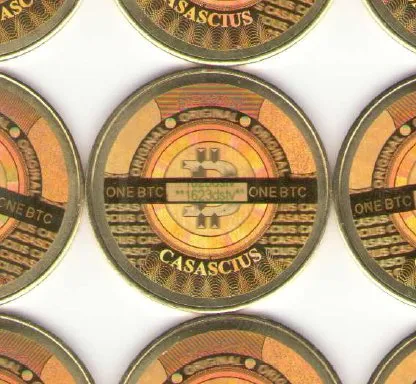

Casascius coins, the iconic physical bitcoins created by Mike Caldwell between 2011 and 2013, represent a fascinating intersection of tangible assets and cryptocurrency. Each coin is more than just a piece of metal; it holds a hidden cache of bitcoin, waiting to be discovered beneath a tamper-evident hologram. With over 38,000 BTC still unclaimed across 17,746 of these coins, the potential Casascius bitcoin value remains staggering, estimated at over $4 billion. The allure of these coins lies not only in their physical form but also in the mystery of unredeemed Casascius specimens, which are part of the approximately 20,000 BTC considered unclaimed. Whether viewed as collector’s items or as vessels containing BTC hidden coins, Casascius coins hold a significant place in the cryptocurrency universe.

Known as physical Bitcoin tokens, Casascius coins are collectible artifacts from the early cryptocurrency era, offering a unique combination of artistry and digital wealth. Minted as tangible representations of Bitcoin, these coins contain real bitcoin that can be redeemed using a secret key concealed under a protective layer. Although the production of these physical forms ceased in 2013 due to regulatory issues, they continue to intrigue collectors and investors alike. The value of these coins is further accentuated by the staggering amount of 38,000 BTC that remains locked within them, forming a substantial part of the unredeemed Bitcoin supply. Each piece embodies the potential for hidden riches, making them a treasure trove for anyone keen on exploring the history and value of cryptocurrency.

The Value of Unredeemed Casascius Coins: A Hidden Treasure Trove

The allure of unredeemed Casascius coins lies in their potential value for collectors and crypto enthusiasts. With approximately 38,000 BTC, currently valued over $4 billion, still locked inside these coins, they represent a significant treasure trove within the crypto realm. Many people are not aware that these physical coins, minted between 2011 and 2013, still safeguard a vast amount of cryptocurrency, making them highly coveted items in both crypto and numismatic circles. Each unpeeled coin is a portal to a hidden digital fortune, encapsulating the essence of tangible assets within a largely digital economy.

Collectors are particularly drawn to the rarity and history of Casascius coins, with each piece telling a story from Bitcoin’s inception. As the number of active Casascius units declines, the remaining coins only grow more valuable. The significance of the unclaimed Bitcoins hidden within these coins cannot be understated; they represent an intersection of art, technology, and finance, symbolizing a time when digital currency was just beginning to capture the imagination of the public. As the crypto landscape evolves, those unredeemed Casascius coins could transcend their physical form, becoming precious relics that encapsulate a pivotal moment in financial history.

How Casascius Coins Became Crypto Collectibles

Originating from Bitcoin’s formative years, Casascius coins were created by Mike Caldwell to bridge the gap between physical and digital currency. These coins were designed not just as currency but also as collectible pieces of art, featuring intricate designs and denominations ranging from 1 to 1,000 BTC. Over time, they have transitioned from mere tokens of value to highly sought-after collectibles, with some series particularly lauded for their rarity. This shift has attracted not only Bitcoin investors but also collectors who appreciate the historical importance of these physical bitcoins.

Their appeal lies in their dual functionality; they serve as both a medium of exchange and a collector’s item. As Bitcoin continues to rise in popularity and value, every Casascius coin still in circulation becomes a unique artifact, preserving a moment in time when Bitcoin was not just a virtual currency but a nascent movement that promised to revolutionize finance. The dynamic nature of collectibles means that, as the available supply of Casascius coins decreases, their value is likely to appreciate further, making them enticing assets for those looking to invest in crypto history.

The Fight Against Time: Redemptions of Casascius Coins

As interest in Bitcoin surges, more collectors are beginning to redeem their Casascius coins. The redemption process reveals the hidden BTC inside, allowing owners to unlock their digital treasures. Since the first redeemed coins earlier this month, the rate of redemption appears to fluctuate, with some collectors eager to peel back the protective seal while others hold onto them as an investment strategy. This behavior creates a fascinating contrast within the crypto community—the balance between immediate gratification through redemption and the long-term strategy of withholding coins for potential appreciation.

