Shor’s Algorithm is emerging as a pivotal topic in the realm of quantum computing, especially when it comes to the security of bitcoin. This revolutionary algorithm threatens the very foundation of cryptography that underpins digital currencies by targeting elliptic curve cryptography, which secures bitcoin wallets. Prominent voices like Martin Shkreli have highlighted that, while current quantum hardware is incapable of executing Shor’s Algorithm at a scale needed to penetrate this security, the implications for future quantum advancements are staggering. As researchers continue to explore the potential of quantum technology, the specter of Shor’s Algorithm looms large, posing a significant risk to bitcoin security and beyond. Understanding its mechanics may well be critical as the landscape of digital finance and cryptography evolves.

The potential dangers posed by Shor’s Algorithm to bitcoin extend into the broader field of quantum computation, where its capabilities could disrupt established cryptographic practices. Known in academic circles for its ability to efficiently factor large integers, Shor’s Algorithm could make current security measures, particularly those relying on elliptic curves, obsolete. This disruptive power has captured the attention of investors and cryptographers alike, as professionals like Martin Shkreli openly discuss the implications for cryptocurrencies. While contemporary quantum machines are still limited in their processing abilities, the anticipation of a quantum leap in technology raises alarms about the future of decentralized finance and digital asset protection. As advancements continue, the conversation around Shor’s Algorithm highlights the critical intersection of cryptography and quantum innovation, emphasizing the need for robust security measures in the age of quantum threats.

Understanding Shor’s Algorithm and Its Implications

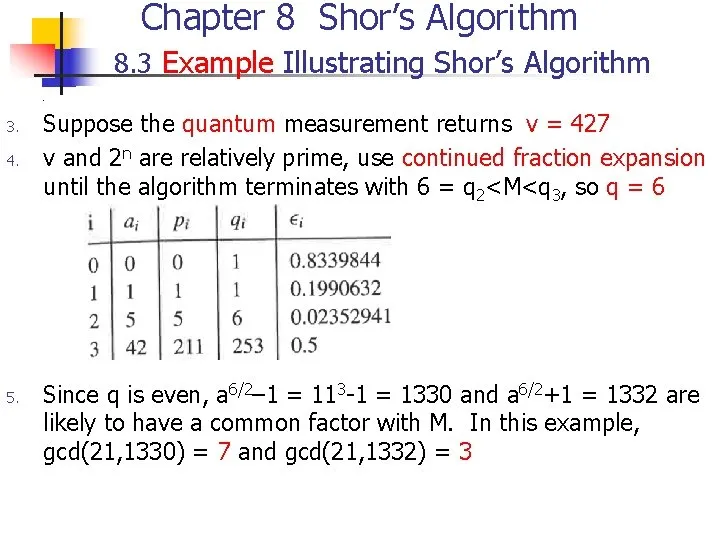

Shor’s Algorithm is a quantum computing breakthrough that poses significant risks to the current cryptographic standards that protect cryptocurrencies like Bitcoin. It operates by factoring large integers efficiently, which can effectively undermine the elliptic curve cryptography often utilized in securing Bitcoin wallets. Unlike classical algorithms that require exponential time to factor large numbers, Shor’s Algorithm reduces this to polynomial time, thus making it a serious threat if quantum computers capable of executing it efficiently are developed. Martin Shkreli emphasizes that this algorithm, rather than advancements in artificial intelligence, poses the most credible path to compromise Bitcoin’s security framework, should quantum technology ever become practically viable.

However, we are currently a long way from unleashing the full potential of Shor’s Algorithm on Bitcoin’s security. Today’s quantum computers are still plagued with issues related to noise and error rates that lead to unreliable outputs during computations. Effective error correction is essential to bridge the gap between theoretical and practical applications of quantum algorithms like Shor’s. This translates to requiring millions of logical qubits—a feat that current quantum systems are unable to deliver. As Shkreli pointed out, while the mathematics behind Shor’s Algorithm is compelling, the hardware necessary to realize this threat remains perpetually out of reach.

