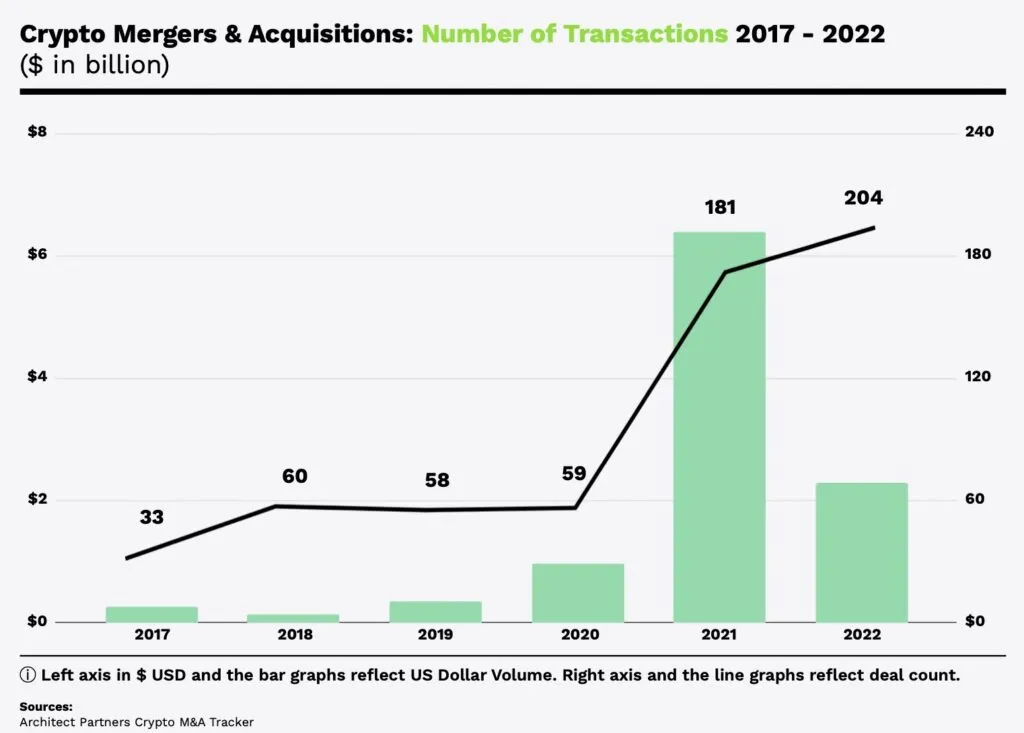

Crypto mergers and acquisitions (M&A) have recently surged, marking a significant milestone as the sector topped $10 billion in deal value during the third quarter. This phenomenal growth, exceeding thirty times last year’s figures, highlights a pivotal shift in the crypto landscape, showcasing its evolution from nimble startups to formidable forces within the financial sector. Major players like Ripple and Coinbase are not only leading the charge with billion-dollar buyouts but also illustrating the rising trend towards blockchain acquisitions that promise expanded market dominance. As traditional financial institutions, including Goldman Sachs and Citigroup, begin to eye these developments, crypto investment opportunities will become even more attractive, driving further consolidation in the market. With the easing of regulations, analysts predict that this crypto M&A boom is just the beginning, setting the stage for more mergers as companies scramble to secure their positions in the burgeoning space.

In the dynamic world of digital currencies, the wave of strategic acquisitions and mergers has taken center stage, solidifying the industry’s foothold within mainstream finance. This phenomenon of consolidating resources and expertise is indicative of a broad trend in financial sector consolidation, where established blockchain entities leverage their assets to gain competitive advantages. With the evolving landscape, companies are also identifying new crypto market trends that foster substantial paths for collaboration and growth. Terms like ‘digital asset consolidations’ and ‘financial technology partnerships’ have become commonplace, as firms navigate complex investment opportunities while adapting to regulatory frameworks. As the digital marketplace evolves, the importance of understanding and participating in these high-stakes moves cannot be overstated.

Understanding Crypto Mergers and Acquisitions

In the ever-evolving landscape of finance, crypto mergers and acquisitions (M&A) have emerged as a significant trend. The recent surge to over $10 billion in crypto deal-making, highlighted by major acquisitions from firms like Falconx and Ripple, marks a pivotal moment in the industry’s development. This influx of capital and activity signifies a shift from a primarily innovative startup sector to a landscape populated by well-established financial entities eager to expand their portfolios through blockchain acquisitions.

This trend underscores the competitive nature of the crypto market, with companies racing to secure vital market share. As traditional financial institutions like Goldman Sachs and Citigroup express interest in the crypto space, the urgency for crypto firms to consolidate and innovate has never been more pressing. As firms pursue aggressive growth strategies, the implications for investors and the broader financial sector could be profound, hinting towards a future where the lines between traditional and digital finance become increasingly blurred.

