Bitcoin search trends have taken a notable turn, capturing the attention of crypto enthusiasts and investors alike. As revealed by Google Trends, interest in the term “Bitcoin” skyrocketed in mid-October, reaching a peak score of 100 before experiencing a significant drop-off in November. This fluctuation indicates not only the volatility of cryptocurrency price interest but also suggests a broader engagement with the market. Analyzing Bitcoin through the lens of cryptocurrency search trends highlights how public curiosity can react sharply to market movements. As we explore the seasonal dynamics of Bitcoin search analysis, we’ll uncover what lies behind these fluctuations and what they mean for future investor behavior.

The recent shifts in Bitcoin interest reflect broader patterns in cryptocurrency engagement and economic sentiment. Utilization of tools like Google Trends reveals an intriguing interplay between market activity and public intrigue, especially following significant price changes. The late October surge in searches points to heightened awareness and curiosity around Bitcoin, akin to a market rally that draws in new traders and investors. With ongoing analysis of cryptocurrency fluctuations, important insights emerge regarding user engagement and future trends. This search interest is not just a metric of popularity but a vital component of understanding the crypto landscape.

Understanding Bitcoin Search Trends

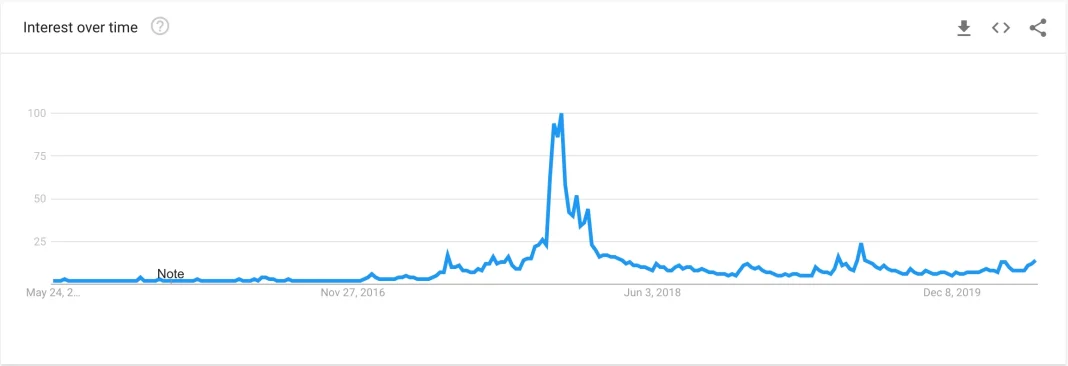

Analyzing Bitcoin search trends over the past few months reveals a dynamic cycle of interest and engagement. According to Google Trends, a notable spike in searches occurred around mid-October, peaking at an index level of 100 on October 11. This surge was primarily driven by increased public curiosity surrounding Bitcoin’s price movements and market developments, highlighting the coin’s volatility and potential investment opportunities. The subsequent decline into early November, dropping to the 30s, indicates a cooling period where the initial excitement has waned, prompting many to reassess their engagement with this leading cryptocurrency.

The fluctuations in Bitcoin price interest suggest a complex relationship between search behavior and market performance. As individuals and investors seek to stay informed about the latest updates, the rising interest often accompanies significant market activity. However, as the trends indicate, this interest isn’t always sustained; factors like market news, large transactions, and regulatory developments can shift public attention rapidly. Understanding this relationship can aid investors and analysts in predicting future trends and making informed decisions.

The Impact of Bitcoin October Spike

The October spike in Bitcoin searches aligns with a broader context of increased activity within the cryptocurrency sector. Over the past year, Bitcoin’s price movements have been closely followed, with the recent rise to $110,281 per coin generating heightened attention in various regions, including El Salvador and Switzerland. This sudden surge in mid-October likely reflects investor sentiment and excitement about potential price increases, allowing Bitcoin to capture widespread media coverage and reinvigorate public interest. Insights from Google Trends suggest that the crypto community is always on the lookout for the next significant movement.

Despite the post-spike decline in searches, the previous month’s interest provides valuable insights into market dynamics. Investors often react to short-term price changes, which can lead to increased inquiries and searches related to Bitcoin price news and trends, suggesting that these spikes are essential for understanding trader behavior. Moreover, associated search behavior around terms like “bitcoin 2025” and “latest bitcoin” indicates that while immediate interest can spike, there is also a sustained curiosity regarding the long-term trajectory of the cryptocurrency, indicating its enduring relevance.

