FIFA blockchain ticket tokens represent a groundbreaking approach to digital ticketing and fan engagement in the world of soccer, particularly in the context of the upcoming FIFA World Cup 2026. As Switzerland’s gambling regulator, Gespa, investigates the compliance of these blockchain-based tokens with national gambling laws, questions arise about their role in the sporting event. The tokens, primarily seen as digital collectibles, provide holders with the conditional right to purchase tickets based on their national team’s performance. Priced at $999, these tokens have already generated significant revenue for FIFA, but concerns about potential gambling violations loom large. The intersection of blockchain technology and ticketing presents both opportunities and challenges that FIFA must navigate carefully in the lead-up to the World Cup.

The innovative concept of FIFA blockchain ticket tokens has ushered in a new era of fan interaction and ticket purchase opportunities for major sporting events like the FIFA World Cup 2026. These digital assets, designed to enhance the experience for supporters, grant ownership rights to tickets contingent upon the success of national teams in qualifying matches. However, Switzerland’s regulatory body, Gespa, is delving into the legality of these ‘right-to-buy’ tokens amid allegations of gambling-related irregularities. As the landscape of ticket sales evolves with blockchain technology, the ramifications for both organizers and fans are becoming a focal point of discussion. While these tokens present enticing collectible value, the underlying risks and regulatory implications cannot be overlooked.

Understanding FIFA Blockchain Ticket Tokens

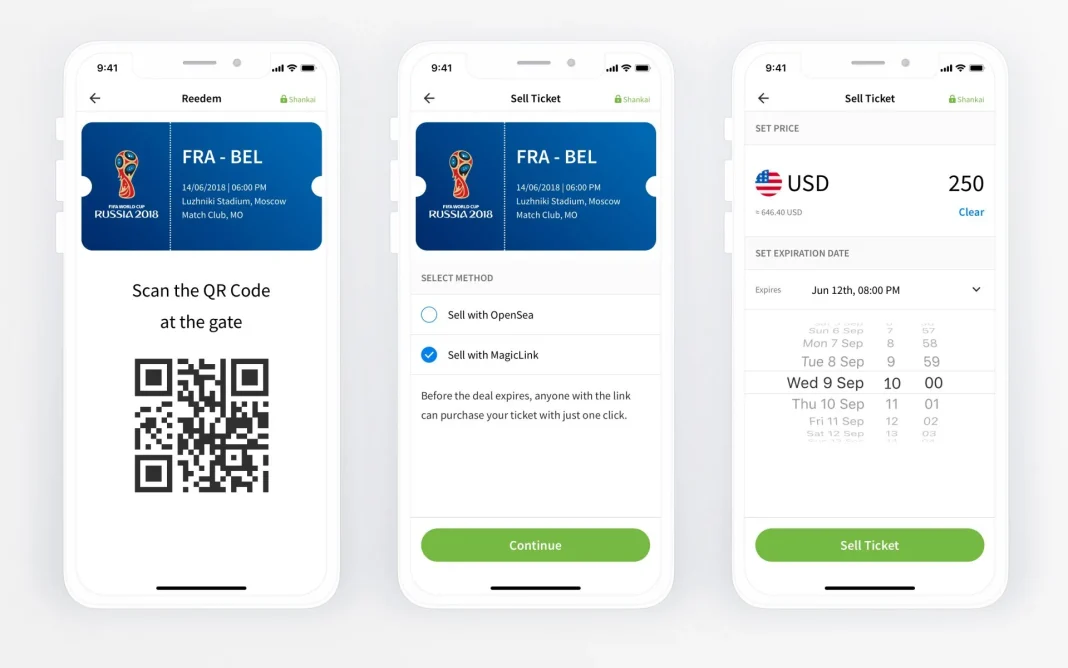

FIFA’s blockchain ticket tokens represent a significant shift in event ticketing, merging traditional ticket sales with innovative blockchain technology. These tokens, launched in 2024, grant holders the right to purchase tickets for the highly anticipated FIFA World Cup 2026, contingent upon their national teams qualifying for the event. Priced at $999, they have already sold out for various countries, yielding FIFA an impressive revenue of $15 million. However, the implications of this model have sparked debate over its classification, as Gespa, Switzerland’s gambling regulator, investigates potential gambling violations.

The essence of these blockchain ticket tokens lies in their underlying technology which allows for secure, decentralized ownership records. Yet, while these digital collectibles offer a novel approach to ticket sales, the speculative nature of the tokens has raised questions about their practical utility. Critics argue that many holders may end up with tokens that do not provide significant benefits, potentially resembling a gambling mechanism because they pay for a chance at obtaining something valuable, similar to a lottery system.