Crypto Market Trends Influencing M&A Activity

The landscape of the crypto market is dynamic, with various trends shaping its trajectory. A key trend driving M&A activity is the ongoing regulatory changes. The recent easing of restrictions under U.S. policy begins to create a conducive environment for consolidation. Financial institutions observe growing compliance frameworks, motivating firms to establish themselves firmly before larger entities dominate the market. Such regulatory clarity is paramount, as it allows crypto firms to confidently pursue partnerships and acquisitions without the looming uncertainty that has characterized the sector in past years.

Additionally, the advancements in blockchain technology play a vital role in this consolidation phase. Companies are not merely looking for financial growth but are also focused on enhancing their technological capabilities. By merging with or acquiring firms that possess superior technology or market knowledge, crypto entities can position themselves strategically in an increasingly competitive landscape. This cycle of innovation and acquisition is indicative of a broader trend toward maturity within the crypto market that could ultimately redefine investment opportunities in the space.

The Role of Consolidation in the Financial Sector

Consolidation in the financial sector is not just a sign of growth; it is a necessity for survival as competition intensifies in the crypto space. As firms seek to enhance their significance within the financial ecosystem, mergers and acquisitions offer a valuable pathway to both market expansion and innovative advancements. This strategic maneuvering is vital as firms attempt to preemptively buff up against the expected influx of traditional financial institutions encroaching into the crypto realm.

Moreover, the consolidation process facilitates resource sharing, synergistic partnerships, and improved efficiencies that can translate into better services for consumers and investors. The ongoing M&A activity indicates a transformation where blockchain and crypto firms are establishing broader financial networks, paving the way for new standards and practices in digital asset management. Such transformations, propelled by strategic mergers, will inevitably enhance market stability and confidence among stakeholders in the financial sector.

Impact of Large-Scale Mergers on Crypto Investment Opportunities

Large-scale mergers in the crypto industry are redefining investment opportunities for both institutional and retail investors. As major players like Coinbase and Ripple solidify their market standing through significant acquisitions, investors are presented with a unique landscape of diverse investment options. This consolidation can serve to bolster investor confidence, as larger firms are generally perceived to have more resources and better risk management strategies.

Furthermore, the influx of capital associated with these mega deals signals to investors a bullish sentiment in the crypto market. The resulting growth from these acquisitions generates new products and services that expand the overall market, offering innovative investment opportunities. As firms become more sophisticated and competitive, they are likely to create more appealing financial instruments that align with the evolving needs of investors, thereby increasing the allure of crypto investments.

Key Players Driving Crypto M&A Trends

Several key players have emerged in the crypto M&A landscape, leading the charge into this burgeoning market. Companies such as Falconx and Coinbase not only highlight the significant financial influx but also set the stage for others by proving that successful expansion is attainable through strategic acquisitions. These players are actively reshaping the market, showcasing their eagerness to invest in promising platforms while signaling to other firms the viability of similar strategies.

In addition, the actions of these influential companies may inspire competitor activity, resulting in a ripple effect across the sector. The success of high-profile mergers attracts attention from potential investors and partners, creating a robust ecosystem where collaboration can thrive. As financial institutions watch closely, the resulting atmosphere is one ripe for innovation, setting the groundwork for an exciting era of development within the crypto ecosystem.

Future Outlook for Crypto M&A Activity

Looking ahead, the future of crypto M&A activity appears robust, with analysts forecasting continued growth and a wave of new transactions. As companies jockey for position in a rapidly evolving market, the need for strategic alliances will drive further consolidation. This proactive approach allows crypto firms to optimize their operations in anticipation of emerging technologies and changing regulatory landscapes, ensuring they remain competitive against traditional financial giants.

Moreover, as the sector matures, it’s likely that crypto M&A will become increasingly focused on niche markets within the blockchain space, leading to tailored solutions and specialized services that cater to specific investor needs. This evolution highlights the growing complexity of the market and suggests that savvy investors should keep a close watch on M&A developments, as these will be pivotal in shaping future investment opportunities and trends within the crypto finance sector.

Navigating Risks in Crypto Investments Amid M&A Buzz

Despite the exciting advancements in crypto mergers and acquisitions, it’s crucial for investors to navigate potential risks. The rapid pace of consolidation can introduce volatility, and while mergers can signal growth, they can also lead to unexpected challenges like culture clashes and operational integration issues. Being aware of these risks helps investors make informed decisions and mitigate potential losses associated with unstable post-merger transitions.

Additionally, scrutinizing the motivations behind mergers can reveal essential insights into the future performance of the combined entities. Investors should assess each company’s history, market position, and strategic objectives to gauge the long-term viability of any investment opportunities stemming from M&A activity. Understanding the dynamics of these mergers within the context of the rapidly changing crypto market will be key to capitalizing on emerging trends and making wise investment choices.

