In the dynamic landscape of cryptocurrency, the **Hyperliquid whale Bitcoin short** has once again captured the spotlight with a staggering $121 million leveraged position at 10x. This prominent trader, renowned for executing high-stakes trades on the Hyperliquid decentralized exchange, appears to be positioning against Bitcoin as it hovers around $110,800. Utilizing on-chain analytics, market observers are keenly analyzing the implications of this notable Bitcoin short, especially in the context of leverage trading strategies. As the crypto market fluctuates, movements from influential figures like this Hyperliquid whale can drastically impact market sentiment and trading strategies. Investors and traders alike are now left to ponder whether this latest move signals a turning point for Bitcoin or simply a calculated risk amid ongoing market volatility.

Referred to informally as a crypto giant, the Hyperliquid whale is known for making waves with substantial short positions in Bitcoin. By implementing high-leverage tactics typical of elite traders within the decentralized exchange ecosystem, this whale’s recent action of taking a massive short position at 10x leverage has become a focal point for analysts following Bitcoin’s price trends. The ongoing activity of this trader exemplifies key trends in leverage trading within the cryptocurrency market and raises questions about potential market reactions. With traders closely monitoring parallel movements in Ethereum and other digital assets, the effects of such strategic plays on the broader crypto market are under intense scrutiny. As this whale navigates the turbulent waters of the crypto realm, their decisions potentially foreshadow larger market dynamics.

Understanding the Hyperliquid Whale’s Bitcoin Strategy

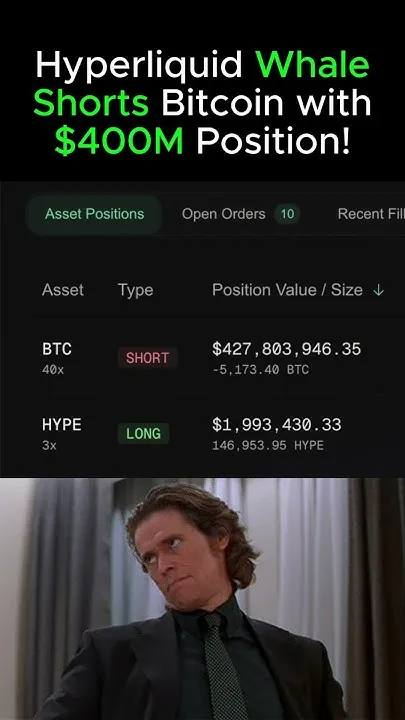

The Hyperliquid whale is a significant player in the cryptocurrency landscape, particularly known for its strategic leverage trading on the Hyperliquid decentralized exchange (DEX). This trader has recently made headlines by reopening a staggering $121.72 million Bitcoin short position at 10x leverage. Through this aggressive week-long strategy, the whale captures the essence of high-stakes trading, demonstrating an ability to read market trends and respond decisively. Key to this strategy is the whale’s capacity to leverage information from market analysis, which aids in predicting potential price reversals in Bitcoin.

Leverage trading Bitcoin provides traders like the Hyperliquid whale with the opportunity to amplify their gains or mitigate their losses through strategically timed entries. By taking large positions against Bitcoin—particularly at pivotal moments—such as before major economic announcements, the whale capitalizes on market volatility. This trading approach not only reinforces the whale’s reputation for precision but also attracts attention from other traders looking to replicate this success or learn from its implications in broader crypto market analysis.

The Risks of High-Leverage Trading in the Crypto Market

While high-leverage trading offers significant upside potential, it comes with substantial risks, as highlighted by the Hyperliquid whale’s recent Bitcoin short position. With a liquidation price set at $135,320—well above the current market price—the whale is navigating a very precarious path. The margin for error in such high-leverage scenarios is slim, and positions can quickly turn from profitable to unmanageable. Traders engaging in leverage trading Bitcoin need to understand these risks fully, considering both the volatility of the crypto market and the potential for rapid price shifts that could lead to significant losses.

Moreover, the presence of Bitcoin short positions taken by entities like the Hyperliquid whale showcases just how important risk management is in the high-leverage trading environment. If the market moves against the whale’s position, the fallout could be catastrophic, leading to substantial unwinding of capital and further market impact. As cryptocurrencies like Bitcoin and Ethereum continue to experience swift price fluctuations, understanding the underlying market dynamics becomes essential for anyone attempting to navigate the world of leveraged crypto trades.

Analyzing the Impact of Ethereum Whales on Bitcoin Movements

Whales in the Ethereum network often replicate trading strategies similar to those observed with Bitcoin, including the recent actions of the Hyperliquid whale. These whales, possessing significant holdings and trading power, can create ripples in the market that impact Bitcoin’s price movements. When Ethereum whales take positions, surrounding market participants often analyze these moves in tandem with Bitcoin trends, leading to potential correlations that can dictate broader market sentiment. Understanding this dynamic is critical for those engaging in crypto market analysis.

