In recent discussions surrounding Ethereum and stablecoin adoption, impactful research emerges from leading institutions, like Blackrock, which emphasizes Ethereum’s significant role in this rapidly evolving landscape. As the world’s largest asset manager, Blackrock notes that the surging adoption of stablecoins is not only transforming traditional financial frameworks but also positioning Ethereum as a vital digital infrastructure supporting this shift. The rise in stablecoin growth indicates a transition from mere speculative trading towards more practical applications, underscoring the demand for reliable and efficient digital assets. The report highlights institutional crypto trends, suggesting that assets issued on Ethereum considerably outnumber those on other blockchains, showcasing its dominance in the sector. Ultimately, Ethereum’s tokenization capabilities offer investors a unique opportunity to engage with a financial ecosystem that responds to real-world needs beyond the volatility associated with cryptocurrency speculation.

Recent evaluations of digital currencies highlight Ethereum’s growing importance alongside the increasing acceptance of stablecoins. Notably, prominent financial institutions, such as Blackrock, have positioned Ethereum at the forefront of this convergence, revealing how institutional crypto trends are reshaping the marketplace. The observed expansion in stablecoin utilization reflects a broader movement toward integrating blockchain assets into everyday transactions, further endorsing Ethereum as a foundational layer for digital finance. Moreover, the tokenization of various assets indicates a significant shift away from speculative trading activities, fostering a new environment for investors. This connection between Ethereum and stablecoin adoption not only redefines investment strategies but also aligns with the emerging themes of technological growth that are increasingly shaping our economic landscape.

The Rising Importance of Stablecoin Adoption

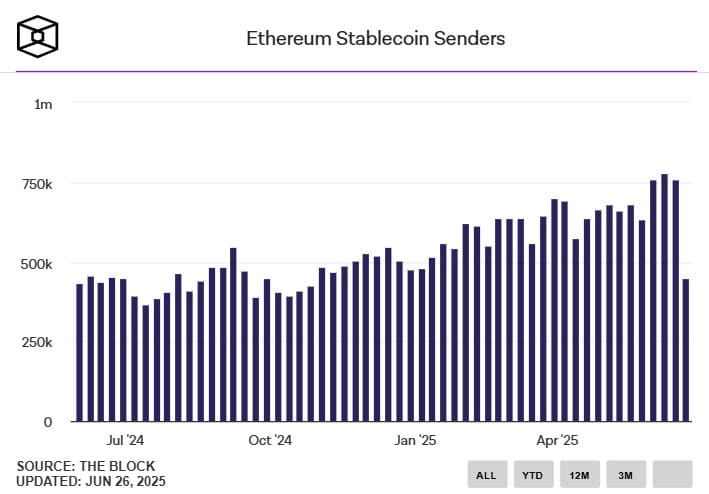

Stablecoins have emerged as a vital component in the evolution of the cryptocurrency market, with their adoption surging in recent years. These digital assets, which are pegged to stable currencies like the US dollar, have gained traction due to their ability to provide liquidity and facilitate transactions without the volatility associated with traditional cryptocurrencies. According to recent data, stablecoin transaction volumes have outpaced spot crypto trading, indicating a shift towards real-world financial applications. This shift underscores the importance of stablecoin acceptance as it bridges the gap between traditional finance and the blockchain ecosystem.

As institutional interest in stablecoins grows, so does their role as a facilitator for decentralized finance (DeFi) and other blockchain applications. By providing a reliable medium of exchange, stablecoins are increasingly being adopted for payments, remittances, and even as a means to access various DeFi protocols. The broader acceptance of these digital assets serves to enhance the utility of cryptocurrencies, transforming how financial transactions are conducted. This trend positions stablecoins as a foundational pillar of the cryptocurrency market, paving the way for increased legitimacy and integration within the financial system.

Frequently Asked Questions

How is Ethereum positioned to benefit from the growing adoption of stablecoins?