Regional Interest in Bitcoin Search Trends

The geographic distribution of Bitcoin search interest provides a fascinating glimpse into where enthusiasm for cryptocurrencies is concentrated. Google Trends shows that regions like El Salvador lead the pack with an interest level of 100, indicative of an environment highly receptive to crypto adoption. In contrast, European countries such as Switzerland and Austria also display significant interest, albeit at slightly lower levels. This variation highlights how different regions are embracing Bitcoin, potentially driven by varying levels of regulatory acceptance and cultural attitudes towards cryptocurrency.

As different regions experience shifting levels of engagement with Bitcoin, we can anticipate future trends in cryptocurrency adoption and interest. The data indicates that while some areas are quickly capitalizing on Bitcoin’s rise, others may be holding back due to economic or regulatory concerns. By analyzing these search trends closely, investors can identify regions that may experience next levels of interest or investment, enabling a more strategic approach towards targeting emerging markets and fostering growth in the cryptocurrency ecosystem.

The Role of Associated Queries in Bitcoin Search Analysis

Google Trends not only reveals the volume of searches for Bitcoin but also uncovers related topics and queries that can aid in understanding public sentiment. Notably, emerging queries such as “bitcoin 2025” and “trump coin price” indicate a growing curiosity about the long-term potential and speculative trends surrounding cryptocurrencies. Such associated queries can provide insight into what information the public seeks and help business analysts and marketers craft relevant campaigns targeting specific interests.

Additionally, monitoring these related queries over time aids in developing an integrated SEO strategy for cryptocurrency brands. By tapping into trending topics and public inquiries, digital marketers can refine their content to align with audience interests, thereby driving organic traffic to their platforms. This holistic view not only allows for better engagement with potential customers but also enriches the understanding of what influences Bitcoin search trends over time.

Forecasting Future Bitcoin Search Trends

As Bitcoin continues to evolve, predicting future search trends becomes essential for investors and analysts. The fluctuations observed in search interest over 30, 90, and 12-month periods suggest that certain patterns are emerging that can be used to forecast future behavior. The historical analysis indicates that interest commonly rises during significant price movements or market news events, leading to peaks in search activity. As such, understanding the indicators that lead to these spikes can prepare stakeholders for future shifts in search dynamics.

Looking ahead, one can anticipate that as Bitcoin’s mainstream adoption continues to grow and more financial products incorporate cryptocurrency, related search trends are likely to follow suit. Analytical tools such as Google Trends will remain crucial for tracking these changes, allowing investors to adapt strategies accordingly. Maintaining a close watch on emerging interest patterns—with respect to price movements and evolving regulations—can provide a competitive advantage in navigating the ever-changing cryptocurrency landscape.

The Connection Between Bitcoin Price and Search Interest

The relationship between Bitcoin price movements and search interest is intriguing, revealing much about market psychology. Despite Bitcoin’s price increased by 58.6% year-over-year, the search interest has shown significant volatility, which seems to suggest that price and interest do not always align perfectly. This disconnect may occur because users often look for confirmation or further information after major price movements, leading to spikes in searches that might not be immediately correlated with previous price increases.

Understanding this dynamic enables investors and cryptocurrency enthusiasts to better navigate the market and improve their strategies for engaging with emerging trends. It highlights the importance of analyzing not just price performance but also public interest when evaluating the cryptocurrency landscape. Recognizing that these search trends can serve as an early indicator of market movements can provide strategic insights into upcoming investment opportunities.

Analyzing the Burst of Interest in Bitcoin Documentation

Recent trends have shown a significant spike in interest surrounding Bitcoin ‘documentation’—evidenced by a notable breakout in queries surrounding educational content about the cryptocurrency. As more investors seek to understand the underlying technology and its implications for finance, this growing demand for documentation indicates an increasing sophistication among participants in the cryptocurrency market. Such educational resources may prove critical for new investors looking to navigate the complexities of Bitcoin and enhance their decision-making processes.

This trend towards seeking documentation highlights a broader movement towards greater transparency and understanding of Bitcoin. While previously the focus may have been on price speculation and immediate profit, there is now a push towards understanding the mechanics behind the cryptocurrency and its ecosystem. As companies and institutions seek to attract a more savvy audience, investing in educational content becomes essential for capturing and sustaining interest in Bitcoin.

Emerging Queries Show Shifting Sentiment Around Bitcoin

Among the rising related queries, phrases like “bitcoin news today” and “latest bitcoin” illustrate the public’s desire for up-to-date information, reflecting a fast-paced environment where news can significantly impact investor sentiment. These queries indicate that while general interest may fluctuate, there is a consistent need for timely updates and insights to make informed decisions. Investors are increasingly seeking not just data points but informative analyses that can guide their next moves in the cryptocurrency market.