Regulatory Scrutiny on Blockchain Technology in Sport

The investigation by Switzerland’s Gespa into FIFA’s blockchain ticket tokens underscores the importance of regulatory oversight in the realm of sports and digital assets. As more organizations utilize blockchain technology, ensuring compliance with existing gambling laws becomes vital to protect consumers. Gespa’s director, Manuel Richard, emphasizes that a thorough examination is crucial, especially since there have been no formal complaints, indicating that even innovative methods may inadvertently cross regulatory boundaries.

As regulators adapt to the rapid evolution of digital technology, it’s essential to establish a solid framework that distinguishes between legitimate digital collectibles and potential gambling violations. The dichotomy between providing fans with new experiences through blockchain technology and adhering to gambling laws creates a complex landscape that demands clarity and guidance. It’s crucial for sports organizations, especially FIFA, to navigate these waters carefully to maintain the integrity of their offerings.

Implications of the FIFA World Cup 2026 Ticketing Model

The FIFA World Cup 2026 presents a unique case in ticketing strategy with the introduction of blockchain ticket tokens. This model not only allows for increased revenue streams but also engages fans in a manner not seen in past tournaments. However, the implications of conditional purchasing rights raise complex questions about access and fairness. Only those holding the necessary tokens and whose teams qualify will have the chance to buy tickets, which could alienate passionate fans whose teams might not make the cut.

This approach increases the stakes for supporters, potentially leading to a disparity where some fans invest significantly for a purchase opportunity that may never materialize. As discussions unfold, figuring out the balance between monetization and equitable access remains critical. Additionally, ensuring transparency and fairness in transactions, particularly within secondary markets for token trading, is paramount to establishing trust among global fans.

The Controversy Over Digital Collectibles and Gambling

FIFA’s decision to implement blockchain ticket tokens has sparked controversy regarding their classification as digital collectibles versus gambling mechanisms. The concerns primarily hinge on the idea that the majority of token holders might not successfully secure tickets, which fosters a perception of playing a speculative game rather than simply purchasing a collectible item. Critics assert that the conditional aspect of owning these tokens could mislead fans into believing they are making a sound investment when, in reality, many may not benefit at all.

The discussion around these tokens touches on larger themes in gaming and digital asset ownership, where the line between entertainment and gambling continues to blur. As various jurisdictions consider potential gambling violations, stakeholders must recognize how technological innovations can sometimes mirror traditional gambling scenarios, thus prompting regulatory bodies to act. This scrutiny serves as a reminder of the complexities inherent in integrating advanced technologies within known legal frameworks.

Best Practices for Compliance with Gambling Regulations

As FIFA navigates this investigation, establishing best practices for compliance with gambling regulations becomes imperative. Organizations leveraging blockchain technology should prioritize transparency in their offerings and understand the laws applicable to their markets. Clear communication about what token holders can expect, including the risks involved, will be essential in ensuring that consumers are well-informed. By fostering a culture of accountability and transparency, organizations can potentially mitigate regulatory challenges.

Moreover, engaging with regulatory bodies proactively can lead to smoother adaptations of innovative practices within existing legal frameworks. By collaborating with regulators like Gespa, FIFA can work towards developing guidelines that enhance consumer protection while still embracing the advantages of blockchain technology. Ensuring that digital collectibles do not unintentionally slip into the realms of gambling requires ongoing dialogue and a commitment to responsible practices.

The Role of Transparency in the Blockchain Market

Transparency in transactions is the cornerstone of the blockchain market. For FIFA’s blockchain ticket tokens, ensuring that all information regarding their functionality and potential outcomes is easily accessible is essential to building trust among fans. By openly disclosing the mechanics of token ownership and the conditions for ticket purchasing, FIFA can alleviate concerns regarding speculation and gambling violations. Such transparency is crucial not only for compliance but also for fostering a loyal and engaged fanbase.

In an age where digital assets are becoming increasingly prevalent, accountability in how organizations manage these products helps safeguard consumer interests. Clearly defining how these blockchain ticket tokens operate and what users can expect also provides a framework for potential regulatory discussions. As industry standards evolve, transparency will play a pivotal role in establishing a sustainable market for innovative ticketing solutions.

Fan Engagement and Blockchain Technology

The use of blockchain technology in the FIFA World Cup 2026 ticketing model presents an engaging opportunity for fans. By integrating blockchain into ticketing, FIFA not only enhances security but also allows for innovative ways to connect with supporters. The novelty of purchasing a token that grants access to potentially highly coveted tickets adds an exciting layer to the fan experience. However, this engagement must be carefully managed to ensure it doesn’t delve into misunderstood gambling territory.

As fan engagement strategies evolve, leveraging blockchain technology can open up new avenues for connectivity. The key will be to balance fan excitement with regulatory considerations, ensuring that the primary aim of fostering love for the sport remains intact. Engaging fans through comprehensible and entertaining avenues will help in maintaining a positive atmosphere around the ticketing process.

