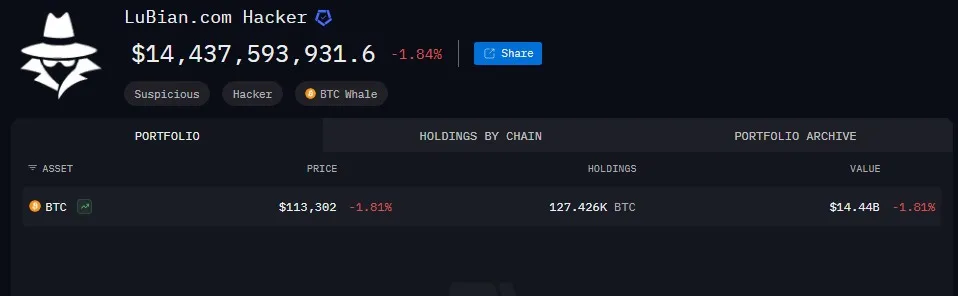

The recent scrutiny surrounding Lubian.com Hacker has brought to light a significant cryptocurrency theft linked to the U.S. government’s efforts to seize over 127,000 BTC. This infamous group, previously tied to the Milky Sad incident, finds itself at the center of a tumultuous investigation led by Arkham Intelligence, which documents financial misappropriation involving wallets associated with Lubian.com. With revelations dating back to late 2020, it appears that a vast amount of funds was drained from the mining pool without detection for years, accumulating a staggering value in today’s market. The Milky Sad incident, highlighting vulnerabilities in the Libbitcoin Explorer, raises questions about the integrity of cryptographic security in such environments. As the drama unfolds, the shadow of the Lubian.com Hacker looms large over the cryptocurrency landscape, captivating both enthusiasts and authorities alike.

Introducing the Lubian.com Hacker brings forth an intriguing narrative steeped in cryptocurrency intrigue and security breaches. This entity, synonymous with colossal Bitcoin drainages estimated at 127K BTC, is deeply intertwined with the 2023 Milky Sad incident that exposed critical flaws in virtual currency wallet seed generation. As fresh investigations by authorities like Arkham Intelligence shed light on these dubious affiliations, the implications for digital currency oversight and security are significant. The chronicles of this hacker group unveil a saga of lost fortunes and hidden truths within the realm of Bitcoin transactions. With questions surrounding their identity and the nature of their exploits dominating discussions, the saga surrounding Lubian.com continues to attract attention from various sectors, drawing a poignant intersection of crime, technology, and law.

Understanding the 127K BTC Seizure: Implications and Analysis

The recent efforts by U.S. authorities to seize over 127,000 bitcoins highlight a significant chapter in cryptocurrency regulation and security. As Arkham Intelligence pointed out, many of the implicated wallets have ties to the notorious “Lubian.com Hacker,” a group previously associated with the Milky Sad weak-key incident. This connection raises alarming questions about the security protocols in place for major cryptocurrency platforms and how vulnerabilities can lead to extensive financial loss. With estimated thefts now reaching tens of billions of dollars, it underscores the urgent need for robust frameworks to safeguard digital assets.

Furthermore, the Bitcoin tied to this case serves as pivotal evidence in attracting public and legal scrutiny towards various cryptocurrency platforms. The history of how these wallets were drained in late 2020, combined with the awareness that they are linked to a recognized hacking group, reveals the intertwining of crime and cryptocurrency. This situation could set precedents in how digital currencies are regulated, monitored, and secured against future breaches.

The Milky Sad Incident: A Lesson in Crypto Security

The Milky Sad incident serves as a stark reminder of the inherent risks associated with cryptocurrency transactions and wallet management. The discovery that Libbitcoin Explorer utilized a flawed pseudo-random number generator resulted in multiple cases of theft, where attackers could effectively recreate wallet seeds and compromise user funds. The vulnerability, recorded as CVE-2023-39910, emphasizes the vital importance of employing strong cryptographic standards in the creation of digital wallets, ensuring that users are safeguarded against such exploitations in the future.

As outlined in the reports, the Milky Sad team raised alarms about their findings, leading to heightened awareness within the cryptocurrency community about the necessity for improved security measures. Law enforcement agencies and developers alike are now urged to engage proactively in addressing these weaknesses, as reliance on poor cryptographic practices can lead to dire consequences for investors and the broader blockchain ecosystem.

Arkham Intelligence and the Tracking of Cryptocurrency Theft

Arkham Intelligence plays a crucial role in tracing cryptocurrency flows and linking wallets to incidents of theft. Their reports have highlighted various patterns of illicit activity, drawing attention to significant instances such as the Lubian.com case. By systematically analyzing blockchain data, Arkham provides insights that help identify malicious actors and enhance the community’s understanding of underlying criminal methodologies in cryptocurrency theft.

