The Bitcoin options market has been buzzing with activity as traders seize the opportunity to capitalize on the cryptocurrency’s recent price fluctuations. With Bitcoin price fluctuations attracting attention, this market provides investors with leverage and flexibility, especially as institutional investors are becoming more engaged in Bitcoin trading. The dynamics of options trading allow for strategic plays, evidenced by rising call options that signal bullish sentiment among traders. As the market evolves, Bitcoin derivatives are gaining traction, further driving the interest toward sophisticated financial products tied to Bitcoin. This momentum is fostering a landscape where the Bitcoin options market not only thrives but also serves as a vital indicator of broader market trends.

In the ever-expanding landscape of cryptocurrency finance, the options market for Bitcoin has emerged as a pivotal platform for traders and investors. This sector, often referred to in terms of derivatives associated with Bitcoin, allows participants to hedge risk and speculate on future price movements. Activity within this niche has noticeably intensified, with institutional players increasingly participating in Bitcoin trading, thus shaping market dynamics. By utilizing options trading strategies, investors can navigate the complexities of the cryptocurrency market more adeptly, highlighting an evolution that underscores the growing acceptance of Bitcoin as a legitimate asset class. As the financial instruments tied to Bitcoin continue to mature, they embody both opportunity and risk in a rapidly changing economic environment.

Understanding the Dynamics of the Bitcoin Options Market

The Bitcoin options market is a sophisticated environment where institutional investors are increasingly making their presence felt. As Bitcoin’s price fluctuations draw attention from traders globally, options trading provides a unique avenue for investors to manage risk and leverage their positions. Currently, Bitcoin price movements showcase significant volatility, making options a preferred method for speculating or hedging against potential dips or surges in value. The growing interest in Bitcoin derivatives reflects a more mature investment landscape, where traders employ strategies that encompass market sentiment and price predictions.

With the rising open interest in Bitcoin options, we see various strategic trades targeting both short- and long-term profit opportunities. For instance, the predominance of call options in the marketplace indicates a bullish sentiment among traders, suggesting they expect further price rises. Moreover, institutional players, attuned to macroeconomic factors and risk assessment strategies, are increasingly utilizing Bitcoin options to assert positions without fully committing capital to the core asset. This hedging capability is crucial for institutional investors navigating the volatile crypto landscape.

The Role of Institutional Investors in Bitcoin Derivatives

Institutional investors are pivotal in shaping the Bitcoin derivatives market, particularly in the realm of options trading. As they deploy large capital into Bitcoin options, their activities directly influence market prices and liquidity. The sophistication they bring contrasts with retail trading behaviors, offering an essential counterbalance in the options landscape. Institutional players often use their market insights to hedge against downturns or amplify favorable movements, driving the overall growth and acceptance of Bitcoin as a legitimate asset class.

As entities such as hedge funds and asset managers partake in Bitcoin options, their preferred strategies often encompass complex structures like spreads and other derivative products. This nuanced approach not only mitigates risks but also enhances potential upside profits, aligning with their investment mandates. Additionally, the growing participation of institutional investors has helped to lower volatility in Bitcoin trading, as their influence tends to bring stability through large-scale trades, further legitimizing the cryptocurrency in traditional financial frameworks.

Analyzing Bitcoin Price Trends in Light of Options Activity and Market Sentiment

Monitoring Bitcoin price trends is crucial for understanding the broader implications of options activity in the market. As Bitcoin exercises upwards pressure, evident from its recent record-breaking peak, the options market mirrors these sentiments by revealing traders’ expectations. With a significant volume of call options expiring soon, traders are closely examining strike prices for insights into potential price ceilings, which could serve to further inflate the market or lead to corrections depending on prevailing sentiment.

Moreover, the interplay between Bitcoin’s current trading price and options market data provides a narrative on investor psychology. For example, the notion of ‘max pain’ levels indicates ranges where option sellers may see the least discomfort, influencing trader positioning. As Bitcoin hovers around these levels, market participants will watch closely to either capitalize on upward movements or prepare for necessary corrections if the sentiment shifts unexpectedly.

