Bitcoin Options Open Interest has surged to unprecedented levels, hitting an all-time high of $65 billion, igniting excitement in the Bitcoin options market amid a cooling price environment. Despite Bitcoin prices hovering around $113,500, traders are positioning themselves heavily with call options, anticipating a potential rally. This increase in open interest is indicative of the growing involvement in derivatives trading, highlighting traders’ bullish sentiment towards future price predictions. Renowned exchanges like the CME continue to dominate with substantial open interest figures, reflecting robust engagement in Bitcoin futures open interest as well. As traders capitalize on the growing momentum, the interplay of bullish call bets and strategic hedges showcases a vibrant landscape of options trading that is essential for understanding market dynamics.

The landscape of Bitcoin derivatives is transforming, particularly within the Bitcoin options ecosystem, where traders are making significant movements. As the open contracts soar, we observe a decisive tilt in market strategies, revealing traders’ expectations for price upswings. With the current spotlight on futures and options trading, the actions taken by these market players shed light on their anticipations for Bitcoin’s future trajectory. Notably, major exchanges like the CME are pivotal, influencing the balance of open interest in the marketplace. This development not only underscores the importance of options but also elucidates the speculative activities surrounding Bitcoin’s price fluctuations and forecasts.

Bitcoin Options Open Interest: A New Record Achieved

The Bitcoin options market has recently reached an unprecedented level, with open interest (OI) soaring to an all-time high of $65 billion. This remarkable milestone reflects the growing enthusiasm and confidence among traders, particularly as they lean towards bullish positions. Notably, Deribit, the dominant player in this market, shows a significant preference for call options, accounting for about 60.2% of the total OI. This indicates that a majority of participants are wagering on price increases, showcasing an optimistic sentiment regarding Bitcoin’s future performance.

Moreover, the substantial OI figure is coupled with notable trader activity focused on long-term contracts, set to expire as far out as December 2025. Such positioning supports projections of Bitcoin reaching impressive price targets, including $140,000 and $200,000. The popularity of these forward-looking contracts underlines a confidence that extends beyond the immediate market fluctuations, suggesting that institutional and retail investors alike are gearing up for considerable price movements in the coming years.

Understanding the Bitcoin Derivatives Market

The landscape of the Bitcoin derivatives market comprises various financial instruments, including options and futures that allow traders to speculate on price movements without owning the underlying asset. As of now, Bitcoin futures open interest stands at approximately $73.8 billion, indicating that traders are deeply engaged despite slight pullbacks in spot prices. This high level of OI signifies a robust trading environment where futures contracts are utilized for hedging strategies and to capitalize on expected price action, aligning with broader market trends.

Furthermore, major exchanges like CME and Binance lead the field, indicating competitive dynamics within the market. With CME commanding a significant $16.79 billion in futures OI, the exchange continues to shape market expectations. As more traders participate in derivatives trading, understanding the implications of OI on market sentiment and Bitcoin’s price predictions becomes essential for effective trading strategies.

The Impact of Call and Put Options on Price Predictions

Analyzing the balance between call and put options provides critical insights into market sentiment. With Bitcoin’s options displaying a ratio of 60.2% calls to 39.8% puts, it’s evident that traders are predominantly betting on upward price movements. This bullish positioning not only reflects the sentiment of the current market but also indicates that many are anticipating a potential rebound in Bitcoin’s prices. The substantial OI in calls, particularly around immediate strike prices of $114,000 to $118,000, suggests that short-term traders are also bracing for a price ascent before the month concludes.

Conversely, the existence of a notable amount of put options—around 200,000 BTC—serves as a hedge against potential price declines. This dual approach allows traders to balance the optimism with caution, indicating a market that acknowledges the volatility inherent in Bitcoin trading. Such protective measures are critical in a landscape where price fluctuations can significantly impact both derivatives trading strategies and broader market dynamics.

How Macro Factors Influence Bitcoin Options Open Interest

The interplay of macroeconomic factors significantly impacts the Bitcoin options market. As traders navigate the complexities of monetary policy changes and global economic conditions, sensitivities to these elements dictate their positioning in both options and futures markets. For instance, uncertainty regarding Fed policy and inflation rates often results in heightened volatility, which traders look to capitalize on through derivatives contracts. As a result, recent spikes in Bitcoin options open interest can be seen not only as a reflection of trader sentiment but also as a response to evolving macroeconomic indicators.

Additionally, with Bitcoin encountering psychological price levels, such as the current vicinity near $113,500, traders often adjust their strategies accordingly. The current bullish sentiment, mirrored in the ascending options OI, underscores a collective belief in a potential upward trajectory influenced by external economic forces. Understanding these dynamics helps to inform pricing predictions and reinforces the importance of following both technical signals and macroeconomic catalysts.

