The recent stablecoin decline has raised eyebrows across the crypto market as investors witness an unsettling trend. Following a noteworthy exodus of $1.244 billion, the stablecoin sector shrank by approximately 0.41%, adding to the previous week’s loss of $1.925 billion. This ongoing capital movement, which reflects a shift from crypto assets into fiat, may signal a cautious sentiment among traders in the burgeoning stablecoin market. Notably, Tether’s USDT continues to dominate the landscape despite a modest increase, while competitors like Circle’s USDC face more significant declines. As the stablecoin performance fluctuates, the impact of such changes on the broader crypto capital movement remains to be seen, prompting calls for deeper analysis of this evolving financial ecosystem.

The recent downturn in digital currency reserves, often linked to the concept of fiat-collateralized tokens, has drawn considerable scrutiny. As we explore the movement of capital away from these digital assets, we can observe the impacts on various stable currencies like Tether and Circle’s offerings. These developments suggest a trend in which crypto liquidity is contracting, forcing traders to reassess their strategies. Additionally, the volatility within this sector hints at broader implications for the overall health of cryptocurrency investments. In light of these shifts, understanding the key players in this space, alongside the factors contributing to their performance, becomes increasingly critical.

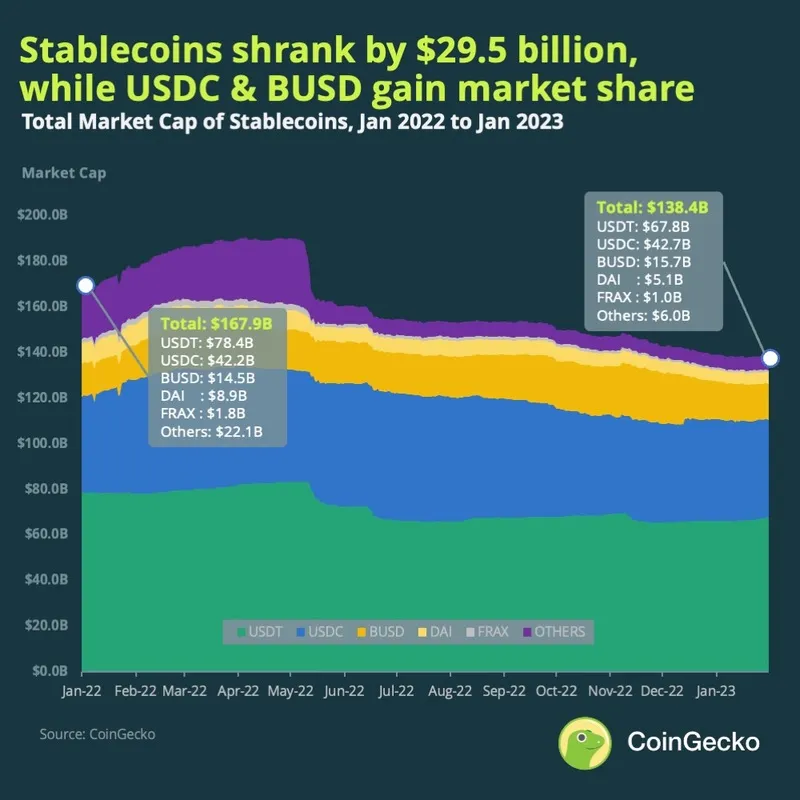

Current Trends in Stablecoin Decline

In recent weeks, the stablecoin market has been witnessing a noticeable decline, with $1.2 billion exiting the ecosystem over a single weekend. This consistent trend raises concerns among investors about the stability and performance of major players like Tether (USDT) and Circle (USDC). As these shifts become more pronounced, many are beginning to wonder whether this exodus signals larger issues within the crypto ecosystem or if it is simply a cyclical pattern in capital movement.

The recent figures illustrate a potential reflection of investor sentiment. The decline in stablecoin valuations may point to a broader interest in shifting investments out of crypto-assets and into fiat currencies or alternative markets. For instance, while Tether’s USDT experienced a slight uptick, its dominance is gradually being challenged, particularly by alternative stablecoins like USDC. This shifting scenario invites increased scrutiny into how these digital assets perform in fluctuating market conditions.

Impacts of Capital Movement on the Stablecoin Market

As $1.2 billion in stablecoins has exited the market, one has to consider the implications for liquidity and market confidence. The continued movement of crypto capital emphasizes a common trend seen among crypto traders—shifting to fiat options when market conditions appear unstable. Given that the overall stablecoin economy is now valued at approximately $304.246 billion, it is critical to monitor how aggressive capital movements affect liquidity for transactions and trading paired with these currencies.

An insight into the capital movement may also be derived from analyzing how individual stablecoins have been affected during this downturn. Tether remains the dominant player, yet the declines of other stablecoins like USDC and USDe suggest that investor preferences may be evolving. Factors such as usability, adoption, and backing assets play crucial roles in maintaining confidence among holders. The ongoing fluctuations not only affect the trading volume of stablecoins but also impact their perceived reliability.

Stablecoin Performance Analysis: Tether vs. Circle

When analyzing the performance of major players within the stablecoin market, Tether (USDT) and Circle (USDC) dominate the discussion. Despite the recent week-to-week decline, Tether remains a giant with a current market cap of $183.896 billion, representing approximately 60.44% of the total fiat-pegged token sector. Interestingly, USDT’s resilience despite the capital outflow could be attributed to its adoption across multiple exchanges and trading platforms, which reinforces its utility in the crypto sector.

