A market bubble has once again captured the attention of investors and analysts, particularly as stock prices are surging amid an unprecedented rise in artificial intelligence spending. While the financial landscape is punctuated with fears of overvaluation and inflation, many top economists are urging caution against jumping to conclusions about a bubble. They point out that despite elevated market valuations, the underlying economic conditions—such as consumer resilience and productivity gains—are not showing signs of a fundamental breakdown. Economists’ predictions indicate that the complexities of the current market may involve adjustments rather than a cataclysmic downturn. With the 2026 economic outlook still favorable, it’s crucial to dissect these trends carefully to distinguish between genuine growth and speculative excesses that characterize a market bubble.

The concept of a speculative bubble in financial markets often evokes a mix of optimism and caution among investors and economists alike. Recent trends suggest an inflation of asset values, possibly resulting from heightened enthusiasm fueled by advancements in technology and corporate growth. However, experts analyze market dynamics, arguing that true bubbles exhibit specific behaviors such as rampant insider trading and excessive public offerings, which seem absent in the current climate. As discussions continue around the AI spending market and its implications, the notion of economic resilience offers a counterbalance to fears of financial collapse. Ultimately, as we move towards 2026, maintaining an analytical perspective on these fluctuations is essential for a clearer understanding of market trends.

Understanding Market Bubbles: A Comprehensive Overview

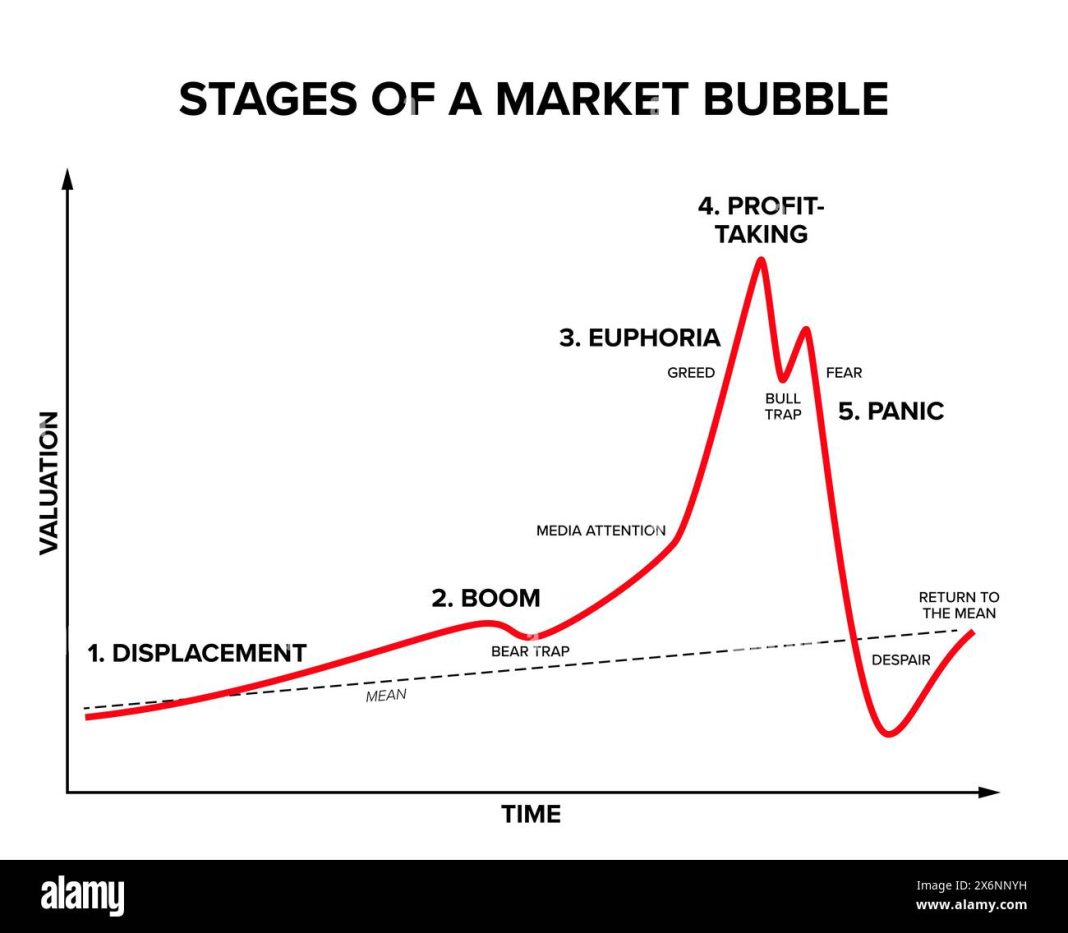

Market bubbles can be defined as periods when asset prices substantially exceed their intrinsic values, driven largely by exuberant market behavior. In recent years, concerns have resurfaced regarding whether the current stock market might be experiencing a bubble due to extraordinary increases in stock valuations and the rapid acceleration of AI spending. However, several economists contend that while certain stock segments may exhibit elevated valuations, this alone does not signal a full-blown bubble. Instead, they suggest a need to analyze underlying economic fundamentals such as growth rates, employment figures, and consumer spending patterns.

