The **BRICS Strategy** heralds a pivotal shift in global economic dynamics, particularly as countries like Russia redefine their role in this multi-nation coalition. Russian President Vladimir Putin elaborated on this strategy during recent discussions, emphasizing cooperation among BRICS nations instead of confrontation, and highlighting a collective departure from dollar dominance as a necessity for fostering global economic independence. Amidst rising tensions and shifting trade policies, the focus on a cohesive **BRICS trade strategy** presents opportunities for member nations to strengthen economic ties using national currencies. With rising sentiment around **Russia BRICS relations**, analysts are closely observing how these developments could challenge the perception of the dollar as the benchmark in international trade. Putin’s concise dismissal of accusations regarding an anti-dollar agenda underscores the bloc’s intention to create a sustainable economic framework based on mutual growth.

The approach adopted by the BRICS alliance represents an emerging paradigm in international economic collaboration, where member states aim for financial autonomy away from dominant currencies. This shift aligns with broader trends as seen in **Putin’s anti-dollar comments**, which signal a commitment to cultivating an environment that thrives on **global economic independence**. Rather than engaging in overtly hostile actions against the dollar, the members are urging for a more integrated **trade strategy** that allows for exchanges in local currencies, thereby reducing vulnerability to currency fluctuations. With discussions on enhancing **Russia’s BRICS relations** serving as a backdrop, there is a growing recognition that diversifying trade practices is essential for resilience in an increasingly interconnected world. As this narrative unfolds, the implications for the global economy continue to be significant, promoting alternative frameworks that compete with traditional financial systems.

Strategic Shift: Russia’s Commitment to BRICS

Russia’s commitment to BRICS represents a significant pivot in the nation’s international relations strategy, particularly in its economic engagements. As President Vladimir Putin articulated, the focus of the BRICS strategy is not to undermine any established economic power dynamics but to enhance cooperation among member nations. This strategic alliance aims to foster an environment where countries can work together to cultivate economic independence, devoid of over-reliance on the U.S. dollar. By embracing a path of mutual support and shared economic interests, BRICS is carving out a new trajectory that emphasizes resilience and autonomy in global markets.

The essence of this shift lies in addressing the various constraints imposed by existing financial systems that often favor dollar dominance. By fostering trade in local currencies and exploring alternative financial infrastructures, BRICS is assembling a framework that could potentially mitigate the risks associated with dollar dependency. This strategy not only benefits Russia but also paves the way for other emerging economies to assert their positions on the global stage, thereby collectively challenging the long-standing hegemony of the dollar in global commerce.

Putin’s Clarification on Anti-Dollar Assertions

In a recent address, Putin explicitly denied any participation in an anti-dollar campaign, emphasizing that Russia’s actions stemming from its membership in BRICS are purely pragmatic. The discussions surrounding the so-called anti-dollar initiative are often misinterpretations of Russia’s genuine efforts to secure flexible economic relationships amid sanctions and geopolitical tensions. As he stated, Russia is compelled to deal in national currencies due to restrictions on dollar transactions, underlining the adaptive measures that nations must take in the evolving landscape of international trade.

This clarification reflects a broader understanding of current economic challenges faced by BRICS nations. It’s a crucial reminder that the ongoing transformations within global financial systems are not purely adversarial. Instead, they signify a collective shift towards achieving a more balanced and independent economic ecosystem. By fostering financial systems that do not rely solely on the dollar, BRICS is contributing to a more diversified financial future, one that can withstand external pressures and enhance the economic self-sufficiency of its member states.

