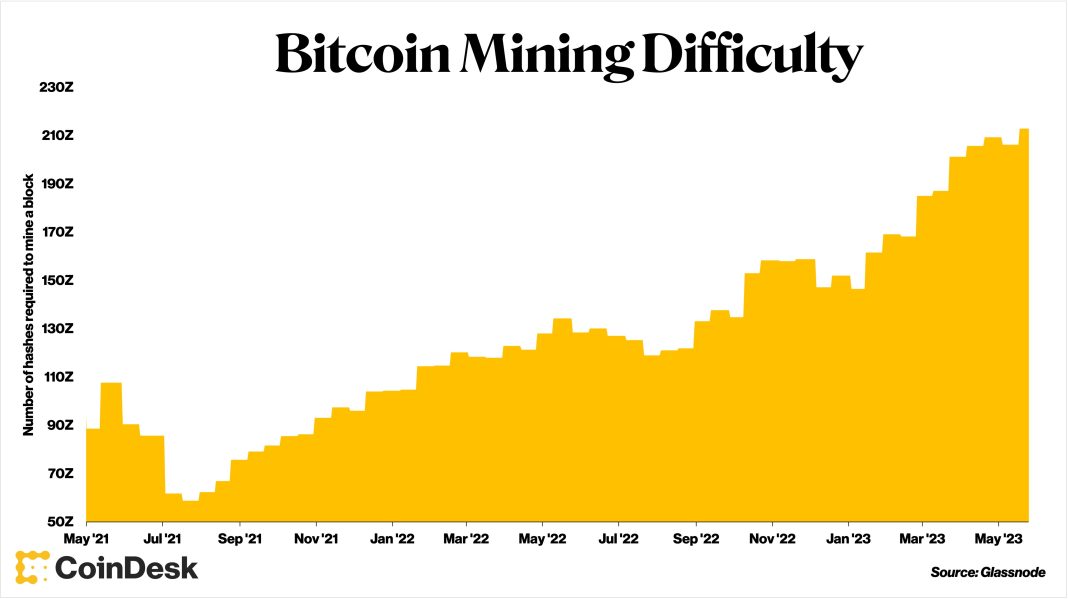

Bitcoin mining difficulty plays a pivotal role in the cryptocurrency ecosystem, adjusting to fluctuations in the hashpower contributed by miners. Recently, this metric dropped by 3.28%, a significant change that brings the difficulty down to 141.67 trillion—levels not seen since September 2025. This adjustment comes as a much-needed relief for bitcoin miners who have been battling dwindling revenues and increasing operational costs. As Bitcoin mining news continues to evolve, understanding the implications of these difficulty adjustments becomes essential for both current and prospective miners. Moreover, mining profitability is tightly intertwined with these changes, meaning that even small shifts in difficulty can have a considerable impact on the broader market dynamics and miner strategies.

The world of Bitcoin mining operates on a system where difficulty levels are constantly in flux, ensuring that new blocks are mined at a consistent rate. This system, often referred to as the Bitcoin difficulty adjustment, reacts sensitively to changes in miner participation and hashrate variations. Each recalibration not only reflects current market conditions but also offers miners a strategic opportunity to optimize their operations amid changing landscapes. With this recent reduction in difficulty, we see a critical window opening for miners to fortify their positions while navigating the challenges of profitability in an increasingly competitive environment. As the Bitcoin miners adapt to these fluctuating dynamics, staying informed about hashrate changes is essential for maintaining a competitive edge.

Understanding Bitcoin Mining Difficulty Adjustments

Bitcoin mining difficulty is a crucial factor in maintaining the stability and consistency of the Bitcoin network. It adjusts approximately every two weeks, recalibrating in response to changes in the network’s total hashrate. When more miners join the network, block times shorten, leading to an increase in difficulty to ensure that new blocks continue to be generated approximately every ten minutes. Conversely, if miners leave or reduce their operations, as has happened recently, the difficulty decreases to support the remaining miners by prolonging the time it takes to find new blocks. This self-correcting feature is essential for sustaining Bitcoin’s issuance metrics and ensuring its overarching ecosystem remains protected against fluctuations in mining capacity and competition.

The recent decrease in Bitcoin’s mining difficulty by 3.28% highlights the dynamic nature of this mechanism. On Thursday, it shifted from 146.47 trillion to 141.67 trillion. Such adjustments are significant as they not only reflect the state of mining activity but also adjust to ensure networks remain resilient against potential manipulation. As Bitcoin’s mining difficulty hovers at levels not witnessed since September 2025, miners have been granted a much-needed respite amidst challenging profit margins, allowing them time to evaluate their mining strategies and potentially enhance their operations in a volatile market.

The Impact of Decreasing Hashrate on Mining Profitability

The phenomenon of decreasing hashrate significantly influences mining profitability, as miners are often forced to adapt to changing conditions swiftly. As hashrate falls, the mining difficulty resets to a lower threshold, effectively increasing the chances for miners still in operation to earn rewards. However, this does not come without challenges, as the constant fluctuations in Bitcoin prices and mining yields can create tension within the community. For example, recent statistics reveal that revenue per petahash (PH/s) has diminished by 5.45% in just a week, reminding miners of the precarious balance between operational costs and potential returns.

