Bitcoin options have emerged as a crucial component of the cryptocurrency trading landscape, providing traders with unique strategies to leverage their positions in the ever-volatile market. These financial instruments allow participants to speculate on the future price of Bitcoin, enabling both bullish and bearish strategies amid fluctuating market conditions. As the options market continues to gain traction, traders are keenly observing key strikes such as $120K and $140K, particularly as they prepare for significant expirations like those in December. With a substantial amount of open interest in BTC options, currently hovering over $50 billion, this segment attracts seasoned market players eager to explore the potential for profit. Engaging in Bitcoin options trading not only offers opportunities for hedging but also presents risks that traders must navigate carefully.

Within the realm of cryptocurrency derivatives, BTC options stand out as a versatile instrument for market participants. Whether referred to as Bitcoin derivatives or Bitcoin contracts, these options play a vital role in managing risk and enhancing trading strategies for those looking to capitalize on price movements. The options market is poised to continue evolving, with traders flocking to various platforms to execute their strategies based on predictions surrounding Bitcoin’s price trajectory. This captivating field of digital finance attracts both experienced investors and newcomers alike, each seeking to leverage the inherent volatility associated with Bitcoin. As participation grows, understanding the dynamics of these options becomes increasingly essential for anyone involved in cryptocurrency trading.

Understanding Bitcoin Options: A Key Player in Cryptocurrency Trading

Bitcoin options have become an essential aspect of the cryptocurrency trading landscape, allowing traders to hedge their positions and speculate on future price movements without directly owning the asset. By utilizing options, traders can benefit from significant leverage, which means they can amplify their potential returns while restricting their losses to the premium paid for the option. This strategy has led to a rise in popularity among both seasoned traders and newcomers venturing into Bitcoin trading. With some of the highest open interest volumes observed in recent weeks, it’s evident that Bitcoin options are attracting a considerable amount of interest.

The market dynamics around Bitcoin options are driven by traders’ expectations of future volatility and price movements. Currently, the open interest in BTC options stands at an impressive $50 billion, indicating a robust marketplace where traders are actively placing bets on significant price swings. Options traders are particularly focused on key strike prices, with substantial activity centered around the $140,000 mark for December expirations. This indicates a cautious bullish sentiment, despite ongoing market fluctuations, as traders position themselves to potentially benefit from dramatic upward movements in Bitcoin prices.

The Impact of Bitcoin Futures on the Options Market

Bitcoin futures are integral to the workings of the entire options market, serving as a barometer for traders’ sentiments and strategies. With a total open interest of approximately 677,750 BTC, valued around $70.24 billion, futures trading lays the groundwork for subsequent options activities. Exchanges like CME and Binance dominate the futures market, contributing significantly to options pricing and trader positioning. The close correlation between futures and options means that movements in the futures market can lead to increased volatility and trading volume in the options market.

Moreover, as traders assess the potential outcomes of their Bitcoin futures positions, they often utilize options as a complementary strategy to either hedge against losses or amplify their gains. The interplay between these two derivatives allows traders to implement sophisticated strategies that take advantage of market trends while managing risk effectively. For instance, if futures prices rise, options could become more valuable, leading traders to adjust their strategies accordingly. Understanding this relationship is crucial for any trader looking to navigate the complexities of cryptocurrency trading successfully.

Max Pain Theory in Bitcoin Options: Understanding the Strategy

The concept of ‘max pain’ plays a crucial role in Bitcoin options trading, providing traders with insights into where they believe the price of Bitcoin will settle as options expiration approaches. Max pain refers to the price point where the most options contracts (both calls and puts) will expire worthless, creating a scenario in which options writers (those who sell the contracts) face the least financial liability. Currently, the max pain levels are sitting at approximately $105,000 on Deribit and $110,000 on Binance, suggesting that the market may gravitate towards these points as traders make adjustments to their positions.

Traders use max pain levels to formulate their strategies, as this insight can inform their decisions on whether to enter or exit positions in the options market. The sharper the volatility, the more traders will look to max pain as a potential guide for where price might stabilize. By understanding these price levels, traders can increase their chances of aligning their strategies with prevailing market forces while potentially capitalizing on swings in Bitcoin’s price. This alignment can lead to more informed decision-making in a rapidly changing crypto trading environment.

Key Strategies for Trading Bitcoin Options Successfully

When handling Bitcoin options, traders should focus on implementing robust strategies that can mitigate risks while maximizing potential rewards. One vital approach is to balance call and put options, maintaining a diverse profile to cover both bullish and bearish market conditions. For instance, taking long positions in BTC calls while simultaneously purchasing puts can allow traders to hedge against unexpected downward movements. This strategy has become particularly relevant given the current market volatility, where options volume near key strike prices indicates active trading sentiments.

