The history of Bitcoin spam dates back to 2011, marking a turbulent journey for this revolutionary cryptocurrency. Over the years, spam has influenced Bitcoin transactions and raised pivotal discussions within the Bitcoin community. A recent Bitcoin Core upgrade has intensified concerns, as it dramatically increased the capacity for data storage on the Bitcoin blockchain—potentially opening the floodgates to a new wave of crypto spam. This increasing volume of junk data not only jeopardizes the efficiency of the Bitcoin network but also stirs fears of major network issues akin to those experienced in the early days. As history shows, the battle against spam has always been part of Bitcoin’s narrative, leading to significant debates on its implications for the future of digital currency.

Exploring the evolution of unwanted data in Bitcoin reveals a saga filled with conflict and resistance. Often referred to as “crypto junk,” this spam phenomenon has notably impacted Bitcoin transactions, threatening the integrity of the Bitcoin blockchain. Recent discussions surrounding a significant upgrade to Bitcoin’s software are reigniting fears of network congestion, reminiscent of past Bitcoin network issues. As enthusiasts recall challenging moments from Bitcoin’s past, the parallels between historical spam attacks and today’s concerns provide valuable insights into both the risks and resilience of this digital asset. Given the imminent possibility of a fragmented community over spam policies, understanding the nuances of Bitcoin’s spam history is more crucial than ever.

The Evolution of Bitcoin Spam: 2011 to Present

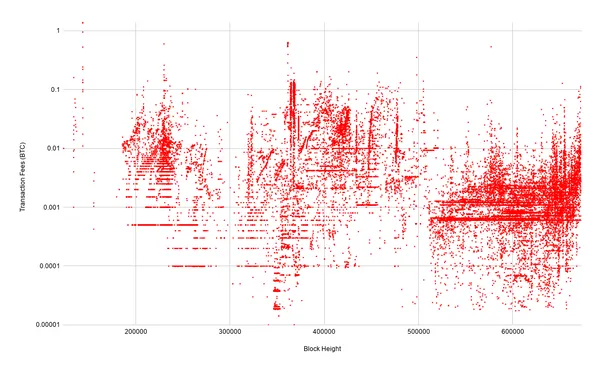

Since its inception, Bitcoin has experienced various spam events that have challenged its network stability and transaction efficiency. The first notable instance of spam occurred in September 2011, when an attacker flooded the Bitcoin network with 704 transactions, each only transferring a single satoshi. This type of transaction, often termed ‘dust,’ incurred higher fees than the value being transferred, illustrating the effectiveness of Bitcoin’s design at deterring spam through fee structures. As time went on, the network witnessed further complications with spamming, such as the introduction of services like Satoshi Dice, which, while initially popular, wound up contributing significantly to network congestion.

The recent rise in spam activity linked to the Ordinals protocol has reignited discussions on Bitcoin’s vulnerability to such issues. Critics, including Bitcoin Core developer Luke Dashjr, argue that the recent upgrade to Bitcoin Core has exacerbated the spam problem by enlarging the storage space for arbitrary data from 83 bytes to 100,000 bytes. This change allows the inclusion of vast amounts of non-financial transactions like NFTs. Such developments raise concerns over the potential for a significant spike in network congestion and transaction fees, echoing historical spam events while highlighting the ongoing battle between utility and network integrity.

Impact of Transaction Spam on the Bitcoin Network

Transaction spam has a profound impact on Bitcoin’s functionality, particularly regarding transaction fees and network efficiency. When compromised with too many insignificant transactions, miners are forced to prioritize lucrative transactions, leading to escalated fees for regular users. This scenario deters everyday transactions and can alienate users. The combination of increased fees and slower processing times represents a major concern for the Bitcoin community, as it could push users towards alternative cryptocurrency platforms that assure quick and cost-effective transactions.

Furthermore, a surge in transaction spam can disrupt the stability of the Bitcoin blockchain, as increased congestion could potentially lead to block size limitations being breached, thus creating an environment for chain splits—a phenomenon that the Bitcoin community is actively striving to avoid. The discord between factions within this ecosystem often centers around the balance of prioritizing large data storage versus maintaining the network’s original purpose and efficiency. The future stability of the Bitcoin network hinges on addressing these spam issues effectively while preserving the core principles of decentralization and security.

Bitcoin Core Upgrade and Its Consequences

The recent upgrade to Bitcoin Core marked a significant turning point for the network. By enlarging the storage capacity for non-financial data, this upgrade has opened the floodgates for more complex forms of transactions, including NFTs. While innovation in transaction types could be seen as a positive step, the substantial increase in potential spam has raised many eyebrows within the crypto community. Observers are keenly watching how this will affect existing transaction dynamics, particularly in terms of processing speed and costs.