The Role of Quantum Computing in Cryptocurrency Security

Quantum computing has the potential to revolutionize many fields, including cybersecurity and cryptocurrency. With advancements in quantum technologies, existing cryptographic systems, which are the backbone of Bitcoin security, could become vulnerable to sophisticated attacks leveraging algorithms such as Shor’s. The elliptic curve cryptography employed by Bitcoin wallets relies fundamentally on mathematical complexities that quantum computers can solve much faster than conventional computers, leading to urgent discussions among cryptography experts about the need for post-quantum cryptographic methods. Experts like Shkreli stress the importance of preparing for these risks before quantum computing becomes mainstream, suggesting that new security protocols must be developed ahead of potential quantum capabilities.

Despite Shor’s Algorithm and potential threats posed by quantum computing, there is a silver lining. The discourse surrounding quantum security has resulted in increased awareness and research within the blockchain community regarding potential vulnerabilities. As Bitcoin users and developers become more educated about quantum risks, there is a push towards developing cryptographic safeguards that can withstand potential quantum attacks. Innovations in post-quantum cryptography aim to create new systems that would remain secure even in a future dominated by quantum technologies, ensuring Bitcoin’s survival and integrity against emerging threats.

Martin Shkreli’s Perspective on Quantum Risks and Blockchain

Martin Shkreli’s foray into the world of cryptocurrencies after his release from prison has brought a keen perspective on the intersection of quantum computing and blockchain technology. His insights during the Bitcoin Rails podcast highlight the critical need for cryptocurrency enthusiasts to separate hype from reality, particularly regarding the advancements in quantum computing. While recognizing the trend towards greater capability in quantum hardware, he remains cautious about overestimating their implications for Bitcoin security in the near term. Shkreli points out that today’s quantum computers are inadequate for a full execution of Shor’s algorithm, underscoring the current hardware limitations that prevent immediate concern for Bitcoin users.

Additionally, Shkreli’s transition to the crypto space illustrates how individuals with diverse backgrounds can contribute to crucial discussions around security and technology. His recognition of decentralized finance (DeFi) potential indicates a balanced understanding of innovation within the blockchain ecosystem. By engaging with the community, he emphasizes the importance of continuously evaluating existing systems against emerging technologies like quantum computing, to devise robust defenses that ensure the security of digital currencies. His opinion that AI may also contribute to breaking cryptographic standards, though less probable than quantum computing, further exemplifies the multidimensional risks that cryptocurrencies face in a rapidly evolving technological landscape.

Future of Bitcoin Security Against Quantum Computing

As the landscape of technology evolves, the future of Bitcoin security must consider the potential advances in quantum computing. The fear surrounding Shor’s algorithm serves as a wake-up call for the cryptocurrency community, urging developers and users alike to rethink the foundations of digital security. Considering Martin Shkreli’s views, the timeline for a quantum attack on Bitcoin is not imminent, but the pace at which technology is developing necessitates that discussions on post-quantum solutions be prioritized. This includes investing in research to improve error correction techniques and exploring alternative cryptographic measures that can withstand the computational power of future quantum machines.

Currently, the transition to a quantum-safe framework involves numerous challenges, from the complexity of developing new cryptographic algorithms to ensuring their integration into existing systems without disrupting the network. Shkreli’s emphasis on the gap between current technology and a feasible quantum attack highlights an urgent need for continuous innovation in cybersecurity strategies. As quantum capabilities advance, organizations invested in cryptocurrencies must remain vigilant and proactive, swiftly adapting strategies to mitigate any emerging threats posed by quantum technologies, thereby securing Bitcoin’s position in the digital economy.

Error Correction Challenges in Quantum Computing

The advancement of quantum computing brings with it formidable challenges, particularly concerning error correction. As Martin Shkreli articulated, each quantum gate operation can fail, leading to inaccuracies that compound dramatically across the several million gates required to run Shor’s algorithm effectively. This raises significant concerns regarding fidelity in quantum circuits, where achieving a minimal error rate is critical for performing reliable computations. Current leading gate fidelities hover around 99.99%, which appears impressive but is insufficient when such precision needs to endure through extensive quantum calculations, including those necessary for a successful Shor execution.