Moreover, the presence of emerging queries signals shifting sentiment, as they often arise during market volatility or significant events. For example, the spike in searches for ‘trump coin price’ demonstrates how external factors, including political events or influential personalities, can drive interest in Bitcoin. As such, monitoring these emerging queries can provide valuable insights into public sentiment towards Bitcoin, helping traders to adapt and respond to shifts in interest as they occur.

Exploring the Future of Bitcoin Search Behavior

In conclusion, Bitcoin search behavior serves as a crucial indicator for understanding the cryptocurrency’s market position and the broader public interest. As we observe ongoing fluctuations, particularly following significant events like the October spike, it’s evident that search trends closely mirror overall market sentiment. Remaining attentive to these patterns can provide valuable context for investors looking to anticipate future movements in Bitcoin’s price and popularity.

Looking to the future, the continued evolution of search behavior related to Bitcoin will depend on various external factors, including technological advancements, financial regulations, and broader market trends. As new developments unfold in the world of cryptocurrency, coupled with changing investor perceptions, we can expect Bitcoin search trends to evolve, helping shape the narratives around this innovative financial asset. Harnessing these insights will prove essential for anyone looking to navigate the complex landscape of Bitcoin and cryptocurrency at large.

Frequently Asked Questions

What caused the spike in Bitcoin search trends in October?

The surge in Bitcoin search trends in October can be attributed to heightened market activity and discussions surrounding Bitcoin price movements. Data from Google Trends shows that interest peaked at a score of 100 around October 11, indicating a significant upturn in searches, likely driven by investors reacting to market fluctuations and news.

How do Google Trends reflect Bitcoin price interest?

Google Trends data provides insights into Bitcoin price interest by measuring search behaviors over time. Although search interest peaked in mid-October, the Bitcoin price also experienced substantial movements. However, as searches began to decline towards early November, the Bitcoin price followed, illustrating that while trends can correlate, they don’t always align perfectly.

What insights can be gathered from Bitcoin search analysis over the past 12 months?

Bitcoin search analysis over the past 12 months reveals patterns of fluctuating interest, with a notable peak at the beginning of the year around the all-time high. Throughout the year, interest fell into a lull in mid-summer before rebounding again in late October. Geographic interest also showed that regions like El Salvador and Switzerland maintained high search volumes, indicating regional trends in Bitcoin curiosity.

Which regions showed the highest interest in Bitcoin according to Google Trends?

According to Google Trends, regions with the highest interest in Bitcoin include El Salvador, which scored a perfect 100, followed by Switzerland at 88 and Austria at 78. This data indicates that interest in cryptocurrency is particularly strong in certain areas of Latin America and Europe, reflecting local market dynamics and acceptance of Bitcoin.

What are emerging related topics in cryptocurrency search trends?

Emerging related topics in cryptocurrency search trends include terms like ‘Documentation’ and significant interest in ‘September,’ which saw a 4,150% increase. Additionally, queries related to future projections, like ‘bitcoin 2025,’ have also become popular, indicating that the community is looking ahead and researching possible developments.

How does Bitcoin’s search interest compare to its price movements?

Bitcoin’s search interest and price movements can sometimes diverge. For instance, while interest surged in October aligning with a 58.6% year-over-year price increase, the decline in interest following this spike does not necessarily correlate with a decline in price, which often suggests investor sentiment may shift independently from search behavior.

What does the October spike in Bitcoin search trends indicate for future interest?

The October spike in Bitcoin search trends indicates a potential for renewed interest in cryptocurrency, especially as regional curiosity reveals which areas are most engaged. The trends suggest that investors may look to capitalize on opportunities as Bitcoin continues to evolve, prompting new waves of search interest during market fluctuations.

| Time Frame | Interest Level (0-100) | Comments |

|---|---|---|

| 30 Days | 50s to 100 | Spike in mid-October, decline by end of month. |

| 90 Days | 40s to 100 | Stable interest followed by spike and subsequent decline. |

| 12 Months | 30s to 100 | Peak interest early in year, lull mid-year, late-October bounce. |

| Geographic Interest (12 Months) | Top countries include El Salvador, Switzerland, Austria, and others. | |

| Related Search Trends | Emerging topics include ‘Documentation’ and queries related to bitcoin price. |

Summary

Bitcoin search trends have shown a notable increase in interest during mid-October, peaking at a 100 index level before experiencing a sharp decline into early November. These trends illustrate the cyclical nature of Bitcoin interest, influenced by various factors including market price fluctuations and relevant news events. The data suggests that while global interest surged recently, it has not sustained at the peak levels, indicating a cooling off in public curiosity that may continue to evolve.