The Securitize MCP Server represents a significant advancement in real-world asset tokenization, providing a robust solution for enterprises, developers, and AI platforms seeking secure access to blockchain asset data. Built on the innovative Model Context Protocol, this server streamlines the process of querying tokenized asset information, offering an easy-to-use integration layer that enhances interoperability in tokenized finance. By integrating with the Securitize platform, users can effortlessly obtain real-time data on tokenized treasuries, private credit, and equities, thereby fostering a new era of data accessibility in the financial sector. As demand for reliable access to blockchain asset data surges, the Securitize MCP Server positions itself as an essential tool for those looking to leverage AI integration in financial systems. Ultimately, this integration not only simplifies data management but also opens doors to advanced analytics and AI-driven decision-making processes in the realm of asset management.

Introducing the Securitize Model Context Protocol (MCP) Server, a cutting-edge solution in the realm of asset tokenization that enables seamless access to tokenized asset information for various platforms and developers. This innovative server enhances the interaction between applications and blockchain technology by standardizing data access, thus simplifying the complexities often associated with API integrations. With the rise of interest in real-world asset tokenization, the MCP Server serves as a crucial bridge, delivering real-time data for treasuries, credit, and equity assets on-chain, empowering financial services with enhanced accuracy and efficiency. As AI technologies continue to evolve, the integration of the MCP Server is a game-changer, ensuring that financial platforms remain competitive and informed. By leveraging this new protocol, users can effectively harness data-driven insights and optimize their workflows in the rapidly changing landscape of digital assets.

Understanding the Model Context Protocol (MCP)

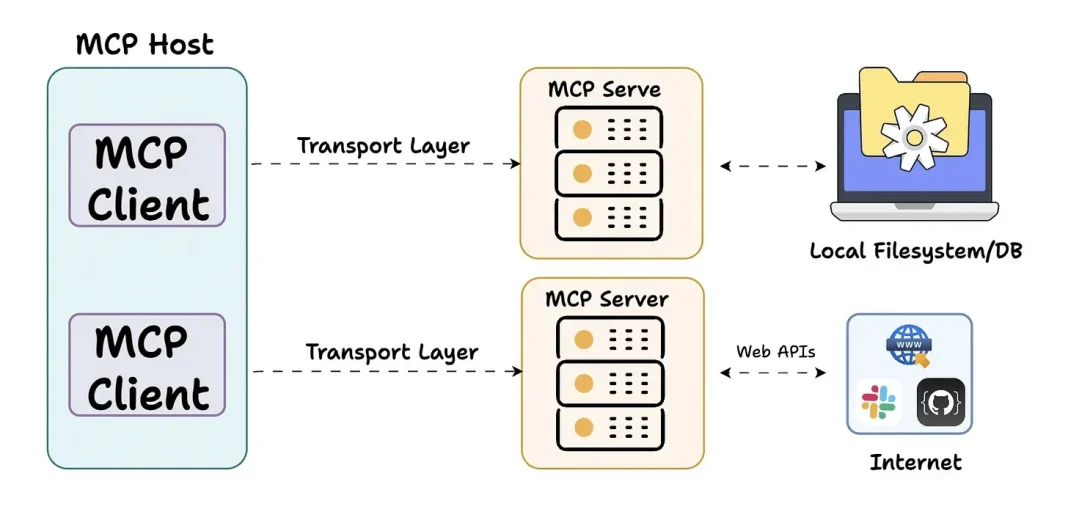

The Model Context Protocol (MCP) serves as a vital bridge enabling standardized communication between various applications and blockchain systems. It allows for seamless interoperability, significantly enhancing access to real-world asset (RWA) data. As enterprises and developers engage with blockchain asset data, MCP simplifies the integration process, paving the way for easier interaction with complex data structures that underpin tokenization.

Using the MCP, developers can query tokenized asset information without the burdensome need for intricate API setups. The protocol’s open-source nature encourages widespread adoption, ensuring that various AI platforms and applications can capitalize on the wealth of tokenized data provided by Securitize. This democratizes access to blockchain technology, facilitating innovative solutions in finance and analytics.