Error correction techniques require vast amounts of additional ‘clean’ qubits to compensate for the noisy nature of current quantum hardware, often resulting in a need for hundreds of millions to billions of physical qubits to achieve a stable logical qubit for practical applications. The challenge extends beyond just increasing the number of qubits; it necessitates pioneering new methods to maintain and improve qubit integrity, thereby enhancing computational power. As researchers strive for methodological advancements in quantum error correction, Shkreli’s warnings serve as an important reminder that while Shor’s algorithm is a theoretical success, its practical applicability hinges on overcoming these significant challenges.

Implications of Quantum Computing for Cryptocurrency Exchanges

Cryptocurrency exchanges face unique vulnerabilities posed by the potential advancement of quantum computing. As outlined in discussions with Martin Shkreli, the primary threat arises from the possibility of Shor’s algorithm enabling attackers to break down the elliptic curve cryptography that secures exchange wallets. A successful quantum attack could lead not only to individual loss of funds but also to a significant erosion of trust across platforms that rely on the security of cryptographic standards. Hence, exchange operators must start considering quantum-resistant protocols to safeguard against future attacks that may compromise the very foundation of their operations.

Moreover, the role of education becomes paramount in the context of cryptocurrency exchanges and quantum risks. Exchanges should take proactive measures by educating their user base about the potential vulnerabilities they face and the efforts being undertaken to enhance security. Initiatives to develop partnerships with quantum researchers and cryptography experts can lead to innovative strategies armored against whatever future technology may pose a threat. Understanding the ramifications of quantum computing on their architecture will empower exchanges to not only enhance their security measures but also prepare their business models for a new era of cryptocurrency operations.

The Intersection of AI and Quantum Computing in Blockchain

As the conversation surrounding cryptocurrency security evolves, the intersection of artificial intelligence (AI) and quantum computing presents intriguing possibilities raised in discussions by experts like Martin Shkreli. While Shor’s Algorithm emerges as the primary quantum threat to Bitcoin, the role that AI could potentially play in breaking through current cryptographic systems should not be overlooked. Although Shkreli acknowledges quantum computing as the more imminent risk, the prospect that AI could lead to innovative mathematical breakthroughs necessitates the exploration of how these two technologies may interact in the realm of blockchain security.

AI’s capabilities might enhance the efficiency of quantum algorithms or contribute to sophisticated simulations that could manipulate existing cryptographic structures. The blending of AI’s pattern recognition and problem-solving capabilities with quantum processing power can open new avenues for both threats and solutions within cryptocurrency frameworks. Therefore, ongoing vigilance is crucial as both AI and quantum technologies develop, necessitating a proactive stance from the blockchain community to ensure that security protocols adapt and evolve in tandem with these technological advancements.

Ethics in Quantum Computing and Cryptography

Engaging in discussions about quantum computing’s implications involves an ethical consideration, particularly highlighted by Martin Shkreli’s reflections on the morality of hacking. The allure of deciphering the secrets behind Bitcoin wallets presents a moral dilemma that raises questions about the responsibilities of those who possess advanced computational knowledge. Shkreli’s perspective underscores that the academic pursuit of breaking encryption, while intellectually stimulating, should be approached with caution and respect for the integrity of individuals’ digital assets. This ethical dimension is a vital aspect of the ongoing discourse on cryptocurrency and quantum computing.

Moreover, as quantum technologies advance, ethical frameworks should be established to govern the use and implications of quantum information sciences. Transparency in research and clear guidelines on responsibly engaging with cryptographic vulnerabilities are paramount to prevent misuse. The blockchain community must navigate these challenging waters by fostering a culture of ethical responsibility as they explore the potential risks and applications of both quantum computing and cryptography, ensuring that technological advancements are used to benefit rather than harm the digital ecosystem.

Frequently Asked Questions

What is Shor’s Algorithm and why is it significant in quantum computing?

