In the evolving landscape of cryptocurrency, the new Bitcoin Improvement Proposal (BIP) has sparked significant debate among developers and users alike. This proposal introduces a temporary soft fork intended to limit the amount of arbitrary data that can be attached to Bitcoin transactions, responding to concerns raised after the Bitcoin Core v30 update. By restricting OP_RETURN data to 83 bytes, the proposal seeks to mitigate potential risks associated with illegal content on the blockchain, ensuring that node operators are not inadvertently exposed to legal liabilities. Proponents of the BIP argue that such measures are crucial to maintaining the integrity and safety of the Bitcoin network, while critics raise alarm over perceived censorship. As discussions continue, the implications of this BIP on future developments and the broader Bitcoin community remain paramount.

The latest development in the Bitcoin ecosystem revolves around a significant proposal, often referred to as the BIP, designed to address the issue of excessive data storage on the blockchain. This initiative seeks to implement a temporary soft fork that caps the size of OP_RETURN outputs, aiming to increase the security and reliability of Bitcoin transactions amidst rising censorship concerns. By regulating the amount of arbitrary information that users can submit, the BIP emphasizes the crucial balance between innovative use of blockchain technology and the ethical responsibility of node operators. Many view this move as a necessary step following the updates introduced with Bitcoin Core v30, which previously removed restrictions on data size. With a focus on defining proper guidelines for blockchain use, this proposal could potentially reshape how developers view transaction data in the future.

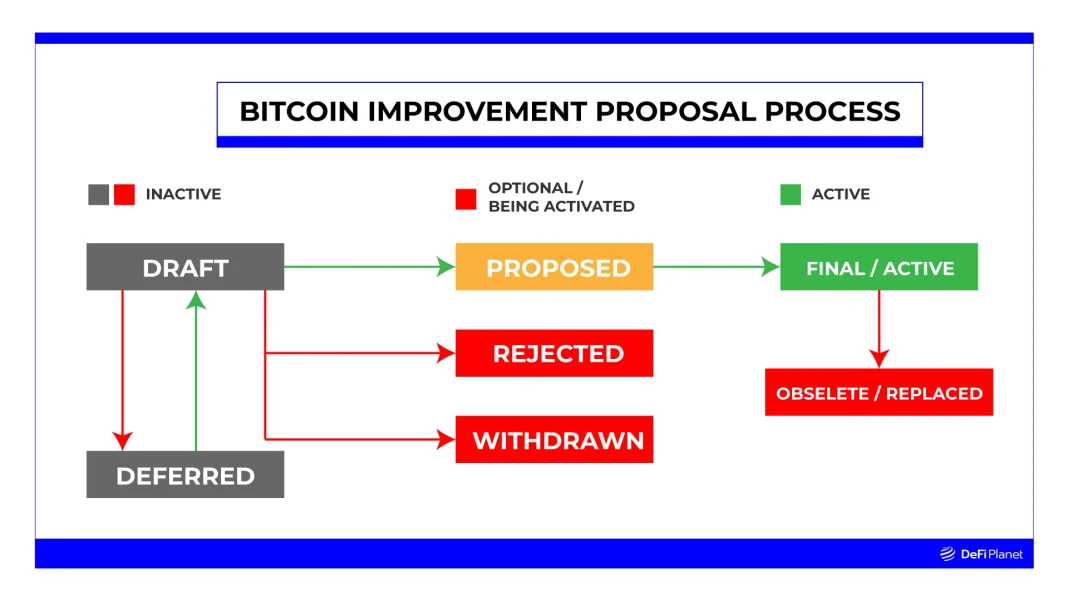

Understanding Bitcoin Improvement Proposals (BIPs)

Bitcoin Improvement Proposals, commonly known as BIPs, serve as the primary mechanism for proposing changes or enhancements to the Bitcoin protocol. These proposals are critical for the continuous evolution of Bitcoin, allowing developers to collaborate and reach consensus on necessary updates. One notable BIP currently under discussion is the ‘Reduced Data Temporary Soft Fork,’ designed to mitigate the risks associated with the unrestricted data storage that emerged after the Bitcoin Core v30 update. By implementing stringent limits on OP_RETURN outputs, the proposal aims to ensure that the Bitcoin network remains secure and compliant with legal standards.

Moreover, BIPs not only detail technical specifications but also touch upon broader implications concerning the functionality and ethics of Bitcoin usage. The ongoing debate surrounding the latest BIP highlights the community’s commitment to maintaining Bitcoin as a decentralized and permissionless system. While some regard certain measures as censorship, advocates argue that responsible protocol stewardship is essential for the long-term sustainability of the Bitcoin network.

Impact of Bitcoin Core v30 Update on Data Regulations

The recent Bitcoin Core v30 update significantly altered the landscape of transaction data regulations by lifting previous restrictions on OP_RETURN data. This change permitted users to attach larger amounts of arbitrary data to transactions, which, while beneficial for innovative applications, raised concerns about potential abuses. Developers are now debating whether this newfound freedom could lead to illegal content becoming an indelible part of the blockchain, a prospect that lends urgency to proposals such as the ‘Reduced Data Temporary Soft Fork.’ This BIP aims to reinforce a safeguard against unintended consequences stemming from the Core update.

