In the ever-evolving crypto landscape, **Solana inflows** have emerged as a critical indicator of market health, signaling renewed investor confidence. On November 19th, Solana witnessed remarkable inflows totaling $55.61 million, outpacing its counterparts amidst a backdrop of market shifts. This surge came as Bitcoin ETFs broke free from a five-day streak of outflows, rekindling optimism within the investor community. While Ethereum outflows continued, Solana’s performance proved resilient, showcasing the growing interest in Solana ETFs as attractive investment options. This dynamic presents an intriguing intersection of crypto market analysis, where fluctuations in asset flows can significantly reshape perceptions and strategies in the digital asset space.

As we delve deeper into the fluctuations of the cryptocurrency market, it becomes evident that recent developments surrounding Solana’s financial inflows are noteworthy. The resurgence of interest in Solana ETFs highlights a broader trend as traditional investment channels like Bitcoin ETFs rebound after a challenging period. Meanwhile, some cryptocurrencies face outflows, particularly Ethereum, which has not fared as well in recent analyses. This environment underscores the complexity of market performances, where even amidst volatility, certain assets like Solana can attract substantial capital inflows. Understanding these trends through the lens of market analysis is essential for grasping the evolving dynamics within the crypto ecosystem.

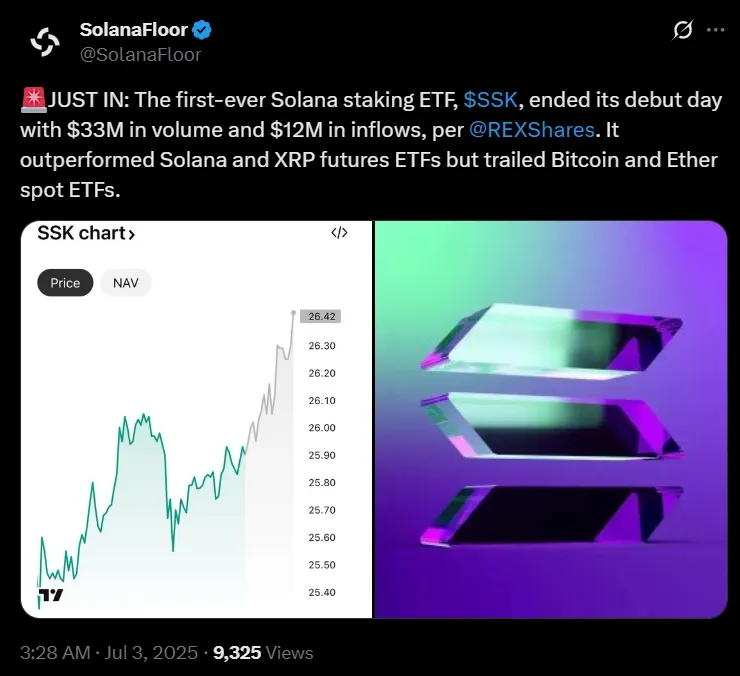

Solana Inflows Set a New Benchmark in ETF Performance

On Wednesday, Nov. 19, Solana ETFs made a significant splash in the cryptocurrency market, amassing a remarkable $55.61 million in new inflows. This surge reflects an undeniable interest from investors who are keen on harnessing the potential of Solana’s underlying technology and its faster transaction capabilities. The notable performance of Solana is a direct result of its robust operational architecture that appeals to seasoned and new investors alike, especially as it continues to outperform traditional assets in the crypto space. This record inflow has cemented Solana’s position as a market leader, inspiring a sense of renewed excitement as it attracts capital amidst fluctuating market dynamics.

The strong inflows are significantly attributed to Bitwise’s BSOL, which alone accounted for $35.87 million, alongside contributions from Grayscale’s GSOL, and new entries like Fidelity’s FSOL. This movement towards Solana not only showcases its resilience amid a sea of uncertainty but also highlights a growing confidence in its long-term viability within the crypto ecosystem, especially when compared to traditional assets, including Bitcoin ETFs.