Securitize MCP Server: Revolutionizing Tokenized Asset Accessibility

The Securitize MCP Server represents a groundbreaking step in enhancing accessibility to tokenized asset data. Designed to interface with both developers and AI systems, this server simplifies real-time data queries, supporting the growing demand for reliable asset information. The MCP Server provides a lightweight integration layer that eliminates the complexities traditionally associated with fetching and processing blockchain data.

With real-world asset tokenization gaining momentum, the Securitize MCP Server is positioned as a key solution for enterprises looking to leverage AI integration in finance. By facilitating connections between AI tools like Claude and the robust dataset of Securitize, businesses can effectively streamline their operations and make data-driven decisions using real-time token data.

The Importance of Blockchain Asset Data

Blockchain asset data is crucial for the transparency and security of transactions in the financial sector. The Securitize platform, by utilizing the MCP Server, ensures that enterprises can access verified and standardized asset data efficiently. This removes doubts regarding data integrity and potential inconsistencies that could arise from disparate sources.

As the market for tokenized finance expands, having access to accurate blockchain asset data becomes increasingly important. Financial institutions can leverage the intelligence provided by the Securitize MCP Server to enhance their compliance practices and offer innovative financial products, such as tokenized treasuries or equities, to their clients.

AI Integration in Financial Services

The integration of artificial intelligence within financial services is transforming how businesses approach asset management and trading strategies. By leveraging the Securitize MCP Server, AI systems can gain direct access to blockchain-based real-world asset data, enhancing their analytical capabilities. This integration allows for improved decision-making processes, maximizing the potential for scalable solutions tailored to the financial sector.

Furthermore, AI models can utilize the structured data provided by Securitize to predict market trends and assess investment opportunities. The synergy between advanced AI algorithms and Securitize’s tokenization platform fosters innovations in how financial entities operate, pushing boundaries in asset management efficiency.

Simplified Data Access and Integration for Developers

One of the standout features of the Securitize MCP Server is its ability to simplify data access for developers. By providing a standardized interface, developers can interact seamlessly with tokenized asset datasets, minimizing the technical barriers often encountered in blockchain integration efforts. This ease of access accelerates the development process, allowing for quicker deployment of financial applications.

The server’s API utilizes common formats like JSON for data transfer, making it compatible with existing systems and workflows. This ensures that both small startups and large enterprises can easily integrate blockchain asset data into their applications without needing specialized technical expertise, thus enhancing the overall ecosystem within the financial technology landscape.

Interoperability in Tokenized Finance

Interoperability is essential for the successful integration of various digital assets within the financial ecosystem. The Securitize MCP Server enhances this interoperability by enabling different applications to communicate efficiently with each other while accessing tokenized asset data. Companies can leverage this to create rich, interconnected services that benefit from real-world asset tokenization.

With the ability to interact across platforms, developers can build innovative solutions that harness the best aspects of tokenized finance. This fosters a collaborative environment where various financial technologies can work together, leading to the emergence of new services and products that meet the evolving demands of investors and consumers.

Future Trends in RWA Tokenization

As we look towards the future, the trend of real-world asset (RWA) tokenization is set to expand significantly. The Securitize MCP Server strategically positions itself within this landscape, setting the stage for enterprises to adopt blockchain technology more widely. By providing reliable and standardized asset data, Securitize is helping pave the way for broader acceptance of tokenization in traditional finance sectors.

Market participants are increasingly recognizing the benefits of tokenization, such as improved liquidity and enhanced asset accessibility. As institutional interest in blockchain-based asset issuance grows, the capabilities of the Securitize MCP Server will continue to foster innovation and facilitate new approaches to asset management, ultimately shaping a more efficient financial system.

Enhancing Compliance with Tokenized Assets

Regulatory compliance is a critical component of financial operations, especially as innovation progresses in the realm of tokenization. The Securitize MCP Server is designed to support compliance efforts by providing transparent and verifiable access to tokenized asset data. By adhering to the Model Context Protocol, the server ensures that all transactions and asset details are consistently documented and traceable.

