Bitcoin price volatility has become a focal point for both seasoned investors and newcomers in the ever-evolving cryptocurrency market. As prices fluctuate dramatically, determining the right bitcoin investment strategy is crucial for maximizing returns and minimizing losses. Notably, prominent figures like Michael Saylor continue to advocate for long-term holding, often endorsing the approach of buying the dip during market downturns. This perspective contrasts sharply with skeptics who warn of potential bankruptcies and bleak forecasts. Understanding current cryptocurrency market trends and Bitcoin future predictions can empower investors to navigate this unpredictable landscape effectively.

The ups and downs of Bitcoin pricing represent a compelling narrative within the digital asset landscape, capturing the attention of financial enthusiasts worldwide. As the market swings between uncertainty and optimism, strategies for investing in Bitcoin and managing risk become essential talking points among both veteran traders and novices. High-profile advocates, such as Michael Saylor, emphasize the importance of a long-range mindset and seizing opportunities amid price dips. The divergence of opinions, from bullish forecasts to critical caution, underscores the complexity of market behaviors and the necessity of analyzing cryptocurrency trends. For anyone looking to engage with this dynamic market, understanding these factors is vital for making informed decisions.

Understanding Bitcoin Price Volatility

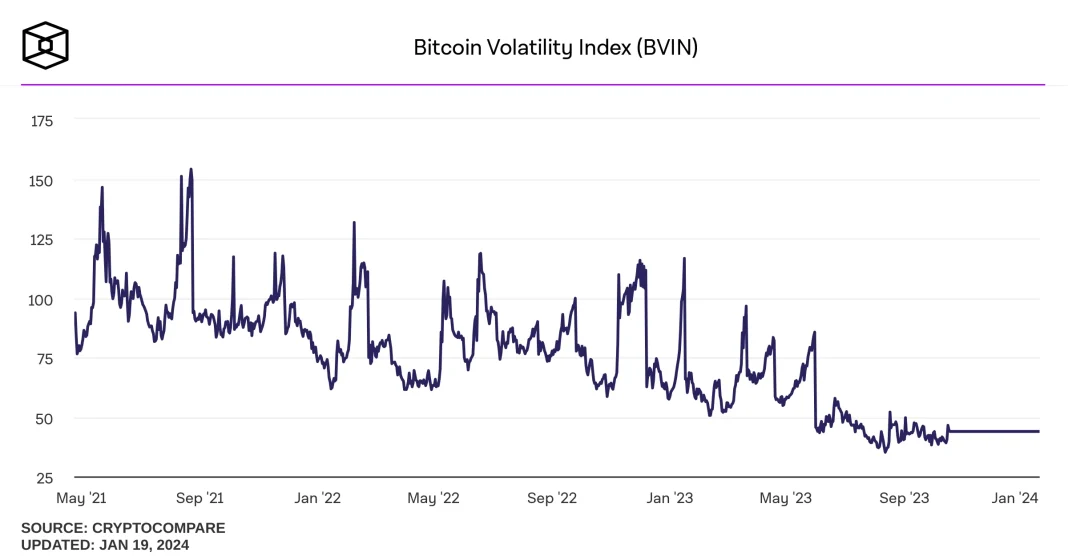

Bitcoin price volatility is a defining characteristic of the cryptocurrency market. Investors must understand that while the potential for significant profits exists, the risks are equally pronounced. Fluctuations can occur due to various factors, such as regulatory changes, market sentiment, and macroeconomic influences. For instance, the recent downturn in Bitcoin prices has raised concerns among investment circles, fostering a debate about the asset’s resilience against economic headwinds and speculation-driven selling.

When considering a bitcoin investment strategy, it’s crucial to prepare for the volatility that comes with the territory. Many experts, including Michael Saylor, advocate a long-term approach, suggesting that a four-year time horizon allows investors to ride out the market’s ups and downs. This perspective aligns with the historical performance of Bitcoin, which has often rebounded from severe declines, but it requires a strong stomach and an unwavering conviction in the asset’s value.

Michael Saylor’s Betting on Bitcoin: A Bold Strategy

Michael Saylor, the chairman of Strategy, has made headlines recently by doubling down on his bitcoin investments, a move that sends a strong message to the market. Purchasing an additional 8,178 BTC despite the asset’s declining price demonstrates Saylor’s unwavering belief in Bitcoin’s long-term potential. This strategic stance sparks conversations around the effectiveness of buying the dip and the psychological resilience required to invest in a currency often fraught with volatility.

Saylor’s bold purchasing moves have positioned Strategy as a significant player in the cryptocurrency space, holding approximately 3.05% of the total Bitcoin supply. His actions also challenge the prevalent skepticism surrounding Bitcoin, especially as critics like Peter Schiff voice concerns over the sustainability of such aggressive investment strategies. Saylor’s commitment illustrates that he isn’t merely speculating but actively reinforcing his future predictions regarding Bitcoin’s ultimate recovery and ascendance.

