Bitcoin volatility remains a hot topic, particularly as its price swings have captured attention across the cryptocurrency market. This week, Bitcoin experienced staggering fluctuations, ranging over $10,000, reflecting the unpredictable nature of digital currencies. Such volatility not only impacts Bitcoin but also reverberates through the altcoins market, where many coins struggle against its erratic trends. Additionally, the surging interest in privacy coins, like Zcash, underlines a growing shift within the crypto landscape, highlighting their performance amidst broader market routs. Investors are currently keeping a close eye on these developments, given that they could shape future strategies in cryptocurrency trading.

The unpredictable behavior of Bitcoin prices underscores the ongoing fluctuations within the cryptocurrency landscape. These dramatic swings in value have significant implications not just for Bitcoin but also for a wide range of digital currencies, often referred to as altcoins. In this volatile environment, new trends are emerging, notably the rise of privacy-focused coins that are garnering increasing attention. Understanding the dynamics of these price movements is crucial for investors navigating through the modern digital financial ecosystem. As discussions regarding market patterns and growth prospects unfold, it’s essential to stay updated on the latest altcoin news and assess their trajectories in light of Bitcoin’s fluctuations.

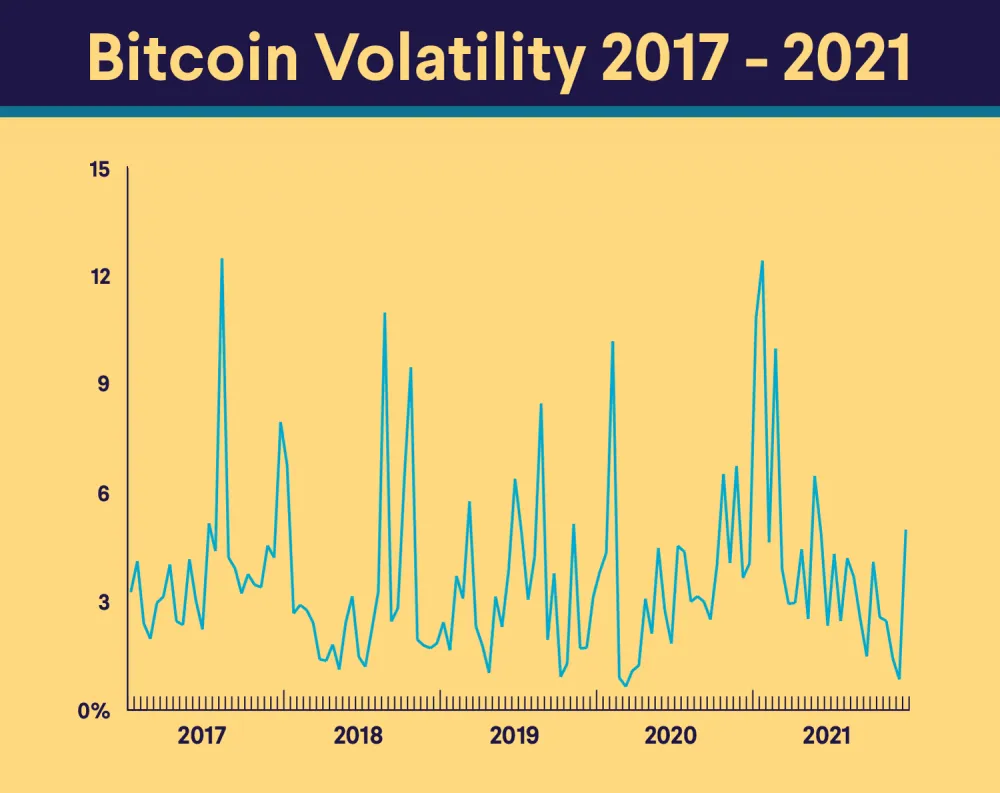

Understanding Bitcoin Volatility

Bitcoin volatility has become a defining characteristic of the cryptocurrency market, often causing wide price swings. Recent data demonstrated that Bitcoin’s price fluctuated by more than $10,000 within a single week, reflecting its unpredictable nature. Such volatility originates from various factors including macroeconomic events, regulatory news, and market sentiments. For instance, rumors of trade deals between major economies like the U.S. and China can create spikes in interest and price, but these surges are frequently countered by political or economic uncertainties that can lead to rapid declines.

Investors in Bitcoin must navigate this highly volatile landscape with caution. The drastic price swings can present opportunities for significant gains, but they also come with increased risks. For example, the coin hit a peak of $116,381 before retracing those gains, illustrating the dual-edged sword of Bitcoin investment. Understanding the drivers of volatility, including investor sentiment and external events such as Federal Reserve announcements, is crucial for anyone looking to capitalize on BTC price movements.

Price Swings: Impact on the Cryptocurrency Market

The recent dramatic price swings in Bitcoin have ripple effects throughout the broader cryptocurrency market. As BTC moved sharply, other altcoins tended to follow suit, reflecting a correlation that often results in a synchronized market behavior. For instance, during Bitcoin’s climb early last week, several altcoins experienced minor gains, but as BTC’s price began to correct downward, most altcoins faced declines ranging from 1.5% to 7%. This pattern highlights how Bitcoin’s volatility often sets the tone for investor behavior and market stability, affecting everything from trading volumes to investor confidence.

Moreover, such fluctuations can also impact overall market sentiment towards new entrants in the crypto space. While established coins react heavily to Bitcoin’s price movements, emerging altcoins may either thrive or falter based on the current trends led by BTC. For example, amid Bitcoin’s instability, privacy coins like Zcash and DASH saw considerable gains as investors sought relative safety in assets perceived as having unique value propositions. This behavior underscores the interconnectedness of the cryptocurrency ecosystem, where Bitcoin volatility directly influences investor strategies across the market.

