Bitcoin Price Analysis is crucial as we witness the flagship cryptocurrency grapple with significant fluctuations, navigating below the $100,000 mark. Traders and investors are closely monitoring Bitcoin market trends, evaluating factors that could lead to a bullish resurgence or a bearish downturn. As we anticipate cryptocurrency predictions, various elements such as the Crypto Fear and Greed Index play a pivotal role in shaping investor sentiment. With discussions surrounding buying Bitcoin in 2025 gaining traction, understanding the current landscape for investing in Bitcoin is more important than ever. This analysis will help decipher the complexities of Bitcoin’s price movements, offering insights into potential strategies moving forward.

When examining the state of Bitcoin, it’s essential to assess the ongoing trends within the cryptocurrency sphere. Price evaluations are not just about numbers; they encompass the broader implications of the Bitcoin ecosystem and market dynamics. As we dive into the underlying factors influencing Bitcoin’s trajectory, the focus shifts to alternative insights like the fear and greed assessments and institutional participation. The importance of strategically positioning oneself for potential investments in Bitcoin by 2025 cannot be overstated. A thorough understanding of these elements positions investors to make more informed decisions in this fast-evolving digital currency landscape.

Understanding Bitcoin Price Analysis: Current Trends and Predictions

The current state of Bitcoin’s price analysis reveals a lot of uncertainty as it fluctuates under the $100,000 mark. This critical point is not just a psychological barrier but also a significant technical level that traders are closely watching. Currently, market trends suggest that investor sentiment is in the ‘extreme fear’ range, as indicated by the Crypto Fear and Greed Index (CFGI). This indicates a period where many investors may reconsider their positions and either buy into dips or sell to cut their losses. Such mixed feelings often create volatility which traders can exploit, leading to potential short-term gains.

Looking forward, the Bitcoin price analysis must account for several potential bullish and bearish influences. Predictions suggest a rebound could be possible if institutional investors continue to step in at current price levels. The involvement of spot exchange-traded funds (ETFs) and increased corporate treasury acquisitions paint a potentially brighter picture. However, on the flip side, bearish market forces linked to macroeconomic trends, such as possible recession fears, could threaten to drive the price lower, showing the ongoing tug-of-war between buying pressures and selling sentiments.

Factors Influencing Bitcoin’s Price Dynamics

Several key factors directly impact Bitcoin’s price dynamics, particularly in relation to recent market trends. The institutional buying observed this year has supported Bitcoin’s price even amidst uncertainties. As corporate treasuries accumulate Bitcoin, they play a substantial role in stabilizing prices. Coupled with favorable pro-crypto policies emerging from the U.S. government, the stage seems set for potential price increases. As we venture further into 2025, these institutional trends combined with regulatory support could energize the market environment, leading to significant upsides for Bitcoin investors.

On the other hand, macroeconomic indicators must not be overlooked. As seen recently, Bitcoin behaves similarly to high-beta tech stocks, suggesting its movements could be closely tied to broader economic conditions. Increasing macro risks, such as inflation and possible recessionary signs, add weight to the bearish narrative surrounding Bitcoin. Therefore, understanding these market dynamics will be critical as traders make decisions about whether to invest in Bitcoin or wait for more favorable conditions.

Bitcoin Market Trends: Navigating the Future

Current Bitcoin market trends showcase a dual narrative that investors must navigate. After hitting an all-time high above $126,000, Bitcoin has encountered resistance and subsequently experienced a significant pullback. This could be interpreted as a healthy consolidation phase or a troubling sign of possible extended bearishness. As predicted buy signals become clearer, traders are focusing on trends that suggest whether the market might soon pivot back to bullishness.

Moreover, the cryptocurrency predictions suggest that a historical pattern could be repeating itself, where significant sell-offs are shortly followed by surges in investor activity. This cyclical nature could mean that Bitcoin might be well-poised for a rebound in late 2025, especially if liquidity improves as interest rates are eased. Investors must closely observe these trends, analyzing historical contexts alongside the current market sentiment to make informed decisions moving forward.

Bitcoin Fear and Greed Index: What Does It Tell Us?

The Bitcoin Fear and Greed Index serves as a barometer of market sentiment, providing crucial insights into the emotional state of investors. Currently, with the index firmly in the ‘extreme fear’ zone, this reflects a time when many traders are hesitant to buy or hold. This extreme bearish sentiment often indicates potential buying opportunities as the market prepares for potential rebounds when fear subsides. Historically, such periods have preceded upward price movements, suggesting that cautious optimism might be warranted as long-term holders digest market fluctuations.

Conversely, the Fear and Greed Index also suggests caution; as extreme fear sets in, the potential for a further decline increases if negative catalysts emerge. Investors should watch for changes in sentiment that could trigger the herd mentality—where panic selling exacerbates downturns. By combining insights from the Fear and Greed Index with technical analysis and macroeconomic factors, traders can better position themselves for potential market shifts.

