Opensea trading volume has surged to an impressive $2.6 billion this month, highlighting its dominance in the NFT space and solidifying its position as the leading NFT marketplace. This substantial trading volume, with over 90% coming from token transactions, demonstrates the increasing popularity of digital assets among collectors and traders alike. In light of this momentum, the company’s CEO announced an ambitious pivot from solely being an NFT platform to a broader trading landscape that will eventually encompass a diverse array of assets. The anticipated SEA token launch marks a significant milestone, as it aims to enhance user interaction and engagement, further bolstering the trading platform’s offerings. With new features on the horizon and continuous updates in NFT trading news, Opensea is set to redefine how users interact with digital collectibles and cryptocurrencies alike.

The recent surge in Opensea’s trading activity reflects not just a momentary spike but a growing trend in the digital asset market. With its historic trading volume now surpassing $2.6 billion, this platform has transformed beyond a simple marketplace for non-fungible tokens (NFTs) into an extensive avenue for trading various digital and physical assets. This initiative comes with exciting developments, including the upcoming launch of the SEA token, which promises to broaden the functionalities available on the platform. As Opensea explores innovative features such as mobile transactions and cross-chain capabilities, it positions itself not only as a pioneer in the NFT space but also as a comprehensive trading ecosystem. In tandem with the latest NFT trading news, users can anticipate a more integrated experience in the world of digital collectibles.

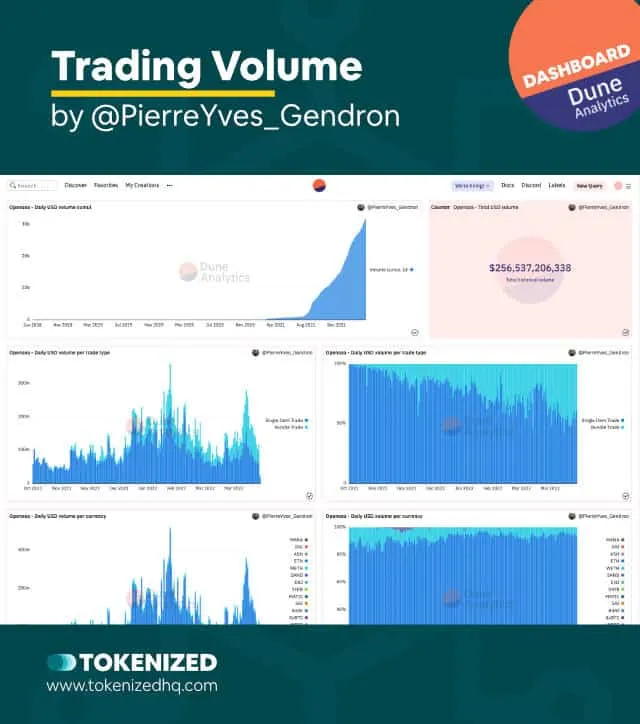

Opensea’s Impressive Trading Volume Surpasses $2.6 Billion

Opensea has achieved a remarkable milestone this month by surpassing $2.6 billion in trading volume. This figure is particularly impressive as over 90% of this volume comes from token trading. The surge in the trading volume indicates a strong demand for non-fungible tokens (NFTs) and highlights Opensea’s position as a leading trading platform in the NFT marketplace. As more users flock to this platform to buy, sell, and trade their digital assets, the marketplace continues to capitalize on its expanding user base, reaffirming its dominance in the NFT space.

With such significant trading volume, Opensea is not just a marketplace for digital art and collectibles; it is evolving into a comprehensive trading platform. This transformation aligns with the company’s vision to aggregate on-chain liquidity, allowing users to trade a variety of assets, including physical items and digital collectibles. As Opensea continues to innovate and expand its offerings, it is poised to attract even greater trading activity, which will further contribute to its impressive trading volume.