Additionally, Ethereum’s whales may influence Bitcoin’s price by shifting capital between the two leading cryptocurrencies. For instance, if Ethereum whales decide to exit or enter substantial positions, it can lead to corresponding reactions in Bitcoin’s price, as traders respond to perceived trends within leading cryptocurrencies. This interconnectedness between Ethereum and Bitcoin highlights the importance of comprehensive market analysis, especially for leveraged trades where timing and market sentiment are of paramount importance.

Hyperliquid Trading: A Closer Look at the Mechanics

Hyperliquid trading represents a modern approach to cryptocurrency exchanges, where user transactions facilitate exciting trading opportunities through high liquidity and leverage capabilities. For traders like the Hyperliquid whale, the platform allows for the swift execution of significant positions—such as those seen with the recent $121 million Bitcoin short. The mechanics of Hyperliquid enable traders to deploy leverage in a manner that traditional exchanges may not match, catering specifically to those looking to harness market predicted volatility.

The allure of Hyperliquid lies in its technology-driven environment, which allows for efficient trade execution and risk assessment tools. The whale’s interactions on this platform reflect a broader trend of professional traders utilizing advanced analytics and platforms to shape their trading strategies. This ultimately influences overall market dynamics, as high-volume trades can sway opinions and expectations among less experienced traders in the crypto market.

Market Reactions to Hyperliquid Whale’s Latest Short Position

The recent moves by the Hyperliquid whale have sparked considerable interest within the trading community. When such a large position is opened—like the $121M Bitcoin short—traders are left speculating on whether this marks an impending shift in market trends or if it could simply be a responsive strategy to recent bullish behavior in Bitcoin. Market reactions often hinge on the historical preciseness of the whale’s timing, leading many to weigh their own positions based on the perceived knowledge the whale might possess.

Market dynamics become even more relevant in times of heightened volatility influenced by significant trades. As the whale’s position is closely monitored, fluctuations in Bitcoin’s value can widen, leading to either aggressive buying or selling. This interplay showcases the delicate balance within leverage trading environments, where one influential trader’s decision can invoke broader market movements and responses from retail traders who seek to capitalize on the volatility that results.

Utilizing On-Chain Analytics to Track Whale Movements

The rise of on-chain analytics tools has significantly enhanced traders’ abilities to monitor and analyze whale movements in the cryptocurrency market. Platforms like Arkham and Hypurrscan provide critical insights into real-time wallet movements, showing how whales like Hyperliquid navigate their positions. With access to this data, traders can make informed decisions based on the sentiment expressed in whale transactions, including the Hyperliquid whale’s recent Bitcoin short. Analyzing these insights can lead to timely entries or exits in trades.

Tracking the movements of prominent wallets also allows for deeper market understanding, as traders can correlate price actions with major trading events. The ability to see correlations between whale activities and market shifts creates opportunities to develop trading strategies that anticipate similar moves. Thus, on-chain analytics and whale tracking become instrumental for all traders looking to influence future positions in the competitive landscape of crypto trading and leverage.

What Drives the Strategy of Hyperliquid Whales?

The strategies employed by Hyperliquid whales like the one responsible for the recent Bitcoin short position are often driven by a combination of market analysis, macroeconomic factors, and a keen understanding of crypto market mechanics. The whale’s decision to establish a $121.72 million BTC short can be traced back to analyses that indicate potential directional changes in Bitcoin’s price, likely responding to current economic trends and sentiments. Through leveraging their extensive trading experience and market acumen, these whales weigh their risk-reward dynamics effectively.

Furthermore, the motivations behind their trades often incorporate timing around key market events—such as regulatory announcements or significant macroeconomic data releases—which have previously led to sharp price changes. This strategic foresight positions whales to exploit the market effectively. As determined traders anticipate market reactions, their trades not only impact their gains but can also redefine market trajectories, making the study of their trading patterns a vital aspect for aspiring professionals and enthusiasts.

The Future of Bitcoin in Light of Whale Activity

The activities of whales like the Hyperliquid trader have significant implications for the future of Bitcoin, especially in the context of leverage trading. As dominant players re-enter short positions anticipating corrections, Bitcoin’s price movements could be more pronounced, leading both to increased volatility and trading opportunities. Traders must stay alert to shifts in big-money positions, as they could signal potential transitions in the broader crypto market.

Moreover, the interplay of whale movements and broader trading sentiments leads to evolving narratives around Bitcoin’s value proposition as a store of value or a speculative asset. Each move by whales not only impacts immediate capital flows but also shapes longer-term expectations about how institutional and retail investors approach Bitcoin. Understanding the motivations and strategies of whales helps traders align their strategies in a manner that acknowledges the underlying movements of the crypto market.

