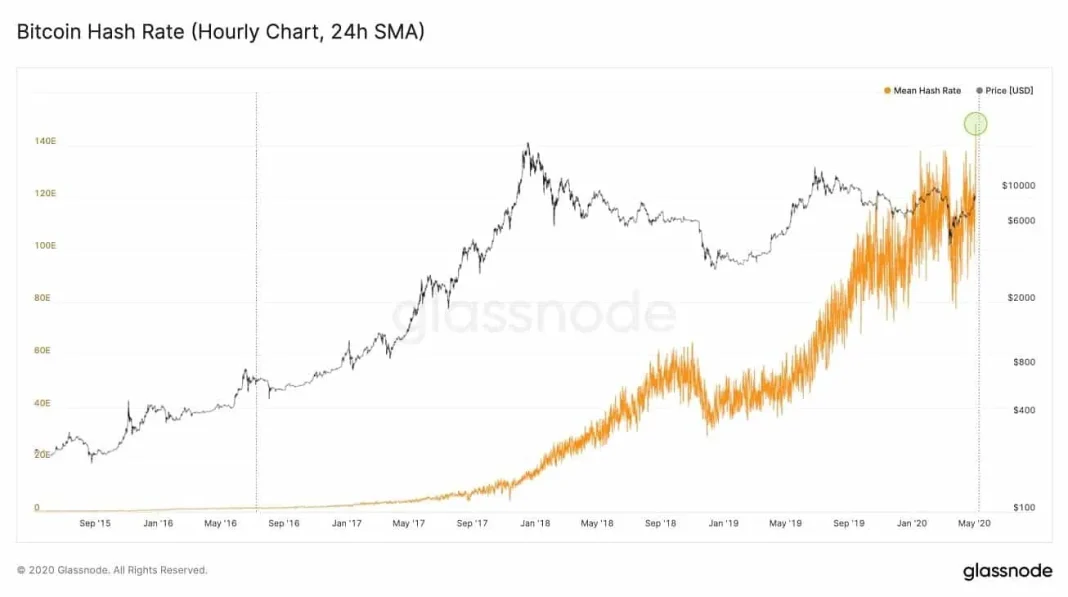

Analyzing hashrate statistics allows stakeholders to gain insight into the historical performance of Bitcoin mining and make future predictions about its growth trajectory. The recent surge in Bitcoin’s hashrate to 1.164 ZH/s signals robust interest in this space, reflecting miners’ readiness to invest in cutting-edge technology to boost efficiency. Historical data illustrate that hashrate has generally trended upward, demonstrating the increasing sophistication of mining operations and the expansion of infrastructure globally. Miners not only focus on achieving higher hashrates but also seek sustainable practices in line with environmental considerations—an emerging trend within the industry.

Future predictions for Bitcoin’s hashrate suggest potential enhancements as prevailing technologies evolve. Transitioning to greener mining solutions could transform the landscape significantly, improving profitability while addressing environmental concerns. As miners strategize for the long haul, understanding the interplay between hashrate, Bitcoin’s market price, and technological advancements will be essential for remaining competitive. Continuous monitoring of hashrate statistics will empower miners and investors to identify emerging trends and adapt to shifting dynamics in the cryptocurrency world.

The Future of Bitcoin Mining: Challenges and Opportunities

The future of Bitcoin mining presents a complex landscape filled with both challenges and opportunities that miners must navigate. As companies like Foundry and Antpool continue to dominate the mining sector, smaller operations may face difficulties in maintaining profitability and relevance due to economies of scale enjoyed by larger pools. Furthermore, rising energy costs and regulatory pressures surrounding cryptocurrency mining practices pose potential hurdles for the industry. However, advancements in mining technology may provide opportunities for innovative miners to reduce costs and increase operational efficiency significantly.

Conversely, the growing adoption of Bitcoin by businesses and financial institutions could lead to greater demand and continued price increases. This, coupled with an increasing hashrate and hashprice, could create a favorable environment for miners willing to adapt to the market’s evolving needs. With an unwavering focus on efficiency and sustainability, Bitcoin mining can potentially thrive, providing lucrative opportunities while mitigating some of the challenges associated with the sector.

Key Factors Influencing Bitcoin’s Hashrate

Several key factors influence Bitcoin’s hashrate, shaping its fluctuations and trends within the market. Primarily, the price of Bitcoin directly impacts mining operations, where higher BTC values generally encourage more miners to enter the network. Increased participation leads to a boost in hashrate as competition grows. Additionally, the introduction of more efficient mining hardware has consistently raised the bar, allowing miners to generate higher hashrates with less energy consumption. This shift is crucial in the context of rising energy costs and environmental concerns, as miners seek to balance profitability with sustainability.

Moreover, the evolving regulatory landscape plays a significant role in shaping miners’ strategies. Changes in regulations could either enhance or inhibit miners’ ability to operate effectively, depending on the jurisdictional environment. As miners must adapt to these regulatory frameworks, they will also need to stay informed about technological advancements and market trends to maintain their competitiveness. Ultimately, understanding the intricate details of these influencing factors will be essential for miners to make informed decisions and navigate the complexities of the Bitcoin ecosystem.

