Satoshi Nakamoto Bitcoin wallets have become a focal point of intrigue and speculation in the cryptocurrency world, particularly given the staggering valence of their contents, estimated at over $111 billion. Despite rampant myths circulating on platforms like X, there is a fundamental misunderstanding about the accessibility of these wallets, especially in terms of the BIP39 standard commonly associated with modern mnemonic seed phrases. Many believe that a simple 24-word sequence can unlock Nakamoto’s substantial holdings, a claim that is more fiction than fact. These misconceptions not only highlight the gaps in Bitcoin wallets security among the general public but also draw attention to the historical context of Satoshi’s activity and the evolution of cryptographic methods. Understanding the true nature of Satoshi Nakamoto’s history and the technology behind Bitcoin addresses is crucial for debunking these cryptocurrency myths and appreciating the sophisticated design that ensures the security of early Bitcoin holdings.

The wallets belonging to Satoshi Nakamoto, the enigmatic creator of Bitcoin, have captivated the imagination of many crypto enthusiasts and analysts. Known as Satoshi’s wallets, these accounts are believed to contain a treasure trove of approximately 1.1 million bitcoins, yet their actual access remains a topic of confusion and misinformation. The allure of these wallets often stems from claims that they can be unlocked through simple phrases or newly developed mnemonic methods. However, a closer look at the origins of Bitcoin reveals that the sophisticated key generation techniques available today were not utilized during Nakamoto’s time, meaning that assertions built on current standards do not apply retrospectively. By exploring the complexities behind Bitcoin public keys and the advancements in wallet technology, we can gain a more nuanced understanding of the security surrounding these legendary wallets.

Understanding Satoshi Nakamoto’s Bitcoin Wallets

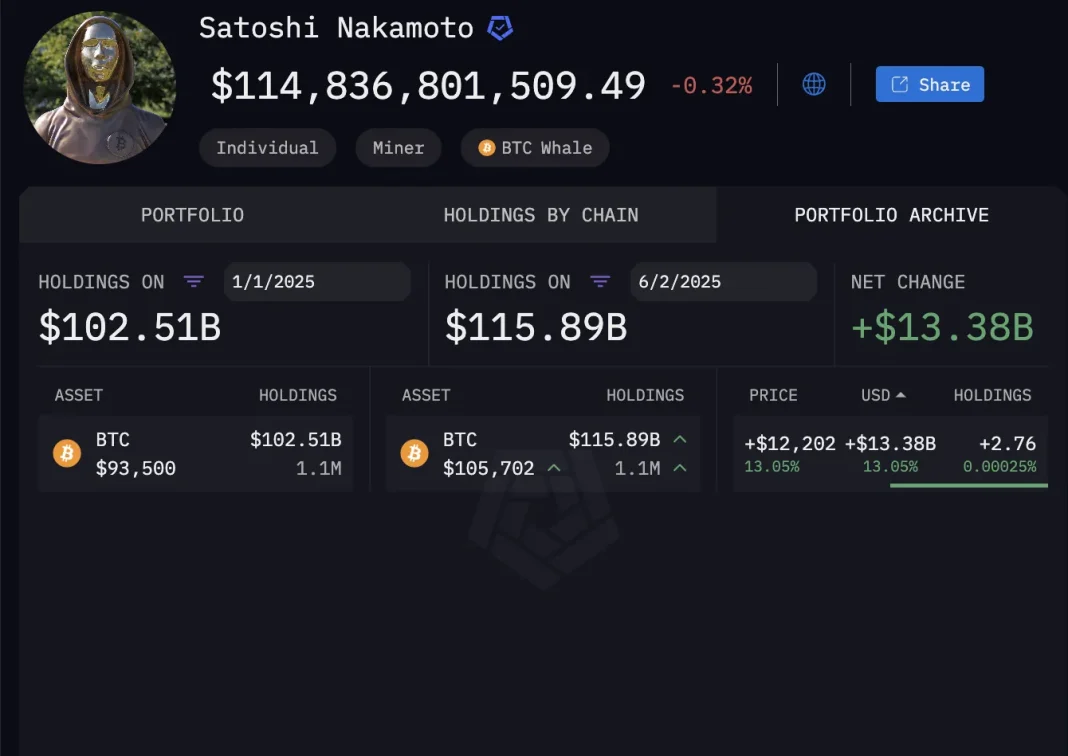

Satoshi Nakamoto, the enigmatic creator of Bitcoin, holds approximately 1.1 million bitcoins across various wallets, a treasure trove valued at around $111 billion as of November 2025. The community has long speculated about the feasibility of accessing these holdings through simplified methods, notably by claiming that a 24-word seed phrase could grant access. However, this notion is misleading and fundamentally misunderstands the historical context of Bitcoin wallet technology. Before the introduction of modern wallet standards, Satoshi operated with raw cryptographic keys, meaning that speculative claims about easily unlocking these wallets are rooted in confusion surrounding Bitcoin’s evolution.