The Role of Institutional Investors in Bitcoin’s Future

Institutional investors have increasingly been recognized as key players in the Bitcoin market, significantly influencing price dynamics. Their entry, especially through vehicles like spot ETFs, has provided substantial support to Bitcoin’s price. Many institutions view the current dip as a unique opportunity to accumulate Bitcoin at considerably lower prices than seen in the past year. As they continue to buy, this could stabilize prices, creating a more robust foundation for future price increases as we approach 2025.

However, the potential downside exists if these institutional purchases begin to slow. Should macroeconomic conditions worsen or profit-taking occur, there could be considerable short-term selling pressure. Therefore, observing the activity of institutional players will be critical for retail investors as this could either fortify the Bitcoin price or lead to further price declines.

Evaluating Bitcoin’s Long-Term Investment Potential

Investors contemplating the long-term potential of Bitcoin must weigh various economic indicators and market dynamics. With a history of volatility, Bitcoin’s price action has been attractive for both speculative trading and long-term investment. Some believe that Bitcoin could redefine its value as a hedge against inflation and a store of wealth, particularly as central banks reconsider their monetary policies. The expectation of substantial returns also continues to drive interest from both individual and institutional investors, looking toward the 2025 horizon.

Nonetheless, with the crowded crypto marketplace and evolving regulatory frameworks, the future trajectories for Bitcoin investment will require diligence. Looking for supportive policy frameworks and assessing risks like market saturation or technological developments will be vital in making smart investments in Bitcoin. Each investor must carefully assess their risk tolerance while considering Bitcoin’s unique characteristics to determine if it aligns with their investment goals.

Macro-Economic Influences on Bitcoin’s Trajectory

The interplay between macroeconomic factors and Bitcoin prices is more pronounced than ever, especially as we head toward an uncertain economic climate. Bitcoin has shown characteristics similar to tech stocks, reacting strongly to broader market fluctuations. Recent downturns sparked by economic concerns illustrate how tightly linked Bitcoin is to risk sentiment, wherein deteriorating economic conditions could result in significant price declines. Currency instability and fears of recession are significant contributors to this phenomenon.

Additionally, the Fed’s monetary stance impacts Bitcoin significantly. As interest rates rise or fall, they can either drive investor interest away from risk assets or invite them to participate in potential rebounds. A more hawkish approach could suppress Bitcoin’s price, while dovish policies may provide a lifeline. Thus, understanding these macroeconomic influences will be vital to anticipate Bitcoin’s movements and make informed investment decisions.

The Impact of Profit-Taking on Bitcoin’s Performance

Profit-taking is a common trading behavior that can have profound short-term effects on Bitcoin’s market performance. Following substantial increases like the rise from $35,000 to over $100,000, many traders are likely to realize their gains, which often contributes to decline pressure in the market. This seasonal selling is particularly prevalent as investors prepare for year-end tax implications. While taking profits can stabilize markets during downturns, it also raises volatility as fluctuations ensue.

In the context of Bitcoin’s price mechanics, especially during critical transition phases through 2025, understanding the profit-taking behavior will be paramount. Analysts assert that this action often leads to corrections, making timing crucial for potential buyers. By observing trends in selling pressure, traders can identify optimal entry points to capitalize on Bitcoin’s future rebounds, paving the way for potential profits as conditions shift.

Navigating Bitcoin’s Volatility: Strategies for Investors

Navigating Bitcoin’s inherent volatility requires strategic planning and proper risk management. As Bitcoin prices oscillate, informed traders must analyze both the macro environment and market sentiment to identify suitable entry and exit points. Establishing clear investment goals, leveraging tools such as the CFGI, and keeping abreast of market trends will serve to enhance decision-making processes. Key related terms—including liquidity conditions and investor behavior—should guide strategy development, fostering a well-rounded approach to Bitcoin trading.

Moreover, employing dollar-cost averaging can help mitigate risks associated with price swings while allowing investors to benefit from market depth. Understanding the market cycles, particularly in the wake of the 2025 predictions, will aid in anticipating shifts that could provide profitable opportunities. By embracing adaptive strategies, traders can navigate Bitcoin’s landscape more effectively, positioning themselves to capitalize on potential rebounds.

Frequently Asked Questions

What are the main factors influencing Bitcoin price analysis today?

Bitcoin price analysis is currently influenced by various factors, including institutional buying patterns, macroeconomic signals, and investor sentiment reflected in the Crypto Fear and Greed Index. These elements can either boost bitcoin prices or contribute to market volatility.

How do institutional investors impact Bitcoin market trends?

Institutional investors significantly impact Bitcoin market trends by creating demand through investments in spot exchange-traded funds (ETFs) and corporate treasuries. Their involvement at current price levels helps stabilize bitcoin’s market, suggesting potential upward price movements.

What should I consider when buying Bitcoin in 2025?

When considering buying Bitcoin in 2025, focus on market trends, potential regulatory changes, and the historical four-year cycle, which may indicate bullish trends. It’s essential to analyze the risk factors and sentiment shifts, particularly as we approach year-end tax harvesting periods.

What role does the Crypto Fear and Greed Index play in Bitcoin price analysis?

The Crypto Fear and Greed Index serves as a sentiment gauge in Bitcoin price analysis, reflecting whether the market is experiencing fear or greed. Current readings in the ‘extreme fear’ zone may indicate a potential buying opportunity, as prices historically rebound after such extremes.

