Max Frequency Ventures (MFV) is making waves in the crypto space with its newly launched $50 million venture fund aimed at empowering ambitious crypto builders. Led by Aptos co-founder Mo Shaikh, MFV seeks to address gaps in the current landscape of crypto venture funds, which often fall short in delivering essential operator experience and mentorship to startups. By investing at an early stage, the firm intends to guide entrepreneurs from the prototype phase right through to successful adoption, emphasizing their commitment to hands-on support rather than mere financial backing. With a robust team of former Aptos executives, MFV boasts a wealth of expertise in fostering innovation, aiming to pave the way for the next generation of groundbreaking cryptocurrency projects. As the crypto landscape evolves, MFV’s focus on long-term partnerships could redefine the criteria for success in early-stage funding within the industry.

Introducing Max Frequency Ventures, this emerging crypto investment powerhouse is carving its niche by providing essential resources to budding blockchain enterprises. Recognized for its focus on early-stage financing, MFV facilitates the growth of innovative crypto projects by leveraging the extensive experience of its founding team, including transformative figures from Aptos. This venture fund stands apart through its unique approach, which prioritizes sustained engagement with startup teams over quick financial returns or token launches. By championing a mentorship model, Max Frequency Ventures is not only investing in technology but also fostering a vibrant ecosystem for crypto builders who are ready to take their ideas to the next level. With the rapidly growing demand for blockchain applications, MFV’s strategy could very well set the stage for the industry’s next wave of advancements.

The Genesis of Maximum Frequency Ventures

Maximum Frequency Ventures (MFV) represents a leap forward in the world of crypto venture funding, launched by Mo Shaikh, a co-founder of the Aptos blockchain. With an initial raise of $50 million, MFV is uniquely positioned to bridge the gap between innovative crypto projects and the resources they need for successful growth. The emphasis on funding ‘MFers ready to build’ highlights a refreshing approach to nurturing early-stage crypto builders, taking a hands-on mentorship role that is often absent from traditional venture capital firms.

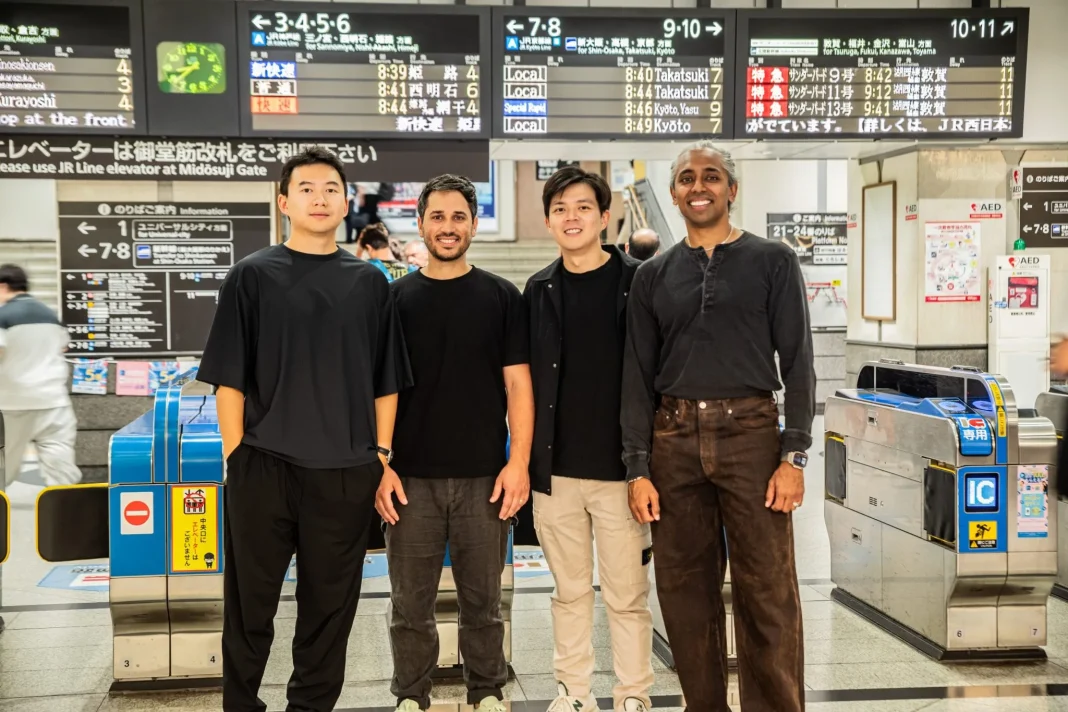

At the core of Maximum Frequency Ventures lies the experience and corporate expertise of its founding team. With a collective background in major financial institutions and tech companies, Shaikh and fellow co-founders Neil Harounian, Alexandre Tang, and Jerome Ong possess a deep understanding of what it takes to escalate a startup from mere concept to thriving enterprise. Their vision is not just about providing capital; it is about fostering an ecosystem where budding founders can thrive with access to valuable operator experience and strategic guidance.