The Importance of Mining Pools in Bitcoin’s Ecosystem

Mining pools play a pivotal role in the Bitcoin ecosystem, acting as collective platforms where individual miners can combine resources to enhance their chances of mining Bitcoin successfully. The collaborative model of mining pools enables participants, regardless of their individual processing power, to receive more frequent rewards compared to solo mining. This helps address the inherent unpredictability of finding new blocks, thus stabilizing earnings for miners. The leading pools, such as Foundry and Antpool, significantly contribute to Bitcoin’s overall hashrate, enhancing network security and reliability.

However, the concentration of hashrate among a few large pools raises concerns about centralization, which can contradict Bitcoin’s fundamental values of decentralization and autonomy. As miners evaluate which pool to join, they must consider factors such as payouts, fees, and the pool’s overall strategy in the market. A diverse pool landscape, including smaller pools, can help to mitigate risks associated with centralization while keeping the mining competitive and invigorated. Hence, the interplay between mining pools and Bitcoin’s hashrate remains a critical aspect of the cryptocurrency’s evolution.

Implications of Bitcoin’s Price Rise on Miners

The recent surge in Bitcoin’s price has profound implications for miners operating within the ecosystem. As BTC values document a considerable rise, miners see an uptick in their revenue due to increased hashprice, which reflects the amount they can earn per unit of computational power. The correlation between Bitcoin’s price and hashprice indicates that when BTC experiences upward momentum, mining profitability improves, thereby incentivizing more miners to participate in the market. This influx of miner activity typically leads to a rise in the overall hashrate, demonstrating the dynamic interplay between price and mining incentives.

Furthermore, a higher BTC price can motivate miners to invest in more sophisticated mining equipment to enhance their operational efficiency and profitability. While increased competition is inevitable as more miners enter the ecosystem, established operations will likely improve their technologies to retain their competitive edge. Nevertheless, even as miners adapt to ever-changing market conditions, they must remain vigilant regarding potential price corrections that could affect their earnings. Thus, the cyclical nature of Bitcoin’s price and its effects on mining operations underscores the need for miners to adopt strategic approaches in navigating this volatile environment.

Frequently Asked Questions

What is the significance of Bitcoin’s hashrate for mining?

Bitcoin’s hashrate is a critical indicator of the network’s security and mining activity. A higher hashrate means more computational power is securing the network, which makes it harder for malicious actors to carry out attacks. Additionally, as Bitcoin miners increase their hashrate, it can lead to heightened competition and potentially improved block rewards.

How does Bitcoin’s hashrate affect the price of BTC?

Bitcoin’s hashrate can impact the BTC price indirectly. As mining becomes more efficient and profitable—indicated by rising hashrate statistics and hashprice increases—this often leads to more miners entering the space, which can create upward pressure on BTC’s price due to increased demand and scarcity.

Which mining pools currently lead in Bitcoin hashrate?

As of recent statistics, Foundry USA and Antpool are the dominant mining pools, collectively commanding approximately 46% of Bitcoin’s overall hashrate. This significant share emphasizes their influence on network stability and mining dynamics.

What trends can be observed in Bitcoin hashrate statistics?

Recent hashrate statistics show a consistent upward trend, with Bitcoin achieving a new peak of 1.164 ZH/s. This growth reflects advancements in mining technology and an increasing number of miners participating in the network.

What factors contribute to the fluctuation of Bitcoin’s hashprice?

Bitcoin’s hashprice fluctuates based on market demand for BTC mining rewards and the overall hashrate. As BTC prices rise, hashprice typically increases, making mining more profitable. Recent data show a hashprice increase of 3.14%, reflecting these trends.

How does Bitcoin mining impact the overall network hashrate?

Bitcoin mining is the process by which new blocks are added to the blockchain. The total hashrate is a reflection of all miners combined effort, and as more miners join the network, the hashrate rises, enhancing network security and efficiency.

What is the average Bitcoin earnings for miners per block?

Currently, miners are earning an average of 3.14 BTC per block, with a minimal portion (0.60%) coming from on-chain fees. This shows that block rewards remain a crucial element of profitability for Bitcoin miners.

What challenges do Bitcoin miners face that affect hashrate?

Bitcoin miners face challenges such as fluctuating electricity costs, technological changes, and competition from other miners. These factors can influence their operational costs and profitability, ultimately impacting the overall network hashrate.

| Key Points | Details |

|---|---|

| Bitcoin’s Current Hashrate | 1,154 EH/s as of Oct. 20, with a recent peak of 1.164 ZH/s |

| Leading Mining Pools | Foundry USA (334.18 EH/s, 28.96%), Antpool (199.24 EH/s, 17.26%) |

| Third Largest Mining Pool | ViaBTC with 135.99 EH/s (11.78%) |

| Hashprice Movement | Increased by 3.14% to $47.97 per PH/s |

| Miners’ Earnings | Average of 3.14 BTC per block, with 0.60% from fees |

| Total Mining Pools | 84 smaller pools contributing to the network |

Summary

Bitcoin hashrate has recently reached impressive new heights, surging to 1.164 Zettahash per second. This showcases the increasing power and efficiency of Bitcoin mining, driven by dominant mining pools like Foundry and Antpool, which collectively command a significant portion of the network’s capacity. As the hashrate rises, so does the hashprice, reflecting the profitability of mining amidst fluctuating Bitcoin prices. Overall, the Bitcoin network continues to demonstrate resilience and strength, pushing the boundaries of digital currency capabilities.