The proposed Bitcoin Reduced Data Soft Fork, also known as the Reduced Data Temporary Softfork, has stirred up significant debate within the cryptocurrency community. This initiative aims to tackle the growing concerns about excessive data storage on the Bitcoin blockchain, especially in the wake of the Bitcoin Core v30 update. While supporters argue that this soft fork is a necessary measure to prevent legal liabilities and ensure the network’s integrity, critics like Mononaut from mempool.space warn that it could inadvertently disable legitimate transaction types. His analysis reveals that multiple historically valid transactions would be affected by the new restrictions, which could lead to a catastrophic disruption for users relying on those outputs. As this Bitcoin BIP proposal evolves, the tension between maintaining Bitcoin’s transactional utility and its viability for innovative use cases continues to intensify.

The discussion surrounding the Bitcoin Reduced Data Soft Fork, often referred to as RDTS, highlights a critical juncture for Bitcoin’s future. This temporary soft fork seeks to introduce strict transaction restrictions aiming to alleviate the burden of data overload on the blockchain. Proponents argue that implementing such changes could protect node operators from potential legal ramifications associated with data misuse. However, as detailed by analysts like Mononaut, the ramifications of these limitations may not be beneficial, as they threaten to render a variety of transaction types invalid. As stakeholders engage in this crucial analysis of the Bitcoin network’s operational longevity versus its emergent capabilities, the implications of this soft fork promise to shape the discourse on Bitcoin’s evolving landscape.

Understanding Bitcoin Reduced Data Soft Fork

The Bitcoin Reduced Data Soft Fork (RDTS) represents a significant proposal aimed at addressing the growing concern over excessive data uploads on the Bitcoin blockchain. Initiated by the mempool.space developer Mononaut, this soft fork seeks to impose a suite of restrictions on data-heavy transactions. The proposals are seen as necessary to protect node operators from potential legal liabilities associated with illegal data embedded in transaction records. This shift towards restrictions aims to enforce a more streamlined use of the Bitcoin network, yet invites a host of critical responses regarding its implications.

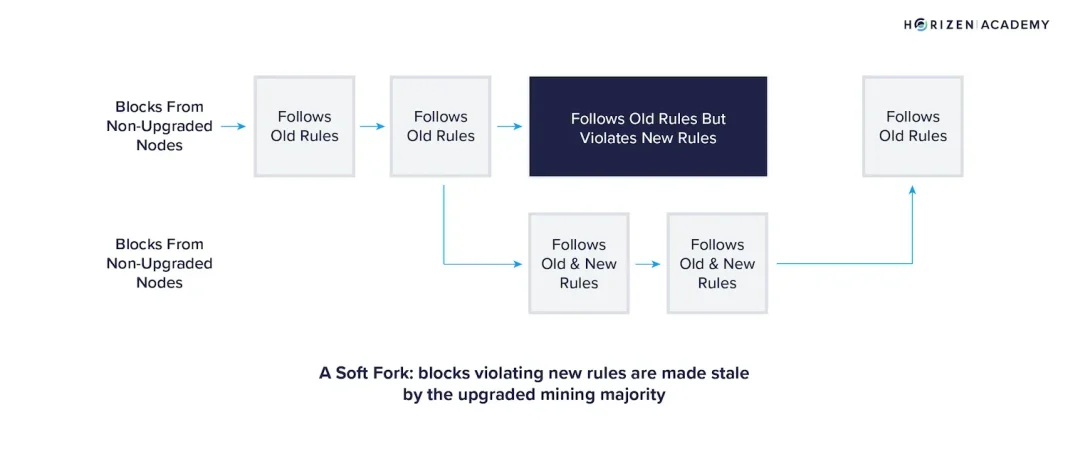

The notion of Bitcoin soft forks is not new, but the proposed changes under RDTS are particularly controversial. While proponents argue that implementing restrictions like limiting scriptPubKeys and OP_RETURN outputs is an emergency brake for the network, detractors fear this could result in substantial disruption to legitimate transaction types. Mononaut’s thorough Mononaut analysis illustrates that a wide swath of historical and current transactions could be rendered invalid due to these proposed rules.

Frequently Asked Questions

What is the Bitcoin Reduced Data Soft Fork (RDTS)?