To accurately assess whether a market is truly in a bubble, one must look beyond surface level trends. A key indicator is the behavior of insider trading — traditionally, bubbles accompany a spike in corporate executives selling shares, indicating a loss of confidence in their company’s future. As highlighted by Owen Lamont, while valuations may appear high, the absence of significant public offerings from insiders implies that industry confidence remains intact. Thus, the current market may be more about a recalibration of expectations rather than the beginning of a bubble.

Economist Insights: Predictions for 2026 and Beyond

Leading economists have presented insights that temper concerns about an imminent stock market bubble while suggesting a cautious approach toward future trends. Jared Bernstein notes that the U.S. economy is well-equipped to navigate challenges leading into 2026, supported by resilient consumer spending and productivity improvements. Bernstein’s assessments point to an adaptive economic framework that can withstand rising interest rates and policy uncertainties, ultimately suggesting that economic stability is achievable despite market fluctuations.

Moreover, as we approach 2026, economists expect continuation of growth, albeit at a moderated pace. Bernstein emphasizes that the current economic environment is characterized as a ‘low-hire, low-fire’ equilibrium, indicating that while job growth may be slowing, it does not precipitate a downturn. Reassessing factors like inflation and productivity reveals an overall optimistic perspective – one that aims to separate the narrative of a bubble from a more nuanced examination of market dynamics.

AI Spending and Market Dynamics: A Double-Edged Sword

The integration of artificial intelligence within the market landscape engenders both excitement and concern. On one hand, a surge in AI spending has the potential to drive innovations and productivity growth across various sectors. Conversely, this surge has also sparked fears of a potential market bubble, driven by inflated expectations surrounding AI capabilities. The current market scenario reflects investor enthusiasm for AI, suggesting a disconnect between actual economic output and skyrocketing asset valuations.

Economists assert that while AI is reshaping the investment landscape, it has yet to create the kind of widespread economic disruption that would definitively signal a bubble. Insights from Kristalina Georgieva emphasize that the global economy has effectively absorbed shocks, suggesting resilience in the face of new technologies. As firms invest in AI to enhance productivity, this process may foster sustained economic growth rather than a speculative bubble characterized by irrational exuberance.

Global Economic Resilience Amidst Uncertainty

Amid various geopolitical tensions and unforeseen economic challenges, the global economy has demonstrated remarkable resilience. Kristalina Georgieva’s insights from the World Economic Forum indicate that, despite daunting prospects, global growth has steadied over recent times. This resilience can be attributed to measured policy responses from central banks and the adaptability of the private sector, which continue to mitigate risks while fostering innovation and investment across economies.

Moreover, while recognizing the challenges posed by rising public debt and uneven growth, Georgieva interprets these issues as manageable within the broader context of economic stability. This perspective highlights the importance of strategic foresight and adaptability among policymakers and business leaders to navigate uncertainties effectively. As global economic interdependencies deepen, emphasis on resilience becomes key to ensuring sustained growth going into 2026 and beyond.

Key Indicators of Economic Health: Beyond Valuations

Evaluating the health of an economy extends far beyond analyzing stock market valuations. Factors such as employment rates, consumer spending levels, and technological advancements play crucial roles in determining economic strength. Our top economists emphasize that while market valuations may cause unease, indicators of long-term economic health suggest that underlying fundamentals remain robust. Therefore, even if certain metrics display inflated numbers, the overall economic picture appears stable.

Concern exists over high valuations and market dynamics, yet economists argue these should be contextualized within a larger analytical framework. Reports indicate that rather than indicating abnormal market behavior, current conditions might simply reflect a transition phase post-pandemic recovery period. Monitoring trends surrounding consumer behavior and policy impacts becomes essential in drawing accurate conclusions about the market’s trajectory as it heads toward 2026.

The Role of Central Banks: Stabilizing Forces in a Volatile Market

Central banks play a pivotal role in managing economic stability, especially during periods of uncertainty. The responses from institutions such as the Federal Reserve influence market dynamics significantly, shaping investor sentiment and guiding monetary policy actions. Amid rising concerns of a market bubble, the role of central banks becomes increasingly crucial in addressing economic imbalances while supporting sustainable growth.

Currently, policymakers are fine-tuning their strategies to balance monetary easing with inflationary pressures, ensuring that the economy does not veer off course as it approaches 2026. Insights from economists indicate that effective central bank interventions can prevent overheating in asset prices and sustain economic momentum. Consequently, as the market navigates these complex dynamics, the strategic actions of central banks remain a focal point for ensuring long-term stability and growth.