Recent Market Developments Driving Bitcoin’s Rally

Recent market developments highlight the intricate factors contributing to Bitcoin’s price rally, particularly the enthusiasm surrounding Bitcoin ETFs and macroeconomic conditions. The influx of institutional capital seeking exposure to Bitcoin through ETFs marks a milestone for the cryptocurrency, drawing in both retail and experienced investors alike. This influx is critical, fostering a positive feedback loop as prices rise, further encouraging investment and trading activity in the options market.

Additionally, external factors such as fears surrounding potential economic downturns or inflationary pressures tend to steer investors toward hard assets like Bitcoin, which are perceived as hedges against traditional market troubles. As Bitcoin price climbs alongside gold and other assets, the correlations observed amplify interest in options trading. Investors can capitalize on bullish trends while utilizing options strategies to protect against potential market volatility.

Navigating Risks in Bitcoin Options Trading

Navigating risks in Bitcoin options trading is imperative for any investor looking to profit from this volatile market. With call options indicating a strong bullish sentiment, traders must remain vigilant regarding the inherent risks linked to such investments. Options trading not only requires an understanding of market dynamics but also entails assessing various external influences, including regulatory developments and broader market trends that could impact Bitcoin’s price.

Implementing risk management strategies, such as setting predefined profit targets and stop-loss orders, can enhance traders’ resilience amid price fluctuations. Furthermore, diversifying positional strategies—such as combining calls with protective puts—can offer traders the ability to balance their risk profiles, ultimately leading to more sustainable trading practices. This careful navigation is especially crucial given the recent price volatility.

Future Outlook for Bitcoin in Options Trading

The future outlook for Bitcoin in options trading appears robust, especially as institutional and retail interest continues to swell. Analysts anticipate that as adoption grows, Bitcoin could see further integration into mainstream financial products, further solidifying its status as a recognized asset class. Predictions for Bitcoin price levels suggest potential targets beyond $140,000, which could be facilitated by increased options trading activity and underlying bullish sentiment.

In anticipation of such growth, market participants must remain informed about global macroeconomic factors and technological developments that could influence trading behavior. The options market will undoubtedly play a significant role in shaping Bitcoin’s trajectory, providing avenues for traders to express their expectations. As more sophisticated strategies emerge, the options market will likely become an integral part of the cryptocurrency narrative.