The Cryptocurrency Market Trends Impacting Bitcoin

Cryptocurrency market trends play a critical role in influencing Bitcoin’s price and its overall sentiment. Recently, a combination of factors, including fears of an AI bubble and broader economic uncertainties, have created headwinds for Bitcoin’s valuation. These trends highlight the interconnectedness of the cryptocurrency market with traditional financial markets, demonstrating how external variables can precipitate sharp price movements.

As the market evolves, the interest in Bitcoin remains, with investors continuously analyzing trends to guide their next moves. The surge in daily trading volumes, even amidst a price slump, indicates persistent interest and a willingness among traders to capitalize on fluctuations. Understanding these trends is vital for anyone considering a Bitcoin investment strategy; it encourages a proactive rather than reactive approach to market dynamics.

Future Predictions for Bitcoin: Should You Invest?

Future predictions for Bitcoin vary widely, showcasing the divergent opinions within the investment community. Prominent figures such as Tim Draper project optimistic targets like $250K, betting on Bitcoin’s adoption and the eventual maturity of the cryptocurrency market. These predictions often encourage investors to remain committed, despite short-term bearish trends. Such optimistic future forecasts can lead many to consider Bitcoin as a viable long-term investment, especially for those willing to endure price volatility.

Conversely, skeptics caution potential investors about the inherent risks associated with Bitcoin as its future remains uncertain. The blend of unpredictable regulatory environments and market dynamics can lead to dramatic price swings, causing concern among those less experienced in the cryptocurrency space. Thus, aligning any investment decision with thorough research and an awareness of the potential market influences is crucial.

The Role of Institutional Investors in Bitcoin’s Future

Institutional investors are reshaping the Bitcoin landscape, significantly impacting its perceived legitimacy as an investment vehicle. The involvement of large players like Strategy, under Michael Saylor’s leadership, illustrates a growing trend of corporate Bitcoin adoption. This shift signals to the market that Bitcoin is increasingly being taken seriously by established financial entities, potentially paving the way for broader acceptance and increased value over time.

Moreover, institutional backing can provide a safety net of sorts during turbulent market conditions. While price volatility remains a factor, the commitment from institutions often lends credibility that can stabilize market sentiment. As more firms reconsider their investment landscapes in the wake of economic change, institutional influence is likely to play a pivotal role in Bitcoin’s future trajectory.

Challenges Facing Bitcoin Investors Today

Investors in Bitcoin face a myriad of challenges that can deter participation in the market. One primary hurdle is the continuous price volatility that has characterized Bitcoin since its inception. Periods of sharp price declines can lead to panic selling among less experienced investors, further exacerbating volatility. Understanding these market dynamics is crucial for anyone looking to not only invest in Bitcoin but to develop a solid investment strategy.

Additionally, external factors like regulatory changes can introduce uncertainty, creating an unpredictable environment for Bitcoin investment. As governments around the world navigate the rapid rise of cryptocurrencies, their policies can have immediate effects on price and market confidence. Thus, prospective Bitcoin investors must remain vigilant and adaptable, always considering how changing market conditions may impact their strategies.

Navigating the Risks of Buying the Dip

The strategy of buying the dip is a popular approach among seasoned Bitcoin investors, yet it comes with its own set of risks. When faced with significant price declines, investors often feel compelled to purchase at lower valuations, anticipating a market recovery. However, this strategy requires careful consideration, as it can lead to increased exposure during prolonged downturns if the market doesn’t rebound as anticipated.

To navigate these risks, it’s crucial for investors to conduct thorough market analysis and remain updated on external factors influencing Bitcoin prices. Moreover, adopting a disciplined approach, including setting stop-loss orders and diversifying investments, can reduce the potential downsides of buying the dip and create a more balanced investment strategy.

The Impact of Market Sentiment on Bitcoin Prices

Market sentiment has a profound effect on Bitcoin prices, often swayed by news cycles and influential figures in the crypto space. Positive announcements, such as endorsements or major purchases by key players like Michael Saylor, can temporarily boost investor confidence and drive prices upward. Conversely, negative sentiment can quickly turn the tide, subjecting Bitcoin to rapid declines in value due to fear and uncertainty.

Investors must be attuned to these shifts in sentiment, as they can precede significant price movements. Staying informed about cryptocurrency market trends and understanding how market psychology interacts with Bitcoin investment strategies can help investors make more calculated decisions, ideally positioning themselves to capitalize on market fluctuations.

Bitcoin’s Adoption Rate: A Key to Future Growth

The adoption rate of Bitcoin among individuals and institutions alike is a crucial factor in its potential for future growth. As more businesses begin accepting Bitcoin as a form of payment and more individuals become educated about cryptocurrency, the demand for Bitcoin may strengthen, potentially stabilizing its volatility. This growing acceptance not only enhances the usability of Bitcoin but also contributes to increased liquidity within the market.

