Bolivia wholesale CBDC marks a significant step towards modernizing the nation’s financial infrastructure, as the Central Bank of Bolivia has begun exploring the implementation of a Central Bank Digital Currency (CBDC) specifically tailored for interbank transactions. This innovative approach aims to enhance the efficiency and security of high-value financial operations among private banks while ensuring the stability of the national fiat currency, the boliviano. By focusing on a wholesale model, the bank emphasizes the substantial benefits that come with enhancing interbank payment processes, which could ultimately lead to a more competitive and transparent Bolivia financial system. Unlike retail CBDCs, which may present limited advantages in the short term, the wholesale CBDC is designed to elevate the efficiency and reliability of transactions within the banking sector. As Bolivia embarks on this digital journey, the adoption of a wholesale CBDC stands to reshape how financial institutions engage with each other, thus reinforcing the country’s economic sovereignty in an increasingly digitized world.

The concept of a wholesale Central Bank Digital Currency (CBDC) in Bolivia signifies a proactive response to the evolving landscape of digital finance. By introducing a digital boliviano aimed at interbank operations, the Central Bank of Bolivia is prioritizing enhancements in the overall functionality of its financial system. This targeted approach is expected to facilitate smoother transactions among banks, ultimately benefiting the entire banking network and ensuring that Bolivia remains competitive on the global stage. Additionally, the implementation of a digital currency can offer substantial advantages for banks by increasing transaction speed and improving financial security, while also fostering greater trust in national currency. As Bolivia seeks to integrate advanced technology into its financial ecosystem, the wholesale CBDC serves as a crucial tool for maintaining economic resilience and promoting innovation within the sector.

Bolivia’s Digital Boliviano: A New Era in Central Banking

The Central Bank of Bolivia’s initiative to implement a wholesale Central Bank Digital Currency (CBDC) marks a pivotal shift in the nation’s approach to digital finance. Dubbed the digital boliviano, this currency aims to streamline and modernize the current financial infrastructure, particularly enhancing interbank transactions. By focusing on a wholesale model, the central bank is positioning itself to improve payment processing among financial institutions, significantly increasing operational efficiency and security in transactions.

The proposed digital boliviano will allow banks to conduct high-value transactions more effectively, ultimately reinforcing the sovereignty of Bolivia’s currency in an evolving digital landscape. As the world leans increasingly towards digitization, this initiative reflects a crucial step for Bolivia in ensuring its financial system remains competitive and resilient against external threats. By adopting this wholesale CBDC, the country aims to integrate international standards into its banking operations, thereby increasing trust and adoption of its national currency.

Benefits of a Wholesale CBDC for Bolivia’s Financial System

Implementing a wholesale CBDC provides numerous benefits for the Bolivian financial system. First and foremost, it enhances the security of internal payment processes among banks, reducing the reliance on traditional payment systems that may expose them to higher risks. The digital boliviano can serve as a reliable alternative for high-value transactions, ensuring that funds are transferred swiftly and securely without the vulnerabilities associated with older systems.

Additionally, the wholesale CBDC could streamline settlement processes, reducing operational costs for banks while also ensuring compliance with financial regulations. This modernization will likely attract more investment into Bolivia’s banking sector, as international stakeholders will appreciate a more robust and efficient financial ecosystem. The benefits for banks and financial institutions extend beyond mere transaction facilitation; they represent a broader commitment to digital transformation within Bolivia’s economic framework.

The Significance of the Central Bank’s CBDC Report

The preliminary report released by the Central Bank of Bolivia outlines the critical evaluation of implementing the digital boliviano. This document serves as a foundational strategy that outlines not only the theoretical benefits but also the practical considerations of transitioning to a digital currency. Recognizing the limitations of a retail CBDC, the bank emphasizes that, given the present state of the retail payment ecosystem in Bolivia, a wholesale model is more advantageous for immediate implementation.

This report is significant as it frames the upcoming consultations with various stakeholders within the financial sector. By actively seeking input from private banks and financial participants, the Central Bank demonstrates its commitment to developing a CBDC that meets the real needs of the market. This collaborative approach is essential for ensuring the successful rollout of the digital boliviano, as it will help build confidence and understanding among users about the benefits of this innovative financial instrument.

Bolivia’s Position in the Digital Currency Landscape

By initiating its CBDC program, Bolivia places itself in a rapidly evolving landscape of digital finance, characterized by both opportunities and challenges. Despite some neighboring countries progressing faster in their CBDC initiatives, Bolivia’s focus on a wholesale model is strategic. The digitization of currency aligns with global trends, where financial systems are increasingly adopting technologies that enhance transaction speed, reduce costs, and foster transparency in financial dealings.