Critics of the Core v30 update argue that lifting these restrictions opens the floodgates for questionable content, compelling node operators to host and share potentially illegal material. The resulting dilemma places significant pressure on node operators who value their roles as key infrastructures of Bitcoin. As we explore the ramifications of the BIP, maintaining a balance between innovation and security remains a central theme, drawing attention to how future updates can shape the Bitcoin ecosystem.

Risks Associated with Unrestricted Data on Bitcoin Blockchain

The proposal for a temporary soft fork under the current BIP highlights the pressing need to address the risks associated with unrestricted data storage on the Bitcoin blockchain. By allowing arbitrary data to be uploaded, the community faces potential issues of both legal accountability and ethical concerns. Specifically, the concern revolves around the possibility of illegal or morally troubling content being permanently archived on the blockchain, creating complications for validators and node operators who might inadvertently facilitate the distribution of such data.

Furthermore, if proposals like the ‘Reduced Data Temporary Soft Fork’ are implemented, they could set proactive measures in place to address these risks before they escalate. Discussions surrounding this BIP underscore a pivotal moment for Bitcoin developers, who must navigate the thin line between innovation and the potential introduction of censorship-like measures. This debate raises essential questions about who governs Bitcoin and how future decisions can either enhance or undermine the core principles of the network.

Censorship Concerns in Bitcoin Data Management

One of the most contentious aspects of the proposed BIP is its potential to introduce a type of data censorship within the Bitcoin protocol. Opponents of the BIP emphasize that imposing strict limitations on the type of data that can be attached to transactions could contradict Bitcoin’s foundational ethos of permissionless innovation. This development raises concerns that such measures might set a dangerous precedent; if censoring certain types of data becomes acceptable, where does the line get drawn?

Defenders of the BIP argue that imposing these restrictions does not equate to censorship but rather represents a form of necessary protocol maintenance aimed at ensuring the network’s integrity. They contend that protecting node operators from legal liabilities is vital in a decentralized system where the permanence of blockchain data could force individuals to make untenable choices. As the Bitcoin ecosystem grapples with these challenges, the discourse on censorship and data regulation will be crucial in determining the path forward.

Technical Details of the Reduced Data Temporary Soft Fork

The technical specifications outlined in the ‘Reduced Data Temporary Soft Fork’ BIP bring forward a significant shift in how Bitcoin transaction data will be handled. Proposed rules, such as capping OP_RETURN outputs at 83 bytes and invalidating output scripts exceeding 34 bytes, are aimed at minimizing the quantity of arbitrary data allowed on the blockchain. This technical focus seeks to foster a more secure environment for node operators while also enabling rapid deployment of these restrictions if illicit data emerges preemptively.

Additionally, these technical changes would not only impact existing data structures but also set a precedent for future BIPs that could adapt similar protective measures. By establishing clear regulations for transaction data, the proposal aims to ensure that Bitcoin can maintain its reliability and respectability in broader financial landscapes. Discussions around the language and definitions within the draft further highlight the nuanced challenges developers face when designing protocols that must balance innovation with security.

Future Implications of BIP on Bitcoin Ecosystem

The potential passage of the BIP under discussion could have far-reaching implications for the Bitcoin ecosystem. If the proposal is adopted and implemented by February 2026, it may alter how developers approach future changes to Bitcoin’s architecture. By introducing temporary limitations on data storage, it encourages a more cautious approach to data management, which could subsequently influence user behavior in terms of how they interact with the blockchain.

Furthermore, the BIP could inspire other cryptocurrencies to consider similar tactics in addressing their data storage policies, highlighting a trend toward greater regulatory foresight within digital asset management. This emerging paradigm raises essential questions about the responsibility of blockchain technologies in a world that demands accountability and ethical behavior. As the community weighs the urgency of the BIP against Bitcoin’s historically unrestricted ethos, the outcome could redefine how blockchain innovation intersects with social responsibility.

Rationale Behind BIP’s Implementation

The rationale behind implementing the BIP stems from a desire to proactively mitigate risks associated with unregulated data storage on the Bitcoin blockchain. By temporarily capping the size of OP_RETURN outputs, advocates argue that the cryptocurrency can preserve its integrity while addressing genuine concerns related to illegal content. This preemptive approach is particularly relevant in the wake of changes introduced by the Bitcoin Core v30 update, which highlighted vulnerabilities in the system’s previous configurations.

Advocates of the BIP also underscore the importance of maintaining a functional network without compromising legal and ethical standards. The proposal serves as a crucial checkpoint that allows the community to evaluate how data regulations might evolve without resorting to excessive censorship measures that could undermine Bitcoin’s core values. Ultimately, the BIP speaks to the need for ongoing discussions surrounding responsible implementation of new features to safeguard the principles that have fostered Bitcoin’s growth.

