Dappradar shutdown marks a significant shift in the Web3 analytics landscape, as the platform’s seven-year journey comes to an abrupt end due to financial challenges. Known for its comprehensive tracking of decentralized applications (dapps) and engaging wealth of data, Dappradar has been an essential resource for developers and users alike. Unfortunately, the RADAR token decline, which saw a 32% drop in value following the announcement, signals the broader instability impacting the decentralized finance (DeFi) space. As the community grapples with the implications of this shutdown, many are left searching for Dapp tracking alternatives to fill the void left behind. This development has sparked conversations around the need for sustainable analytics within the rapidly evolving Web3 market, underscoring the importance of accessible data to navigate these unique ecosystems.

The recent announcement of Dappradar’s cessation of operations highlights a critical juncture for data analytics within the blockchain space. As a pioneering entity in dapp analysis, it has paved the way for insights into decentralized ecosystems, yet its closure raises questions about the future of Web3 metrics. The decline of the RADAR token is emblematic of the challenges facing many projects in the decentralized finance sector as they strive for viability. Looking ahead, stakeholders are keenly interested in identifying other platforms that can serve similar functions, as reliance on robust analytics continues to be paramount. The need for reliable tools to monitor and understand blockchain activities has never been more pressing, signaling potential opportunities for emerging competitors in this competitive landscape.

Dappradar Shutdown: Impact on Web3 Analytics Market

The announcement of Dappradar’s impending shutdown marks a significant turning point in the evolving landscape of Web3 analytics. For the past seven years, Dappradar has been a pioneering platform that provided critical insights into decentralized applications (dapps) and blockchain trends. Now, as the platform ceases operations, its absence will be felt not only by users who relied on its comprehensive data tracking but also by the broader cryptocurrency ecosystem that depended on Dappradar for its analytical rigor. The shift in market dynamics, compounded by Dappradar’s financial challenges, reflects a growing need for sustainability in the Web3 space.

As the decentralized finance (DeFi) sector grapples with uncertainty, the void left by Dappradar highlights the importance of analytical tools. Developers and researchers who depended on Dappradar’s extensive database for dapp monitoring and blockchain analytics will need to pivot towards alternative platforms. The shutdown serves as a reminder of the volatility within the cryptocurrency market and the necessity for efficient management in analytics to adapt to rapid changes. Consequently, users may seek viable substitutes that can provide similar insights, ensuring they stay informed about the latest developments in Web3.

Exploring Dapp Tracking Alternatives Post-Dappradar

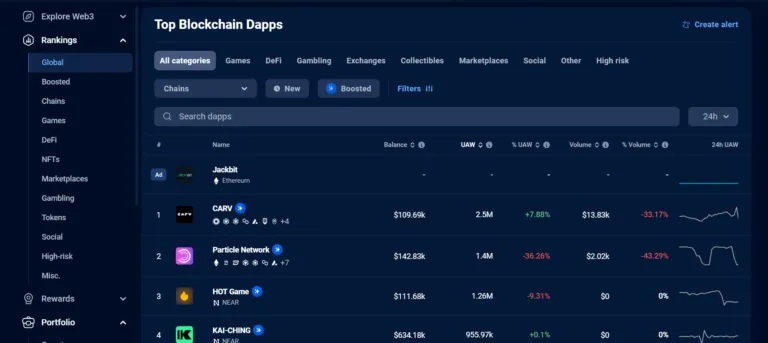

With Dappradar’s closure, the search for effective dapp tracking alternatives becomes increasingly urgent for those invested in the decentralized ecosystem. Platforms like Defillama, Dune Analytics, and Token Terminal are stepping in to fill the gap left by Dappradar, offering various analytics and tracking tools that cater to the needs of developers and investors alike. Each of these alternatives provides unique features and capabilities, which may appeal to users depending on their specific requirements in analyzing decentralized applications.

For instance, Dune Analytics allows users to create their dashboards, harnessing community-generated data to provide tailored insights. Meanwhile, Defillama focuses on comprehensive DeFi analytics, making it a perfect choice for users interested in tracking yield farming and liquidity. As users transition to these alternatives, it’s imperative that they take advantage of these tools to navigate the complexities of decentralized finance and blockchain technology effectively. The market’s resilience and continuing growth potential hinge on the availability of robust analytics platforms to support informed decision-making in the Web3 landscape.