The Evolution of Ticketing in the Digital Age

The evolution of ticketing systems reflects broader changes in consumer behavior and technological advancements. With the rise of digital assets, methods of accessing events are transforming. Traditional ticket sales are increasingly supplemented by blockchain-based solutions like FIFA’s ticket tokens, which symbolize a shift towards a more speculative engagement model. This transition raises discussions around the benefits of innovation alongside its pitfalls, particularly regarding gambling laws.

In this digital age, it’s important for organizations to stay ahead of trends while remaining compliant with regulatory standards. Understanding how blockchain technology operates within the scope of existing ticketing practices can help maintain a balance between innovation and consumer protection. As the sector adapts, ongoing conversations about responsible usage and the implications of new technologies will be essential.

Secondary Markets: Opportunities and Challenges

Secondary markets present both opportunities and challenges for blockchain ticket tokens. On one hand, these markets enable token holders to trade their assets, potentially increasing liquidity and accessibility. This can create a thriving ecosystem of buyers and sellers. However, it also raises concerns about speculative trading, where the focus shifts from fan engagement to profit-making. Such dynamics can attract regulatory scrutiny, especially in relation to gambling discussions.

To mitigate these challenges, organizations must implement robust guidelines for secondary market transactions. Establishing clear terms and conditions can protect both buyers and sellers while ensuring compliance with regulatory bodies. By addressing these issues upfront, FIFA can enhance the user experience while aligning with best practices, ultimately empowering fans and preserving the integrity of their blockchain ticketing system.

Frequently Asked Questions

What are FIFA blockchain ticket tokens and how do they work?

FIFA blockchain ticket tokens are digital assets that give holders the right to purchase tickets for the FIFA World Cup 2026, conditional upon their national team’s qualification. These tokens, designed to utilize blockchain technology, operate on a speculative model where holders may end up with digital collectibles that lack direct utility.

Why is the Swiss regulator investigating FIFA’s blockchain ticket tokens?

The Swiss gambling regulator, Gespa, is investigating FIFA’s blockchain ticket tokens to determine if they comply with national gambling laws. Concerns have been raised that the token offering might resemble gambling mechanisms, due to its speculative nature and limited functional utility, leading to potential violations of gambling legislation.

What risks do FIFA blockchain ticket tokens pose to consumers?

Consumers face risks with FIFA blockchain ticket tokens as the speculative model may result in holders acquiring digital assets with little to no functional use. Critics argue that such a structure may funnel money into a gambling-like system where most participants are unlikely to benefit.

How much revenue has FIFA generated from the blockchain ticket tokens?

FIFA has reported generating approximately $15 million in revenue from the sale of blockchain ticket tokens for the 2026 World Cup, with individual tokens priced at $999. This revenue stream has raised questions about transparency and fairness in their ticketing practices.

Can token holders sell their FIFA blockchain ticket tokens?

Yes, FIFA blockchain ticket tokens are tradable on secondary markets, allowing holders to potentially resell their tokens. However, this trading also adds complexity to the speculation surrounding their actual value and utility.

What is the difference between traditional ticket sales and FIFA’s blockchain ticket token model?

Traditional ticket sales for FIFA events typically operate on a first-come, first-served basis. In contrast, the blockchain ticket token model requires holders to wait for their national team to qualify before they can purchase tickets, which introduces a gambling-like uncertainty in the ownership experience.

What implications does the investigation have for the future of FIFA blockchain ticket tokens?

The ongoing investigation by the Swiss regulator could lead to changes in the operational framework of FIFA blockchain ticket tokens. Depending on the findings, FIFA may need to adjust its offerings to ensure compliance with gambling regulations, potentially altering how fans engage with digital collectibles related to the World Cup.

What are the concerns regarding the transparency of FIFA blockchain ticket tokens?

Concerns around transparency with FIFA blockchain ticket tokens stem from the speculative nature of their sales, where critics argue that the offering lacks clear utility and fairness, possibly masking a gambling-like model that could lead to consumer exploitation.

| Key Point | Details |

|---|---|

| Investigation by Gespa | The Swiss gambling regulator is examining FIFA’s blockchain ticket tokens for compliance with gambling laws. |

| Nature of Tokens | The tokens are ‘right-to-buy’ tickets for the 2026 FIFA World Cup based on national team qualification. |

| Revenue Generation | FIFA has earned approximately $15 million from token sales priced at $999 each. |

| Concerns Raised | Critics argue that the tokens resemble a gambling mechanism due to their speculative nature and limited utility. |

| Regulatory Actions | Gespa has not yet received formal complaints but continues to investigate the potential for regulatory action. |

| Sale of Tokens | Tokens for eight countries have sold out among the 51 nations participating in the tournament. |

Summary

FIFA blockchain ticket tokens have garnered significant attention as they introduce a new model for ticket sales, but they face scrutiny from the Swiss regulator, Gespa, for potential gambling violations. As FIFA continues to innovate through blockchain technology for ticketing, the regulations governing this new system will play a crucial role in shaping its future and ensuring fairness for all participants.