Evaluating the Long-Term Benefits of Crypto M&A

As crypto mergers and acquisitions proliferate, investors and market analysts are increasingly evaluating the long-term benefits these deals may bring. The potential for enhanced economies of scale and synergies can create a more resilient and competitive market environment. Such consolidation efforts often foster innovation and technological advancements that improve overall efficiency, leading to more effective solutions for consumers.

In the longer term, successful mergers can lead to increased market stability, reduced competition among smaller players, and a more considerable alignment with traditional financial practices. As companies grow and evolve through M&A, they are likely to explore even more advanced blockchain solutions, potentially driving the sector towards greater mainstream acceptance. By focusing on the value brought about by these powerful partnerships, stakeholders can anticipate a brighter future for the crypto market.

Identifying Opportunities in Blockchain Acquisitions

Blockchain acquisitions are rapidly becoming a focal point for investment opportunities in the crypto realm. As firms identify promising blockchain technologies, strategic acquisitions not only broaden the companies’ capabilities but also fuel industry-wide innovation. Investors keen on maximizing their portfolios should closely monitor companies that are actively participating in blockchain acquisitions, as these moves can indicate a strong commitment to future growth and technological advancement.

Furthermore, investing in firms that engage in blockchain acquisitions often provides a gateway to unique technologies that can disrupt traditional markets. As these technologies gain traction, firms that are proactive in their acquisition strategies may reap significant rewards, positioning themselves as frontrunners in the fast-evolving landscape of digital finance. Identifying these opportunities early can be a game-changer for savvy investors committed to navigating the complexities of the crypto market.

Frequently Asked Questions

What impact do crypto mergers and acquisitions have on crypto market trends?

Crypto mergers and acquisitions significantly influence crypto market trends by accelerating consolidation and enhancing competitiveness among firms. As companies like Ripple and Coinbase make strategic acquisitions, they can capture larger market shares and drive innovation in blockchain technology, thus shaping the overall direction of the crypto market.

How are blockchain acquisitions changing the landscape of the crypto industry?

Blockchain acquisitions are transforming the crypto industry by allowing established players to integrate new technologies and talent. This consolidation leads to the creation of more robust platforms and services, ultimately improving user experience and expanding development capabilities within the crypto ecosystem.

What are the key factors driving the growth of crypto investment opportunities through M&A?

The growth of crypto investment opportunities through M&A is driven by regulatory easing, heightened interest from traditional finance, and the need for crypto firms to scale quickly. As major players like Goldman Sachs enter the crypto space, M&As enable firms to broaden their service offerings and enhance market position.

What role do financial sector consolidation trends play in crypto mergers and acquisitions?

Financial sector consolidation trends play a crucial role in crypto mergers and acquisitions by increasing competition and the pressure to innovate. As traditional financial institutions merge or acquire crypto firms, the landscape shifts, prompting existing crypto companies to pursue M&As to strengthen their foothold in the evolving financial ecosystem.

How can I assess the potential of crypto mergers and acquisitions for investment decisions?

To assess the potential of crypto mergers and acquisitions for investment decisions, consider factors such as the financial health of the companies involved, potential synergies from the merger, and the overall trends in the crypto market. Analyzing past M&A activity and its outcomes can also provide insights into likely future performance and growth opportunities.

What are the emerging trends in crypto M&A to watch in the coming years?

Emerging trends in crypto M&A to watch include an increase in cross-sector collaborations with traditional finance, strategic partnerships focusing on innovative blockchain solutions, and an upsurge in regulatory-driven mergers as firms aim to align with compliance standards while enhancing market presence.

| Key Point | Details |

|---|---|

| Record Growth in Crypto M&A | Crypto mergers and acquisitions reached over $10 billion in Q3 2025, marking a thirty-fold increase from the previous year. |

| Major Deals in the Sector | Significant transactions included Falconx’s acquisition of 21shares, Ripple’s $2 billion purchase of GTreasury, and Coinbase’s $2.9 billion buyout of Deribit. |

| Regulatory Impact | Easing regulations under President Trump have facilitated this surge in crypto M&A. |

| Traditional Financial Firms’ Interest | Companies like Goldman Sachs and Citigroup are showing interest in the crypto space as consolidation increases. |

| Future Expectations | Analysts anticipate further large-scale mergers as crypto firms aim to compete with traditional finance before opportunities diminish. |

Summary

Crypto mergers and acquisitions are redefining the financial landscape as the sector moves from niche startups to significant market players, evidenced by the recent surge exceeding $10 billion. The current climate, characterized by favorable regulatory conditions and a keen interest from traditional financial giants, presents an unprecedented opportunity for growth in the crypto M&A space.