Ripple payment settlement is set to revolutionize the way we think about digital transactions. In a groundbreaking collaboration with Mastercard, Ripple aims to introduce stablecoin payments through RLUSD, a U.S. dollar-backed stablecoin, on the XRP Ledger. This strategic partnership, unveiled at the Ripple Swell 2025 event, represents a significant advance in merging blockchain technology with traditional finance, known as TradFi. By leveraging the efficiency of the XRP Ledger, this initiative promises to enhance fiat card transactions and pave the way for broader cryptocurrency adoption. As companies like Mastercard explore innovative payment solutions, the integration of stablecoins signifies a pivotal shift towards a more regulated and efficient payment ecosystem.

The evolution of payment systems is becoming increasingly evident with initiatives like Ripple’s partnership with Mastercard. This project aims to leverage next-generation digital currency, specifically focusing on stablecoin settlement via the RLUSD on the XRP Ledger. As traditional financial institutions recognize the potential of blockchain technology, terms like cryptocurrency integration and fiat card processing gain prominence. By embracing alternatives such as regulated stablecoins, organizations are not only enhancing efficiency in transactions but also fostering a more robust framework for digital finance. Such developments illustrate the growing landscape of financial innovation where established players and digital currencies converge.

Integrating Stablecoin Payments with the XRP Ledger

The collaboration between Mastercard and Ripple is set to revolutionize the way fiat payments are settled by integrating stablecoin payments into the financial infrastructure. Utilizing Ripple’s RLUSD on the XRP Ledger, this initiative aims to streamline traditional payment processes by harnessing the efficiencies of blockchain technology. As financial institutions face growing pressure to modernize their operations, the potential for stablecoin payments like RLUSD to facilitate quick and secure transactions is becoming increasingly evident. This partnership marks a pivotal step in the evolution of payment systems, making it easier for consumers and businesses to engage in cryptocurrency adoption without sacrificing regulatory compliance.

Moreover, the integration of the XRP Ledger for stablecoin payments ensures that transactions are settled swiftly and with minimal costs, appealing to both consumers and merchants alike. The underlying technology not only enhances the efficiency of card transactions but also builds trust within the financial ecosystem, thereby fostering a greater acceptance of cryptocurrency and blockchain in everyday financial activities. This alignment between traditional finance and blockchain capabilities is anticipated to set a benchmark for future partnerships in the fintech space.

Mastercard’s Role in Blockchain and Stablecoin Adoption

Mastercard’s involvement in the stablecoin pilot with Ripple highlights its commitment to leading the transformation of payment systems through innovative blockchain solutions. By leveraging its vast global payment network, Mastercard aims to introduce regulated stablecoin payments into mainstream finance, which promises to simplify cross-border transactions and enhance consumer experience. Sherri Haymond’s emphasis on compliance is essential, as the current regulatory environment around cryptocurrency is rapidly evolving. The alignment between innovation and regulation will ensure that stablecoin adoption progresses smoothly within the established frameworks of traditional banking.

This initiative is particularly important as it addresses the challenges of regulatory concerns while providing a seamless experience for users. Integrating RLUSD with Mastercard’s existing infrastructure could set a precedent for other financial institutions to follow suit, thereby expanding the use of stablecoins in various payment scenarios. This partnership could pave the way for similar collaborations, further enhancing the role of stablecoins in the global financial system and promoting greater adoption of blockchain technology.

The Impact of RLUSD on Traditional Finance

The introduction of Ripple’s RLUSD into traditional finance via this partnership represents a significant leap toward the future of monetary transactions. With RLUSD being fully backed by cash and cash-equivalent reserves, it offers a level of stability that is essential for consumer trust. Financial institutions, like Webbank, recognize the unique opportunity presented by stablecoins to expedite payments and improve transaction efficiency. As traditional banking services evolve, the reliance on digital assets for everyday transactions will likely increase, leading to a more integrated financial ecosystem.

As RLUSD gains traction, it may influence how banks structure their offerings and interact with customers. The push for using a stablecoin on the XRP Ledger can enhance the speed and transparency of transactions, ultimately benefiting not just institutional players but also individual users. The successful integration of RLUSD could usher in a new era where conventional fiat transactions are seamlessly blended with cryptocurrency solutions, driving broader cryptocurrency adoption across various demographics.

Future of Card Transactions with Blockchain Technology

The potential of blockchain technology to transform card transactions is becoming increasingly evident, especially with initiatives like the collaboration between Mastercard and Ripple. By facilitating stablecoin payments through the XRP Ledger, traditional card transactions could become faster and more secure, enhancing customer experiences across the globe. This shift could redefine how consumers view digital payments, making them more receptive to using cryptocurrency for everyday purchases. It also allows for the reduction of transaction costs, a significant concern in current payment systems.