With Bitcoin’s current economic landscape, the recent adjustment in mining difficulty presents a significant opportunity for miners to stabilize their profitability. The inherent volatility of Bitcoin mining profitability, amplified by hashrate changes and market demand, underscores the importance of strategic planning among miners. Unlike previous periods of heightened competition, the current environment allows miners breathing space to reduce operational strains and rethink their strategies without the immediate pressure of escalating difficulty levels. This reprieve could prove beneficial as they explore efficient mining techniques and improve their equipment to maximize returns once the market stabilizes.

Bitcoin Miners: Navigating the New Mining Landscape

For Bitcoin miners, adapting to the latest mining landscape is crucial for sustaining long-term profitability. The recent decrease in mining difficulty offers a moment of relief, as it reduces the competitiveness faced by miners during uncertain times. As external pressures like fluctuating Bitcoin prices and rising electricity costs persist, miners are now encouraged to optimize their operations. By enhancing the efficiency of their technology or exploring renewable energy sources, miners can better position themselves to weather economic storms while preparing for potential future difficulty increases.

Miners must stay informed about the latest Bitcoin mining news to adapt effectively to shifts in the network’s ecosystem. Engaging with forums, reading analytical insights, and analyzing market trends will empower these individuals to make informed decisions regarding their operations. Discussions around mining profitability often emphasize the need for a calculated approach, considering factors such as local electricity prices and hardware capabilities. In light of recent developments, Bitcoin miners who prioritize agility and innovation will likely find themselves thriving in a notoriously unpredictable industry.

The Significance of Revenue per Petahash in 2026

The revenue per petahash (PH/s) is a crucial metric that Bitcoin miners must monitor closely to maintain profitability. Recently, the revenue has fallen to around $39.90, decreasing by 5.45% from earlier figures. This decline illustrates the tight margins miners face in a landscape where profitability is directly tied to Bitcoin’s price fluctuations and difficulty rating. Understanding this metric isn’t just about the immediate returns; it also paints a broader picture of the market dynamics, highlighting the growing competition and evolving technology driving the Bitcoin mining sector.

As the mining difficulty adjusts and the hashprice fluctuates, miners should develop strategies that rely not only on the current revenue per petahash but also on future trends. With the reduction in difficulty providing what appears to be a temporary relief, miners have an opportunity to reassess their operational costs and possibly invest in more efficient mining rigs. Long-term strategies should encompass not only technological advancements but also staying updated with market dynamics and potential algorithm adjustments, ensuring they can capitalize on any economic shifts going forward.

Future Trends in Bitcoin Mining: What to Expect

Looking ahead, the future of Bitcoin mining is rife with possibilities, particularly as the industry grapples with ongoing adjustments in mining difficulty. The current trends indicate that as more miners exit due to diminishing returns, we may see further reductions in difficulty, sparking renewed interest among those who still operate. Staying competitive will require miners to not only focus on technology advancements but also on broader market trends, including regulations that may impact their ability to mine profitably. As the industry matures, understanding the relationship between network hashrate and difficulty adjustments will become increasingly essential.

Moreover, the role of sustainability in mining practices is poised to shape the future landscape. With rising concerns over environmental impacts, miners may find themselves under pressure to adopt greener practices or face increased scrutiny from regulatory bodies. As Bitcoin mining difficulty adjusts in response to the hashrate, miners who invest in sustainable energy solutions may find themselves at an advantage both morally and economically. Ultimately, the intersections of technology, sustainability, and market dynamics will define Bitcoin mining’s future trajectory, setting the stage for new challenges and opportunities.

Analyzing Bitcoin Mining Difficulty: A Competitive Edge

Analyzing Bitcoin mining difficulty offers considerable insight into the competitive landscape of Bitcoin mining. Understanding the nuances of these adjustments can provide miners with a distinct advantage in operational planning. The latest adjustment, noted at a 3.28% decrease, is indicative of current market conditions where miners need to remain vigilant and proactive. By anticipating future adjustments, miners can strategize their next moves, addressing aspects such as equipment upgrades or shifts in mining locations where electricity costs may favor profitability.

Owning a deep comprehension of Bitcoin mining difficulty is not just a necessity but a strategic differentiator in this competitive industry. Miners who are adept at reading market signals and responding quickly to changes can better position themselves to withstand adversity. This analytical prowess can lead to better decision-making, allowing miners to allocate resources smartly during uncertain periods, ensuring that they remain competitive even as the network evolves and Bitcoin’s hashprice fluctuates.

The Role of Hashrate Changes in Mining Strategies

Hashrate changes play a pivotal role in shaping the strategies employed by Bitcoin miners. As the network experiences fluctuations in overall hashpower, the difficulty adjustments follow suit, impacting how quickly blocks are mined and how rewards are distributed. Miners must adapt their strategies in line with these changes to optimize their chances of profitability. When hashpower decreases, leading to reduced difficulty, it presents an opportunity for miners to secure blocks with less competition.

