Bitcoin has surged to new heights, hitting an impressive $111K and capturing the attention of investors across the globe. As the crypto market continues to evolve, this dramatic price increase signals a strong resurgence in cryptocurrency enthusiasm, encouraging both seasoned traders and newcomers. The interest from whales buying Bitcoin has played a crucial role in this climb, as large holders accumulate assets in anticipation of future gains. With the cryptocurrency news buzzing around this milestone, analysts are scrutinizing market trends while the crypto fear and greed index fluctuates, hinting at investor sentiment. As Bitcoin price reaches unprecedented levels, it sparks conversations about the future of digital currencies and their role in the financial ecosystem.

The ascent of Bitcoin, now surpassing the $111,000 threshold, highlights a vigorous shift within the digital currency landscape. Investors are keeping a keen eye on the movements within the cryptocurrency realm, where market dynamics are dictated by both large-scale buyers and retail enthusiasts. This latest surge is not just a number; it reflects a wave of confidence in digital assets amidst fluctuating sentiments measured by the crypto sentiment index. With major players in the industry actively acquiring Bitcoin, the buzz around emerging trends in the space is palpable. As crypto enthusiasts analyze the latest developments, the question arises: what does this mean for the sustained growth of digital currencies?

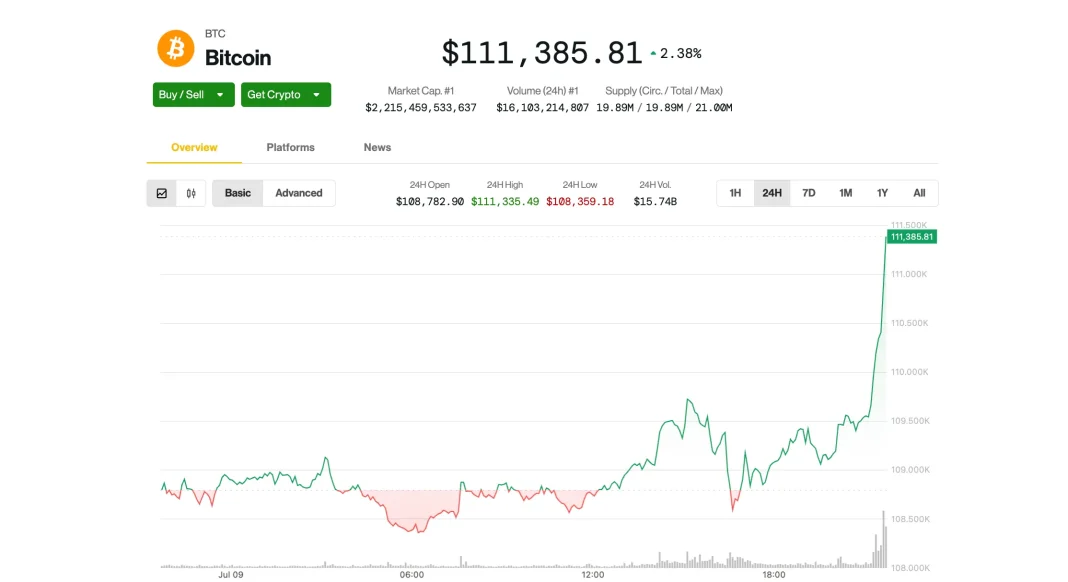

Bitcoin Tops $111K: Market Momentum and Investor Sentiment

As Bitcoin tops $111,000, the crypto market showcases remarkable recovery and momentum. The increase in Bitcoin price has reignited interest among both retail and institutional investors. This pivotal moment highlights a burgeoning confidence in the cryptocurrency sector, paving the way for further investments and trading activity. Navigating through market fluctuations, savvy investors are keenly watching the opportunities arising from Bitcoin’s impressive rise and the broader crypto market’s evolution.

The recent surge in Bitcoin price correlates with an observable influx of activity from whales—those who hold significant quantities of Bitcoin. These whales have been actively buying, indicating a potential bullish outlook for the cryptocurrency market. As they accumulate more Bitcoin, it raises questions about the upcoming market trends and how it might affect prices in the near future. This dynamic shift is crucial as it can signal broader market sentiment and pave the way for a potential shift from fear to greed in the overall crypto ecosystem.

The Role of Whales in Driving the Crypto Market Forward

Whales play a pivotal role in shaping the dynamics of the cryptocurrency market. Their buying patterns can lead to significant price increases, as observed when Bitcoin crossed the $111,000 threshold. By accumulating large amounts of Bitcoin, these entities can influence market behavior, drawing attention from smaller investors. This phenomenon emphasizes the interconnectedness of the cryptocurrency market and the importance of understanding whale activities as they can signal future trends and contribute to the overall sentiment in the crypto market.