Looking ahead, the evolution of card payments through blockchain could spur innovation in how merchants interact with consumers. The implementation of stablecoins, like RLUSD, can provide merchants with immediate access to funds, minimizing the wait times typically associated with card transactions. This could lead to a more efficient retail environment where speed, security, and customer satisfaction are prioritized. As others look to replicate this model, the partnership between Mastercard and Ripple will likely serve as a blueprint for leveraging blockchain technology in payment processing.

XRP Ledger Settlement: Advantages and Opportunities

The XRP Ledger has become a focal point in discussions around efficient payment settlements, particularly with the rise of stablecoins like RLUSD. By utilizing this advanced blockchain technology, Ripple and Mastercard are positioned to revolutionize how settlements are conducted in both domestic and international markets. The system’s capability to settle transactions within seconds contrasts sharply with traditional banking methods, which can often take days. This speed is advantageous for businesses that require immediate access to capital and enables consumers to enjoy a seamless purchasing experience.

Furthermore, the use of the XRP Ledger for stablecoin settlements introduces opportunities for enhanced real-time monitoring of transactions. This transparency can significantly benefit compliance programs, especially in light of increasing regulatory scrutiny on cryptocurrency transactions. By adopting blockchain solutions, financial institutions can ensure that they adhere to financial regulations while simultaneously harnessing the innovative potential of cryptocurrency and stablecoins. This creates an environment where cryptocurrencies are not only embraced but also integrated into the foundational elements of financial transactions.

Consumer Trust in Digital Payments and Stablecoins

As the collaboration between Mastercard and Ripple unfolds, building consumer trust in digital payments, particularly with stablecoin transactions, becomes paramount. The highly regulated nature of RLUSD offers users added security, which is crucial in encouraging the broader public to adopt cryptocurrency for day-to-day purchases. Mastercard’s emphasis on compliance is not just a regulatory necessity; it is a strategic move that fosters confidence among consumers wary of emerging financial technologies.

Education plays a vital role in building this trust. As financial institutions work to implement stablecoin payments, they must effectively communicate the benefits and security measures associated with this new technology. Through consumer education campaigns, potential users can learn about how stablecoin payments can be seamlessly integrated into their existing spending habits. This proactive approach to education combined with regulatory adherence could accelerate cryptocurrency adoption, making digital payments more mainstream.

Regulatory Challenges and Opportunities for Stablecoins

As financial institutions like Mastercard and Ripple actively engage in integrating stablecoins into their payment systems, navigating the regulatory landscape becomes a significant challenge. Establishing a framework that supports innovation while ensuring consumer protection and financial integrity will be essential. The pilot project’s approach to utilizing RLUSD under the supervision of New York’s Department of Financial Services exemplifies how collaboration between regulators and innovators can foster an environment conducive to cryptocurrency adoption.

However, these regulatory challenges also present opportunities for the development of clearer standards and guidelines that could benefit the entire industry. As more stakeholders participate in the dialogue around stablecoin regulation, there is potential for global consistency that could simplify cross-border transactions. By proactively engaging with regulators, the partnership between Mastercard and Ripple may help shape the future regulatory framework for stablecoins, ultimately driving broader acceptance and use in the marketplace.

The Role of Gemini in the Financial Ecosystem

Gemini’s involvement in the collaboration between Mastercard and Ripple highlights the importance of partnerships in advancing the integration of digital assets into the financial ecosystem. As a regulated cryptocurrency exchange, Gemini brings credibility and compliance to the table, ensuring that stablecoin transactions align with existing financial regulations. The integration of RLUSD with the Gemini Credit Card demonstrates how traditional financial products can evolve to include digital assets, thereby expanding consumer options for spending.

Furthermore, incorporating stablecoins into card programs enhances liquidity and operational efficiency for partners like Webbank. As financial services continue to evolve, entities like Gemini play a crucial role in bridging the gap between cryptocurrency and traditional finance. This facilitates easier access to stablecoins for everyday consumers, ultimately contributing to a more inclusive and integrated financial landscape.

Implications for Financial Institutions Moving Forward

The collaboration between Mastercard, Ripple, and Gemini sets a precedent for how financial institutions can effectively adapt to evolving market demands. As more banks and financial services embrace the idea of integrating blockchain solutions into their operations, we can expect a landscape that’s more attuned to consumer needs. This movement towards combining traditional finance with emerging technologies like stablecoins may help drive operational efficiencies and cost reductions, pivotal for financial stability in a digital age.

Moreover, financial institutions must adopt a forward-thinking approach to stay competitive. Understanding the implications of stablecoin payments not only enables banks to serve their customers better but also positions them to be part of the growing cryptocurrency ecosystem. In this regard, the current partnership exemplifies how strategic collaborations can help institutions not only to adapt but also to thrive amidst the changing financial paradigm.

Frequently Asked Questions

What is Ripple payment settlement and how is it used in stablecoin payments?