Another strategy involves monitoring volume and open interest data closely. High-volume levels paired with significant open interest in particular strike prices, such as the recently highlighted $140,000 and $85,000, can signal potential breakout areas or reversal points. Traders who remain vigilant can capitalize on these trends, adjusting their positions as market sentiment changes. By employing these informed strategies, traders can navigate the Bitcoin options market effectively, leveraging existing market dynamics to enhance their trading outcomes.

Current Trends and Predictions for Bitcoin Options Trading

As we move towards December 2025, the landscape of Bitcoin options trading continues to evolve, driven by significant market shifts and trader sentiment. With Bitcoin hovering around $103,000, traders are increasingly focusing on the upcoming options expiration dates that could induce volatility. The current trend shows a rising interest in call options at higher strike prices, further indicating a cautiously optimistic outlook. Such trends are typically responsive to broader market conditions, including macroeconomic factors and trader psychology.

Predictions surrounding Bitcoin options suggest that there will be continued volatility as traders react to price movements and adjust their positions accordingly. It’s essential for traders to stay informed and adapt to new information, whether positive or negative. Maintaining awareness of macroeconomic influences, such as regulatory changes or geopolitical events, will be crucial as these factors can decisively impact Bitcoin’s price movement and, consequently, how options strategies are executed in real-time.

Leveraging Market Insights for Informed Bitcoin Trading

To excel in Bitcoin options trading, it is crucial for traders to leverage market insights effectively. Understanding the underlying factors that drive the options market—such as liquidity, market sentiment, and news events—can empower traders to make informed decisions. Many successful traders utilize technical analysis combined with fundamental insights to anticipate price movements and adjust their strategies proactively. Keeping an eye on significant news events and economic indicators can provide additional context that influences Bitcoin’s behavior in both the futures and options markets.

Additionally, utilizing platforms that provide real-time data around open interest and volume can enable traders to spot trends early. For example, a surge in open interest on specific strike prices may indicate where traders expect Bitcoin’s price to move in the short term. Understanding these market dynamics allows traders to position themselves advantageously and maximize their profitability in options trading. This structured approach ultimately leads to more strategic trading outcomes in the ever-evolving cryptocurrency landscape.

The Role of Exchanges in Bitcoin Options Trading

Exchanges play a pivotal role in the Bitcoin options trading ecosystem, serving as the primary venues for executing trades and providing liquidity. Major exchanges like Deribit, CME, and Binance dominate the space, facilitating the large volumes of trading activity seen today. Each exchange has its unique features and offerings, catering to different types of traders—whether they seek advanced trading tools, lower fees, or varied contract types. As the Bitcoin options market develops, the importance of choosing the right exchange cannot be overstated, especially as competition increases among platforms.

Furthermore, exchange stability and reliability are essential for traders looking to navigate the volatile conditions inherent in the cryptocurrency markets. With issues like sudden outages or unreliable service during high-volume trading periods being a genuine concern, traders need to select exchanges with robust infrastructure and support. By ensuring they operate through reputable platforms, traders can minimize risks and focus on devising their strategies for success in the dynamic world of Bitcoin options.

Navigating Volatility: Bitcoin Options Amid Market Fluctuations

Volatility is an inherent characteristic of the cryptocurrency market, particularly with Bitcoin options trading. As traders navigate these fluctuations, understanding how to assess and react to market changes becomes vital. The current market dynamics underscore the unpredictable nature of Bitcoin prices, prompting traders to utilize strategies that factor in this volatility. Those leveraging options often use them as a hedge against adverse price swings, allowing traders to safeguard against losses while still pursuing potential upside gains.

Moreover, the fluctuating interest rates and emerging macroeconomic trends add layers of complexity to options trading strategies. Traders must remain vigilant and adaptable, ready to adjust their positions as the market evolves. By leveraging insights into the broader financial landscape and pricing trends in both futures and options markets, traders can develop strategies that mitigate risks. Navigating this volatility effectively will determine success or failure among Bitcoin options traders moving forward.

Future Outlook: What Lies Ahead for Bitcoin Options

The future of Bitcoin options trading appears both promising and challenging, marked by rapid innovation and persistent volatility. As more institutional investors enter the cryptocurrency space, the legitimacy and complexity of options trading are likely to grow. This influx could enhance market liquidity and attract a new wave of strategies that incorporate Bitcoin derivatives into broader investment portfolios. However, with these developments will also come heightened scrutiny and regulations that could impact trading behaviors.