As developers and users debate the implications of this upgrade, it’s clear that the fine line between innovation and operational integrity comes into play. Those like Luke Dashjr argue that the possibilities for abuse are vast, potentially undermining what Bitcoin was originally built to combat—excessive transaction fees and spam. In contrast, proponents of the upgrade see it as an opportunity for Bitcoin to evolve alongside new crypto trends. The outcome of this ongoing discourse will ultimately shape the Bitcoin network’s trajectory in the coming years.

Spam Filtering Mechanisms in Bitcoin History

Throughout its history, Bitcoin has employed various mechanisms to filter out unwanted spam transactions. Filters have historically been instrumental in maintaining transaction integrity, ensuring that only legitimate transfers are processed on the blockchain. Early discussions highlighted the importance of transaction fees in deterring spam attacks, a principle that was designed into Bitcoin’s architecture from its inception. Developers have continuously iterated on these filtering systems to enhance their effectiveness as spam threats have evolved.

As we observe the recent upsurge in spam linked to the Ordinals protocol, the efficacy of these filters is once again under scrutiny. The upgrade to Bitcoin Core, broadening data transfer capabilities, has sparked debates about whether these mechanisms will be sufficient to tackle the increased volume of spam. The intricate balance between enabling new forms of expression within the blockchain and retaining the network’s original resilience highlights the complexities that developers like Dashjr grapple with in protecting Bitcoin’s integrity.

The Role of Bitcoin Community in Spam Discussions

The ongoing discussions surrounding Bitcoin spam are not just technical; they are deeply rooted in the values and beliefs of the Bitcoin community. Users, miners, and developers are often divided on the best approach to managing transaction spam, reflecting a broader tension over Bitcoin’s identity and evolution. This discord can occasionally escalate into fervent debates, with disparate factions advocating for progressive changes versus those who argue for conservative approaches to uphold Bitcoin’s foundational principles.

Community engagement is pivotal in navigating these challenges, with various voices contributing to the discourse surrounding transaction fees, spam filtering, and overall network functionality. Forums, social media, and community meetups serve as venues for these important discussions, where ideas are exchanged, and consensus is sought. Understanding that Bitcoin is a living, evolving entity allows the community to grapple collectively with these spam issues while striving to sustain a secure and efficient blockchain.

Bitcoin Spam Prevention: Strategies and Solutions

As Bitcoin continues to evolve, the need for robust spam prevention strategies has never been more critical. Users and developers are exploring various approaches to mitigate the impact of spam on the network. One viable solution lies in refining transaction fee structures to ensure that spammy-looking transactions become prohibitively expensive. Increasing the minimum transaction fee can deter individuals from initiating worthless dust transactions, thereby preserving valuable block space for legitimate activities.

In addition to enhancing fee structures, the development of more sophisticated filtering algorithms could play a significant role in distinguishing between legitimate and spam transactions. This advancement may involve machine learning techniques that analyze transaction patterns, improving real-time decision-making processes for miners regarding which transactions to include in the blockchain. By prioritizing spam prevention, the community can work towards maintaining a decentralized, efficient, and abuse-resistant Bitcoin network.

Historical Spam Events That Shaped Bitcoin

Several historical spam events have significantly influenced the development of Bitcoin’s transaction policies and network protocols. One of the most notorious was the September 2011 spam attack, where numerous one-satoshi transactions were sent to clutter the network. This event not only demonstrated the vulnerability of the Bitcoin protocol at the time but also catalyzed discussions about the importance of transaction fees as deterrents against spam, paving the way for future upgrades and policies.

Additionally, the emergence of services like Satoshi Dice in 2012 sparked further innovation in transaction mechanism exploitation, compounding the issue of spam. As Bitcoin’s popularity surged, so did the creativity of those looking to manipulate the network for their advantage. Each historical instance of spam has contributed valuable lessons, shaping how the community approaches new technologies, systems, and upgrades to ensure that transactions can flow freely without compromising network integrity.

Current Debate: Innovation vs. Network Integrity

The recent upgrade to Bitcoin Core has sparked a significant debate over innovation versus network integrity in the Bitcoin community. With the ability to store more data, many fear that Bitcoin will face overwhelming spam attacks that could threaten its functionality and core principles. Proponents of the upgrade argue that allowing for NFTs and other innovations will breathe new life into the Bitcoin ecosystem, creating opportunities for expansion and application beyond simple transactions.

In contrast, skeptics warn that widening the data storage capacity could lead to the network’s degradation, echoing questions from earlier spam events. The juxtaposition of these perspectives highlights the need for balance in evolving the system while protecting its foundational ethos. Engaging in open dialogue, the community must work toward strategies that embrace innovation while also fortifying against the threats posed by increased spam.