The Launch of SEA Token: A New Era for Opensea

The announcement of Opensea’s new token, SEA, marks a pivotal moment in the platform’s evolution. Scheduled for launch in the first quarter of 2026, SEA is designed to enhance the Opensea ecosystem. The incorporation of staking utilities related to tokens and collections aims to incentivize users and build a more engaged community. This strategic move not only supports the inherent value of NFTs but also positions Opensea as a forward-thinking trading platform that prioritizes user involvement and rewards.

The SEA token will play a vital role in Opensea’s transition from an NFT marketplace to a broader “trade everything” platform. By integrating this token into its existing infrastructure, Opensea aims to simplify transactions and enhance liquidity for a diverse range of digital and physical assets. As users prepare for the upcoming token generation event, the excitement surrounding SEA reflects the growing interest in innovative trading platforms that cater to a wide variety of asset classes.

New Features Coming to Opensea: Mobile Trading and More

Opensea is not resting on its laurels; the platform has exciting new features in the pipeline that aim to enhance user experience. Currently, mobile trading is in a closed alpha, allowing users to trade NFTs on the go, which could transform the way individuals interact with digital assets. Additionally, with the introduction of perpetuals trading, users will have more flexibility in managing their trades, potentially boosting overall trading volume as more sophisticated tools become available.

Moreover, cross-chain abstraction is on the horizon, which will enable users to trade assets across different blockchain networks seamlessly. This feature is particularly significant as it addresses one of the major barriers in the NFT space: interoperability. By allowing users to engage in cross-chain transactions, Opensea is positioning itself as a comprehensive NFT trading platform that not only offers unique collectibles but also a wide array of functionalities that enhance the trading experience.

Understanding Opensea’s Shift to a Broader Trading Platform

Opensea’s recent strategic shift from being solely an NFT marketplace to a broader trading platform reflects its ambition to redefine digital trading. The company’s CEO emphasized that NFTs represent just the beginning of its journey. By planning to aggregate liquidity from various asset types—both digital and physical—Opensea aims to provide users with a comprehensive platform for trading everything, thus expanding its appeal beyond strictly NFT collectors.

This shift is significant as it suggests that Opensea is anticipating future trends where users seek a singular platform to manage and trade multiple types of assets. The features planned for upcoming releases not only underscore this broader goal but also enhance reliability and user trust—critical factors for increasing trading volume as seen in their current robust figures.

Insights into NFT Trading News and Market Trends

As the NFT marketplace continues to evolve, keeping up with the latest trading news is essential for investors and collectors alike. Opensea’s announcement of $2.6 billion in trading volume is not just a statistic; it signifies a thriving marketplace where new trends are emerging. With a majority of this volume stemming from token trading, influencers and collectors need to be aware of the shifts in consumer behavior and market dynamics.

Moreover, as Opensea rolls out new features and the SEA token launch approaches, participants in the market must stay informed about how these developments may impact their trading strategies. Knowing when to enter or exit the market based on current trading news can provide traders with a competitive edge, ensuring they can capitalize on opportunities as the NFT landscape continues to grow.

Navigating the Future of Opensea: What Users Can Expect

Looking ahead, Opensea is poised to transform the way users interact with digital assets. The planned features and SEA token launch are just the beginning of a larger vision that integrates advanced trading options and community engagement. As the platform becomes a ‘trade everything’ hub, users can expect to see more innovative tools that facilitate seamless transactions between various asset types.

The future of Opensea seems bright, especially as it embarks on this journey towards inclusivity in trading. Users should prepare themselves for a more dynamic marketplace where cross-chain capabilities and user-centric mechanisms will enhance their trading experience. By actively participating in this evolution, traders can make informed decisions and capitalize on the myriad possibilities within the Opensea ecosystem.

Understanding Token Trading: The Heart of Opensea’s Success

Token trading has become the heartbeat of Opensea, propelling the platform’s trading volume to unprecedented heights. With 90% of the recent $2.6 billion trading volume attributed to token activity, it is clear that the market is responding favorably to new token initiatives. As non-fungible tokens (NFTs) gain traction, the integration of token trading into Opensea’s business model has solidified its status as a market leader in the NFT landscape.