Traders should brace for evolving trends, adapting their strategies to align with technological advancements and changing regulatory landscapes. Additionally, as Bitcoin options mature, there will be a growing emphasis on data analytics and machine learning tools to predict price movements and optimize trading decisions. By staying informed and flexible, traders can harness the potential of Bitcoin options to achieve substantial returns while managing the inherent risks in this vibrant market.

Frequently Asked Questions

What are Bitcoin options and how do they work in cryptocurrency trading?

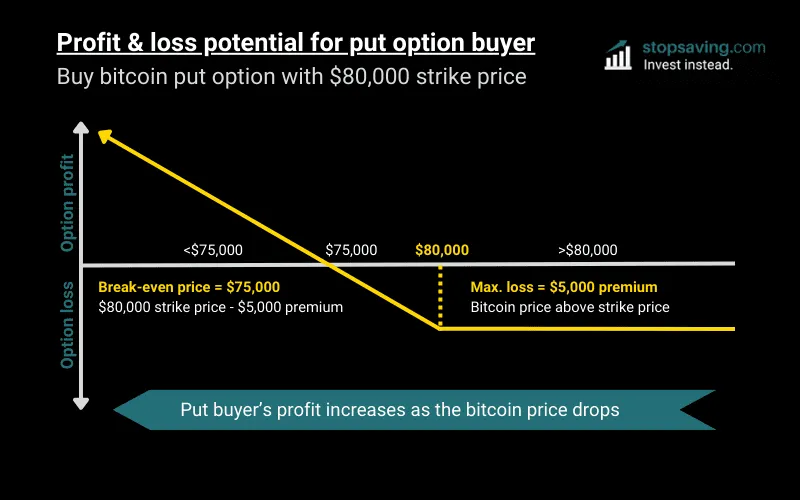

Bitcoin options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell Bitcoin at a predetermined price before a specific date. In cryptocurrency trading, these options allow traders to hedge against price volatility or speculate on future price movements, making them an essential part of the options market alongside Bitcoin futures.

How do Bitcoin options compare to Bitcoin futures in terms of risk management?

Bitcoin options offer more flexibility compared to Bitcoin futures, as they allow traders to limit potential losses while still gaining from upward price movements. While Bitcoin futures require obligations to buy or sell, BTC options only execute if it benefits the trader, making them a popular tool for risk management in cryptocurrency trading.

What is the current trend in the options market for Bitcoin?

The options market for Bitcoin is currently showing a bullish bias, with call options making up 61% of the total BTC options open interest. This trend indicates that traders are positioning themselves for potential price increases, particularly around key strikes like $140,000 and $120,000 for the upcoming expiration.

What do max pain levels indicate for Bitcoin options traders?

Max pain levels represent the point at which the most options contracts will expire worthless, causing the maximum loss to options holders. For Bitcoin options, the current max pain level is around $105,000 on Deribit and $110,000 on Binance, suggesting that options writers may prefer Bitcoin to remain around these price points to minimize payouts and enforce trader discomfort.

How can traders use Bitcoin options to navigate market volatility?

Traders can use Bitcoin options to navigate market volatility by employing strategies such as hedging or speculative plays. By buying put options, they can protect against falling prices, while call options provide exposure to potential gains, allowing traders to balance risk and reward amidst fluctuations in the cryptocurrency market.

| Key Points | Details |

|---|---|

| Current Bitcoin Price | Above $103,000 after a brief dip below $100,000 |

| Total Bitcoin Futures Open Interest | $70.24 billion, up 3.47% in 24 hours |

| Top Futures Exchanges | CME ($14.35 billion), Binance ($12.45 billion) |

| Open Interest Rise | MEXC +17.45%, BingX +9.32% |

| Total Bitcoin Options Open Interest | Just over $50 billion, with calls at 61% |

| Most Active Options Strikes | $140,000 (calls), $85,000 (puts), $200,000 (call) |

| Max Pain Levels | $105,000 (Deribit), $110,000 (Binance) |

| Trader Sentiment | Cautiously bullish with hedging strategies |

Summary

Bitcoin options are a vital component in the cryptocurrency market, offering traders opportunities to capitalize on price movements while mitigating risk. In recent developments, traders are positioning themselves for December with significant strikes at $120K and $140K, indicating a bullish outlook despite recent volatility in the market. With a $50 billion options open interest and varying max pain levels, the market is gearing up for potential swings as expectations rise for Bitcoin’s performance as we approach year-end.