Implications of Increasing Open Interest in Bitcoin Options

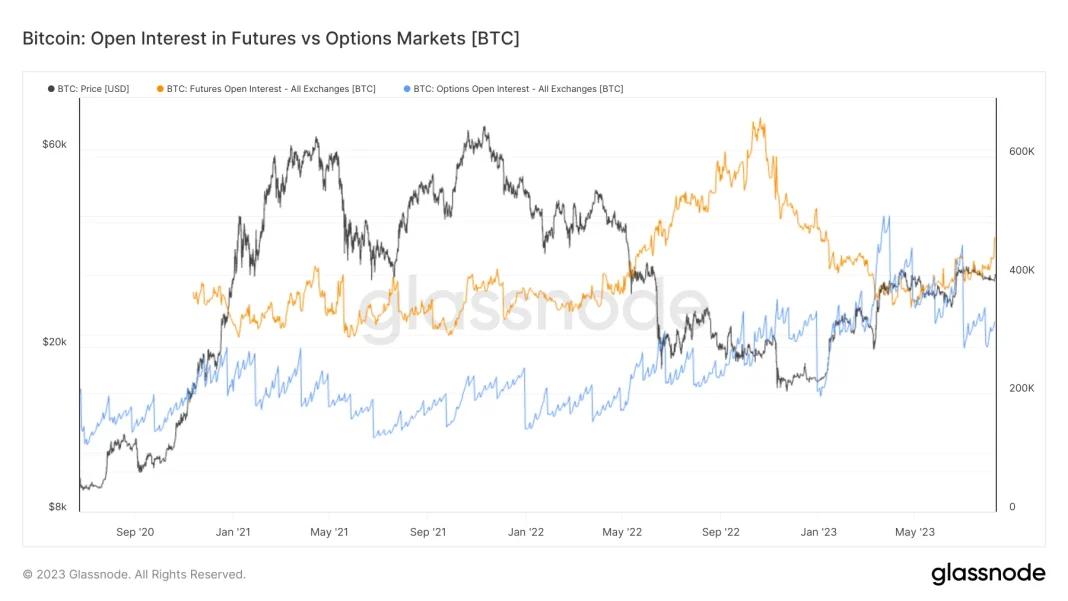

Increasing open interest in Bitcoin options signifies a growing engagement among traders and investors, reflecting heightened market activity and liquidity. This uptick often results from bullish market sentiments, with traders positioning themselves for anticipated price movements. As options contracts proliferate, they create opportunities for price discovery and allow traders to express their views on Bitcoin price dynamics through structured bets.

Moreover, rising open interest can strategically inform traders about market sentiment; a notable dominance of calls can indicate overall bullish expectations. Conversely, a surge in puts could suggest hedging against potential downturns. These dynamics become crucial for traders who rely on options pricing to make informed decisions regarding entry and exit points in their Bitcoin trading strategies.

The Intersection of Bitcoin Trading and Macro Trends

The intersection of Bitcoin trading and macro trends is increasingly pivotal in understanding its market movements. As Bitcoin integrates further into the global financial system, its price behavior often mirrors macroeconomic conditions. Investors exploring Bitcoin options should take into account factors such as inflation rates, currency valuations, and global political events, as these elements intricately influence Bitcoin price and trading activity.

Additionally, macroeconomic indicators serve as essential barometers for Bitcoin traders. For example, fluctuating interest rates or impending government policy changes can lead to shifts in capital allocation, prompting changes in Bitcoin trading patterns. Understanding this nexus grants traders a competitive edge and enhances their capacity to leverage options effectively in an evolving market landscape.

Analyzing Call and Put Volume in Bitcoin Options Market

Analyzing call and put volume in the Bitcoin options market provides critical insights into trader sentiment and market expectations. A dominating volume of call options typically indicates bullish expectations, suggesting that traders are gearing up for a price increase. In contrast, a noticeable rise in put options can signal bearish sentiment or protective hedging strategies as investors prepare for potential downturns in Bitcoin’s price.

Moreover, examining shifts in call and put volumes can help reveal the risk appetite among traders, guiding their decisions in an uncertain market. For instance, a heightened interest in out-of-the-money calls can signal a collective anticipation of significant price movements, while a rise in puts may reflect caution among traders. Understanding these dynamics can empower traders in their strategies to capitalize on market trends effectively.

Conclusion: Strategies for Leveraging Bitcoin Options Market

In conclusion, leveraging the Bitcoin options market necessitates a nuanced understanding of market dynamics, risk management, and trading psychology. As institutional involvement broadens and sophisticated trading strategies emerge, both retail and seasoned traders must adapt their tactics to stay competitive in the evolving landscape. Constructing a well-defined options strategy can prove invaluable, particularly in volatile markets.

Moreover, constant vigilance regarding market indicators, such as open interest and volatility metrics, is essential for fine-tuning trading strategies. By embracing disciplined trading practices and staying informed about Bitcoin price trends and macroeconomic factors, traders can position themselves for sustained success in the dynamic world of Bitcoin options trading.

Frequently Asked Questions

What are Bitcoin options and how do they impact the Bitcoin options market?

Bitcoin options are financial derivatives that give traders the right, but not the obligation, to buy or sell Bitcoin at a predetermined price before a specified expiration date. They play a crucial role in the Bitcoin options market by enabling traders to hedge against price fluctuations, speculate on future price movements, and manage risk more effectively. With increasing activity in the options market, particularly as institutional investors engage more, the dynamics of Bitcoin trading are significantly influenced by options prices and strategies.