Shor’s Algorithm is a quantum algorithm for integer factorization, which can efficiently solve problems that are currently intractable for classical computers. Its significance in quantum computing stems from its potential to break widely used cryptographic systems, specifically those based on elliptic curve cryptography, such as bitcoin wallets.

How does Shor’s Algorithm pose a risk to bitcoin security?

Shor’s Algorithm poses a risk to bitcoin security by potentially allowing a sufficiently powerful quantum computer to factor large numbers and solve discrete logarithm problems, thereby breaking the elliptic curve cryptography that secures bitcoin transactions and wallets.

Why are current quantum machines not capable of executing Shor’s Algorithm on bitcoin?

Current quantum machines are not capable of executing Shor’s Algorithm on bitcoin because they suffer from high error rates, noise, and insufficient qubit counts. Achieving a successful Shor run would require millions of logical qubits, which cannot be achieved with today’s hardware.

What are the requirements for a practical implementation of Shor’s Algorithm against bitcoin?

A practical implementation of Shor’s Algorithm against bitcoin would require a stable quantum computer with error-corrected logical qubits—potentially hundreds of millions to a billion physical qubits—capable of running complex computations without significant error.

Could artificial intelligence (AI) or mathematical breakthroughs provide a faster solution than Shor’s Algorithm to breach bitcoin security?

While some believe AI could lead to mathematical breakthroughs that might affect bitcoin security, Martin Shkreli argues that Shor’s Algorithm remains the most credible threat and is more likely to be the first method to breach the elliptic curve cryptography used by bitcoin.

What is the difference between classical computing and quantum computing in the context of Shor’s Algorithm?

The difference lies in their computational capabilities; while classical computing relies on traditional logic and gates which can be slow for complex problems, quantum computing, using Shor’s Algorithm, can dramatically reduce the time complexity from exponential to polynomial, making it feasible to factor large numbers and compromise cryptographic systems.

Is Shor’s Algorithm a risk today or a long-term threat to bitcoin security?

Shor’s Algorithm is viewed more as a long-term threat to bitcoin security, as current quantum computing technology is not advanced enough to execute the algorithm effectively on the elliptic curve cryptography that secures bitcoin transactions.

What are the challenges faced by quantum computing in executing Shor’s Algorithm?

Challenges include achieving high error correction fidelity, building reliable physical qubits, and scaling up qubit count to the millions required for successful execution of Shor’s Algorithm, all of which are still significant hurdles in quantum computing technology.

| Aspect | Details |

|---|---|

| Quantum Computing vs. Classical Computing | Quantum computing won’t replace classical computing but poses risks due to Shor’s algorithm. |

| Shor’s Algorithm Impact | Shor’s algorithm can potentially crack elliptic curve cryptography used by bitcoin if quantum computing scales. |

| Current Quantum Hardware Limitations | Today’s quantum machines are slow, noisy, and fragile, lacking the fidelity required for effective attacks. |

| Key Issue: Fidelity | Fidelity of quantum gates is critical; with 99.99% fidelity, errors accumulate across necessary logic gates. |

| Logical vs Physical Qubits | A practical Shor’s attack could require millions of logical qubits, translating to hundreds of millions of physical qubits. |

| Ethereum and Market Predictions | Shkreli predicts Ethereum may surpass Bitcoin in market value, a scenario dubbed ‘the Flippening’. |

| Near-Term Threat Assessment | Shor-class attacks on Bitcoin are likely decades away, given current hardware limitations. |

| Ethics of Hacking | Shkreli acknowledges the challenge as intellectual achievement rather than financial gain. |

Summary

Shor’s Algorithm poses a significant potential threat to Bitcoin’s security as quantum computing technology continues to advance. Martin Shkreli emphasizes that while the current quantum hardware is not yet capable of executing effective attacks, Shor’s algorithm represents a credible risk that could unravel the cryptographic foundations of Bitcoin wallets in the future. Understanding the limitations of today’s quantum machines, particularly their fidelity and scalability, is essential for assessing the timeline of this potential risk. As research in quantum computing progresses, Shor’s Algorithm stands as a pivotal factor in the ongoing discourse regarding the future of digital currencies.