The misconception surrounding Satoshi Nakamoto’s bitcoin wallets speaks to a broader trend in cryptocurrency education, where myths proliferate on social media platforms. Despite claims made in viral posts asserting that Nakamoto’s vast holdings could be unlocked through a mnemonic phrase, the reality is that the technology for such seed phrases did not exist during Nakamoto’s active period. The wallets in question were created using early Bitcoin software, which did not include the user-friendly mnemonic systems introduced years later by BIP39.

Frequently Asked Questions

What do Satoshi Nakamoto’s Bitcoin wallets demonstrate about wallet security?

Satoshi Nakamoto’s Bitcoin wallets highlight the importance of wallet security, as they use raw 256-bit private keys generated before modern standards like BIP39. This emphasizes that early Bitcoin wallets relied on secure key management rather than mnemonic phrases for recovery.

Why can’t a 24-word seed phrase unlock Satoshi Nakamoto’s Bitcoin wallets?

A 24-word seed phrase cannot unlock Satoshi Nakamoto’s Bitcoin wallets because the BIP39 standard was introduced years after Satoshi’s last activity. Instead, Satoshi’s wallets used raw private keys, which do not relate to the contemporary seed phrase recovery methods.

How does BIP39 relate to the security of Bitcoin wallets?

BIP39 enhances the security of Bitcoin wallets by allowing users to create mnemonic seed phrases that represent cryptographic keys. This increases wallet usability and recovery options, but does not apply to Satoshi Nakamoto’s wallets, which used different security methods prior to BIP39’s introduction.

What are some common cryptocurrency myths regarding Satoshi Nakamoto’s Bitcoin wallets?

Common cryptocurrency myths include the belief that Satoshi Nakamoto’s Bitcoin wallets can be accessed with a simple 24-word phrase. These misconceptions disregard the technological advancements in wallet security, particularly the timeline of BIP39 and the historical use of raw private keys.

What is the significance of Bitcoin public keys in the context of Satoshi Nakamoto’s wallets?

Bitcoin public keys play a crucial role in understanding Satoshi Nakamoto’s wallets, as they represent the addresses where significant amounts of Bitcoin are held. These keys are part of a security framework independent of modern mnemonic structures like BIP39.

How many private keys are needed to access Satoshi Nakamoto’s Bitcoin fortune?

To access Satoshi Nakamoto’s estimated 1.1 million BTC, numerous private keys are required—around 22,471 unique keys based on early Bitcoin mining patterns. This further emphasizes the complexity and security inherent in Satoshi’s wallet management.

What does blockchain analysis reveal about Satoshi Nakamoto’s Bitcoin wallet activity?

Blockchain analysis shows that Satoshi Nakamoto’s Bitcoin wallets have remained inactive since 2010. This reinforces the notion that no modern methods, including BIP39-based recovery, apply to these historical wallets that rely on earlier security measures.

How does the BIP39 explanation clarify the historical context of Bitcoin wallets?

The BIP39 explanation clarifies that mnemonic seed phrases were only proposed in 2013, long after Satoshi Nakamoto’s last public communication. This historical context underscores the differing technologies and security measures used in the early days of Bitcoin.

Why is it mathematically infeasible to brute-force Satoshi Nakamoto’s Bitcoin private keys?

Brute-forcing Satoshi Nakamoto’s Bitcoin private keys is mathematically infeasible due to the immense number of potential combinations, approximately 1.1579 x 10^77 for a 256-bit key. This far exceeds the capabilities of current computing power, rendering attempts virtually impossible.

What role do social media plays in perpetuating myths about Satoshi Nakamoto’s Bitcoin wallets?

Social media often amplifies myths about Satoshi Nakamoto’s Bitcoin wallets by spreading misinformation, such as the idea that a 24-word seed phrase can unlock them. These narratives can easily capture attention but lack factual basis, misleading the public about Bitcoin security.

| Key Point | Details |

|---|---|

| Satoshi Nakamoto’s Bitcoin Holdings | Satoshi is estimated to hold 1.1 million bitcoins, valued around $111 billion as of Nov. 12, 2025. |

| Misconception About 24-word Seed Phrase | Claims that Satoshi’s wallets can be unlocked with a 24-word seed phrase are inaccurate due to the timing of BIP39’s introduction. |

| Introduction of BIP39 | BIP39 was proposed on Sept. 10, 2013, after Satoshi’s mining activities, making it irrelevant to his wallets. |

| Nature of Satoshi’s Wallets | Satoshi’s bitcoins are stored across numerous pay-to-public-key (P2PK) addresses, not a single address. |

| Brute-forcing 256-bit Keys | Attempting to crack a 256-bit private key is practically impossible with current technology. |

| Public Transaction Records | Satoshi’s addresses have never shown transacted activity since 2010, confirming the inaccessibility of these wallets. |

Summary

Satoshi Nakamoto’s Bitcoin wallets cannot be unlocked with a 24-word seed phrase, as widely speculated on social media platforms. This misconception arises from a misunderstanding of the timeline associated with BIP39, which was only introduced years after Nakamoto ceased to be publicly involved in Bitcoin development. As a result, theories suggesting easy access to Nakamoto’s estimated 1.1 million bitcoins are fundamentally flawed. The wallets remain secure due to the cryptographic principles inherent in Bitcoin’s design and the nature of how Satoshi’s private keys were created and stored.