As institutional adoption continues to rise, the dynamics of crypto inflows are changing, with Solana’s ETFs gaining momentous traction among young investors seeking alternatives to Bitcoin and Ethereum. The various funds, with diverse strategies, highlight a growing trend in the cryptocurrency market where Solana is increasingly perceived as a reliable investment vehicle. This sentiment shift is crucial as it underscores the essence of innovation in the decentralization of finance, which Solana represents incredibly well. Investors are now diversifying their portfolios with a combination of Solana ETFs alongside traditional assets,

recognizing the potential for high returns as the crypto market begins to correct itself from the recent downturns seen in Ethereum.

Bitcoin ETFs Rebound After Streak of Outflows

Following a challenging week, Bitcoin ETFs ended their five-day streak of outflows, posting a positive net inflow of $75.47 million. This recovery is seen as a positive signal for the crypto market as Bitcoin, often regarded as the bellwether for other cryptocurrencies, reflects renewed investor interest in digital assets. Blackrock’s IBIT played a significant role in this rebound, attracting $60.61 million alone, which indicates a promising re-entry for institutional investors who are increasingly preferring ETFs over direct asset purchases.

This rebound underlines a possible change in market sentiment as macroeconomic factors come into play. Investors are reevaluating their positions in Bitcoin, viewing it as a digital hedge against inflation and an alternative asset class amid economic uncertainty. Coupled with stable trading volumes at $6.89 billion, the increased net assets of Bitcoin ETFs rising to $117.34 billion reflect this resurgence in confidence.

However, not all Bitcoin funds participated equally in this recovery. Some funds, such as Fidelity’s FBTC and Vaneck’s HODL, experienced notable losses, signaling that while optimism has returned, volatility remains inherent in the crypto space. This variance in performance reminds investors to approach the cryptocurrency market with caution, as conditions can shift rapidly. Nevertheless, the overall positive trend in Bitcoin ETF inflows highlights a crucial inflection point where investors are reassessing the digital currency’s potential to rebound and compete against newer entrants like Solana.

Ethereum Faces Continued Challenges Amid Solana’s Growth

In stark contrast to the rising fortunes of Solana, Ethereum continues to face challenges, recording its seventh consecutive day of outflows that totaled $37.35 million. The pressures on Ethereum’s ETFs, such as Blackrock’s ETHA and Grayscale’s ETHE, indicate a growing concern over its scalability issues and market performance when compared to newer entrants like Solana. As Ethereum struggles, investors are re-evaluating their options, leading many to defer their resources towards more promising projects, particularly those that demonstrate innovative scalability and transaction speed.

This predicament accentuates the ongoing struggles Ethereum faces against Solana’s burgeoning ecosystem. As Ethereum battles against these persistent outflows, understanding its current challenges is crucial for investors and developers alike. The recent decline in trading value for Ethereum, which hovered around $2.54 billion, illustrates that while it remains a legacy blockchain, it must innovate vigorously to reclaim investor confidence and compete effectively in a rapidly evolving market.

The overall decline in Ethereum’s net assets, now settling at $18.19 billion, poses a significant challenge for its ecosystem. The continuous outflows suggest that many market participants are looking for new opportunities in other cryptocurrencies like Solana, which has showcased impressive performance metrics over the past few weeks. As Ethereum embarks on scaling and improving its network capabilities, it will need to address these investor concerns head-on to halt the trend of outflows and to re-establish its footing amidst rising competitors in the crypto market.

The Emergence of New Entrants in the Solana ETF Space

The Solana ETF landscape is diversifying with various platforms entering the fray to capitalize on the growing popularity of this cryptocurrency. Not only has Bitwise’s BSOL led the charge, but newcomers such as Fidelity’s FSOL and Vaneck’s VSOL are also making their presence felt. These new entrants are critical in providing investors with access to Solana’s innovative blockchain technology while allowing for a diversified investment approach across various facets of the crypto market.

This influx of new Solana ETFs signals a trend where established firms are recognizing the potential for growth within the Solana ecosystem. By entering the market, these firms aim to capture investor interest and actively participate in the burgeoning landscape of blockchain technology that is gaining traction among retail and institutional investors alike.

The combination of established players alongside new entrants fosters a competitive environment, prompting innovation and ultimately enhancing the product offerings for investors. As these firms vie for market share, they may introduce unique investment strategies and enhanced features, such as lower fees or added liquidity, to attract a broader audience. This focus on enhancing the Solana ETF landscape illustrates the optimistic outlook many have regarding the network’s continued development and long-term potential to disrupt traditional financial systems.

