Monetary policy serves as a critical tool employed by central banks, such as the Federal Reserve, to help navigate the complexities of the economy. Recently, Fed Governor Lisa Cook delivered an insightful speech at the Brookings Institute, shedding light on the delicate balance between inflation and employment that policymakers strive to achieve. As highlighted in her remarks, the Fed’s dual mandate includes maintaining stable prices and fostering maximum employment, making the recent interest rate cuts particularly significant for the U.S. economic outlook. With inflation trending toward the targeted 2%, Cook’s assessment underscores the importance of remaining adaptable in response to ongoing economic conditions. Through her commitment to data-driven decision-making, she illustrates the proactive approach necessary to combat potential economic challenges ahead.

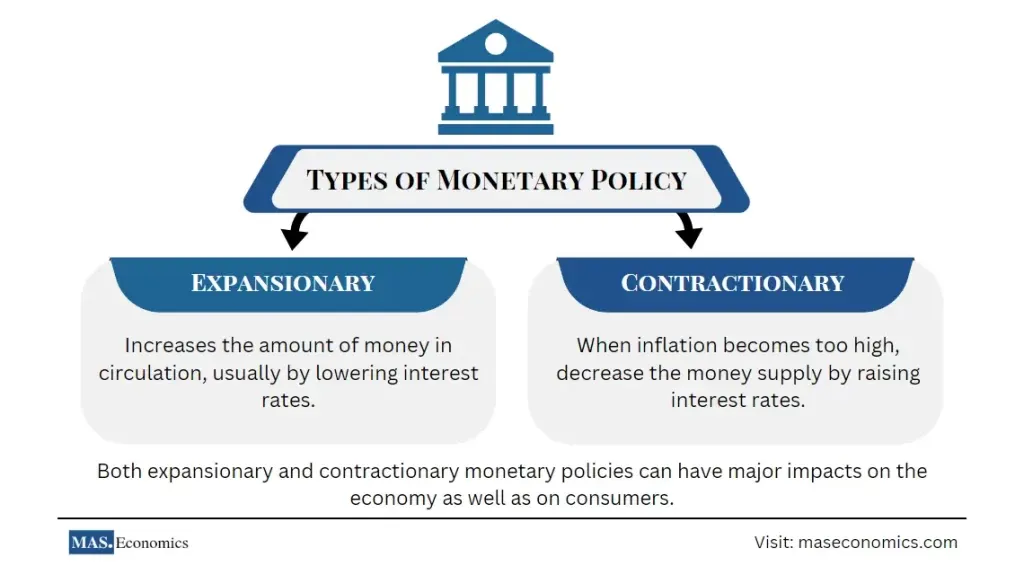

When discussing economic governance, the phrase “monetary policy” can encompass various strategies employed by authorities to control the money supply and interest rates. Central figures, like Federal Reserve Governor Lisa Cook, often articulate the nuances of these approaches during public addresses, as seen in her recent speech at a Washington, DC forum. The overarching goal of such policies is to create a favorable environment for both inflation stability and job creation, thus shaping the country’s financial landscape. Cook’s insights reflect a deep understanding of the interplay between economic growth and inflation management, particularly in light of recent interest rate adjustments. Overall, the health of the economy hinges on the responsible application of these fiscal tools, ensuring that policymakers remain vigilant in their efforts to safeguard against downturns.

The Current State of U.S. Monetary Policy

U.S. monetary policy is currently navigating complex challenges, primarily influenced by evolving economic conditions and geopolitical risks. In her recent speech at the Brookings Institute, Fed Governor Lisa Cook highlighted the delicate balance the Federal Reserve must maintain between controlling inflation and promoting maximum employment. As the Fed implements interest rate cuts to stimulate economic growth, it faces the dilemma of ensuring that inflation remains on target at 2% while simultaneously addressing potential employment stagnation.

Cook stressed the importance of data-driven decision-making in formulating monetary policy. This entails a continual assessment of inflation trends, labor market conditions, and global economic impacts, particularly tariff-related issues that could disrupt these trends. Her remarks underscore the need for agility within the Federal Reserve as it prepares to respond to unexpected economic shifts, keeping the U.S. economic outlook in focus while adhering to its dual mandate.

Understanding the Balance of Inflation and Employment

The interplay between inflation and employment is at the core of the Federal Reserve’s dual mandate. Governor Lisa Cook emphasized that while the employment scenario remains solid, signs of gradual cooling are evident, prompting a close watch on potential downside risks. This cautious approach to monetary policy reflects the Fed’s commitment to fostering a work environment that supports job creation without allowing inflation to spiral out of control. Striking this balance is crucial for maintaining economic stability.