Currently, many whales are diversifying their holdings by moving away from traditional assets like gold in favor of Bitcoin. This shift in investment strategies among high-net-worth individuals illustrates an increasing acceptance of cryptocurrency as a legitimate asset class. As Bitcoin continues to garner interest from institutional investors, the market’s potential for growth seems promising, regardless of the prevailing fear reflected in the Crypto Fear and Greed Index. The interplay between whale investment activities and market sentiment could dictate the next chapter of crypto market momentum.

Navigating Extreme Fear: Optimism Amidst Market Uncertainty

Despite an ongoing sense of ‘extreme fear’ within the market, as indicated by a recent Crypto Fear and Greed Index reading, the emergence of positive trends remains evident. When Bitcoin reached $111K, it seemed to uplift overall sentiment, reducing fear and hinting at a potential bullish turnaround. This paradox highlights how even during periods of uncertainty, investor sentiment can shift rapidly, especially following significant market milestones.

Moreover, this current phase of fear in the market contrasts sharply with the vigorous buying activity among whales and other savvy investors. While many are cautious, the activities of seasoned investors can often shake the ground beneath prevailing fears, creating pockets of optimism. Observers are hopeful that this could signal a transition towards stability and increased investor activity, encouraging a sustainable recovery in the cryptocurrency sector moving forward.

Ethereum and Other Altcoins: Following Bitcoin’s Lead

Alongside Bitcoin’s significant price surge, Ethereum and other altcoins displayed encouraging gains, indicating a healthy market environment. Ether climbed nearly 2.7% while other notable cryptocurrencies like Binance Coin (BNB) and Solana also saw substantial rises in value. This collective growth suggests that the crypto market, fueled by Bitcoin’s rise above $111,000, is more than just a one-asset phenomenon; it reflects a revitalized interest in diversified investments across various digital currencies.

Investors often look at Bitcoin as a market leader, typically setting the tone for altcoin movements. The correlation between Bitcoin and other altcoins is strong, and an increase in Bitcoin price often begets a bullish trend across the entire crypto landscape. As these altcoins gain attention, more investors may be prompted to join the crypto space, further stoking the momentum initiated by Bitcoin’s recent achievements.

Market Cap Gains: The Broader Implications of Crypto Expansion

The crypto market’s total capitalization has soared to $3.71 trillion, reflecting an overall buoyancy that should not be overlooked. This impressive surge can be attributed to Bitcoin’s stellar performance as it climbs past $111,000, driving investor interest and market liquidity. A rising market cap strengthens the case for cryptocurrencies as a viable asset class, which could encourage institutional investors wary of volatility to dip their toes into the crypto waters.

Moreover, a robust market cap reinforces investor confidence—signaling a maturity in the cryptocurrency ecosystem. The broad-based gains among digital currencies like Ethereum, XRP, and even emerging projects like Hyperliquid indicate that the market is expanding beyond Bitcoin, which could lead to more diversified portfolios for investors. This could usher in an era where liquid assets in the crypto space become fundamental components of investment strategies across the globe.

From Fear to Greed: The Shift in Crypto Sentiment

The shift from an ‘extreme fear’ sentiment to a more balanced perspective reflects changing dynamics within the crypto market. With the latest reading on the Crypto Fear and Greed Index indicating a slight improvement, many investors are starting to see potential opportunities in what was once perceived as a turbulent environment. A movement towards moderate fear suggests that traders are beginning to recalibrate their expectations based on the recent successes of leading cryptocurrencies.

As Bitcoin continues to ascend, investor sentiment is likely to follow suit, transforming due caution into calculated optimism. This shift could lead to renewed interest in not only Bitcoin but the entire crypto market, as investors reconcile previous fears with newfound positive trends. This evolving sentiment is crucial not just for price movements but for fostering a more resilient and knowledgeable investor base, which is key to the sustainability of growth in the crypto market.

The Influence of Investors: How Buying Trends Shape Crypto Prices

Investor activity has a profound impact on cryptocurrency prices, particularly in a market that remains sensitive to shifts in sentiment and buying behavior. As whales increase their Bitcoin holdings, they exert considerable influence on price dynamics and market confidence. The actions of these large-scale investors create ripples throughout the market, leading to potential price rallies and shifts in overall sentiment.

Moreover, understanding investor psychology—how fear and greed affect trading decisions—can provide useful insights into market trends. As the Crypto Fear and Greed Index fluctuates, it highlights how emotional responses can alter the course of trading. In this context, the ascension of Bitcoin past $111,000 amid a fear-driven environment demonstrates the complexity of human behavior in finance, where even amidst apprehension, opportunities for growth remain ripe.

Regulatory Perspectives: The Impact on Bitcoin and the Crypto Market

Regulatory considerations are increasingly relevant as Bitcoin and the overall crypto market continue to gain traction. Policymakers worldwide are focusing on establishing clearer guidelines that address the intricacies of digital currencies. As more regulations emerge, the impact on prices, particularly Bitcoin prices, may become more pronounced, shaping how investors navigate this vibrant landscape.