The Decline of RADAR Token Amidst Dappradar’s Shutdown

In the wake of Dappradar’s announcement, the RADAR token saw a staggering decline of 32%, marking a significant downturn for holders and investors. The price plummet reflects the broader instability within the crypto market, as many tokens are experiencing high volatility in response to news events. The uncertainty surrounding Dappradar’s future operations inevitably impacted RADAR’s market performance, indicating that even the tokens associated with a once-popular platform are vulnerable to broader market shifts and internal operational challenges. Investors must remain vigilant and strategic in positioning within the market.

The RADAR token’s significant drop highlights the risks involved in the decentralized finance space, where market sentiments can change rapidly based on operational updates from key players like Dappradar. This decline not only jeopardizes current investments but also raises questions about the future of tokens associated with analytical platforms. As the market seeks alternatives to Dappradar for their analytical needs, RADAR’s fate remains uncertain, prompting discussions on the sustainability of such tokens going forward. Overall, this event acts as a cautionary tale for potential investors eyeing the Web3 market.

The Future of Web3 Analytics Without Dappradar

As Dappradar winds down, the future of Web3 analytics appears to be at a crossroads. While the shutdown of such an integral platform may introduce temporary disruption for users and developers, it also opens the door for innovation and the emergence of new analytical services. There is a palpable demand for robust analytics tools in the Web3 space, particularly tools that can facilitate better understanding and adoption of decentralized finance and dapps. The expectation is that alternative platforms will rise to the occasion, aiming to fulfill the gaps left by Dappradar and potentially offer even more refined and user-centric services.

Moreover, the closure of Dappradar underlines the urgent need for organizations within the Web3 ecosystem to consider sustainability and scalability in their business models. New platforms that develop will need to learn from Dappradar’s experience, ensuring that they establish financial resilience in an unpredictable market. Long-term success will depend on their ability to attract users by providing reliable, accessible, and insightful analytics services that can adapt to the ever-evolving cryptocurrency landscape. The future of Web3 will rely heavily on such platforms to drive analysis and understanding within the decentralized application ecosystem.

Navigating the Shift in DeFi Ecosystem Post-Dappradar

The shutdown of Dappradar serves as a significant indicator of the shifting dynamics within the decentralized finance (DeFi) ecosystem. As one of the primary sources of data for dapps across multiple blockchains, Dappradar’s closure forces stakeholders—ranging from developers and investors to casual users—to reassess their available resources and tools. This transitional phase could see a rise in innovation as new solutions vie for attention in a market ripe for disruption. Developers might embolden themselves to create platforms that offer more scalable, efficient, and user-friendly analytics tailored to the rapidly evolving demands of the DeFi sector.

Additionally, the ongoing turbulence in the DeFi landscape propels a greater emphasis on transparency and effectiveness within analytics tools. Stakeholders understand the critical role that seamless access to data plays in decision-making processes, particularly as the market witnesses heightened scrutiny and regulatory pressures. Projects that can provide accurate, timely insights into dapps and their performance will not only fill the gap left by Dappradar but will also likely pioneer new methodologies and features that enhance the user experience in Web3 analytics, thus reshaping the future of decentralized financial services.

Impact of Dappradar’s Exit on the DeFi Community

Dappradar’s impending closure is sending shockwaves throughout the DeFi community, as the platform has long been regarded as an essential resource for insights into decentralized applications. The loss of a centralized hub for tracking dapp performance can not only result in operational challenges for developers but also impede broader efforts to educate new users about the DeFi landscape. With millions relying on Dappradar for critical data, its exit poses a considerable setback for community-driven projects that thrive on accessibility and transparency.

This sudden void could also hinder the momentum behind new DeFi initiatives, as investors and developers may find it harder to access reliable tracking and analytics tools. However, in the face of such adversity, the community might rally to support emerging platforms designed to fill the gap, possibly aiming to promote greater collaboration and shared insights among projects. In this way, Dappradar’s exit could catalyze a renaissance of decentralized analytics tools and community-driven initiatives that prioritize effective onboarding and knowledge sharing, ultimately leading to a more robust DeFi ecosystem.

The Role of Community in Post-Dappradar Analytics

As Dappradar shifts to wind down its services, the role of the community in shaping the future of Web3 analytics becomes more pronounced. Community engagement will be crucial for identifying the analytics needs and expectations of users who are accustomed to Dappradar’s offerings. Developers and potential new analytics platforms must actively seek feedback from the community to build solutions that truly resonate with users. This collaborative approach fosters a robust environment for creating innovative tools tailored to the practical requirements of the DeFi landscape.