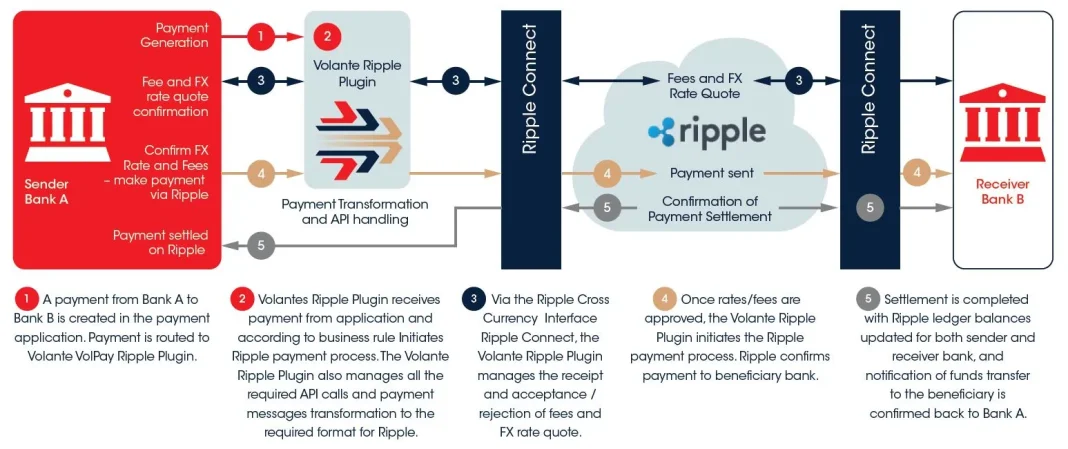

Ripple payment settlement refers to the process by which Ripple facilitates financial transactions using its XRP Ledger (XRPL) technology. In the context of stablecoin payments, Ripple collaborates with partners like Mastercard to integrate its RLUSD stablecoin for efficient and regulated transactions. This allows for faster and more reliable settlement of fiat card transactions leveraging blockchain benefits.

How does the collaboration between Ripple and Mastercard enhance cryptocurrency adoption?

The collaboration between Ripple and Mastercard significantly enhances cryptocurrency adoption by leveraging the established global payments network of Mastercard to introduce stablecoin payments into mainstream finance. By utilizing RLUSD on the XRP Ledger, the partnership promotes awareness and acceptance of cryptocurrencies in everyday transactions, making digital assets more accessible to consumers.

What role does the XRP Ledger play in Ripple payment settlement?

The XRP Ledger is a decentralized blockchain that serves as the underlying technology for Ripple payment settlement. It enables fast and secure transactions, allowing the integration of stablecoins like RLUSD for efficient settlement of fiat card transactions. This blockchain infrastructure enhances the overall efficiency of financial processes while maintaining high compliance standards.

What impact will the Mastercard blockchain have on traditional fiat card transactions through Ripple’s RLUSD?

The Mastercard blockchain will have a transformative impact on traditional fiat card transactions by enabling instant and secure settlements using Ripple’s RLUSD stablecoin. This integration aims to streamline payment processes, reduce transaction costs, and improve overall user experience, marking a significant advancement in how financial institutions handle payments.

How does Ripple and Gemini’s partnership contribute to the future of stablecoin payments?

Ripple’s partnership with Gemini is pivotal for the future of stablecoin payments as it validates the use of regulated digital currencies like RLUSD in everyday transactions. With the Gemini Credit Card integrating these stablecoin settlements, customers can utilize digital assets seamlessly alongside traditional fiat currency, thus promoting the growth and acceptance of cryptocurrency payments in the financial ecosystem.

What are the benefits of using RLUSD for payment settlements on the XRP Ledger?

Using RLUSD for payment settlements on the XRP Ledger offers numerous benefits, including enhanced transaction speed, reduced costs, and increased security due to the immutable nature of blockchain technology. Furthermore, as a regulated stablecoin, RLUSD ensures compliance, providing users with confidence when engaging in fiat card transactions.

| Key Point | Details |

|---|---|

| Collaboration Announcement | Ripple, Mastercard, Webbank, and Gemini announced a partnership to test stablecoin settlement with RLUSD at the Ripple Swell 2025 event. |

| Objective | Integrating blockchain efficiency with traditional finance to enable fiat card transactions through RLUSD on the XRP Ledger. |

| Regulatory Compliance | Mastercard aims to bring regulated open-loop stablecoin payments into the financial mainstream, ensuring compliance and consumer protection. |

| Importance of RLUSD | RLUSD is fully backed by cash reserves and has surpassed $1 billion in circulation since launch, marking it as a significant stablecoin. |

| Future Integration | The next phase involves integrating RLUSD with the XRP Ledger and into Mastercard and Webbank’s settlement processes, pending regulatory approval. |

Summary

Ripple payment settlement is poised to transform traditional finance by leveraging stablecoin technology through partnerships with industry leaders like Mastercard. The initiative aims to harmonize traditional payment systems with blockchain capabilities, thereby enhancing efficiency and compliance. As the financial landscape shifts towards digitalization, Ripple’s efforts in establishing stablecoin settlements demonstrate a forward-thinking approach, catering to the evolving demands of consumers and businesses alike.