The Lubian Bitcoin Movement has captured significant attention in the cryptocurrency landscape, particularly as the U.S. government has recently intensified its scrutiny of bitcoin transactions. Amidst a monumental seizure involving over 127,000 BTC connected to illicit activities, an intriguing development emerged: the movement of an additional 16,237 BTC from wallets associated with Lubian.com, a now-infamous mining pool. This substantial shift raises questions about the origins of these funds and their relation to ongoing Bitcoin recovery efforts, especially considering earlier hacks linked to the Lubian.com hack. As watchdogs monitor these transactions closely, the scenarios surrounding the recovery of US government bitcoin assets continue to evolve. Understanding the dynamics of the Lubian Bitcoin Movement is crucial for crypto enthusiasts and investors navigating this rapidly changing environment.

The recent activities surrounding the Lubian Bitcoin Movement highlight the intricate interactions between crypto assets and government interventions. The focus on a historical mining pool, which has become a case study in Bitcoin seizure and recovery strategies, presents an evolving narrative. With the U.S. government consolidating vast holdings of Bitcoin, questions arise about the implications of such interventions on the market and the broader network of miners and investors. Additionally, the connections to prior exploits, such as the notable Lubian.com hack, add layers of complexity that further intrigue industry analysts. As discussions around national crypto policies unfold, the significance of these movements within the digital currency realm cannot be understated.

Understanding the Mystery Behind the Lubian Bitcoin Movement

The recent headlines surrounding the Lubian Bitcoin movement have captured the attention of the cryptocurrency community. With the U.S. government seizing an astonishing 127,000 BTC linked to the Prince Group and the Lubian mining pool, the public is left questioning the security of digital assets. In the last 24 hours, a notable amount of 16,237 BTC, previously held in Lubian wallets, transitioned to new addresses. This movement could be a strategic maneuver or potentially a recovery of funds linked to a past hack. Many users are speculating about how these transactions could affect the market and whether they signify a larger scheme at play.

Additionally, the intricacies of the Lubian Bitcoin movement are intertwined with the history of Bitcoin seizures by the U.S. government. The official explanation lacks clarity regarding the origins and security of the assets. With allegations of connections to hacking incidents, including the infamous 2020 Lubian.com hack, the narrative becomes even murkier. Analysts are closely monitoring these developments, as the investigation unfolds, to unveil the truth behind every transaction and its impact on Bitcoin’s reputation. This ongoing saga is drawing attention not only because of the amounts involved but also due to its potential implications for future cryptocurrency regulations and security protocols.

Bitcoin Seizures and the U.S. Government’s Growing Holdings

The 16,237 BTC movement from Lubian wallets adds to the already staggering amount held by the U.S. government, which has escalated to approximately 324,779 BTC, making it the largest known hoard of Bitcoin held by any nation-state. This significant accumulation raises questions about the U.S. federal government’s strategy for managing seized assets. The increasing Bitcoin treasure trove is not just a statistic; it represents approximately $36.18 billion in cryptocurrency that could influence market dynamics. Many cryptocurrency analysts are now speculating on how the U.S. government will utilize these holdings in the long run and how it will address the regulatory challenges they face.

Moreover, the implications of such large-scale Bitcoin seizures reveal a significant turning point in how governments perceive blockchain and cryptocurrency. As more authorities begin to seize Bitcoin linked to illicit activities, the question remains as to the ethical and legal frameworks surrounding these assets. The U.S. government’s bold positioning in the crypto space sparks concerns among Bitcoin purists about the safety of funds and the rising power of state actors in the digital currency landscape. Moving forward, it’s crucial for stakeholders, from investors to regulators, to understand the broader implications of these developments on Bitcoin’s future.

The Lubian.com Hack: A Deeper Dive into the Security Flaws

The infamous Lubian.com hack of 2020 represents a crucial intersection of security vulnerabilities and Bitcoin market dynamics. Linked with the recent 16,237 BTC movement, this hack exploited weaknesses in the Lubian mining pool, unveiling critical security flaws in the system. The aftermath of this event led to significant scrutiny over the integrity of wallets and their custodial security. As Bitcoin evolves, the lessons learned from the Lubian incident highlight the importance of robust cybersecurity measures within decentralized platforms—pointing to a need for heightened awareness among users and operators alike.

In light of the recent transactions and the overlapping connections to the U.S. government’s seizures, the Lubian hack serves as a cautionary tale about the risks inherent in the cryptocurrency marketplace. Experts argue that until platforms strengthen their defenses against hacks, the threat of significant losses remains ever-present. With ongoing investigations surrounding the Lubian wallet movements, stakeholders are reminded of the necessity for improved standards in wallet security and transaction transparency in the crypto ecosystem.

Elucidating the Financial Impact of the Lubian Bitcoin Movement

The financial ramifications of the Lubian Bitcoin movement are profound, not just for the parties directly involved but for the broader cryptocurrency market. As wallets formerly associated with Lubian became inactive and the 16,237 BTC moved to new addresses, the market reacted with increased speculation and volatility. Traders are keenly watching to see how this unexpected shift affects pricing trends. The sheer weight of these movements means they can lead to significant fluctuations in market confidence, thus shaping investor behavior and potential regulatory responses.