Understanding BRICS Trade Strategy and Global Economic Independence

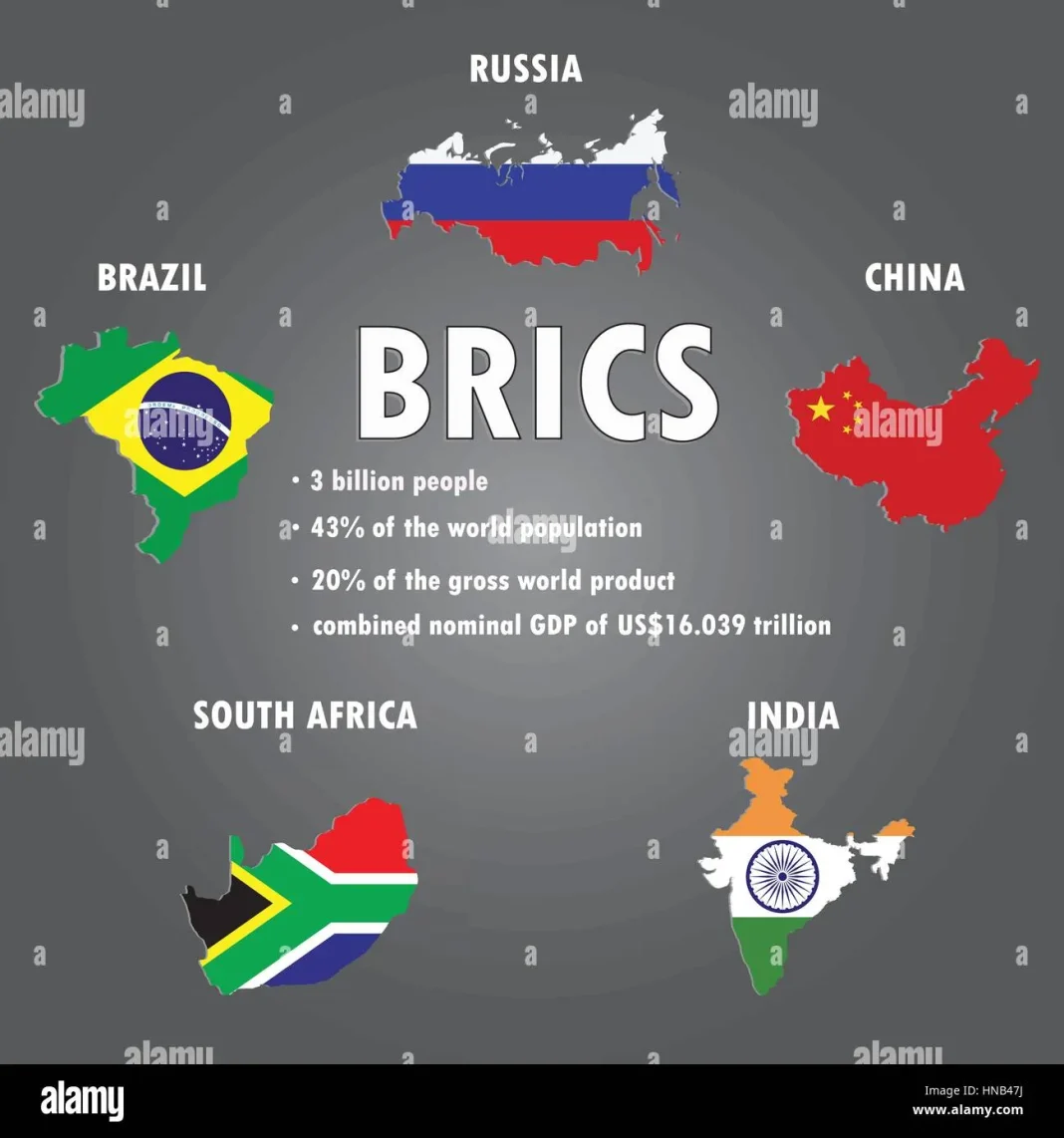

The BRICS trade strategy is fundamentally rooted in the principle of enhancing economic independence among its member nations, which include Brazil, Russia, India, China, and South Africa. This strategy is characterized by initiatives aimed at reducing dependency on the U.S. dollar. In light of shifting geopolitical landscapes, BRICS members recognize the need for self-sustaining economic practices that enhance resilience in times of uncertainty. The overarching goal is to create a unified platform where trade can occur with minimal friction, thereby fortifying the economic sovereignty of each member nation.

Furthermore, this emphasis on economic independence is not just about fiscal policy but also involves exploring innovative trading mechanisms, including the use of local currencies for trade. Russia’s engagement in this strategy, particularly after facing sanctions that hindered dollar transactions, underscores a critical turning point for BRICS. By prioritizing trade and cooperation among member countries, BRICS aims to establish a strong, alternative pathway reminiscent of a multipolar world that welcomes diverse economic models without solely leaning on the dollar’s established dominance.

The Future of Dollar Dominance in BRICS Context

As BRICS continues to strengthen its foundation as an economic bloc, the future of dollar dominance comes into question. With member nations actively pursuing alternatives to U.S. currency for trade purposes, it raises significant dialogue about the sustainability of dollar hegemony. Analysts and financial experts are observing a trend where countries are increasingly seeking methods to conduct trade that do not involve the dollar, thereby reducing vulnerability to external economic sanctions and influence. This movement could potentially lead to a redefined global economic order where the dollar takes a back seat in international transactions.