As the demand for innovative financial solutions rises, especially with the advent of stablecoins, the Central Bank’s proactive stance can help protect Bolivia’s economic sovereignty. By ensuring that transactions can occur within a secure and modern framework, the CBDC may mitigate the risks posed by external pressures and prevent the fragmentation of the financial system. Consequently, this initiative not only aims to modernize local banking practices but also to position Bolivia favorably in the broader Latin American financial ecosystem.

Challenges of Implementing a Retail CBDC in Bolivia

While the Central Bank is focusing on a wholesale CBDC, it’s crucial to recognize the challenges that a retail CBDC would face in the Bolivian context. One of the primary concerns highlighted in the report is the limited development of the current retail payment infrastructure. With many consumers still reliant on traditional payment methods, introducing a retail CBDC could lead to complications associated with user adoption and transition.

Furthermore, a retail CBDC may not provide the immediate benefits that a wholesale model would yield. The current state of the financial system suggests that the introduction of a retail CBDC would result in a drawn-out implementation period, delaying potential gains in efficiency and security. Therefore, focusing on a wholesale approach allows Bolivia to harness the advantages of CBDC technology without overwhelming the existing system while addressing systemic vulnerabilities in a targeted manner.

Future Steps for the Central Bank of Bolivia

Looking ahead, the Central Bank of Bolivia is committed to engaging stakeholders throughout the financial landscape to glean insights on the upcoming digital boliviano. By addressing key concerns and needs expressed by banks and the public, the Central Bank aims to tailor the CBDC to better serve its intended purpose of enhancing the financial system. This participatory approach is vital for ensuring that the introduction of the digital boliviano meets the expectations of its end-users.

Moreover, the Central Bank plans to release further reports detailing the progress and findings from public surveys, signaling transparency and a dedication to stakeholder involvement. As developments unfold, stakeholders in the Bolivian financial system will have the opportunity to adapt to this revolutionary change, ensuring that the country can fully leverage the benefits of wholesale CBDC implementation for economic growth and stability.

Impacts of CBDC on Bolivian Banking Sector

The introduction of a wholesale Central Bank Digital Currency (CBDC) is poised to have significant impacts on the Bolivian banking sector. As a digital counterpart of the boliviano, the digital boliviano can effectively facilitate interbank transactions, providing banks with a secure and efficient means of daily operations. The implication is that banks can manage liquidity better while also experiencing decreased transaction costs, setting the stage for a more robust banking environment.

In addition to enhancing transactional capabilities, the wholesale CBDC could foster greater collaboration among financial institutions. With the potential to issue smart contracts and provide real-time data for monitoring transactions, banks may find innovative ways to improve service offerings. This interconnectedness is invaluable in an accelerating digital economy, and it becomes increasingly crucial for banks to remain competitive on both national and international fronts.

Bolivia’s CBDC and International Standards

Bolivia’s strategic move towards implementing a wholesale CBDC reflects its commitment to aligning with international financial standards. The Central Bank emphasizes that the adoption of digital currencies can not only modernize the financial framework but also ensure that Bolivia’s financial sector remains compliant with global practices. By integrating international standards within the digital boliviano, the Central Bank seeks to reinforce the country’s financial reputation on the global stage.

Adhering to global standards benefits not only the banks involved but also consumers who seek security and reliability in financial transactions. As cross-border payments become more prominent, a robust wholesale CBDC could facilitate easier collaborations with foreign entities, thus enhancing Bolivia’s stance within regional trading frameworks. This alignment further strengthens the sovereignty of the national currency, allowing it to maintain its standing amidst growing digital alternatives.

Next Generation of Transactions in Bolivia’s Financial Landscape

As Bolivia prepares to launch the digital boliviano, the financial landscape is set for a transformation that prioritizes efficiency and security in transactions. By embracing a wholesale CBDC model, the Central Bank is not only addressing immediate transaction needs but is also paving the way for future developments that could encompass more inclusive financial products and services. This evolution aligns with the global movement towards cashless economies.

The anticipated effects of the digital boliviano extend beyond the banking sector, touching on various areas of commerce and trade within the economy. Businesses and consumers alike stand to benefit from more streamlined transactions, reduced costs, and increased security against fraud. In this scenario, the Central Bank’s initiative could be a catalyst for greater regional economic integration as Bolivia positions itself to adapt to the digital age.

Frequently Asked Questions

What is the purpose of the Bolivia wholesale CBDC initiative?

The Bolivia wholesale CBDC initiative aims to modernize the financial system by enhancing high-value interbank transactions and reinforcing the sovereignty of the Bolivian boliviano in a digital landscape.

How will the Bolivia wholesale CBDC benefit banks?

The wholesale CBDC in Bolivia will benefit banks by streamlining their internal payment processes and improving transaction efficiency between financial institutions, ultimately contributing to a safer and more competitive financial environment.