Increased adoption may also signal a shift in public perception, wherein Bitcoin is seen not just as a speculative asset but as a legitimate alternative to traditional currency. Such a transformation could lead to significant long-term value increases, making it an attractive proposition for investors aligning their strategies with market trends focused on comprehensive adoption.

Key Takeaways for Bitcoin Investors

As Bitcoin continues to navigate through periods of price volatility, investors are left with key takeaways to enhance their understanding of the market. Notably, the importance of a long-term investment horizon is frequently emphasized by market leaders such as Michael Saylor. This perspective encourages investors to adopt a more patient approach rather than succumb to the pressures of short-term trading.

Moreover, understanding market trends and sentiment is essential for formulating a robust Bitcoin investment strategy. Investors need to maintain awareness of external influences and remain adaptable to navigate the evolving landscape of cryptocurrency. Armed with the right knowledge and strategies, investors can position themselves to capitalize on Bitcoin’s potential, irrespective of the immediate price fluctuations.

Frequently Asked Questions

What causes Bitcoin price volatility in the current market?

Bitcoin price volatility is primarily driven by factors such as market sentiment, regulatory news, cryptocurrency market trends, and macroeconomic indicators. Speculative trading, changes in demand and supply, and major purchases or sales by influential investors also contribute significantly to price fluctuations.

How does Michael Saylor’s strategy affect Bitcoin price volatility?

Michael Saylor, as a vocal advocate for Bitcoin, influences market perception and investor sentiment. His strategy of ‘buying the dip’ during periods of price volatility can signal confidence to other investors, potentially stabilizing prices. However, large-scale acquisitions can also lead to short-term fluctuations, contributing to overall Bitcoin price volatility.

Is it a good time for buying the dip in Bitcoin given its current volatility?

Buying the dip can be a sound strategy during periods of Bitcoin price volatility, especially for long-term investors. By accumulating Bitcoin when prices are lower, investors position themselves for potential future gains, as seen by bullish predictions from figures like Tim Draper.

How do Bitcoin future predictions account for price volatility?

Bitcoin future predictions, such as reaching $250K by experts, often take into consideration past price volatility, market trends, and macroeconomic conditions. By analyzing historical data and current market behavior, analysts make informed predictions, but they also acknowledge the inherent volatility that characterizes the cryptocurrency market.

What are the risks of investing in Bitcoin due to its price volatility?

Investing in Bitcoin carries inherent risks due to its high price volatility. Investors can experience significant gains, but they can also face considerable losses in a short timeframe. Assessing individual risk tolerance, employing sound bitcoin investment strategies, and conducting thorough market research are crucial steps for potential investors.

Can Bitcoin price volatility be mitigated through a specific investment strategy?

While Bitcoin price volatility cannot be completely mitigated, employing strategies such as dollar-cost averaging, diversifying holdings, and maintaining a long-term investment outlook can help investors manage risk and navigate turbulent market conditions.

What impact do economic factors have on Bitcoin price volatility?

Economic factors, including interest rates, inflation, and market sentiment towards technology and investments, play a significant role in Bitcoin price volatility. Uncertainty surrounding these elements often leads to increased trading activity and price fluctuations, affecting investor decisions and market stability.

How do long-term investors perceive current Bitcoin price volatility?

Long-term investors often view current Bitcoin price volatility as temporary and a natural part of the cryptocurrency market cycle. They may take this opportunity to accumulate more Bitcoin at lower prices, reinforcing the sentiment that patience and a long-term perspective can yield favorable outcomes.

| Key Point | Details |

|---|---|

| Bitcoin Price Volatility | Bitcoin has faced significant price drops recently, with its value falling below $100K and currently sitting at around $91K. |

| Michael Saylor’s Actions | Michael Saylor purchased an additional 8,178 BTC, bringing his total to about 649,870 BTC, reflecting his confidence in Bitcoin despite its volatility. |

| Market Reactions | Despite Saylor’s bullish stance, Bitcoin continued to flounder as skeptics cast doubt on its future. |

| Broader Market Influences | Factors such as fears of an AI bubble and macroeconomic uncertainties have contributed to Bitcoin’s recent struggles. |

| Investor Sentiment | Certain major investors, like Tim Draper, remain optimistic about Bitcoin’s long-term prospects, predicting prices as high as $250K. |

| Criticism | Critics argue that Saylor’s strategy could backfire and lead to bankruptcy for his company, as warned by Peter Schiff. |

Summary

Bitcoin price volatility continues to be a significant concern for investors as it has dropped to around $91K amidst economic and market uncertainties. Michael Saylor’s strategic purchases showcase his strong belief in Bitcoin’s potential even as critics suggest that this aggressive acquisition strategy may lead to negative outcomes. Despite the ongoing challenges, some prominent investors remain bullish, emphasizing that patience is key for those willing to hold onto their investments long-term. The mixed sentiments highlight the unpredictable nature of the cryptocurrency market.