Moreover, understanding the trends in hashrate shifts allows miners to forecast potential changes in their operational approaches. By staying attuned to the overall network activity, miners can strategize their entry and exit points more effectively. Capitalizing on decreased difficulty periods can lead to enhanced profitability, especially for those who possess the technical agility to upgrade their rigs or explore alternative mining strategies. In this way, monitoring hashrate changes not only informs miners but empowers them to take calculated risks in an ever-evolving digital landscape.

How Mining Difficulty Influences Bitcoin’s Network Resilience

The relationship between mining difficulty and Bitcoin’s network resilience is crucial for the cryptocurrency’s broader adaptability and security. By automatically adjusting difficulty levels, the network ensures that it functions optimally regardless of the volume of computation applied. This self-regulating nature helps Bitcoin maintain its average block time of ten minutes, thwarting potential attacks or anomalies that could harm its ecosystem. Difficulty adjustments act as a safeguard against volatility, allowing miners to rely on predictable outputs even when competitive dynamics shift.

Moreover, with Bitcoin’s recent adjustment marking the lowest difficulty level since September 2025, the crucial role of this mechanism is underscored. A more manageable difficulty level enables existing miners to stabilize operations and compete more effectively, safeguarding the network against undue pressure during less profitable market conditions. As such, the nuances of mining difficulty not only impact individual operations but resonate across the entire ecosystem, reinforcing Bitcoin’s robustness as the landscape continues to evolve.

Staying Updated: The Importance of Bitcoin Mining News

For Bitcoin miners, staying informed through Bitcoin mining news is vital for navigating the complexities of the market effectively. Recent developments, including difficulty adjustments and shifts in hashrate, provide crucial insights that can influence decision-making. Knowledge of these dynamics enables miners to anticipate market shifts, adapt their operations, and potentially increase their profitability. Engaging with the latest news ensures miners remain ahead of trends, providing them with a competitive edge in a rapidly changing environment.

Beyond just reading articles, actively participating in community discussions and forums can sharpen a miner’s awareness of industry shifts. Learning from the experiences of peers can offer valuable lessons on risk management, technology adoption, and operational efficiency. Consequently, knowledge is power in the realm of Bitcoin mining, and those who are well-versed in the latest news and trends are more likely to thrive in an increasingly competitive landscape.

Frequently Asked Questions

What is Bitcoin mining difficulty and how does it affect miners?

Bitcoin mining difficulty is a crucial parameter that adjusts approximately every two weeks to ensure that new blocks are generated roughly every ten minutes. This adjustment reflects changes in network hashpower, directly impacting mining profitability for Bitcoin miners. A rise in difficulty means a tougher competition for miners, while a decrease, like the recent 3.28% drop, provides relief by allowing miners to generate rewards more easily.

How does Bitcoin difficulty adjustment impact mining profitability?

Bitcoin difficulty adjustment can significantly influence mining profitability. When the difficulty decreases, as it recently did by 3.28%, miners can enjoy a better chance of earning rewards. As revenue per petahash (PH/s) has declined, this adjustment offers a needed respite for miners struggling with tightening profit margins.

Why did Bitcoin’s mining difficulty decrease recently?

The recent decrease in Bitcoin’s mining difficulty by 3.28% was primarily due to a decline in overall network hashpower. This adjustment, occurring at block 933,408, helps maintain the target block time of about ten minutes, making it easier for miners to compete for Bitcoin rewards in the current economic landscape.

How often does Bitcoin’s mining difficulty change?

Bitcoin’s mining difficulty changes approximately every two weeks, or every 2,016 blocks. This self-correcting mechanism ensures that block generation remains consistent despite fluctuations in computational power and hash rate across the network.

What does the recent mining difficulty reduction mean for Bitcoin miners?

The recent 3.28% reduction in Bitcoin’s mining difficulty means that miners have a brief opportunity to stabilize operations and potentially increase profitability amidst declining revenue per petahash. This adjustment offers a short-term respite after a period of intense competitive pressure within the network.

| Key Point | Details |

|---|---|

| Mining Difficulty Reduction | Decreased by 3.28%, from 146.47 trillion to 141.67 trillion. |

| Impact on Miners | Offers a respite for miners, as revenue per petahash has fallen by 5.45%. |

| Purpose of Difficulty Adjustment | Maintains block generation at approximately 10 minutes, adapting to hashpower changes. |

| Recent Adjustments | 2026 has seen two decreases; the latest being 1.20% prior to this adjustment. |

| Historical Context | Last in the 141.67 trillion range was in September 2025, at block height 933,408. |

Summary

Bitcoin mining difficulty has had a significant adjustment that occurred on Thursday, with a notable decrease of 3.28%. This change to a new level of 141.67 trillion marks an important moment for miners who have been facing declining revenues. As the difficulty recalibrates approximately every two weeks, this current setting offers a necessary opportunity for miners to stabilize their operations during a time when competition has been fierce and profitability tight. Overall, the Bitcoin mining difficulty remains a critical aspect of network security and miner operations, ensuring the integrity and consistent creation of new blocks.