As users increasingly engage in token trading, opportunities arise not only for individual users but also for developers and creators looking to harness the liquidity generated by this model. This shift aligns with Opensea’s goal to create a more extensive ecosystem that allows for diverse trading opportunities, contributing to its overall success as a premier trading platform.

The Competitive Edge of Opensea’s Unique Features

Opensea has carved out a significant competitive edge in the crowded NFT marketplace by introducing unique features that resonate with user needs. With its plan to roll out mobile trading capabilities and perpetuals trading, Opensea enhances the overall trading experience, making it more accessible and engaging. Such features not only attract new users but also retain existing ones by providing them with versatile tools to manage their collections effectively.

Additionally, the emphasis on user custody throughout these transitions reinforces trust and safety, two critical factors that often dictate user engagement in trading platforms. As Opensea continues to unveil features that prioritize user experience and asset security, it solidifies its position as a frontrunner in the ever-evolving domain of digital trading.

The Importance of Community in Opensea’s Evolution

Community plays a pivotal role in the success of platforms like Opensea. As the company prepares to launch the SEA token, allocating 50% of the total supply to the community highlights the importance of user involvement in the platform’s future. This strategy not only empowers those invested in the ecosystem but also fosters a sense of belonging and shared purpose among participants.

By prioritizing community engagement, Opensea is ensuring that its evolution is not solely driven by profits but also by the interests and needs of its users. As users are incentivized through token rewards and new features, it is expected that they will take a more active role in promoting the platform, which, in turn, can contribute to increased trading volume and overall market success.

Frequently Asked Questions

What is Opensea’s current trading volume?

Opensea recently reported a trading volume exceeding $2.6 billion this month, marking significant activity primarily driven by NFT and token trading.

What changes is Opensea making to its trading platform?

Opensea is evolving its marketplace from a solely NFT focused platform to a broader ‘trade everything’ platform, which will support a variety of tokens and collectibles.

How are non-fungible tokens (NFTs) performing on the Opensea NFT marketplace?

NFTs continue to drive a substantial portion of Opensea’s trading volume, contributing to over 90% of the $2.6 billion reported this month.

What is the SEA token and when will it be launched?

The SEA token, announced by the Opensea Foundation, is set to launch in the first quarter of 2026 and will include various staking utilities on the Opensea platform.

What features will Opensea introduce alongside the SEA token launch?

In anticipation of the SEA token launch, Opensea plans to roll out new features such as mobile functionality, perpetual trading options, and enhancements for cross-chain trading.

How will the SEA token be distributed to the Opensea community?

50% of the SEA token supply will be allocated to the community, with a significant portion available for initial claims during the launch.

What are the benefits of the new ‘trade everything’ approach on Opensea?

The ‘trade everything’ strategy will enhance the Opensea platform by allowing users to trade a wider array of assets, increasing on-chain liquidity and maintaining user custody.

Can you provide updates on NFT trading news related to Opensea?

Opensea’s latest trading news highlights its impressive $2.6 billion trading volume and strategic shift towards broader asset trading, alongside upcoming SEA token developments.

| Key Points |

|---|

| Opensea’s trading volume for the month exceeded $2.6 billion, with over 90% from token trading. |

| The CEO emphasized a strategy shift from being just an NFT marketplace to a broader ‘trade everything’ platform. |

| A new token named SEA will be released by the Opensea Foundation in Q1 2026. |

| $SEA will include staking options and community allocation of 50% of the total supply. |

| Upcoming features include mobile capability, perpetuals trading, and cross-chain abstraction. |

Summary

Opensea trading volume has recently surpassed $2.6 billion, signaling a significant transformation in the platform’s operation and strategy. With a heavy focus on token trading, Opensea is not only looking to lead in the NFT space but is also expanding its services to incorporate a wider array of assets. The planned introduction of the SEA token in 2026 demonstrates Opensea’s commitment to community involvement and innovative trading solutions. As they continue to roll out new features and enhancements, Opensea is well-positioned to maintain its leadership role within the broader blockchain marketplace.