With Bitcoin recently achieving a significant milestone by surpassing $111,000, regulatory developments could either curb the excitement or propel it further. Clear frameworks could instill confidence in mainstream investors, while overly strict regulations could dampen the market’s upward trajectory. As the dialogue around cryptocurrency regulation evolves, stakeholders must remain vigilant to understand how these developments influence market dynamics and investor behavior.

Looking Ahead: The Future of Bitcoin and Crypto Market Opportunities

As it stands, Bitcoin continues to define the narrative of the cryptocurrency market. With its recent rise to to top $111,000, many are now looking towards the future and contemplating the next phases of growth and development for Bitcoin and altcoins alike. This moment can serve as a springboard for further exploration of investment opportunities, making it a pivotal time for both veteran traders and newcomers alike in the crypto space.

Looking ahead, analysts suggest that as Bitcoin establishes new thresholds, further innovations and adoption within the crypto market may follow. The combination of sustained growth and the entrance of innovative projects could redefine the landscape, attracting more investors and potentially leading to the emergence of new market leaders. As Bitcoin remains at the forefront, the journey onward promises to be filled with exploration and opportunity amidst persistent market fluctuations.

Frequently Asked Questions

What does it mean for Bitcoin to top $111K in the crypto market?

When Bitcoin tops $111K, it signifies a major psychological and market milestone that can drive investor confidence and attract new capital into the crypto market. This surge often reflects increased demand and market sentiment, causing a ripple effect across other cryptocurrencies.

How does the Bitcoin price surge to over $111K affect the overall cryptocurrency news?

The Bitcoin price surge to over $111K dominates cryptocurrency news, highlighting market trends, investor behavior, and the overall health of the crypto economy. Such milestones often prompt increased media coverage and analysis, bringing more attention to the digital asset space.

What role do whales buying Bitcoin play in its rise above $111K?

Whales buying Bitcoin significantly impact its price movement, as large purchases can lead to increased demand and price appreciation. Their accumulating behavior, especially when Bitcoin surpasses $111K, signals bullish trends and can instill confidence in retail investors.

How does the Crypto Fear and Greed Index react when Bitcoin tops $111K?

When Bitcoin tops $111K, the Crypto Fear and Greed Index might show varying readings, often reflecting a shift from fear to a more neutral sentiment. As prices rise, the index may climb from ‘extreme fear’ to ‘fear’ or even ‘greed,’ indicating increased investor optimism.

What market dynamics are observed after Bitcoin tops $111K?

After Bitcoin tops $111K, market dynamics include increased trading volume, potential price volatility, and a notable uptick in interest from both institutional and retail investors. This heightened engagement often brings broader attention to other cryptocurrencies as well.

How can Bitcoin reaching over $111K influence other cryptocurrencies?

Bitcoin reaching over $111K often leads to a positive influence on other cryptocurrencies, as many digital assets typically follow Bitcoin’s price trends. Such movements can generate bullish sentiment across the crypto market, making it an opportune time for investors to explore altcoins.

Is the rise of Bitcoin to $111K sustainable in the current crypto market?

The sustainability of Bitcoin’s rise to $111K in the current crypto market depends on various factors, including market sentiment, whale activity, and macroeconomic conditions. While the current trend shows resilience, fluctuations are typical in the crypto space.

What does it indicate when Bitcoin’s market cap swells alongside its price surge above $111K?

When Bitcoin’s market cap swells alongside its price surge above $111K, it indicates growing investor confidence and market interest. A robust market cap suggests strong demand and can attract institutional investors looking to diversify their portfolios.

| Key Point | Details |

|---|---|

| Bitcoin Price Surge | Bitcoin topped $111,000, reaching $111,282 and maintaining over 59% market dominance. |

| Market Performance | The entire crypto market cap increased by 1.81%, reaching $3.71 trillion. |

| Top Performers | Ethereum rose by 2.7% to $3,925; BNB jumped 5.99% to $1,134, while other coins like XRP and Solana also saw gains. |

| Fear and Sentiment | Despite a ‘fear’ sentiment reflected in the Crypto Fear and Greed Index, the market showed resilience. |

| Whale Accumulation | Addresses holding between 100 and 1,000 BTC have been accumulating more, indicating strong bullish sentiment. |

| Market Outlook | Investor interest in Bitcoin is increasing, with speculation about gold investors switching to BTC. |

Summary

Bitcoin tops $111K, marking a significant milestone in the crypto market. As Bitcoin crosses this remarkable threshold, it showcases the growing strength and resilience of the cryptocurrency ecosystem amidst lingering fears. With the overall market capitalizing on this momentum, many investors are turning their sights towards Bitcoin, with large-scale accumulators suggesting a bullish outlook for the near future. Analysts believe that this trend may signal a shift in investment strategies, as traditional gold investors consider the advantages of digital currency.