The Rising Popularity of Privacy Coins

Despite the turbulence in the cryptocurrency market, privacy coins have shown resilience and impressive growth. Coins like Zcash (ZEC) demonstrated remarkable performance, not only overcoming market downsides but also setting new highs. Reaching $443, ZEC has outperformed many larger cryptocurrencies and overtaken Monero to reclaim its position as a leading privacy coin by market cap. This surge illustrates a growing demand for enhanced privacy features within the cryptocurrency community, as investors become increasingly aware of their digital security.

Additionally, the substantial growth of other privacy coins such as RAIL, DASH, and others with triple-digit gains indicates a strong trend towards privacy-centric cryptocurrencies. As market volatility continues to challenge traditional cryptocurrencies, the appeal of privacy coins strengthens, drawing in both individual and institutional investors. This shift signifies not just a reaction to market fluctuations but also reflects a changing narrative in cryptocurrency investment, where personal financial privacy is becoming a paramount concern.

Zcash Performance and Market Dynamics

Zcash’s performance stands out in a volatile market, showcasing its potential to attract investors looking for stability amidst the uncertainty. Having surged back to its highest level in over seven years, Zcash has positioned itself not only as a top privacy coin but also as a viable alternative during market downturns. This significant uptrend suggests that investors are increasingly valuing the anonymity and security features that Zcash offers, which differentiates it from more mainstream cryptocurrencies like Bitcoin.

Moreover, the contrast between Zcash’s growth and the general decline of many altcoins further emphasizes the unique attributes of privacy coins in the current market climate. As coins like COAI and GIGGLE faced severe losses of over 60%, Zcash maintained upward momentum, indicating that market participants are seeking alternatives that can offer privacy as a safeguard against potential regulatory impacts on public cryptocurrencies. This shift in focus towards privacy coins is a testament to the evolving strategies of investors looking to hedge against market volatility.

Altcoins News: Winners and Losers

In the recent week laden with Bitcoin’s volatility, altcoin performance varied significantly, revealing clear winners and losers in the broader cryptocurrency market. Only a few altcoins like BCH and HYPE managed to post gains while the majority struggled under the weight of Bitcoin’s price correction. This trend exemplifies the heightened risk environment where the dominance of Bitcoin often leads to wider repercussions for altcoins, resulting in losses ranging from 1.5% to 7%. Traders closely monitoring altcoin developments must adapt quickly to these fluctuations to capitalize on emerging opportunities.

Furthermore, the drastic losses seen in coins like COAI and GIGGLE, which dropped 79.1% and 62.2%, respectively, reflect the high-stakes nature of cryptocurrency investment. Such volatility has led investors to proceed with caution, reinforcing the importance of thorough analysis and market insights when engaging in altcoin trading. The diverse performances among altcoins during turbulent weeks underline the need for strategic investment approaches, as some coins manage to defy market trends while others sink amidst price corrections.

Frequently Asked Questions

What causes Bitcoin volatility and price swings in the cryptocurrency market?

Bitcoin volatility is primarily driven by market sentiment, regulatory news, and macroeconomic factors. Sudden price swings often occur due to speculation, major trades, and updates on global economic conditions that impact the cryptocurrency market’s stability.

How do Bitcoin price swings compare to those of privacy coins like Zcash?

While Bitcoin often experiences significant price swings, privacy coins like Zcash have shown resilience by posting strong gains, particularly during market downturns. For instance, Zcash recently surged to a seven-year high, showcasing different volatility dynamics compared to Bitcoin.

What role do external market conditions play in Bitcoin’s volatility?

External market conditions, such as news about trade agreements and interest rate changes, greatly impact Bitcoin’s volatility. For example, the recent rumors of a U.S.-China trade deal contributed to Bitcoin’s sudden price increase before it experienced a substantial decline due to Federal Reserve announcements.

Why is the cryptocurrency market experiencing increased volatility?

The cryptocurrency market is experiencing increased volatility due to factors such as regulatory developments, investor sentiment shifts, and macroeconomic influences. These can lead to quick price movements, affecting Bitcoin and altcoins alike.

How did Zcash perform compared to Bitcoin during recent market volatility?

During recent market volatility, Zcash outperformed Bitcoin by achieving significant gains, highlighting a trend where privacy coins defy downward pressures on the broader cryptocurrency market. For instance, Zcash recently reached its highest value in years while Bitcoin’s value fluctuated dramatically.

| Key Points | Details |

|---|---|

| Weekly Price Swings | Bitcoin’s price fluctuated over $10,000 throughout the last week of October. |

| Market Influences | Rumors of a U.S.-China trade deal and Federal Reserve rate decisions impacted Bitcoin’s price. |

| Leading Performing Altcoins | BCH (9%) and HYPE (2%) were the only altcoins to show positive gains during this period. |

| Privacy Coins’ Performance | Zcash (ZEC) soared to $443, outperforming the market with significant gains of over 100% for several other privacy coins. |

| Market Losers | COAI lost 79.1% and GIGGLE dropped 62.2%, marking the largest declines of the week. |

Summary

Bitcoin volatility dominated the crypto market as prices experienced massive swings of over $10,000 within a week. The influence of external factors such as trade negotiations and Federal Reserve announcements drove this volatility, making Bitcoin a focal point in discussions about market fluctuations. While major altcoins recorded losses, privacy coins like ZEC thrived, showcasing an interesting divergence within the market. Understanding Bitcoin’s volatility is crucial for investors and market watchers alike, as it highlights the unpredictable nature of cryptocurrencies.