Inflation rates can significantly influence employment levels, and vice versa. When inflation is too high, the purchasing power of consumers declines, which can lead to reduced spending and, ultimately, job losses. Conversely, low unemployment can lead to wage inflation as employers compete for talent. Cook’s insights into this balance are therefore vital for understanding how the Federal Reserve’s policy decisions can impact the broader economy, especially in times of uncertainty.

Impact of Interest Rate Cuts on the Economy

Interest rate cuts are a powerful tool in the Federal Reserve’s arsenal, designed to stimulate economic activity by making borrowing cheaper. In her speech, Lisa Cook reiterated her support for recent rate cuts, which align with actions taken to address the slow economic growth and trade tensions. By lowering interest rates, the Fed aims to promote consumer spending and investment, helping to boost job growth while grooming the economy for future stability.

However, these rate cuts come with their own set of challenges. While they can lead to short-term economic uptick, there’s a risk that prolonged low rates may contribute to asset bubbles or excessive inflation down the line. Cook’s approach remains focused on a careful analysis of incoming data to ensure that monetary policy is adjusted as necessary, paving the way for sustainable economic growth without disregarding the potential threats posed by fluctuating inflation rates.

The Role of the Federal Reserve in Economic Recovery

As the U.S. continues to navigate economic recovery post-COVID-19, the role of the Federal Reserve has become even more pivotal. Governor Lisa Cook addressed this point during her latest talk, emphasizing the need for the Fed to remain proactive in its policy-making. This proactive stance is particularly important now, considering the various external pressures, such as global supply chain issues and rising geopolitical tensions that could significantly impact the domestic economy.

By utilizing tools like interest rate cuts and open market operations, the Federal Reserve aims to stabilize the economy while encouraging growth and job creation. Cook’s ongoing commitment to data-driven policies ensures that the Fed is adequately prepared to meet any emerging challenges, reaffirming its essential role in the U.S. economic recovery process.

Future Outlook for the U.S. Economy

The future outlook for the U.S. economy remains mixed, with uncertainty lingering around inflation and employment trajectories. Fed Governor Lisa Cook’s recent discussions have highlighted this fragile landscape, where tariff effects and potential global economic disruptions are at play. As inflation is tracked closely, policymakers face the challenge of making informed decisions that align with both current economic performance and future projections.

Looking ahead, the Federal Reserve must approach its monetary policy with a forward-thinking mindset. By focusing on comprehensive economic indicators and remaining adaptable to changing circumstances, Cook suggests that the Fed can secure an environment conducive to sustainable growth. The emphasis on consultation with a variety of data sources before each policy meeting illustrates a commitment to mitigating risks while fostering a resilient economy.

Lisa Cook’s Leadership at the Federal Reserve

Lisa Cook’s leadership within the Federal Reserve signals a dynamic shift toward a more inclusive approach to economic policy. Her background and expertise bring valuable insights into how monetary policy can be shaped to respond to real-world issues. Throughout her tenure, Cook has garnered attention for her principled stance on various monetary policies, particularly in navigating the complexities that arise from socio-political and economic challenges.

Her recent speeches, including at the Brookings Institute, reflect her commitment to open dialogue and transparency in monetary policy discussions. As she weighs the implications of interest rate cuts and inflation management, Cook’s role in shaping the Federal Reserve’s strategy toward a balanced economy focused on both growth and stability is becoming increasingly vital.

Challenges in Implementing Monetary Policy

Implementing effective monetary policy is not without its challenges, and Fed Governor Lisa Cook outlined several of these during her recent address. Despite the clarity of the Federal Reserve’s dual mandate, the interconnectedness of global economic systems can complicate decision-making processes. Factors such as international trade disputes, fluctuating currency values, and changes in foreign economic conditions can disrupt domestic monetary policy effectiveness.

Furthermore, the unpredictability of inflation and employment shifts poses a continuous hurdle. Cook acknowledged that understanding these dynamics requires a flexible approach. By utilizing extensive data analysis and recognizing the limits of conventional monetary tools, the Fed can remain agile in its policy responses, adapting to changes that may affect the overall economic landscape.

Inflation Trends and Economic Indicators

Inflation trends are critical indicators of economic health, and their tracking is central to the Federal Reserve’s policy-making process. In her address, Governor Lisa Cook discussed how the Fed monitors inflation data closely to make informed decisions regarding interest rates and other monetary policy measures. Current trends suggest that inflation is moving toward the Fed’s target of 2%, facilitating a balanced approach to employment.

As inflation rates fluctuate, they directly impact consumer behaviors and business investments. By keeping an eye on these trends, the Fed can make proactive adjustments to foster a more stable economic environment. Cook’s commitment to analyzing economic indicators helps position the Federal Reserve to effectively manage inflation while addressing employment challenges, ultimately aligning monetary policy with the broader economic strategy.