The Bitcoin Reduced Data Soft Fork (RDTS) is a proposed temporary soft fork aimed at implementing several consensus-level restrictions to reduce data-heavy transactions on the Bitcoin blockchain. It seeks to limit scriptPubKeys, cap OP_RETURN outputs, and impose various other restrictions on Bitcoin transaction types.

What are the concerns surrounding the Bitcoin soft fork proposal RDTS?

Critics of the Bitcoin soft fork proposal RDTS argue that it could disable legitimate transaction types, leading to significant disruptions in the Bitcoin network. The proposed restrictions may affect pay-to-public-key (P2PK) and multisig (P2MS) outputs, as well as certain Tapscript functions, potentially introducing de facto censorship.

What did Mononaut’s analysis reveal about Bitcoin transaction restrictions under RDTS?

Mononaut’s analysis indicates that many historical transactions may be invalidated under the Bitcoin transaction restrictions proposed by RDTS. His findings suggest that crucial functions, including OP_IF and certain operational outputs, would be disabled, impacting thousands of transactions and introducing risks for users relying on these features.

How long is the Bitcoin Reduced Data Temporary Soft Fork (RDTS) proposed to last?

If adopted, the Bitcoin Reduced Data Temporary Soft Fork (RDTS) would be activated for a proposed duration of one year, during which the outlined restrictions on Bitcoin transactions would be in effect.

What implications does the RDTS have on Tapscript logic in Bitcoin?

The Bitcoin Reduced Data Soft Fork (RDTS) introduces sweeping rules that would ban certain Tapscript functionalities, including OP_SUCCESS operations and those using OP_IF or OP_NOTIF. This could impact many legitimate transaction types, including decaying multisig and hash-time-locked contracts, as well as those relying on unconventional outputs.

Why do supporters advocate for the Reduced Data Soft Fork (RDTS)?

Supporters of the Reduced Data Soft Fork (RDTS) argue it is a necessary emergency measure intended to preserve Bitcoin’s monetary utility, reduce the legal risks associated with data storage on the blockchain, and alleviate the burden on node operators by limiting excessive data uploads.

What are the potential consequences of implementing the RDTS according to critics?

Critics caution that implementing the RDTS could lead to unintended consequences, such as the invalidation of valid Bitcoin transactions and the hindrance of ongoing projects within the ecosystem, which may stifle innovation and the adaptability of Bitcoin to new use cases.

How does the debate over RDTS reflect broader discussions in the Bitcoin community?

The discussion surrounding the Bitcoin Reduced Data Soft Fork (RDTS) mirrors ongoing debates within the Bitcoin community about the balance between maintaining strict monetary utility and accommodating experimental uses of the blockchain, such as data storage and non-monetary applications.

| Key Point | Details |

|---|---|

| Proposed Soft Fork Name | Reduced Data Temporary Softfork (RDTS) |

| Developer Warning | Mononaut warns that RDTS could disable legitimate transaction types. |

| Purpose of RDTS | To curb excessive data storage on the Bitcoin blockchain. |

| Criticism of RDTS | Mononaut’s analysis suggests significant disruption to transactions. |

| Expected Rules | Limits scriptPubKeys to 34 bytes, caps OP_RETURN at 83 bytes, restricts Taproot control blocks, and more. |

| Impact on Transactions | All pay-to-public-key (P2PK) and multisig (P2MS) outputs would fail due to size limit. |

| Historical Implications | More than 54,000 historic transactions would be impacted. |

| Duration of RDTS | If adopted, RDTS is expected to last for one year. |

| Ongoing Discussion | The proposal is still in draft and under discussion within the community. |

Summary

Bitcoin Reduced Data Soft Fork (RDTS) has sparked a contentious debate within the cryptocurrency community, highlighting significant concerns from developers like Mononaut regarding its potential to restrict legitimate transaction types. While proponents assert that RDTS is a necessary short-term measure to address excessive data storage, critics argue it could inadvertently introduce widespread censorship of valid transactions. Mononaut’s findings suggest that many historical transactions would be adversely affected, emphasizing the need for careful consideration and discussion among Bitcoin developers and users to navigate this complex issue.