The implications of such a shift are profound. If the BRICS trade strategy succeeds in establishing robust economic practices that favor local currencies and new trade mechanisms, we may witness a substantial decline in the dollar’s pivotal role in global finance. In this context, initiatives such as creating alternative digital currencies for trade settlements might gain traction, thereby fostering greater economic resilience and autonomy. Consequently, the evolving dynamics within BRICS could catalyze a significant transformation in how global trade is conducted in the 21st century.

The Role of Digital Currencies in BRICS Initiatives

In light of President Putin’s comments on the need for resilience in international trade, digital currencies emerge as a pivotal component of BRICS’ strategic initiatives. As the bloc looks to diminish reliance on the U.S. dollar, exploring the potential of cryptocurrencies and blockchain technologies for trade purposes becomes increasingly appealing. Digital currencies offer the advantages of speed, lower transaction costs, and enhanced security, which are critical elements for countries striving to establish more independent financial systems.

The integration of digital currencies into BRICS’ trade strategy could revolutionize how transactions are conducted among member nations. With enhanced transaction efficiency, BRICS countries could reduce the pressures from external economic forces imposed by dollar dominance. This approach not only supports economic independence but also aligns with global trends of utilizing cutting-edge technology for financial transactions. As BRICS continues to evolve, its adoption of digital currencies could set a precedent for other international alliances, heralding a new era of decentralized, technology-driven economic relationships.

Frequently Asked Questions

What is the BRICS Strategy regarding dollar dominance?

The BRICS Strategy aims to reduce dependence on dollar dominance by promoting trade among member countries in their national currencies. This approach is part of a broader plan to establish global economic independence and enhance economic cooperation among Brazil, Russia, India, China, and South Africa.

How do Russia’s BRICS relations impact its trade strategy?

Russia’s BRICS relations are pivotal to its trade strategy as they facilitate alternative trade agreements that bypass the dollar. This strategy aligns with President Putin’s vision of creating a common platform for economic interaction among BRICS nations, fostering a cooperative instead of confrontational trade environment.

What are Putin’s comments about anti-dollar strategies within the BRICS framework?

President Putin has clarified that there is no formal anti-dollar strategy within BRICS. Instead, he emphasizes that the bloc’s efforts focus on enhancing internal cooperation and finding alternatives due to current restrictions on dollar payments, underscoring the necessity of this shift for global economic independence.

How does the BRICS Strategy contribute to global economic independence?

The BRICS Strategy contributes to global economic independence by reducing reliance on the U.S. dollar. By promoting trade in local currencies and developing shared economic principles, BRICS nations aim to create a more balanced global trade network that mitigates the influence of dollar dominance.

What changes has the BRICS trade strategy undergone in response to global economic conditions?

The BRICS trade strategy has adapted to global economic conditions by shifting towards increased cooperation and utilizing national currencies for trade. This adjustment stems from the need to counteract restrictions on dollar payments and to establish a more resilient economic framework among BRICS members.

Why are alternative currencies important in the BRICS Strategy?

Alternative currencies are important in the BRICS Strategy as they enable member countries to circumvent constraints imposed by dollar dominance. This move promotes trade flexibility and resilience in international transactions, aligning with the bloc’s vision for greater economic independence.

What role does Putin envision for digital currencies within the BRICS trade strategy?

Putin envisions digital currencies playing a supportive role in the BRICS trade strategy by enhancing transaction efficiency and flexibility. As BRICS nations explore alternative settlement systems, digital currencies could help decrease reliance on traditional banking and foster smoother trade among members.

| Key Point | Details |

|---|---|

| Putin’s Emphasis on Cooperation | Putin asserts that Russia’s focus within BRICS is on collaboration rather than confrontation, striving for economic independence. |

| Rejection of Anti-Dollar Claims | Putin clearly states that Russia is not partaking in an anti-dollar movement, but rather adapting to constraints on dollar payments. |

| BRICS Strategic Goals | The BRICS bloc aims for a common economic platform and shared interaction principles among member nations. |

| Analysts’ Perspectives | While some see this diversification as a challenge to the dollar, others view it as a natural evolution in global finance. |

| Support for Alternative Systems | Proponents suggest that embracing digital currencies and alternative financial systems can enhance trade resilience and flexibility. |

Summary

The BRICS Strategy is centered around enhancing cooperation among its members to achieve economic independence. Putin’s insights reflect a pivotal shift in global monetary relations, underpinning the importance of developing flexible trade systems while not aligning with an anti-dollar campaign. As the BRICS nations continue to navigate their economic pathways, they are likely to set new standards in international finance that prioritize their mutual interests.