Navigating Political Pressures and Policymaking

Political pressures can greatly influence monetary policymaking, and Fed Governor Lisa Cook’s experience encapsulates the complexity of this relationship. Amidst her ongoing legal battles and scrutiny from political leaders, Cook remains focused on the Federal Reserve’s mission to promote economic stability. Her resolve to prioritize data over personal grievances exemplifies a commitment to uphold the integrity of monetary policy amidst external pressures.

Cook’s navigation through these political waters reveals the importance of maintaining independence within the Federal Reserve. Strong policy decisions must be grounded in economic data rather than political ideology or influence. By championing a principled approach to policymaking, Cook not only reinforces the Fed’s credibility but also ensures that monetary policies remain robust, aiming for a healthy U.S. economic outlook.

The Importance of Data in Monetary Policy Decisions

The reliance on data-driven analysis is crucial in guiding the Federal Reserve’s monetary policy decisions. In her recent speech, Lisa Cook emphasized the significance of sourcing diverse economic data to shape policy actions that respond effectively to current conditions. This comprehensive approach aids in understanding inflation trends and employment rates, allowing the Fed to make informed decisions that promote a balanced economic environment.

Data analysis also helps mitigate risks associated with unforeseen economic downturns or volatility. By continually assessing economic indicators, the Fed can adjust its policy stance to foster stability within the financial system. Cook’s commitment to prioritizing data ensures that the Federal Reserve can navigate the complexities of monetary policy with agility and precision, reaffirming its role as a stabilizing force in the U.S. economy.

Frequently Asked Questions

What is Lisa Cook’s role in shaping U.S. monetary policy?

Lisa Cook, a Federal Reserve Governor, plays a significant role in influencing U.S. monetary policy through her participation in Federal Reserve meetings and decisions. Her recent speech at the Brookings Institute highlighted the complexities of balancing inflation, employment, and interest rates, reflecting her commitment to the Fed’s dual mandate.

How do interest rate cuts impact the U.S. economic outlook according to Fed Governor Lisa Cook?

According to Fed Governor Lisa Cook, interest rate cuts can stimulate economic growth by making borrowing cheaper, thereby encouraging spending and investment. During her recent address, she indicated that such cuts are part of a strategy to navigate inflation and support employment, ultimately shaping a positive U.S. economic outlook.

What challenges does the Federal Reserve face with inflation and employment as discussed by Lisa Cook?

In her speech, Lisa Cook described the challenge of maintaining a balance between inflation and employment. She noted that while inflation is trending towards the Fed’s target of 2%, the employment market shows signs of gradual cooling, necessitating careful monitoring and adjustments to monetary policy to support both objectives.

What are recent developments in Fed policy following Lisa Cook’s comments?

Recent developments in Federal Reserve policy, as noted by Lisa Cook, include two interest rate cuts earlier in the year aimed at addressing economic conditions. Cook emphasized that policy decisions will be made based on incoming data and evolving economic threats during her upcoming assessments, particularly leading into the December meeting.

How does Lisa Cook assess risks in connection to U.S. monetary policy?

Lisa Cook assesses risks related to U.S. monetary policy by closely monitoring economic indicators and potential downside risks, particularly in the labor market. Her approach is data-driven, reflecting her commitment to adapting monetary policy to meet the dual mandate of stable prices and maximum employment.

| Key Point | Details |

|---|---|

| Fed Governor’s Speech | Lisa Cook emphasized the complexities and challenges of U.S. monetary policy at the Brookings Institute. |

| Dual Mandate | Cook discussed the Federal Reserve’s dual mandate: achieving stable prices and maximum employment. |

| Inflation Target | Cook believes inflation is on track to reach the target of 2% as tariffs’ impacts abate. |

| Employment Insights | She characterized the employment landscape as ‘solid’ but noted a gradual cooling. |

| Personal Challenges | Cook’s past legal battles under the Trump administration were highlighted but she remains committed to her role. |

| Data-Driven Decisions | Her future decisions, including the December Fed meeting, will rely strictly on data rather than personal issues. |

Summary

Monetary policy plays a crucial role in maintaining economic stability and growth, as highlighted in Fed Governor Lisa Cook’s recent speech. She underscored the ongoing challenges of balancing inflation and employment within the Federal Reserve’s framework. As the landscape evolves, Cook’s data-driven approach emphasizes the importance of responsive monetary policy, particularly in light of external pressures such as tariffs. Moving forward, her focus on real-time data will be essential in navigating the complexities of the economic environment.