Investors Eye Solana’s Strong Performance Amid Crypto Market Shifts

The recent surge in Solana’s value, highlighted by its impressive inflows, has captured the attention of many investors looking for opportunities in the fluctuating crypto market. Investors are increasingly aware of Solana’s capabilities, particularly in handling high transaction volumes at lower costs compared to Ethereum. Such factors make Solana an attractive alternative for those who remain cautious following volatility in the larger crypto space. As Solana continues to demonstrate unique advantages, such as scalability and speed, a narrative is building around its potential to rival established assets like Bitcoin and Ethereum.

Moreover, this strong performance from Solana sends a message that innovation in the blockchain space is not just limited to Bitcoin and Ethereum. The crypto market analysis indicates that investors are actively diversifying their portfolios and exploring emerging technologies that showcase real-world applications. Solana’s growth trajectory emphasizes a broader market trend where innovation can lead to significant financial gains, driving active investor interest away from traditional cryptocurrencies.”},{

Frequently Asked Questions

What are the recent trends in Solana inflows compared to Bitcoin ETFs?

Recent trends show that Solana inflows have surged significantly, with $55.61 million in new capital reported on November 19. This strong performance contrasts with Bitcoin ETFs, which, despite recovering with $75.47 million in inflows, had experienced a five-day streak of outflows prior to this rebound.

How have Solana ETFs performed in the crypto market analysis this week?

In the latest crypto market analysis, Solana ETFs showcased remarkable performance, dominating inflows with a total of $55.61 million. This impressive increase highlights Solana’s position as a key player in the current market, particularly in contrast to the struggles faced by Ethereum ETFs.

What factors contributed to the rise in Solana inflows?

The rise in Solana inflows can be attributed to increased investor confidence and strong institutional interest, particularly from notable contributors like Bitwise and Grayscale. This influx of capital into Solana ETFs reflects a growing sentiment towards Solana’s potential in the evolving crypto landscape.

Why are Solana inflows considered significant for the crypto market?

Solana inflows are significant for the crypto market as they demonstrate a strong appetite for alternative digital assets, particularly in light of recent performance dynamics. The substantial inflows into Solana ETFs indicate investor belief in its growth trajectory, especially amid Bitcoin’s recovery and Ethereum’s ongoing struggles.

How do Solana inflows affect its overall market performance?

Solana inflows positively influence its overall market performance by boosting trading volumes and attracting more attention from institutional investors. The $55.61 million added to Solana ETFs suggests increasing validation of its value proposition, which can help to stabilize and enhance its market position relative to Bitcoin and Ethereum.

What role do Ethereum outflows play in the context of Solana inflows?

Ethereum outflows play a critical role in highlighting Solana’s appeal as an attractive alternative investment. As Ethereum experiences continued outflows and struggles with net declines, Solana inflows can be seen as a flight to quality, with investors pivoting to assets they perceive to have stronger growth potential amidst market uncertainties.

How do recent trends in Solana performance compare to those of Bitcoin and Ethereum?

Recent trends indicate that Solana’s performance has outpaced both Bitcoin and Ethereum, particularly with its recent $55 million inflow. While Bitcoin has seen a recovery in ETF inflows after days of outflows, Ethereum continues to struggle with repeated outflows, making Solana’s upward trajectory even more pronounced in this comparative landscape.

| Asset | Inflow Amount | Contributors | Trading Volume | Net Assets |

|---|---|---|---|---|

| Solana ETFs | $55.61 million | Bitwise BSOL ($35.87m), Grayscale GSOL ($12.60m), Fidelity FSOL ($5.42m), Vaneck VSOL ($1.71m) | $53.18 million | $714.80 million |

Summary

Solana inflows have surged impressively with a remarkable $55 million captured primarily from leading ETFs. This demonstrates a strong resurgence amidst a recovering market where Bitcoin ETFs have also started to show positive inflows after a streak of losses. Investors continue to exhibit keen interest in Solana’s potential, ensuring its place as a key player in the cryptocurrency landscape.