Moreover, as the U.S. government’s Bitcoin holdings balloon, this hoarding behavior creates a narrative that might dissuade new investors wary of Tether and algorithmic trading flaws. Many analysts posit that such events are shaping the investment landscape, driving potential buyers away from Bitcoin as they fear governmental intervention or instability. Thus, the Lubian Bitcoin movement is tethered not only to security concerns and the saga of government seizures but also to the market psychology that guides investor decisions amidst evolving narratives.

Tracking the 16,237 BTC Transaction Trail

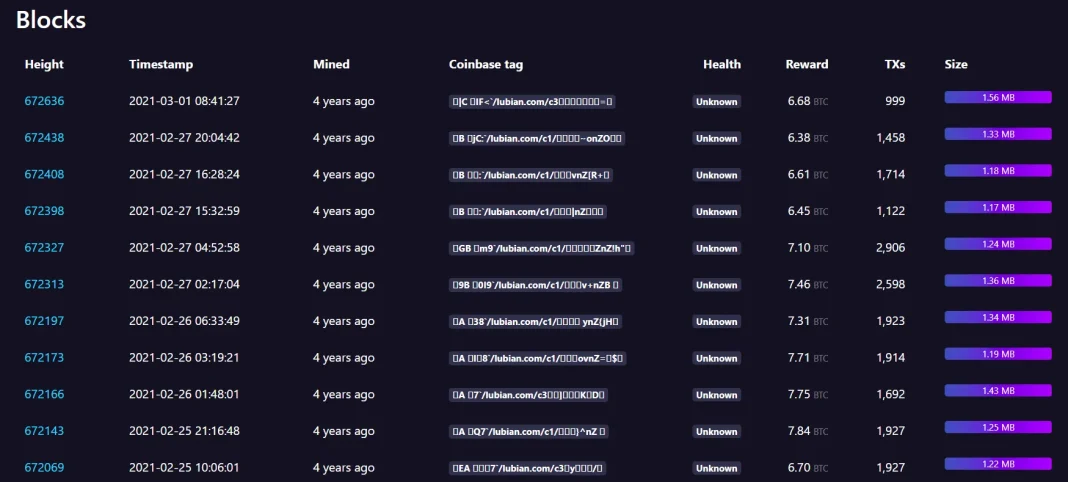

Tracing the transaction trail of the 16,237 BTC moving from Lubian wallets requires intricate blockchain analysis and a keen understanding of the cryptocurrency’s underlying technology. Each transaction leaves a digital footprint, providing forensic accountants and blockchain analysts with the tools needed to uncover the origins and final destinations of these funds. The mystery of their movement has sparked a flurry of investigative activity, leading to advanced tracking techniques that might reveal the handlers behind these digital assets. Interestingly, newfound insights into how these coins were reorganized could herald new methodologies in blockchain analysis for future transactions.

Additionally, the dynamics at play in this transaction trail highlight the ongoing battle between privacy and transparency in Bitcoin dealings. As more parts of the blockchain become exposed through rigorous analysis, it raises ethical dilemmas regarding user privacy versus the public’s right to trace large sums of cryptocurrency. The implications of the Lubian movement showcase that while Bitcoin is heralded for its decentralized nature, the reality of tracking and recovery can lead to potential vulnerabilities for individual users aiming to protect their assets. The coming weeks will prove critical as analysts delve deeper into the workings behind the movement of these funds.

The Broader Implications for Bitcoin’s Regulatory Landscape

The recent events surrounding the Lubian Bitcoin movement are not just isolated incidents; they signal potential shifts in the overall regulatory environment for cryptocurrencies. As governments around the world grapple with the challenges posed by digital assets, the large seizures and movements like that of the Lubian funds create an impetus for more stringent regulations. These actions by the U.S. government, as it accumulates unprecedented amounts of Bitcoin, might encourage legislators to formulate clearer frameworks that address asset seizure, support recovery, and define ownership rights.

Furthermore, this transformative period could delineate a new era of compliance for cryptocurrency exchanges and wallet providers. With the visibility gained from high-profile transactions, the pressure will increase for industry players to enhance their protocols against hacks, comply with KYC/AML regulations, and implement better security measures. The Lubian saga, intertwined with complex legal dilemmas, could result in a foundational shift that molds the regulatory landscape for Bitcoin and similar cryptocurrencies in the near future.

Public Sentiment and Market Response to the Lubian Bitcoin Developments

Public sentiment plays a pivotal role in the cryptocurrency market’s trajectory, and the recent Lubian Bitcoin developments are no exception. From growing skepticism regarding exchange security to fears of government intervention, how the public perceives these events can greatly influence market trends. The rapid movement of 16,237 BTC has elicited varied reactions among investors, many of whom are now reassessing the perceived safety of their assets and the viability of engaging in the cryptocurrency space.