Considering Crypto Market Volatility in Strategy Development

As the Hyperliquid whale engages in substantial trading actions, the volatility endemic to the cryptocurrency market becomes a focal point for all traders. This volatility is both a challenge and an opportunity, prompting traders to develop robust strategies accommodating wild price swings. Whether entering short positions or capitalizing on upward momentum, acknowledging this volatility assists in structuring trades with appropriate risk management protocols, particularly under high-leverage conditions.

High-leverage scenarios, as evidenced by the Hyperliquid whale’s $121 million short, require traders to incorporate comprehensive risk assessments into their strategies. Position size, entry points, and potential exit strategies all need to align with prevailing market conditions. By recognizing the unpredictable nature of cryptocurrency markets, traders can mitigate risks and exploit existing opportunities, facilitating a more resilient approach that stands against sudden price changes.

Frequently Asked Questions

What does the Hyperliquid whale’s $121M Bitcoin short signify for the crypto market?

The Hyperliquid whale’s recent reload on a $121 million Bitcoin short at 10x leverage indicates a strong bearish sentiment toward Bitcoin’s price movement. This substantial position suggests the whale anticipates a price correction, which could influence other traders’ strategies within the crypto market.

How does leverage trading Bitcoin work with the Hyperliquid whale’s strategy?

Leverage trading Bitcoin involves borrowing funds to increase the position size beyond one’s initial capital. The Hyperliquid whale employs a 10x leverage strategy, meaning for every $1 of their own capital, they can control $10 in Bitcoin, amplifying both potential profits and losses.

What impact does the Hyperliquid whale have on Bitcoin short positions?

The Hyperliquid whale significantly impacts Bitcoin short positions due to their large trades that can shift market sentiment. Their ability to execute multi-million dollar shorts often attracts attention, influencing the decisions of other traders and contributing to market volatility.

Why is the Hyperliquid whale’s recent bet against Bitcoin noteworthy?

The Hyperliquid whale’s recent short position is noteworthy due to their history of accurately timing their trades before market movements. The $121 million bet at a high entry price suggests they believe Bitcoin is overvalued at current levels, raising questions about the sustainability of the recent price rally.

What analytics tools track the Hyperliquid whale’s trading activity?

On-chain analytics platforms like Arkham and Hypurrscan are instrumental in tracking the Hyperliquid whale’s trading activity. These tools provide insights into the whale’s substantial Bitcoin holdings and leveraged positions, helping analysts evaluate market trends and potential impacts.

How does the Hyperliquid whale’s portfolio distribution reflect on market trends?

The Hyperliquid whale’s portfolio is primarily concentrated in Bitcoin, with over 93% of their $4.81 billion holdings in BTC. This concentration suggests confidence in Bitcoin’s potential while also highlighting the risks associated with such heavy reliance on a single asset in the volatile crypto market.

What can traders learn from the Hyperliquid whale’s trading patterns?

Traders can learn from the Hyperliquid whale’s trading patterns by observing their timing and strategic decisions around major market events. The whale has a reputation for making significant moves shortly before notable economic announcements, indicating the importance of market analysis in crypto trading.

How does the Hyperliquid whale manage risk with their Bitcoin short positions?

The Hyperliquid whale manages risk by utilizing substantial liquidity, including $301 million in USDC, which allows for flexibility in entering new positions or supporting margin calls. Their disciplined approach to leverage trading Bitcoin helps mitigate the risks associated with large market swings.

| Key Point | Details |

|---|---|

| Background | The Hyperliquid whale is known for making significant leveraged trades on the Hyperliquid decentralized exchange. |

| Current Position | The whale currently holds a $121.72 million Bitcoin short at 10x leverage. |

| Trade Entry | The entry price of this short is $109,762, with the current mark around $110,629. |

| Unrealized Loss | As of now, the position reflects an unrealized loss of -$953,902. |

| Potential Liquidation | The liquidation price is noted at $135,320, indicating a bearish outlook. |

| Total Wallet Value | The wallet’s total value stands at $29.03 million, primarily in perpetual contracts. |

| Recent Trading Activity | In early October, the whale executed large shorts earning over $190 million prior to major market events. |

| Market Monitoring | The movements of the whale are tracked by analytics platforms due to their high-stakes timing. |

| Portfolio Overview | The whale controls approximately 40,720 BTC and has substantial USDC and ETH holdings. |

Summary

Hyperliquid whale Bitcoin short positions continue to capture market attention as the enigmatic trader reloads a $121.72 million position at 10x leverage. As this significant stake suggests a bearish outlook amidst Bitcoin’s recent rallies, market participants closely monitor the potential implications of this high-profile move. With detailed positioning and a history of market-timing, the Hyperliquid whale remains a central figure that could influence upcoming Bitcoin price actions.