The stories behind each redemption often resonate with nostalgia for the early days of Bitcoin. Each peeled coin signifies a transaction that connects the present with the past, infusing the act with both personal and cultural significance. As of October 2025, only 17,746 of the original Casascius coins remain unredeemed, which accentuates the sense of urgency for those who possess these tangible embodiments of BTC. Consequently, market dynamics will likely shift as more coins are redeemed, increasing the tangible supply of bitcoins available while intriguing those who perceive Casascius coins as an integral piece of Bitcoin history.

Unclaimed BTC: The Enigmatic Future of Casascius Coins

While much of the world increasingly embraces the digital nature of Bitcoin, thousands of unclaimed BTC locked within Casascius coins remain a mystery. The large quantity—38,000 BTC—is a staggering sum that has many theorizing about the fate of those coins. Are they lost forever, tucked away in forgotten drawers, or held deliberately by individuals who believe their value will soar? The speculation surrounding unclaimed Casascius coins contributes to their allure and mystique, especially as awareness spreads regarding the potential wealth hidden within these simple-looking brass or silver artifacts.

The future of these collectibles depends on a myriad of factors, including the broader acceptance of cryptocurrencies and the fluctuating market valuations of BTC. As people grow more aware and interested in the historical significance of Casascius coins, there could be a resurgence of interest, prompting holders to redeem their coins. Whether they choose to redeem now or wait, the fate of these unclaimed coins will continue to spark curiosity among collectors and investors, all eager to unlock the latent value layered beneath the protected surface of their elegant designs.

Understanding the Market Dynamics of Casascius Coins

The market dynamics surrounding Casascius coins are deeply influenced by their rarity and historical significance. Since production ceased in 2013, the number of available coins has continuously decreased, thereby elevating their value. This scarcity model mirrors traditional collectibles and establishes a structural value that resonates with investors. As the world becomes more aware of the potential that these physical bitcoins hold, both in terms of their redeemable BTC and as collectible items, we can expect increasing activity in the resale and redemption markets.

In recent years, sales of Casascius coins at auctions have fetched impressive sums, showcasing the willingness of collectors to invest in these rare items. The vibrant secondary market not only reflects a growing community of enthusiasts but also indicates shifting perceptions around the value of physical bitcoins. As each transaction unfolds, the narrative around Casascius coins continues to evolve, reinforcing their place in the annals of Bitcoin history while also presenting fresh opportunities for those looking to enter the market.

The Rarity and Redemption Rates of Casascius Coins

The rarity of specific Casascius coins significantly impacts their redemption rates, with certain denominations seeing higher activity than others. For instance, Series 1 and 100 BTC bars far exceed the average redemption rates, indicating a high demand for these coveted items. This pattern suggests that collectors prioritize securing historically significant coins, resulting in an interesting trend where less common coins maintain a higher retained value due to lesser redemption rates. This interplay between rarity and redemption creates a unique dynamic within the Casascius coin market.

As collectors seek to complete their sets or simply add valuable items to their portfolios, the redemption of more coins is likely to surge. Interestingly, while collectors may be eager to redeem coins like the 100 BTC bars, others remain static, keeping their treasures sealed as a testament to Bitcoin’s explosive growth potential. The contrasting motivations of immediate vs. long-term investment highlight a nuanced understanding of Casascius coins that blends financial acumen with an appreciation for cryptocurrency history.

Casascius Coins: A Timeline of Redemption and Value

The timeline of Casascius coin redemptions paints an intriguing picture. Since their introduction, these coins have slowly shifted from being collector’s items to active payment methods and then back to their current status as iconic pieces of Bitcoin’s legacy. Initially, redemption rates were vigorous, particularly between 2012 and 2014, as early adopters were keen to unlock their hidden BTC. However, as time progressed, the rate of redemptions slowed, marking a transition in how owners perceive the value of their coins, with many opting to retain them for potential future gains.

As we approach the end of 2025, the landscape of Casascius coins continues to evolve. With over 10,000 units redeemed, the current number of active coins drops to just 17,746. This record serves as a crucial indicator for both collectors and investors, enabling them to gauge market sentiment. While some coins remain untouched, the increasing visibility and demand for these pieces of bitcoin history hint at a future where more will be redeemed, thereby influencing both the market value of the remaining coins and the overall perception of Bitcoin as a collectable asset.

Why Casascius Coins are Not Just Collector’s Items

Although widely recognized as collector’s items, Casascius coins carry value beyond just their physical form. Each coin encapsulates real Bitcoin under its holographic surface, making them not just artifacts but tangible representations of digital currency. This duality adds a layer of significance that appeals not only to collectors but also to investors seeking to diversify their portfolios. As more people become aware of the underlying Bitcoin secured by these coins, the demand and interest in Casascius coins will likely rise, further enhancing their profile in both the collector and investment markets.

