Crypto liquidity has become a pivotal topic as the market grapples with significant changes, particularly following the recent stablecoin reduction. As approximately $840 million has evaporated from the fiat-pegged token sector since mid-November, liquidity challenges have surfaced, casting a shadow over the crypto trading volume. This contraction not only impacts market cap drops but also exacerbates the existing volatility in crypto, leaving traders wondering about the sustainability of their investments. With order books resembling ghost towns, the delicate balance of liquidity has become increasingly crucial for maintaining a stable trading environment. As the market continues to navigate through these complexities, understanding crypto liquidity becomes essential for anyone involved in digital assets.

In the realm of digital currencies, the availability of liquid assets—often termed trading liquidity—has taken center stage during recent market corrections. The diminishing supply of stable-value coins has prompted a deeper examination of the trading ecosystem, where shrinking market caps and subdued trading volumes intertwine. Amidst this backdrop, investors face heightened liquidity challenges that could affect their trading strategies and risk management. Coupled with the ongoing fluctuations, trading liquidity’s stability is questionable and demands careful attention from market participants. As we explore the intricacies of trade liquidity, the potential impacts on price movements and investor confidence warrant thorough analysis.

Understanding Crypto Liquidity Dynamics

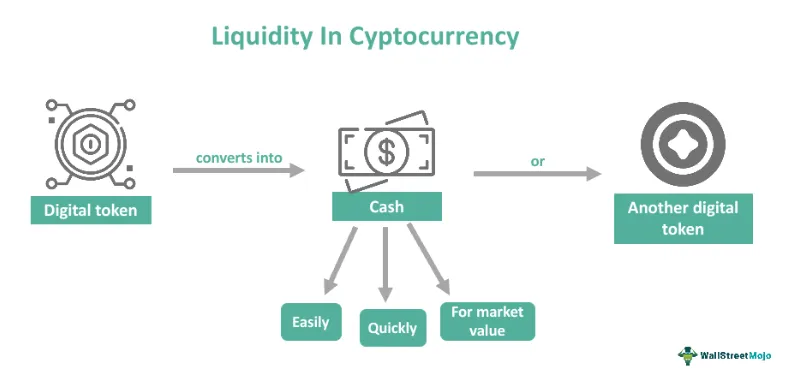

Crypto liquidity refers to the ease with which assets can be bought or sold in the market without affecting their price. As seen recently, the liquidity situation in the crypto market has become increasingly precarious, particularly due to the crippling reduction in stablecoin supply. With a drop of approximately $840 million from the stablecoin market since November 15, market participants are facing heightened uncertainty. This lack of liquidity poses challenges for traders who rely on quick executions and robust order books to maintain their strategies.

In addition to the diminishing stablecoin reserves, the overall trading volume has drastically declined over the past few weeks. This shrinkage ultimately means that buyer and seller activity dwindles, leading to thinner order books and an increase in price volatility. As liquidity dwindles, it becomes more challenging to execute trades without experiencing significant price impact, making the environment increasingly risky for crypto investors.

Frequently Asked Questions

What impact does stablecoin reduction have on crypto liquidity?

Stablecoin reduction contributes significantly to declining crypto liquidity by depleting the available capital that traders can use. As the supply of stablecoins contracts, market participants have fewer options to engage in trades, leading to reduced trading volume and fragile liquidity conditions.

How does a drop in crypto trading volume affect liquidity challenges?

When crypto trading volume diminishes, it exacerbates liquidity challenges because lower activity results in thinner order books. Consequently, even minor sell-offs can trigger large price movements, heightening overall market volatility and creating an unstable trading environment.

What do market cap drops signify for crypto liquidity?

Market cap drops in stablecoins indicate a reduction in overall liquidity within the crypto market. As the market cap of major stablecoins diminishes, it leads to less capital in circulation, resulting in an environment where liquidity is strained and price stability is compromised.

What is the relationship between volatility in crypto and liquidity?

Volatility in crypto markets often rises in environments of low liquidity. When liquidity is fragile, small trades can lead to significant price fluctuations, amplifying market volatility and creating increased risk for traders.

Can we expect crypto liquidity to improve in the future?

Historically, periods of reduced liquidity do not last indefinitely. As capital influx resumes and stablecoins regain their footing, crypto liquidity often improves, helping to stabilize trading conditions and reduce volatility.

| Key Point | Details |

|---|---|

| Stablecoin Decline | $840 million has drained from the stablecoin market since Nov. 15, 2023. |

| Impact on Liquidity | The decline in trading activity and stablecoin supply has created a fragile liquidity environment. |

| Market Cap Losses | Stablecoins like Tether USDT and Ethena USDe have seen significant market cap reductions recently. |

| Low Trading Volume | Order books are sparse, leading to increased price volatility with little selling pressure. |

| Future Outlook | Market liquidity may improve as capital returns, but currently remains precarious. |

Summary

Crypto liquidity has come under pressure due to a combination of reduced stablecoin supplies and decreased trading volumes. This current environment has led to a fragile liquidity situation, where minimal selling can trigger significant market reactions. As the year-end holidays approach, trading activity may remain subdued. However, history suggests that liquidity can rebound as market conditions stabilize and capital flows resume.