Profit-Taking Trends in the Bitcoin Market

Recent trends within the Bitcoin derivatives market highlight a responsive nature to profit-taking activities as traders monitor their positions closely. Over the past 24 hours, many exchanges noted modest open interest contractions ranging from 1.6% to 10%. This indicates a level of caution among traders who want to realize gains amidst slight pullbacks in spot prices. Such behavior underscores a balancing act where traders seize profit while remaining alert to the market’s volatility, often leading to strategic repositioning in their futures and options contracts.

However, certain platforms, like BingX and MEXC, demonstrated resilience with substantial increases in OI, suggesting that while some traders are cashing out, others are actively seeking out new speculative opportunities. This divergence illustrates how the Bitcoin market remains robust despite profit-taking trends, with keen interest in both short-term maneuvers and longer-term prospects. Ultimately, these profit-taking behaviors will play a crucial role in shaping market sentiment and influencing future price movements.

Institutional Involvement in Bitcoin Derivatives

The influx of institutional players into the Bitcoin derivatives space has dramatically transformed trading dynamics. Institutions bring considerable capital and strategic insight, influencing both Bitcoin options open interest and overall market sentiment. As larger players enter the fray, their considerable positions can sway market movements, reinforcing bullish sentiments expressed through options OI. This institutional engagement not only elevates Bitcoin’s profile as a legitimate asset class but also contributes to higher speculative activity within the options and futures markets.

Moreover, as these institutions increasingly utilize Bitcoin derivatives to hedge their portfolios or speculate on price movements, the overall architecture of trading evolves. This creates a more stable environment for retail traders, who often look to institutional engagement as a sign of legitimacy and growth potential within the market. The ongoing trend suggests that as institutional participation grows, so too will the sophistication of trading strategies, likely impacting future Bitcoin price predictions.

The Future Outlook for Bitcoin Prices and Trading Strategies

Looking ahead, Bitcoin’s price trajectory remains a focus of interest for traders and investors alike. With projections extending beyond $140,000—according to popular bullish contracts—there’s significant pressure on the market to fulfill these anticipations. The rising options open interest reflects both confidence and caution, as various market participants position themselves for potential price surges while also preparing for possible downturns. As Bitcoin grapples with these competing forces, the effectiveness of trading strategies will hinge on traders’ ability to adapt to rapidly changing market conditions.

In this evolving landscape, traders must remain vigilant, keeping a close eye on key indicators and sentiment shifts. The interplay of derivative trading, market sentiment, and broader economic factors will dictate not only Bitcoin’s immediate price movements but also its potential long-term trajectory. As the market continues to develop, the combination of strategic foresight and responsive trading will be paramount for capitalizing on the opportunities presented by Bitcoin and its derivatives.

CME Bitcoin Options: Leading the Charge in the Market

CME Group has established itself as a leading exchange within the Bitcoin options market, highlighted by its substantial open interest presence. Commanding approximately $16.79 billion, the CME has solidified its position as a reliable platform for institutional traders. This dominance is essential for maintaining liquidity and fostering enhanced trading conditions, allowing participants to engage efficiently with Bitcoin derivatives. Furthermore, the CME’s products are often viewed as benchmarks, influencing trends across other exchanges.

The CME’s commitment to developing Bitcoin options has not only attracted significant capital but has also increased market transparency and accessibility. As traders look for reliable trading venues, the CME’s robust infrastructure and regulatory oversight encourage participation from a wider range of investors. The ongoing success and innovation seen in CME Bitcoin options are pivotal in shaping the overall derivatives landscape, reinforcing the market’s significance in global finance.

Navigating Risks Associated with Bitcoin Options Trading

While the Bitcoin options market presents extensive opportunities, it is not without risks. Traders must navigate the inherent volatility in Bitcoin prices, which can lead to significant gains or losses. Understanding ‘max pain’—the price point where the maximum number of option holders stand to lose at expiration—becomes vital for traders aiming to strategize effectively. As this price typically aligns closely with the current trading range, traders are advised to factor it into their analyses when developing their options strategies.

Additionally, leverage within the Bitcoin derivatives market amplifies both potential profits and risks, necessitating a disciplined approach to trading. Implementing effective risk management techniques, such as setting stop-loss limits and diversifying positions, can help mitigate the dangers posed by sudden price fluctuations. By adopting a strategic framework for options trading, participants can better position themselves to capitalize on market movements while minimizing exposure to downside risks.

Frequently Asked Questions

What does Bitcoin options open interest indicate about market sentiment?

Bitcoin options open interest (OI) reflects the total number of outstanding options contracts that have not been settled. A high open interest, especially at an all-time high like the current $65 billion, indicates strong market interest and speculative activity. It suggests that traders are actively engaging with the Bitcoin options market, often signaling bullish sentiment as most of the current contracts lean towards calls rather than puts.

How does Bitcoin options open interest compare to Bitcoin futures open interest?

Currently, Bitcoin options open interest stands at a significant $65 billion while Bitcoin futures open interest is around $73.8 billion. This close proximity illustrates a healthy relationship between the two derivatives markets, indicating that traders are simultaneously engaging in both Bitcoin options and Bitcoin futures trading as they position themselves based on price predictions and market volatility.

What is the impact of Bitcoin options open interest on price predictions?