What are the potential risks facing Bitcoin before the end of 2025?

Potential risks that could impact Bitcoin before the end of 2025 include profit-taking by long-term holders, recession fears, and bearish market momentum that may force prices below critical support levels. Each of these factors could hinder a sustained recovery in Bitcoin’s value.

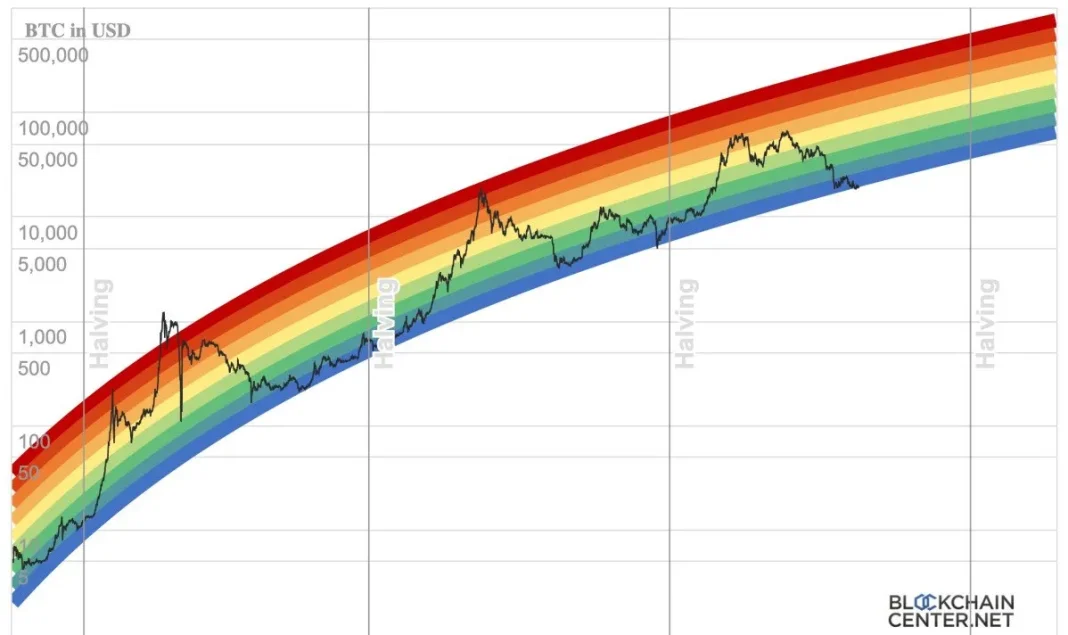

Can historical cycles predict future Bitcoin price movements?

Yes, historical cycles can provide insights for future Bitcoin price movements. Analysts often look at past performance patterns, particularly post-halving cycles and major market corrections, to gauge potential rebounds or further declines in Bitcoin prices.

Why is understanding macroeconomic conditions important for Bitcoin price analysis?

Understanding macroeconomic conditions is crucial for Bitcoin price analysis because broader economic factors, such as the Federal Reserve’s monetary policy and global liquidity conditions, can directly influence investor behavior and market sentiment, impacting Bitcoin’s price trajectory.

How do technical indicators affect Bitcoin price predictions?

Technical indicators, such as support and resistance levels and sentiment indicators like the Fear and Greed Index, influence Bitcoin price predictions by highlighting potential trading opportunities and warning of possible reversals based on market trends.

What factors might prevent Bitcoin from rising in 2025?

Factors that could prevent Bitcoin from rising in 2025 include aggressive distribution by long-term holders, increased macroeconomic risks, and the impact of profit-taking as investors adjust their portfolios ahead of tax deadlines.

How can I improve my Bitcoin price analysis skills?

To improve your Bitcoin price analysis skills, familiarize yourself with market indicators, follow key news events, understand historical price cycles, and study investor sentiment measures like the Crypto Fear and Greed Index, thus developing a holistic view of cryptocurrency markets.

| Factors for Potential Rebound | Factors for Potential Decline |

|---|---|

| 1. Institutional Buyers Stepping in at Current Levels | 1. Long-Term Holders Aggressively Distributing |

| 2. Pro-Crypto Policy Momentum in the U.S. | 2. Macro Risk-off Environment Is Intensifying |

| 3. Classic Cycle Behavior | 3. The 4-Year Cycle May Have Already Peaked |

| 4. Improving Liquidity Conditions Into Year-End | 4. Profit-Taking and Year-End Tax Harvesting Pressure |

| 5. Oversold Technicals and Extreme Bearish Sentiment | 5. Momentum Is Bearish, and Downside Targets Are Being Met |

Summary

Bitcoin Price Analysis suggests that the cryptocurrency is at a critical juncture, with factors both for a potential rebound and those that may lead to further decline. As institutional interest continues to grow and pro-crypto policies emerge, there is optimism for a recovery. However, market dynamics like profit-taking, macroeconomic conditions, and bearish momentum pose significant risks. The next few months will be crucial in determining whether Bitcoin can overcome these hurdles and surge upwards, or if it will continue to struggle as a result of the current trends.