Building the Future of Crypto Innovation

As crypto becomes increasingly mainstream, the need for robust support systems around emerging projects is paramount. Maximum Frequency Ventures is keenly aware of this need, which is why their strategy revolves around embedding with startups long-term. Unlike many crypto venture funds that focus solely on quick exits, MFV prioritizes the long-term development and adoption of products—an approach that could potentially transform the landscape of crypto investments. Shaikh emphasizes that their funding will empower crypto builders to concentrate on meaningful advancements and sustainable growth.

Through MFV’s commitment to early-stage funding, new projects will benefit from hands-on assistance as they navigate the often complex journey from prototype to market dominance. This support is especially critical in the ever-evolving crypto landscape, where staying relevant requires not just capital but also mentorship and guidance from those who have successfully traversed similar paths. By combining financial backing with an operator-driven approach, MFV aims to cultivate the next generation of successful crypto entrepreneurs.

Aptos: The Backbone of Maximum Frequency Ventures

The roots of Maximum Frequency Ventures are deeply intertwined with the success of Aptos, where co-founder Mo Shaikh first made his mark. Aptos is not just a blockchain; it is a thriving ecosystem that has enabled over 200 projects to build upon its architecture, fostering innovation and creativity in the crypto space. The insights gained from developing and launching Aptos inform the strategies MFV employs in supporting its portfolio companies, ensuring they are well-equipped to achieve large-scale adoption.

By leveraging the lessons learned through their work at Aptos, the MFV team understands the crucial elements that contribute to a project’s success. They recognize that achieving product-market fit is not merely about having a great idea, but also about execution, user engagement, and the ability to adapt in a fast-paced environment. With such experience at their fingertips, MFV positions itself not just as an investor but as a partner to those ‘MFers ready to build’ the future of crypto.

The Importance of Mentorship in Crypto Ventures

In the realm of crypto, mentorship can often be the missing link between a startup’s potential and its actual success. Maximum Frequency Ventures prioritizes this element by embedding its team with funded projects to guide them through critical early stages. This level of involvement ensures that startups are not isolated in their journey; instead, they have access to seasoned advisors who can help them navigate challenges and capitalize on opportunities. As Mo Shaikh states, the focus should be on helping startups until adoption occurs, rather than merely waiting for a financial return.

The MFV approach is a refreshing commitment to fostering a culture of collaboration and shared success in the crypto community. By valuing mentorship as a core component of their investment strategy, MFV aims to redefine how venture capital operates within the blockchain space. Their belief is that informed guidance can significantly enhance the capabilities of crypto builders, encouraging innovative solutions and yielding a stronger ecosystem overall.

What Sets Maximum Frequency Ventures Apart?

Maximum Frequency Ventures distinguishes itself from traditional crypto venture funds through its deliberate choice to engage deeply with portfolio companies. Instead of simply writing checks, MFV focuses on building long-term relationships with startup founders, allowing them to benefit from continuous support and expertise. This approach not only facilitates faster product evolution but also cultivates a community of resilient entrepreneurs who can rely on each other and share valuable insights along their journeys.

The MFV strategy stands in stark contrast to the conventional cookie-cutter methods of many venture funds, which often emphasize rapid financial gains over sustainable growth. By fostering a more collaborative environment, Maximum Frequency Ventures aims to redefine expectations within the crypto venture capital landscape. The firm’s forward-thinking approach ensures that founders receive the mentorship and operational support needed to navigate the complexities of the crypto market effectively.

The Impact of Early-Stage Funding on Crypto Builders

Early-stage funding is crucial for the success of any startup, particularly in the fast-paced world of cryptocurrencies. With maximum investment amounts, many promising crypto builders often struggle to secure the capital they need to turn their ideas into viable products. This is where Maximum Frequency Ventures steps in, aiming to provide that much-needed financial support while also embedding itself in the day-to-day operations of the funded projects. This dual approach is designed to help founders take their concepts from mere hypotheses to operational realities.

Moreover, the impact of MFV’s funding goes beyond simple capital injection. By providing extensive mentorship and operational support, MFV enhances the likelihood that these companies will not only survive but thrive in an increasingly competitive landscape. The firm’s commitment to empowering ‘MFers ready to build’ ensures that visionary projects are given every chance to establish a foothold in the market and achieve sustained adoption.

Lessons from Aptos: Shaping the Future of Venture Capital

The journey of Aptos has provided invaluable lessons that Maximum Frequency Ventures aims to apply in its operations. The Aptos blockchain experience highlighted the importance of adaptability, user feedback, and continuous improvement—factors that are vital for the success of any crypto venture. By applying these insights when funding new projects, MFV intends to achieve a stronger likelihood of success while cultivating an atmosphere of learning and growth among its portfolio companies.