Why did the Central Bank of Bolivia favor a wholesale CBDC over a retail CBDC?

The Central Bank of Bolivia favored a wholesale CBDC due to its potential for greater impact on high-value transactions among banks, whereas a retail CBDC was deemed to offer limited benefits given the current state of the retail payment system.

What is the ‘digital boliviano’ and its role in Bolivia’s financial system?

The digital boliviano is Bolivia’s proposed central bank digital currency (CBDC), which aims to modernize the national financial infrastructure and ensure the sovereignty of the boliviano amid increasing digital transactions.

What future steps will the Central Bank of Bolivia take regarding the wholesale CBDC?

The Central Bank of Bolivia will engage with financial system participants and conduct public surveys to identify needs for the wholesale CBDC, with outcomes to be reported in a second review planned for Q4 2026.

What potential challenges does the Bolivia wholesale CBDC address?

The wholesale CBDC addresses challenges related to safeguarding Bolivia’s financial sovereignty and mitigating risks from the growing use of stablecoins and legacy payment system sanctions.

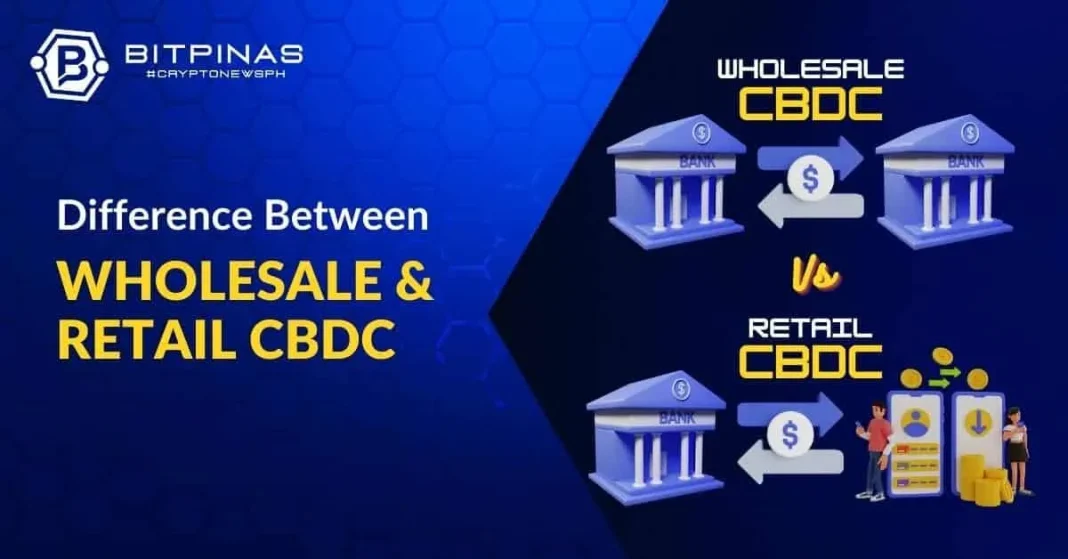

How does a wholesale CBDC differ from a retail CBDC in Bolivia?

A wholesale CBDC focuses on interbank transactions among financial institutions, while a retail CBDC would target individual consumers, which the bank currently sees as offering limited short-term benefits.

How is the Central Bank of Bolivia set to gather feedback on the digital boliviano?

The Central Bank of Bolivia plans to conduct a public survey and engage with financial sector participants to gather insights and feedback on the needs and expectations for the wholesale CBDC.

| Key Points | Details |

|---|---|

| CBDC Implementation | The Central Bank of Bolivia is working to implement a wholesale CBDC to modernize the financial system. |

| Focus on Wholesale | The decision to prioritize a wholesale CBDC is based on its potential to enhance high-value transactions among banks and improve payment processes. |

| Limited Retail CBDC Benefits | A retail CBDC was deemed less beneficial in the short term due to the current capabilities of Bolivia’s retail payment system. |

| Sovereignty and Security | The wholesale CBDC aims to safeguard the Bolivian fiat currency against external pressures and enhance the financial network’s security. |

| Future Steps | The Central Bank plans to consult financial system participants and conduct a public survey to better understand CBDC needs, with further reports due in 2026. |

Summary

Bolivia wholesale CBDC signifies a pivotal advancement in the country’s financial infrastructure. The Central Bank of Bolivia’s initiative to launch a wholesale Central Bank Digital Currency aims to enhance the nation’s financial system’s security and efficiency, positioning Bolivia favorably against the backdrop of digital innovation in Latin America. By focusing on a wholesale model rather than a retail one, Bolivia plans to leverage high-value transactions to fortify its currency sovereignty and resist potential economic challenges. The upcoming engagements with stakeholders and the public are set to play a crucial role in shaping the future of this digital currency, ensuring it meets the actual needs of the financial ecosystem.