Looking Ahead: The Future of Bitcoin and Spam

As Bitcoin continues to grapple with its spam issues, the future of the network will significantly depend on the community’s collaborative efforts to develop effective solutions. Enhancements to transaction fee structures and spam filter systems will likely be at the forefront of ensuring the system remains viable for everyday users. The need for innovative solutions, coupled with a willingness to adapt to evolving technological landscapes, is essential for the future resilience of Bitcoin.

Furthermore, the ongoing discussions about the role of NFTs and other non-financial transactions in Bitcoin highlight the importance of aligning these innovations with user expectations and network performance. The concerted efforts of developers, users, and industry leaders to navigate these challenges will ultimately determine Bitcoin’s trajectory in a rapidly evolving digital landscape, ensuring it remains a robust, secure, and user-friendly cryptocurrency.

Frequently Asked Questions

What is the history of Bitcoin spam transactions?

Bitcoin spam transactions date back to September 2011, with notable events like the ‘September 2011 Single Satoshi Spam’, where attackers flooded the network with tiny transactions, incurring higher fees than the transferred amounts. These spam events have been recurring challenges for the Bitcoin blockchain over the years.

How did Satoshi Dice contribute to Bitcoin spam issues?

Satoshi Dice, a popular gambling site in 2012, significantly increased Bitcoin transactions, at one point accounting for over half of all transactions on the network. Although it exploited Bitcoin’s design for transaction fees, its operation led to debates about how such services affect Bitcoin transaction dynamics and spam.

How did the Bitcoin Core upgrade in 2023 impact Bitcoin spam history?

The recent Bitcoin Core upgrade expanded the data field dramatically, allowing up to 100,000 bytes for non-fungible tokens and other arbitrary data in transactions. This change has reignited concerns about an influx of spam on the Bitcoin network and could result in increased transaction costs.

What are the potential consequences of increased Bitcoin spam?

If Bitcoin experiences a surge in spam transactions, it could lead to higher transaction fees for users. Additionally, there is a risk of contentious divisions within the community, potentially resulting in a chain split as factions disagree on how to manage the escalating spam issue.

How have historical Bitcoin network issues been linked to spam?

Throughout its history, the Bitcoin network has faced various spam issues that have stressed its transaction capacity and raised fees. The flexibility of Bitcoin to store arbitrary data has contributed to ongoing debates about how to balance network integrity while managing transaction loads.

What did Luke Dashjr say about the evolution of Bitcoin spam measures?

Luke Dashjr noted that from 2010 to 2022, Bitcoin managed spam using effective filters. However, with the discovery of the ‘Inscription’ exploit and subsequent upgrades, he warns that Bitcoin’s core properties may be jeopardized, leading to implications for its future.

What role does the Ordinals protocol play in Bitcoin’s spam history?

Launched in 2023, the Ordinals protocol has been a significant source of spam-like data on the Bitcoin network, adding to the existing challenges established over the years. It highlights a contemporary issue among Bitcoin users regarding how to treat non-financial data within the blockchain.

Are Bitcoin spam challenges a new phenomenon?

No, Bitcoin spam challenges are not new. Since its inception, the Bitcoin blockchain has faced various types of spam transactions, with a history marked by repeated attempts to address and navigate these issues, as highlighted by Bitmex and other crypto analysts.

What measures are in place to combat Bitcoin transaction spam?

Historically, Bitcoin’s design has included transaction fee requirements meant to deter spam. However, the recent increase in data allowances has led some, like Luke Dashjr, to fear that these measures may no longer be effective against the surge in spam transactions.

What are the community’s reactions to the recent Bitcoin spam developments?

The Bitcoin community is divided, with some viewing the recent activities as a typical spam cycle while others warn of serious risks to the network’s integrity and functionality. This conflict could lead to further debate and possible forks within the ecosystem.

| Date | Event | Details | Impact |

|---|---|---|---|

| September 2011 | Single Satoshi Spam Attack | 704 transactions, each worth one satoshi, were sent, incurring higher fees than value. | Increased awareness of spam vulnerability in Bitcoin. |

Summary

Bitcoin spam history highlights a persistent challenge for the cryptocurrency since its inception. Over the years, the Bitcoin network has experienced various notable spam incidents, beginning with the infamous Single Satoshi Spam in 2011. Recent developments, particularly involving the Ordinals protocol and the 2023 software upgrade, have reignited the debate on spam’s impact on the network, with key figures in the community voicing their concerns about potential increases in transaction fees and the risk of a chain split. Understanding Bitcoin spam history is crucial for grasping the ongoing dynamics within the Bitcoin community.