Social media platforms and crypto forums are abuzz with speculation and concern, leading to a broader conversation about the need for transparent practices in the Bitcoin ecosystem. Investors are particularly focused on understanding the motivations behind such large transactions and questioning the merits of decentralized finance against centralized government intervention. As discussions unfold, this evolving public sentiment will likely translate into a reconsideration of investment strategies and a reevaluation of trust in both technologies and institutions involved in the cryptocurrency market.

Why Monitoring Bitcoin Movements is Crucial for Investors

For investors in the cryptocurrency sphere, the need for close scrutiny of Bitcoin movements, such as the Lubian Bitcoin transactions, cannot be overstated. As the U.S. government gathers its holdings, understanding the implications of such large switches in assets can yield advantages for traders and investors alike. Knowledge of these busts, seizures, and movements can provide critical insights into market trends and enable informed decision-making that can significantly affect portfolio performance.

Furthermore, tracking Bitcoin transactions enhances an investor’s ability to anticipate potential market shifts caused by these large publicized movements. Being aware of technical algorithms and blockchain analysis enables stakeholders to respond proactively to market fluctuations, allowing them to hedge against potential losses or seize the opportunity for profit. Remaining vigilant on these developments will empower investors not just to react but to forecast and strategize around the effects of government actions and notorious transactions within the cryptocurrency ecosystem.

Frequently Asked Questions

What is the Lubian Bitcoin Movement and how is it related to the recent Bitcoin seizure?

The Lubian Bitcoin Movement refers to activities surrounding the Lubian.com mining pool, particularly its involvement in the recent U.S. government seizure of Bitcoin. It became prominent when over 127,000 Bitcoins were seized from wallets linked to Lubian.com, which was suggested to be part of a wider international fraud scheme.

What are the details behind the 16,237 BTC that were recently moved from Lubian.com wallets?

Recently, an additional 16,237 BTC was tracked moving from wallets connected to Lubian.com, separate from the U.S. government seizure. This transaction prompted speculation regarding the identity of the wallet holders and their connection to previous hacks involving Lubian.

How did the Lubian.com hack contribute to the U.S. government’s Bitcoin recovery efforts?

The Lubian.com hack, which occurred in 2020, exposed vulnerabilities that later linked to the 2023 Milky Sad weak-key vulnerability. These historical exploits complicate the narrative around the U.S. government’s Bitcoin recovery efforts, raising questions about the origins of the seized funds.

What does the recovery of funds from Lubian.com mean for regulators and Bitcoin governance?

The recovery of Bitcoin associated with Lubian.com by the U.S. government signifies an escalating interest and involvement of regulatory authorities in tracing and reclaiming cryptocurrency funds, which could impact future governance in the Bitcoin ecosystem.

How is the U.S. government’s control of 324,779 BTC significant in the context of the Lubian Bitcoin Movement?

The U.S. government now holds approximately 324,779 BTC, largely connected to the Lubian Bitcoin Movement, making it the largest holder of Bitcoin among nation-states. This consolidation of assets directly relates to both the Lubian.com hack and the ongoing scrutiny of cryptocurrency’s role in finance.

What implications does the 2020 Lubian hack have for future Bitcoin security measures?

The 2020 Lubian hack highlights the need for improved security measures within Bitcoin and other cryptocurrencies. It serves as a cautionary tale for miners and investors regarding the importance of safeguarding digital assets against potential vulnerabilities and exploits.

Can the identity of the 16,237 BTC holders from Lubian.com be traced?

While efforts are ongoing to trace the identity of the holders of the 16,237 BTC recently moved from Lubian wallets, it remains largely speculative. Analysts suggest they could potentially include individuals connected to the previous management of Lubian.com.

What role does the Lubian Bitcoin Movement play in the larger narrative of Bitcoin history?

The Lubian Bitcoin Movement plays a critical role in Bitcoin history as it encapsulates themes of hacking, government intervention, and the complexities of managing large cryptocurrency assets. The scale and mystery surrounding this event contribute to the developing story of Bitcoin’s impact on global finance.

| Key Points |

|---|

| The U.S. government seized over 127,000 BTC linked to a fraud ring and Chinese national Chen Zhi, allegedly connected to Lubian.com. |

| An additional 16,237 BTC moved from Lubian.com wallets to new addresses without the involvement of the previously seized funds. |

| Arkham Intelligence linked the seized funds to the ‘Lubian Hacker,’ involved in a 2020 exploit of Lubian.com. |

| The U.S. government now possesses approximately 324,779 BTC, valued at around $36 billion, making it the largest national holder of bitcoin. |

| The identity behind the recent movement of 16,237 BTC remains unclear, although speculation points towards former administrators of Lubian.com. |

| This case illustrates a significant chapter in bitcoin’s forensic history due to the scale of the government’s holdings and the mysterious circumstances surrounding the Lubian wallets. |

Summary

The Lubian Bitcoin Movement marks a pivotal moment in the cryptocurrency landscape as the U.S. government unveils a massive hoard of over 324,000 BTC linked to significant international fraud activities. This complex saga intertwines historical exploits from the Lubian.com mining pool and the ongoing intrigue surrounding recent bitcoin transitions. As investigations unfold and more details emerge, the movement of these substantial assets raises crucial questions about digital asset security and regulatory implications in the evolving world of cryptocurrency.