Feedback from Bitcoin Community on BIP

Feedback from the Bitcoin community regarding the proposed BIP has been diverse, with passionate arguments on both sides of the debate. Proponents argue that the risks associated with unlimited data attachments necessitate immediate action, advocating for a responsible framework that keeps node operators free from legal entanglements. Supporters view the proposal as a crucial step towards safeguarding the network’s reputation while allowing room for future revisions that could foster innovation.

Conversely, critics have raised alarms about the implications of introducing such restrictions, viewing it as a slippery slope toward censorship. Detractors argue that the subjective nature of data legality creates a challenging environment in which developers cannot precisely determine what constitutes harmful content. This discourse reflects the broader conflict within the cryptocurrency space regarding the balance between innovation, ethical considerations, and potential systemic constraints.

Final Thoughts on Data Restrictions in Bitcoin

As discussions surrounding the BIP continue, one can observe a deeper contemplation of Bitcoin’s future within the ever-evolving digital landscape. The ongoing deliberations and diverse perspectives from the community underscore the complexity of managing a decentralized protocol where the ethos of permissionlessness frequently clashes with modern regulatory expectations. Final decisions about data restrictions like those proposed could change how the Bitcoin network operates, potentially influencing user trust and market behavior in the long term.

Ultimately, these conversations are expected to shape the future framework of Bitcoin, serving as a litmus test for how emerging technologies can respond to societal concerns without compromising foundational principles. Engaging in constructive dialogue about the proper balance between data innovation and responsible governance will be essential as the community navigates the coming years with a commitment to preserving Bitcoin’s integrity.

Frequently Asked Questions

What is the purpose of the Bitcoin Improvement Proposal (BIP) regarding OP_RETURN data?

The Bitcoin Improvement Proposal (BIP) aims to temporarily limit the amount of arbitrary data, specifically OP_RETURN outputs, that can be included in Bitcoin transactions. This measure seeks to curb potential abuses of data storage on the blockchain following the Bitcoin Core v30 update, which lifted previous limits on OP_RETURN usage.

How does the BIP address concerns about Bitcoin censorship?

While opponents argue that the BIP could set a precedent for Bitcoin protocol-level censorship, proponents assert that it is a necessary measure for protocol maintenance. The BIP is designed to protect node operators from being forced to store illegal or immoral content, rather than censoring free speech on the network.

What specific changes does the BIP propose to the Bitcoin blockchain?

The BIP proposes several changes, including capping OP_RETURN outputs at 83 bytes, invalidating output scripts that exceed 34 bytes, and limiting Taproot control blocks to 257 bytes. These changes aim to simplify rapid deployment if illegal data appears on the blockchain.

When would the BIP’s temporary soft fork take effect?

If activated, the BIP’s temporary soft fork would begin at block height 934,864, which is expected around February 1, 2026, and would self-expire at block height 987,424, approximately one year later.

What are the arguments for and against the proposed BIP?

Proponents argue that the BIP is a crucial safety measure to prevent abuse of the OP_RETURN function and protect node operators from legal repercussions. Critics, however, contend that it contradicts Bitcoin’s core ethos by limiting data storage capabilities and imposing consensus-level restrictions.

Who authored the Bitcoin Improvement Proposal related to restricting OP_RETURN outputs?

The BIP was authored by Dathon Ohm and published on October 24, 2025. It reflects ongoing debates among Bitcoin developers about the future of data storage on the network.

What is the expected duration of the soft fork outlined in the BIP?

The soft fork outlined in the BIP is expected to last for approximately one year, with an expiration date projected around February 1, 2027.

How might the BIP affect Bitcoin node operators?

The BIP seeks to alleviate the burden on Bitcoin node operators who could face legal liability for hosting illegal content embedded in the blockchain. By limiting the data that can be stored through OP_RETURN, the proposal aims to protect these operators from potential legal issues.

| Key Point | Details |

|---|---|

| Purpose of the BIP | To temporarily limit the amount of arbitrary data attached to transactions to prevent potential abuses. |

| Author and Publication Date | Authored by Dathon Ohm, published on October 24, 2025. |

| Proposed Changes | Capping OP_RETURN outputs at 83 bytes, invalidating output scripts exceeding 34 bytes, and limiting Taproot control blocks to 257 bytes. |

| Duration | The soft fork is proposed to last for about a year, expiring around February 1, 2027. |

| Criticism | Opponents argue it imposes censorship and contradicts Bitcoin’s permissionless ethos. |

| Support | Supporters believe it is a necessary safeguard against potential abuses that could harm node operators. |

| Activation Details | If activated, the BIP would begin at block height 934,864. |

Summary

The Bitcoin Improvement Proposal (BIP) currently under debate aims to introduce a temporary soft fork to limit the amount of arbitrary data that can be attached to Bitcoin transactions. This proposal is a response to concerns following the Bitcoin Core v30 update and seeks to protect node operators from potential legal liabilities associated with storing illicit content. While supporters frame the BIP as a necessary measure to prevent abuse, critics caution against setting a precedent for censorship within the Bitcoin network. Given the complexities of data legality across jurisdictions, the discussions surrounding this proposal reflect the ongoing tension between maintaining Bitcoin’s security and upholding its foundational principles of decentralization and permissionless participation.