How are call options influencing the Bitcoin options market dynamics?

Call options are currently dominating the Bitcoin options market, accounting for about 59.77% of the open interest. This indicates that traders are increasingly bullish, favoring positions that allow them to benefit from potential price increases while limiting risk. As seen in recent trading volumes, such as the significant interest in $140,000 and $200,000 strike prices for December 2025, call options are amplifying positive momentum in Bitcoin’s price and shaping market expectations for future gains.

What role do institutional investors play in the Bitcoin options market?

Institutional investors are becoming increasingly influential in the Bitcoin options market, as their sophisticated positioning strategies contribute to notable price movements and market trends. Their participation reflects a growing interest in Bitcoin derivatives, driven by factors like the recent market uptick and strategic investments in Bitcoin ETFs. This influx of institutional capital into options trading is helping to stabilize the market while providing liquidity, thereby enhancing trading opportunities for all market participants.

Why is understanding Bitcoin derivatives critical for Bitcoin trading strategies?

Understanding Bitcoin derivatives, including options, is essential for developing effective Bitcoin trading strategies. Derivatives, such as options, allow traders to hedge their positions, speculate on price movements, and manage risks in a volatile market. By leveraging options strategies—like call spreads or protective puts—traders can enhance their potential returns while reducing the risk associated with Bitcoin price fluctuations.

How does open interest in the Bitcoin options market indicate market sentiment?

Open interest in the Bitcoin options market reflects the total number of outstanding options contracts and is a key indicator of market sentiment. An increase in open interest signals that more traders are entering the market, often suggesting bullish sentiment, especially when call options dominate the landscape. Conversely, a decrease may indicate a lack of confidence or a potential correction. Monitoring open interest helps traders gauge the overall health and direction of the Bitcoin options market.

What is the significance of the ‘max pain’ point in the Bitcoin options market?

The ‘max pain’ point is a theoretical price level at which the largest number of options (both calls and puts) would expire worthless, thus causing maximum financial pain to option sellers. In the Bitcoin options market, understanding this level assists traders in predicting possible price movements as expiration approaches, revealing where market players are incentivized to drive prices towards, often providing insights into potential volatility and market stability.

How can traders benefit from the current trends in the Bitcoin options market?

Traders can capitalize on current trends in the Bitcoin options market by adopting strategies that align with the prevailing bullish sentiment. With substantial open interest in upward strike prices and a high volume of call options being traded, implementing spread and calendar strategies can optimize their risk-reward profiles. Furthermore, monitoring volatility indicators and remaining adaptable to changes in market conditions will enhance their trading success in this dynamic environment.

What are the implications of the recent rise in Bitcoin options open interest?

The recent rise in Bitcoin options open interest, nearing record levels, suggests increased confidence among traders about future price movements, especially given macroeconomic factors like ETF inflows and government policy uncertainties. This growing interest may lead to intensified trading activity, potentially driving Bitcoin price volatility as traders position themselves ahead of upcoming expiries and anticipate market shifts in sentiment.

| Key Point | Details |

|---|---|

| Active Market | Bitcoin options market remains active with significant trading volumes. |

| Current Price | Bitcoin reached a peak of $126,272, currently around $124,843. |

| Call Options Dominance | Calls account for 59.77% of open interest, indicating a bullish sentiment. |

| December 2025 Calls | Significant open interest at the $140,000 strike, with targets for price range. |

| Trading Strategy | Traders mix calls and puts, showing caution with defined risk strategies. |

| Institutional Positioning | Sophisticated strategies signal confidence in continued market upside. |

| Max Pain Levels | Around $125,000, suggesting stability preference among dealers. |

Summary

The Bitcoin options market is showing significant bullish activity as institutional investors position themselves for potential price increases. With calls representing over half of the open interest, and key strikes at $126,000 to $140,000, traders are optimistic about future price movements. This surge in activity, combined with macroeconomic factors and increased demand for hard assets like Bitcoin, indicates a self-reinforcing cycle that could propel Bitcoin’s value higher in the coming months.