Through their meticulous tracking of transactions, Arkham not only assists law enforcement in recovering stolen assets but also informs users of possible risks associated with certain wallets, underscoring the need for heightened vigilance and due diligence among investors and exchanges alike. As the U.S. government moves to solidify its case regarding the 127K BTC seizure, Arkham’s data becomes a pivotal component in substantiating claims and fostering accountability in the evolving cryptocurrency landscape.

The Role of Lubian.com in Cryptocurrency Security Debates

Lubian.com has emerged as a significant player in discussions about cryptocurrency security, particularly due to its association with the 127,000 BTC theft. As a mining pool linked to a substantial amount of Bitcoin, the platform has been at the forefront of scrutiny from blockchain analysts and regulators alike. This situation raises critical questions about the responsibilities of mining pools in safeguarding user funds and how lapses in security can have repercussions beyond mere financial loss.

The investigation surrounding Lubian.com not only sheds light on the vulnerabilities present within blockchain technologies but also emphasizes the collective responsibility that exchanges, mining pools, and individual users share in fortifying the safety of their financial transactions. As the crypto market continues to expand, the Lubian incident serves as a focal point for ongoing dialogues about strategies and protocols necessary to bolster security in this burgeoning digital economy.

ZachXBT’s Insights: The Intersection of Theft and Accountability

ZachXBT, a prominent on-chain investigator, has provided noteworthy insights into the connection between the Lubian.com hacking and the ongoing U.S. 127K BTC case. His analysis highlights how the addresses associated with the government’s seizure of funds were indeed linked to previously reported incidents, including the Milky Sad disclosure. His statements emphasize the interplay between criminal activities and law enforcement approaches to cryptocurrency management, suggesting that the investigation might reveal new layers of complexity regarding ownership and accountability.

The discussions sparked by investigators like ZachXBT not only contribute to the narrative of accountability in cryptocurrency theft but also challenge the traditional perceptions of security in digital financial systems. By potentially establishing a link between government actions and external hacking operations, these insights push for a reevaluation of how criminal undertakings are viewed and addressed within the evolving landscape of cryptocurrency.

Strengthening Crypto Security: Lessons from Weak-Key Vulnerabilities

The vulnerabilities highlighted by the Milky Sad incident, particularly surrounding Libbitcoin Explorer’s weak-key issue, serve as critical lessons in strengthening security within the cryptocurrency ecosystem. By utilizing flawed algorithms for wallet seed generation, Libbitcoin inadvertently opened doors for hackers to exploit. This incident illustrates the importance of rigorous testing and the adoption of industry-wide best practices for cryptographic implementations to prevent future occurrences of similar breaches affecting wallets across platforms.

Investors and developers alike must learn from past mistakes and prioritize security in every aspect of digital currency management. Implementing advanced cryptographic techniques, conducting regular security audits, and establishing transparent communication regarding vulnerabilities can significantly reduce the risks associated with cryptocurrency theft while restoring trust in digital asset platforms.

Government Investigations and the Future of Crypto Regulation

The role of government investigations in the context of cryptocurrency regulation is evolving, particularly as cases like the 127K BTC seizure become more common. As authorities seek to navigate the complexities surrounding digital currencies, it is evident that regulations must adapt to address the challenges presented by both legitimate use and criminal exploitation of cryptocurrencies. The involvement of the U.S. government in this unfolding situation indicates a growing commitment to curbing illicit activities tied to digital currencies, but poses questions of surveillance and civil liberties within the crypto space.

In the face of growing scrutiny and regulatory frameworks, stakeholders within the cryptocurrency community must prepare for a landscape that prioritizes compliance and security. As incidents related to theft and mismanagement of digital assets are brought to light, collaboration between tech developers, regulators, and law enforcement will be critical in shaping a responsible, sustainable future for cryptocurrencies.

Financial and Technical Ramifications of the Lubian Case

The Lubian.com case underscores not only significant financial ramifications but also raises technical concerns regarding the security measures in place within the cryptocurrency space. The questionable wallet transactions linked to this incident have prompted significant financial implications for affected parties, including loss of confidence in platforms that inadequately protect user assets. With significant amounts of BTC at stake, the potential ramifications of mismanagement are substantial, prompting calls for more stringent operational practices across the industry.

As technological vulnerabilities are revealed through investigations like that by Arkham Intelligence, the responsibility falls on cryptocurrency exchanges and developers to bolster their defenses against potential breaches. Ensuring that adequate security practices are integrated into their systems will mitigate risks and rebuild trust among users. The lessons learned from these cases will likely inform future technological advancements and operational protocols to enhance the overall integrity of the cryptocurrency sector.

Navigating Ethical Dimensions of Cryptocurrency Theft Recoveries

Navigating the ethical dimensions of recovering cryptocurrency stolen through hacks, such as those associated with the Lubian.com incident, is complex. As funds are traced back and seized, questions arise regarding the ethics behind ownership and the implications of asset recovery for victims versus investigative bodies. The cryptocurrency community is forced to grapple with the moral dilemmas that arise when intersecting law enforcement actions with users’ rights, transparency, and the implications on individual liberty within the blockchain.