Market Sentiment and Its Implications for Investors

Market sentiment has significant implications for investor decision-making, particularly as fears of a bubble influence perceptions around equity valuations. Investors often react to prevailing market narratives, shaping their strategies based on fear or optimism rather than rational economic indicators. This behavior can feed into speculative patterns, potentially inflating valuations further and creating a feedback loop that culminates in bubbles.

However, prudent investors should focus on separating sentiment-driven movements from underlying economic realities. By analyzing fundamentals such as earnings growth and economic performances, astute investors can make informed decisions that align more closely with sustainable growth prospects. As highlighted by economists, identifying the difference between typical market fluctuations and genuine bubble patterns is critical for maintaining long-term investment health.

Risks and Opportunities: Navigating the Current Market Landscape

Identifying risks and opportunities in today’s market requires a nuanced understanding of economic indicators and broader geopolitical contexts. While elevated valuations and increasing AI investments pose concerns about a bubble, they also indicate significant shifts toward innovation-driven growth. By recognizing the potential for growth amidst uncertainty, investors can uncover opportunities that support long-term strategies rather than reactive decisions based solely on market sentiment.

Furthermore, understanding how to navigate risks effectively necessitates an appreciation for adaptive economic frameworks. As opinion leaders suggest, rather than avoiding volatility outright, investors should embrace a calculated approach that incorporates both growth and defensive strategies. This dual approach enables investors to capitalize on emerging opportunities while maintaining safeguards against potential downtrends as we approach 2026.

Future Outlook: What Lies Ahead in the Market

As we look toward the future, the market outlook remains a critical topic of discussion among economists and investors alike. Anticipations for 2026 reveal a complex landscape, one that balances potential market corrections against sustained economic growth. Emerging trends, particularly in sectors influenced by burgeoning technologies like AI, suggest both challenges and opportunities that can redefine traditional economic models.

Ultimately, the future of the market may hinge on the delicate interplay between technological advancements and economic resilience. By proactively analyzing these relationships and adapting to shifts in policy and consumer behavior, stakeholders can forge paths that promote stability and growth. Thus, predictions for 2026 may serve as a guiding framework for navigating potential market bubbles while seizing growth prospects amid uncertainty.

Frequently Asked Questions

Are we currently experiencing a market bubble in the stock market?

Despite rising stock prices and increased AI spending, leading economists believe we are not currently in a market bubble. Indicators like significant insider selling and higher IPO issuance, which typically mark the peak of a bubble, are absent.

What do economists predict for the U.S. economy outlook in 2026?

Economists, including Jared Bernstein, predict that the U.S. economy will continue to grow into 2026, supported by factors like consumer spending and productivity gains, despite a deceleration in job growth.

How does the current market valuation relate to the concept of a market bubble?

Current market valuations are elevated, but experts argue that the lack of mass equity issuance and the continued reduction of share counts through buybacks suggest we are not in a market bubble yet.

What factors contribute to global economic resilience amid fears of a market bubble?

Global economic resilience can be attributed to adaptive private sector strategies, steady central bank policies, and ongoing technology implementation, as highlighted by Kristalina Georgieva of the IMF.

What risks should investors be aware of regarding the market bubble and economic growth?

Investors should monitor high valuations, rising public debt, and the uneven pace of technological adoption, as these factors pose potential risks to market stability and growth.

Are AI spending trends signaling a stock market bubble?

While increasing AI spending has raised concerns about a market bubble, economists argue that substantial productivity gains, alongside cautious market behavior, indicate that underlying economic health remains strong.

How are consumer trends influencing the market bubble discussion?

Consumer spending and real wage increases help counterbalance concerns of a market bubble, according to economists who emphasize that while retail participation has risen, it does not alone signify a bubble.

What role does insider behavior play in identifying a market bubble?

Insider behavior is crucial in identifying a market bubble; experts suggest that true bubbles are often marked by significant selling activity from corporate executives, which we have not yet seen in this cycle.

| Key Point | Details |

|---|---|

| Market Bubble Concerns | Economists see signs of a possible bubble with rising stock prices and AI spending, but they argue the economic fundamentals remain strong. |

| Economists’ Insights | Owen Lamont believes that current market conditions do not show the typical signs of a bubble, such as increased insider selling. |

| U.S. Economic Outlook | Jared Bernstein predicts continued economic growth into 2026, supported by consumer spending and productivity gains despite slower job growth. |

| Global Economic Resilience | Kristalina Georgieva indicates that the global economy has absorbed shocks effectively and maintains resilience, despite challenges such as high public debt. |

| Common Conclusion | Overall, the economists agree that the market is adjusting rather than collapsing, and the distinction between a boom and a bubble lies in investor behavior. |

Summary

The topic of market bubbles is a pressing concern for investors and economists alike, especially amid rising stock prices and technological advancements. However, leading economists argue that the current economic landscape offers more stability than perceived bubble fears suggest. As discussions unfold, key insights from noted economists reveal that while certain areas show elevated valuations, the overarching economic conditions do not indicate an impending market bubble, but rather a complex adjustment period as we approach 2026.