This built-in compliance framework helps businesses mitigate risks associated with non-compliance and fosters trust among investors and regulators alike. By maintaining high standards of data integrity, Securitize elevates the tokenized finance landscape, ensuring that institutions can confidently adopt blockchain technology in their operations.

The Role of Securitize in Institutional Investment

Securitize has positioned itself as a key player in facilitating institutional investment into tokenized assets. With the introduction of the MCP Server, the firm is able to provide institutional investors with access to reliable and compliant asset data, fostering a more accommodating environment for investment strategies centered around RWA.

As interest from established financial players in blockchain-based issuance ramps up, the Securitize MCP Server will provide essential support in delivering compliant and standardized data. This creates opportunities for more robust investment strategies and financial products driven by data insights, ultimately attracting larger institutional players into the tokenized finance space.

Frequently Asked Questions

What is the Securitize MCP Server and how does it facilitate blockchain asset data access?

The Securitize MCP Server is a lightweight integration layer designed to provide secure and standardized access to blockchain-based asset data relating to real-world asset (RWA) tokenization. This server uses the Model Context Protocol (MCP) to enable seamless data exchange between applications, allowing developers and AI platforms to easily retrieve tokenized asset information without complex API calls.

How does the Model Context Protocol (MCP) benefit integration with Securitize tokenization?

The Model Context Protocol (MCP) serves as the foundation for the Securitize MCP Server, offering a standardized framework for accessing real-world asset data. This enhances interoperability and simplifies integration for developers, making it easier to interact with tokenized asset data generated by the Securitize platform.

Can AI assistants utilize the Securitize MCP Server for querying real-time token data?

Yes, AI assistants, such as Claude by Anthropic, can directly interact with the Securitize MCP Server to query real-time token data. By leveraging the server’s standardized functions, AI can efficiently access essential blockchain asset information without needing direct API programming.

What types of data can developers access through the Securitize MCP Server?

Developers can access various types of blockchain asset data through the Securitize MCP Server, including token supply, distribution details, and token metadata. The server provides built-in functions for listing tokenized assets and searching by symbol or description, streamlining the data retrieval process.

How can enterprises benefit from using the Securitize MCP Server for financial operations?

Enterprises benefit from the Securitize MCP Server by gaining reliable and easily integrable access to blockchain-based asset data tied to tokenized finance. This infrastructure allows businesses to enhance their analytics capabilities, improve decision-making, and facilitate compliance in the market of real-world asset tokenization.

Where can developers find and access the Securitize MCP Server for integration purposes?

Developers can access the Securitize MCP Server publicly at the URL mcp.securitize.io/mcp, where they can establish custom connections to the server for integrating blockchain asset data with their applications.

What makes Securitize the leading platform for real-world asset tokenization?

Securitize leads in the real-world asset tokenization space due to its robust infrastructure, superior compliance standards, and a focus on providing standardized and secure data access through innovations like the MCP Server, catering to an increasing institutional interest in blockchain-based asset issuance.

| Feature | Details |

|---|---|

| MCP Server Overview | Securitize’s integration layer for accessing tokenized asset data securely. |

| Purpose | Designed for enterprises, developers, and AI platforms to simplify access to RWA data. |

| Key Features | Built-in tools for listing assets, searching by symbol, and retrieving blockchain details in JSON format. |

| AI Integration | Allows AI assistants to query token data without complex programming, enhancing data accessibility. |

| Interoperability | Enhances connections across tokenized finance, supporting various assets issued through Securitize. |

| Access | Publicly available at mcp.securitize.io/mcp for custom connections. |

Summary

The Securitize MCP Server represents a significant advancement in real-world asset tokenization technology. By providing a standardized, secure access layer for developers and AI platforms, it enhances the ease with which these entities can work with tokenized asset data. As financial markets increasingly demand reliable access to real-time token information, Securitize is well-positioned as a leader in the industry. Developers utilizing the MCP Server benefit from built-in functionality that streamlines the integration process, making it easier to incorporate AI tools and applications into financial workflows. This infrastructure not only enhances interoperability in tokenized finance but also promotes broader adoption of blockchain-based asset issuance, further solidifying Securitize MCP Server’s pivotal role in the evolving financial landscape.