Bitcoin options open interest can greatly influence price predictions by indicating trader sentiment. With around 60.2% of the OI being call options, many traders are betting on Bitcoin price increases. Such positioning may lead to upward price pressures, especially as larger positions, like the popular $140,000 call option, suggest that market players expect significant price movements in the future.

Which exchanges dominate Bitcoin options open interest?

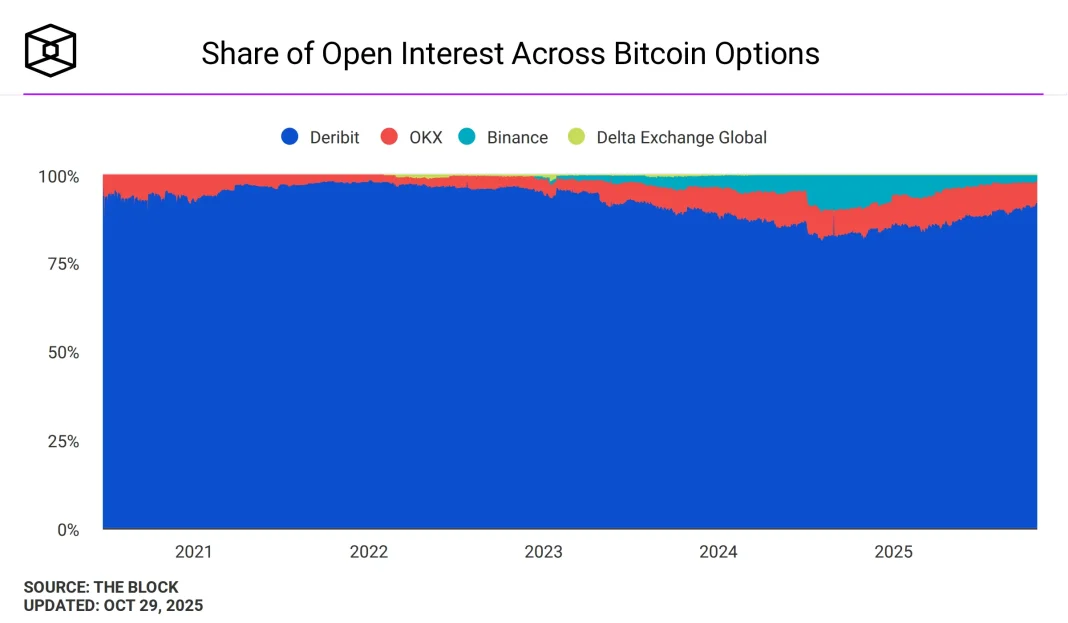

The Bitcoin options market is primarily dominated by Deribit, which captures over 90% of the total options open interest. This exchange currently has a substantial OI, reinforcing its position as a leading player in Bitcoin derivatives trading compared to others. Understanding where the majority of Bitcoin’s options OI is centralized can help in analyzing market trends and sentiment.

What does a high Bitcoin options open interest level suggest about traders’ strategies?

A high Bitcoin options open interest level, particularly one that has reached all-time highs, indicates that traders are employing diverse strategies ranging from bullish to hedging positions. With significant positioning in long-term calls, traders demonstrate confidence in future upward price movement while maintaining a level of caution by holding puts as hedges. This balance of strategies showcases the complexity and depth of sentiment in the Bitcoin options market.

What key prices should traders monitor in relation to Bitcoin options open interest?

Traders should closely monitor Bitcoin’s ‘max pain’ price, currently around $114,000. This is the price point where options traders would lose the most at expiry, and thus where market makers are likely to benefit. Observing how the spot price reacts to this level can provide insights into market dynamics, especially in relation to Bitcoin options open interest.

How can traders leverage Bitcoin options open interest for investment decisions?

Traders can leverage Bitcoin options open interest as an indicator of market strength and potential direction. By analyzing which strikes have the highest OI, traders can gauge where other market participants are focusing their bets. This insight helps in making informed decisions regarding entry and exit points, particularly when considering long-term bullish or bearish positions in Bitcoin.

| Metric | Value |

|---|---|

| Current Bitcoin Spot Price | $113,500 |

| Bitcoin Futures Open Interest | $73.8 billion |

| CME Futures OI | $16.79 billion (22.7%) |

| Binance Futures OI | $12.69 billion |

| Bitcoin Options Open Interest (Notional) | $65 billion |

| Call vs Put Ratio | 60.2% Calls, 39.8% Puts |

| Max Pain Price | $114,000 |

| Most Popular Call Option | $140,000 Call on Deribit |

Summary

Bitcoin Options Open Interest has reached a lifetime high, reflecting a strong bullish sentiment among traders even as spot prices hover around $113,500. The $65 billion notional open interest in options indicates significant trading activity and speculative positioning towards future price increases, with a predominant focus on call options. As traders engage heavily in both long-term betting on price rallies and short-term positioning for imminent movements, the derivatives market remains a vital indicator of investor sentiment in the cryptocurrency landscape.