Furthermore, the community can leverage insight-sharing and collaborative initiatives to develop decentralized platforms that emphasize openness and transparency. Initiatives such as community-driven analytics projects can establish baselines for accuracy and accessibility, ensuring that new systems meet the standards previously set by Dappradar. As Web3 continues to evolve, understanding user needs will enable the creation of analytics solutions that not only fill Dappradar’s void but also improve upon the former systems, enhancing the overall user experience in the decentralized finance realm.

Lessons Learned from Dappradar’s Journey

Dappradar’s journey, from its founding as a promising analytics platform to its eventual shutdown, provides valuable lessons for future Web3 projects. A key takeaway is the critical importance of robust financial management and sustainability. While the platform gained prominence during the early days of the dapp revolution, sustaining growth in an ever-evolving market requires careful planning and adaptability. Projects aspiring to thrive in the decentralized landscape must prioritize long-term viability over fleeting success to avoid similar fates.

Additionally, Dappradar’s experience underscores the changing tides in decentralized finance and the need for continuous development and innovation. As user needs evolve, platforms must remain agile, ready to respond to market shifts and demands. Dappradar’s reliance on market trends emphasizes the necessity for analytics solutions to embrace flexibility and enhance their offerings based on user feedback and technological advancements. Thus, future projects can derive essential insights from Dappradar’s story to pave their paths toward success in the ever-changing environment of Web3 and DeFi.

Frequently Asked Questions

What are the reasons behind the Dappradar shutdown?

Dappradar announced its shutdown due to financial challenges and sustaining operations at its current scale amid shifting market conditions. The platform, which provided vital Web3 analytics, concluded that it had become financially unsustainable.

How will the Dappradar shutdown affect the tracking of decentralized applications (dapps)?

As part of its shutdown process, Dappradar will cease tracking dapps and associated blockchains worldwide, halting the Web3 analytics it provided for over 12,000 dapps across various networks.

What does the RADAR token decline mean for investors?

Following the Dappradar shutdown announcement, the RADAR token experienced a steep decline of over 32%. Investors should await further updates regarding the token’s future and the DAO decisions, which will be communicated through community channels.

Are there any alternatives to Dappradar for decentralized finance analytics?

Yes, there are several alternatives to Dappradar for tracking decentralized applications, including Defillama, Token Terminal, Dune Analytics, and Artemis Terminal, which can serve as replacement platforms for Web3 analytics.

What will happen to Dappradar’s dapp tracking data after the shutdown?

Once Dappradar shuts down, its dapp tracking data will no longer be available, impacting developers and users who relied on this Web3 analytics platform for insights and monitoring decentralized finance (DeFi) activities.

How long has Dappradar been operational before its shutdown?

Dappradar operated for seven years before announcing its shutdown, marking its significant role in the evolution of tracking decentralized applications since 2018.

Will there be any communication regarding the Dappradar DAO after the shutdown?

Yes, the Dappradar team indicated that communications regarding the DAO and potential future developments related to the RADAR token will be provided separately through community channels.

What impact did the Dappradar shutdown announcement have on the broader crypto market?

The announcement of Dappradar’s shutdown coincided with a decline in the broader crypto market, where BTC also faced significant drops, indicating a challenging market environment for all cryptocurrency assets.

| Key Points | Details |

|---|---|

| Dappradar Shutdown Announcement | Dappradar, a platform for tracking dapps, is shutting down after seven years due to financial unsustainability. |

| Operational History | Founded in 2018, Dappradar tracked more than 12,000 dapps across over 50 blockchains and became a key analytics resource for developers and users. |

| Market Context | The announcement comes amidst a decline in the crypto market, with Bitcoin prices dropping significantly. |

| Impact on RADAR Token | Following the announcement, the RADAR token plummeted over 32%, indicating a loss of confidence among investors. |

| Future of Web3 Analytics | Dappradar’s founders hope that another organization will replace its role in providing Web3 analytics, acknowledging ongoing demand in the sector. |

Summary

The Dappradar shutdown marks a significant turning point in the Web3 landscape. After seven years of operation, Dappradar has ceased its functions due to financial challenges and an unsustainable business model. This news is particularly pertinent for users and developers who have depended on the platform for decentralized application analytics. As the cryptocurrency market continues to fluctuate, the hope remains that innovative solutions will emerge to fill the gap left by Dappradar’s exit.