Furthermore, the limited availability of these coins adds to their allure as a unique investment vehicle. Unlike standard cryptocurrencies, which can be traded endlessly, the finite number of Casascius coins creates a sense of urgency among collectors and investors alike. As Bitcoin’s acceptance grows, the potential for these coins to appreciate in value will likely attract new participants eager to possess a piece of cryptocurrency history. This combination of collectibility and investment potential ensures that Casascius coins remain relevant in both historical and modern discussions surrounding Bitcoin.

Navigating the Future of Casascius Coin Ownership

As we look ahead, the future of Casascius coin ownership appears intriguing. With approximately 38,000 BTC still unclaimed, strategies around ownership and redemption will evolve as market conditions fluctuate. Potential holders face choices: to redeem their coins for immediate access to Bitcoin or to preserve their collectibles as potential assets for future appreciation. This blend of tangible and digital assets creates a complex scenario for owners, balancing immediate financial needs against the allure of long-term investment.

Moreover, as the market for cryptocurrencies continues to mature, the role of Casascius coins may evolve, with potential resurgence in interest leading to renewed activity in the redemption space. This shift could see more owners opting to peel back their protective seals, ultimately impacting the total supply of active coins in circulation. As the crypto landscape evolves, the dynamic around Casascius coins will remain pivotal in understanding the interplay between tangible collectibles and digital currencies, shaping the history of Bitcoin as we know it.

Frequently Asked Questions

What are Casascius coins and why are they valuable?

Casascius coins are physical bitcoins minted from 2011 to 2013, each encapsulating real bitcoin secured under a tamper-evident hologram. Their value lies not only in their metal composition but also in the bitcoin they hold, making them both collectibles and potential vaults for BTC.

How many unredeemed Casascius coins are still in circulation?

As of late 2025, approximately 17,746 active Casascius coins remain unredeemed, guarding over 38,000 BTC, which is valued at more than $4 billion.

What is the significance of unredeemed Casascius coins?

Unredeemed Casascius coins signify untapped bitcoin value, with many collectors holding onto these physical bitcoins as a speculative investment or a nostalgic piece of cryptocurrency history.

What percentage of Casascius coins have been redeemed?

As of October 2025, around 10,193 Casascius coins have been redeemed, which is about 36.5% of the total minted, unveiling over 53,000 BTC in the process.

Why did production of Casascius coins stop?

Casascius coin production halted in 2013 due to regulatory scrutiny from U.S. authorities regarding money transmission laws, which limited the ability to mint and distribute these physical bitcoins.

What types of Casascius coins exist?

There are several types of Casascius coins, including denominations of 1, 10, 25, 100, 500, and rare 1,000 BTC pieces. The most common are the 1 BTC brass tokens, while the 100 BTC bars are highly sought after by collectors.

How can I tell if a Casascius coin is unredeemed?

To check if a Casascius coin is unredeemed, one can look for the holographic seal and verify its private key through blockchain explorers or Casascius coin tracking websites.

What is the current Casascius bitcoin value?

The current value of unredeemed Casascius coins is tied to the bitcoin market; as of October 2025, the total value of the bitcoin inside unredeemed Casascius coins exceeds $4 billion.

Are there any rare Casascius coins with higher bitcoin value?

Yes, some rare Casascius coins, like the 500 BTC bar and the limited-edition silver coins from Series 3, are considered highly valuable due to their scarcity and the amount of bitcoin they contain.

How do I acquire Casascius coins?

Acquiring Casascius coins can be done through cryptocurrency auctions, online marketplaces, or through private sales among collectors, but it’s essential to verify their authenticity and redemption status.

| Key Point | Details |

|---|---|

| Total Casascius Coins | 17,746 active coins still unredeemed. |

| Total BTC Secured | 38,051 BTC worth over $4 billion remain sealed. |

| Redeemed Coins | 10,193 coins redeemed, revealing over 53,213 BTC. |

| Production History | Minted between 2011-2013; production ceased due to regulatory scrutiny. |

| Redemption Trends | Redemption peaked between 2012-2014; slows in recent years. |

| Value of Redeemed BTC | Total value of redeemed BTC exceeds $5 billion. |

Summary

Casascius coins have maintained immense intrigue in the cryptocurrency world, being a unique bridge between tangible collectibles and digital currency. With over 38,000 BTC still locked away in active Casascius coins, the allure of these physical bitcoins continues to captivate collectors and investors alike, reflecting both historical significance and potential future value. As awareness and interest in these coins grow, their legacy as physical embodiments of bitcoin’s early days remains firmly intact.