Ethereum is strategically positioned as a primary beneficiary of the rising adoption of stablecoins, according to recent findings by Blackrock. With over 65% of tokenized assets launched on its platform, Ethereum stands out as the leading blockchain for stablecoin transactions, facilitating real-world financial applications beyond mere speculative trading.

What trends in stablecoin growth are influencing Ethereum adoption?

The notable trends in stablecoin growth, such as skyrocketing transaction volumes and predictions of surpassing spot crypto trading activities by 2025, are indicative of a shift toward practical applications in financial markets. This growth solidifies Ethereum’s role not just as a trading asset but as foundational infrastructure for tokenization and on-chain finance.

How does Blackrock’s outlook suggest Ethereum plays a role in institutional crypto trends?

Blackrock’s outlook emphasizes Ethereum’s significant role in institutional crypto trends, forecasting that as stablecoin adoption increases, Ethereum will likely serve as the backbone for various tokenized financial instruments, enhancing its appeal to institutional investors looking for robust digital infrastructures.

Why is Ethereum referred to as a core digital infrastructure in the context of stablecoin adoption?

Ethereum is referred to as core digital infrastructure because it hosts the majority of tokenized assets and supports a wide array of applications, including payments and settlements. This positions it favorable as stablecoin adoption matures, reflecting its integral role in facilitating real-world financial transactions and services.

What implications does stablecoin adoption have for the future of Ethereum tokenization?

The implications of stablecoin adoption for Ethereum tokenization are profound, suggesting an expansion of Ethereum beyond speculative trading. As stablecoins gain traction, Ethereum is poised to lead in tokenization, creating opportunities in private credit markets and real assets, thereby enhancing its utility across various financial sectors.

How are institutional investors responding to the Ethereum ecosystem amid these trends?

Institutional investors are increasingly responding positively to the Ethereum ecosystem as it aligns with their long-term investment strategies. The rise of stablecoin adoption and Ethereum’s dominance in tokenization draws substantial interest, with initiatives like the Ishares Ethereum Trust facilitating deeper institutional engagement in digital assets.

What does the Blackrock report indicate about the future synergy between Ethereum and stablecoin markets?

The Blackrock report indicates a promising future synergy between Ethereum and stablecoin markets, highlighting that as stablecoins solidify their role in the broader financial landscape, Ethereum will likely strengthen its position as a fundamental infrastructure for crypto economy, driving innovation and utility.

How does stablecoin growth impact the overall narrative of Ethereum in the crypto market?

Stablecoin growth significantly impacts the overall narrative of Ethereum by shifting the focus from speculative trading to real-life applications. This transition supports Ethereum’s evolution as a key player in the infrastructure of decentralized finance, attracting both retail and institutional investors looking for reliable investment avenues.

| Key Point | Details |

|---|---|

| Institutional Influence | Blackrock’s research influences crypto narratives, moving beyond retail speculation. |

| Ethereum’s Role | Ethereum is positioned as the primary beneficiary of increasing stablecoin adoption and tokenization. |

| Market Trends | Shift from trading to payments and settlement highlights stablecoin’s real-world utility. |

| Stablecoin Growth | Stablecoin transaction volumes are expected to exceed spot crypto trading by 2024-2025. |

| Tokenization Statistics | Over 65% of tokenized assets are issued on Ethereum, significantly more than competitors. |

| Broader Strategy | Blackrock’s strategy includes launching Ether-focused products to tap into Ethereum’s potential. |

| Thematic Investing | The report highlights a thematic shift in investment towards innovations like AI and infrastructure. |

Summary

Ethereum and Stablecoin Adoption is shaping the future of finance as institutional interest continues to grow. Blackrock’s recent analysis underscores Ethereum’s pivotal role in the rise of stablecoins, marking a shift towards tangible financial infrastructure. With stablecoin transactions expected to surpass traditional crypto trades, Ethereum stands to benefit significantly from these changes, showcasing its dominance in the tokenization landscape. The insights from Blackrock advocate for a strategic outlook, highlighting how Ethereum not only supports crypto trading but also bridges into broader financial utilities, ensuring a robust framework for future investments.