Additionally, the challenges faced during the development of Aptos have fine-tuned the MFV team’s understanding of what it takes to build a successful project in the crypto environment. Their shared experiences underscore the necessity of having a hands-on approach, which informs their investment decisions. This lesson in perseverance and innovation will play a crucial role in shaping the future of venture capital, particularly as new and exciting technologies continue to emerge in the crypto world.

Empowering the Next Wave of Crypto Entrepreneurs

With the launch of Maximum Frequency Ventures, there lies a promise of empowerment for the next generation of crypto entrepreneurs. By focusing on early-stage funding and active mentorship, MFV sets itself apart as a facilitator of not just capital but also knowledge. This commitment to nurturing ‘MFers ready to build’ signifies a shift towards a more supportive investment culture in the cryptocurrency space. As the crypto landscape evolves, this kind of initiative will be crucial in empowering innovators.

The landscape of venture capital in the crypto sphere is rapidly changing, with more emphasis on supporting grassroots movements and founders who are genuinely passionate about building impactful projects. MFV’s unique approach not only highlights the potential of each builder it supports but also contributes to a more vibrant and dynamic ecosystem, ultimately enriching the entire cryptocurrency community. By investing in the right people, Maximum Frequency Ventures aims to produce lasting contributions to the future of technology and finance.

The Future of Crypto Funding: Trends and Predictions

As the crypto industry matures, the demand for innovative funding solutions like those offered by Maximum Frequency Ventures will likely increase. Trends indicate that venture capitalists are shifting toward models that emphasize long-term growth and mentorship rather than immediate financial returns. This shift reflects a broader understanding of how critical it is for startups to establish product-market fit before focusing on exit strategies—not only in crypto but across the tech landscape.

Furthermore, as more founders express the need for operator support, funds that adopt the MFV model could see a rise in interest and engagement. This evolution may set new standards for investor relations within the crypto sector, prioritizing partnerships that encourage sustainable development over quick profits. In the long run, Maximum Frequency Ventures and similar initiatives will pave the way for a reinvigorated venture capital environment where impactful innovation can reign.

Frequently Asked Questions

What is Maximum Frequency Ventures (MFV)?

Maximum Frequency Ventures (MFV) is a newly established $50 million crypto venture fund, launched by Aptos co-founder Mo Shaikh, aimed at supporting early-stage crypto builders and fostering adoption in the blockchain space.

Who are the founders of Maximum Frequency Ventures?

The fund is spearheaded by Mo Shaikh, co-founder of Aptos, alongside three former executives from Aptos: Neil Harounian, Alexandre Tang, and Jerome Ong, all of whom have extensive experience in the crypto industry.

How does MFV differ from traditional crypto venture funds?

Maximum Frequency Ventures stands out by committing to long-term partnerships with startups, embedding within teams, and emphasizing product adoption rather than focusing solely on quick token events and exits.

What is the main focus of Maximum Frequency Ventures?

The primary focus of MFV is to invest in ambitious crypto builders at the early-stage level, providing not just funding but also mentorship and operational experience to drive successful project adoption.

Why is the launch of MFV important in the crypto space?

The launch of Maximum Frequency Ventures is significant as it underscores the importance of operator experience and mentorship in nurturing the next generation of crypto innovation, addressing gaps left by other venture funds.

What industries does MFV target with its funding?

Maximum Frequency Ventures primarily targets the cryptocurrency and blockchain sectors, specifically seeking innovative projects and startups that aim to enhance crypto adoption and functionality.

What does Mo Shaikh’s approach to crypto funding entail?

Mo Shaikh advocates for a hands-on approach at MFV, where the team actively engages with startups to ensure they progress from the prototyping phase to achieving significant market adoption.

How has Mo Shaikh’s experience influenced Maximum Frequency Ventures?

Mo Shaikh’s extensive background, including his role as an Aptos co-founder, has informed MFV’s strategy to prioritize operator experience and long-term involvement over traditional short-term venture capital models.

| Key Point | Details |

|---|---|

| Maximum Frequency Ventures (MFV) | A new $50 million venture fund launched by Mo Shaikh, co-founder of Aptos, aimed at funding early-stage crypto projects. |

| Founding Team | Mo Shaikh, alongside former Aptos executives Neil Harounian, Alexandre Tang, and Jerome Ong, bringing significant industry experience. |

| Investment Approach | MFV emphasizes operator experience and long-term mentorship, embedding with teams rather than just providing capital. |

| Market Position | MFV aims to support ‘MFers ready to build’, focusing on product adoption over short-term profits. |

| Context | The fund emerges from the experience of more than 200 projects building on the Aptos platform, a layer-one blockchain. |

Summary

Max Frequency Ventures aims to revolutionize the crypto investment landscape by focusing on the adoption of innovative projects. With a robust team of experienced founders and a commitment to embedding with startups, MFV distinguishes itself by providing not just funding, but also mentorship tailored for sustained growth. In the rapidly evolving world of cryptocurrency, Max Frequency Ventures is well-positioned to guide ambitious builders towards successful adoption and real-world impact.