As regulatory frameworks evolve, it is essential to address these ethical concerns within the cryptocurrency sector. Ensuring that victims have a voice in recovery processes and that law enforcement operations respect user rights can promote equitable resolutions for all involved. Establishing clear guidelines for ethical practices in asset recovery will be crucial for fostering trust and accountability in the future of the digital economy.

Frequently Asked Questions

What link does Lubian.com Hacker have with 127K BTC theft?

The Lubian.com Hacker is believed to be connected to the theft of approximately 127,426 BTC identified by Arkham Intelligence. These wallets are associated with a hack that occurred in late 2020, which remains one of the largest untapped thefts in cryptocurrency history.

How does the Milky Sad incident relate to Lubian.com Hacker?

The Milky Sad incident, published in 2023, documented a serious flaw in Libbitcoin Explorer’s wallet seed generation. This vulnerability allowed the Lubian.com Hacker to exploit weak keys, leading to substantial cryptocurrency theft linked to the Lubian.com mining pool.

What role does Arkham Intelligence play in understanding Lubian.com Hacker’s activities?

Arkham Intelligence tracks and analyzes the cryptocurrency activities of entities like Lubian.com Hacker. Their reports connect wallets associated with Lubian to significant BTC movements, including the 127K BTC now under U.S. government scrutiny.

What are the implications of the 127K BTC case involving Lubian.com Hacker?

The implications are vast: it raises questions about the origins of the Bitcoins and whether U.S. authorities might have a stake in the recovery process. The case underscores the links between the Lubian.com Hacker and criminal cryptocurrency activities.

What is Libbitcoin Explorer’s impact on Lubian.com Hacker discussions?

Libbitcoin Explorer’s flaw is central to discussions about the Lubian.com Hacker. A weak key generation technique documented as CVE-2023-39910 enabled the hacker to exploit wallets, emphasizing the importance of security in cryptocurrency.

What did ZachXBT reveal about Lubian.com Hacker and U.S. authorities?

ZachXBT indicated that the addresses involved in the ongoing U.S. seizure of 127K BTC were also flagged in the Milky Sad report, suggesting potential connections between the Lubian.com Hacker’s activities and U.S. law enforcement.

Can the identity of the Lubian.com Hacker be confirmed?

While Arkham Intelligence has identified the Lubian.com Hacker in relation to the BTC theft and the Milky Sad incident, the actual identity of the individual or group behind these activities has not been conclusively verified in public records.

What is the significance of the 11,886 BTC still held by Lubian.com?

The 11,886 BTC remaining with Lubian.com, estimated to be worth $1.35 billion, represents a significant asset that ties back to the vulnerability exploited by the Lubian.com Hacker, raising further questions about the mining pool’s management and operations.

Why is the weak-key incident crucial for understanding Lubian.com Hacker?

The weak-key incident is crucial as it provides insight into vulnerabilities that can lead to massive cryptocurrency thefts, such as those perpetrated by the Lubian.com Hacker, thereby stressing the need for enhanced security measures in the crypto space.

What is the relation between cryptocurrency theft and U.S. law enforcement actions?

The ongoing U.S. law enforcement actions surrounding the 127K BTC are influenced by insights from investigations into the Lubian.com Hacker and other cryptocurrency thefts, illustrating the growing intersection of criminal activity and regulatory response in the crypto market.

| Key Points | Details |

|---|---|

| Seizure of Bitcoins | U.S. authorities aim to seize over 127,000 bitcoins linked to investigations. |

| Lubian.com Hacker | Identified by Arkham Intelligence; linked to a theft involving Lubian.com, a mining pool tied to China. |

| Milky Sad Incident | A flaw in Libbitcoin Explorer led to predictable wallet keys, causing theft of funds. This flaw is recorded as CVE-2023-39910. |

| Investigation Timeline | The funds drained from Lubian.com wallets in December 2020, going unnoticed for years until reported by Arkham in August 2023. |

| Current Status | Lubian.com still holds 11,886 BTC worth approximately $1.35 billion, while the investigation continues. |

| Law Enforcement Insights | The DOJ has not clarified how the bitcoins came to be in U.S. custody, raising questions about the nature of the seizure. |

| Role of ZachXBT | Investigative expert ZachXBT highlighted connections between the seized bitcoins and the Milky Sad report, suggesting potential links to governmental actions. |

Summary

Lubian.com Hacker is at the center of U.S. authorities’ ongoing efforts to seize over 127,000 bitcoins tied to a significant theft. This case sheds light on the vulnerabilities within cryptocurrency systems and emphasizes the importance of security in blockchain technology. The implications of the Libbitcoin Explorer flaw, along with the mystery surrounding the flow of these bitcoins, highlight the need for ongoing vigilance and reform in crypto security practices. As the investigation unfolds, it remains crucial for stakeholders in the cryptocurrency community to stay informed about developments linked to the Lubian.com Hacker.