On the flip side, Circle’s USDC has seen a decline of 1.20%, signaling that challenges may lie ahead for the second-largest stablecoin as it attempts to assert its presence in a competitive landscape. The performance gap between these stablecoins shines a light on consumer choices and how trust portability in digital assets can shift over time. Analyzing these variations can provide valuable insights into how stablecoin holders view risk—essentially a barometer for investor sentiment in the wider crypto environment.

The Future of Stablecoins: Stability Amidst Decline

Despite the recent turmoil, the future of stablecoins is still ripe with possibilities, primarily driven by technological advancements and regulatory developments. The decline in market cap signifies not an end, but a transitional phase where stakeholders may recalibrate their strategies in favor of newer alternatives or regulatory-compliant solutions. Innovations such as programmable money and smart contracts could bolster the appeal of stablecoins as they enhance transaction efficiency and add layers of security.

As market participants navigate through these fluctuations, the continued push towards regulatory recognition may enable stablecoins to regain momentum. Market participants should consider the emerging regulations and how they evolve market mechanisms, influencing investor confidence. For instance, stablecoins like Circle’s USDC may strengthen their foothold by addressing compliance proactively, paving the way for a more stabilized crypto environment.

Market Dynamics: Understanding Stablecoin Metrics

The stablecoin market’s dynamics cannot be understood without delving into the metrics that represent supply, circulation, and liquidity. Metrics such as the total market cap of stablecoins, volume fluctuations, and the rate of new issuance provide clear insight into overall market health. Notably, the $304.246 billion valuation nets a critical perspective on investor behavior—indicating whether trading preferences are veering back to fiat or towards alternative crypto avenues.

Tools and platforms for tracking these metrics are essential for traders. Understanding specific historical trends in stablecoin performance, like how Tether USDT remains stable amidst loss, allows for better-informed trading strategies. This awareness of market metrics not only aids in individual decision-making but collectively enhances insights into broader capital flows within crypto ecosystems.

Investment Considerations in a Declining Stablecoin Market

Investing in stablecoins during a decline requires a clear strategy rooted in understanding the underlying factors affecting these digital assets. It is important for investors to assess the reasons behind the movement of capital out of the market, closely examining the performance metrics of stablecoins like Tether and Circle. Investors who employ a focus on long-term trends may recognize that the current downturn could ultimately be an optimal entry point as valuations stabilize.

Moreover, diversified exposures—balancing investments across multiple stablecoins—could mitigate risks associated with specific asset declines. As emerging alternatives gain traction, staying attuned to the overall developments in the crypto sector, including potential regulatory frameworks, can help guide investment decisions. Thus, the inclusion of stablecoins in an investment portfolio needs to be carefully evaluated, ensuring they align with broader financial goals and risk appetites.

The Role of Innovation in the Stablecoin Sector

Innovation plays a crucial role in shaping the future of the stablecoin sector, especially as market fluctuations induce shifts in investor confidence. New models of digital currencies and changes in how they are integrated into the financial system could provide stablecoins like Tether and Circle with unique opportunities for growth, especially if they effectively respond to market demands. Innovations related to blockchain technology, decentralized finance (DeFi), and smart contracts could redefine stablecoin functionalities, appealing to users seeking greater efficiency.

Moreover, competition is forcing existing players to push boundaries, leading to the development of new features and capabilities. This technological renewal can help stabilize prices, particularly for declining stablecoins like USDC, by offering added functionalities such as faster transaction times and improved user experiences. Thus, embracing innovation positions the stablecoin sector not merely as a simple digital asset but as an evolving component of the financial infrastructure.

Broader Economic Implications of Stablecoin Movements

Stablecoins do not exist in vacuums; rather, their fluctuations can have broader economic implications, influencing market sentiment across various asset classes. As evidenced by the recent outflows exceeding $1 billion, the movement of capital from the stablecoin sector often reflects changes in economic confidence. Investors withdrawing from stablecoins often indicate a preference for fiat currency in uncertain times, showcasing the close relationship between stablecoin performance and investor sentiment in broader financial markets.

Furthermore, as central banks explore cryptocurrencies, the stablecoin decline could simultaneously present both challenges and opportunities for traditional banking systems. The interactions between stablecoins and fiat currencies are an evolving narrative that could alter how liquidity is perceived and managed. The outcome of these trends remains paramount as they shape the next narrative in digital finance.

Conclusion: Navigating the Future of Stablecoins Amidst Volatility

As the stablecoin sector continues to navigate through periods of volatility, characterized by recent capital declines, understanding market dynamics becomes fundamentally important for all stakeholders in the ecosystem. Despite seeing significant outflows, the potential for recovery and innovation remains, as institutions and investors investigate the best roads forward. Identifying the factors driving these changes—not just numbers—is crucial for assessing future stability and performance.

The ongoing narrative surrounding stablecoins like USDT and USDC reflects a combination of investor confidence and market maturity. Whether the recent trends signal a lasting downturn or a transitional phase, participants in the crypto landscape must remain vigilant. Both macroeconomic factors and innovative trends will significantly influence how stablecoins evolve, prompting ongoing reevaluation of strategies in the shifting sands of the digital currency landscape.

Frequently Asked Questions

What caused the recent stablecoin decline in the market?

The recent decline in the stablecoin sector can be attributed to a significant capital movement out of the crypto market, with over $1.2 billion leaving the sector. This indicates that investors may be shifting their assets into fiat or other investment areas, leading to a noticeable stablecoin decline.

How do Tether USDT and Circle USDC perform amid the stablecoin decline?

During the latest stablecoin decline, Tether USDT has shown resilience with a minimal increase of 0.16%, maintaining its dominance in the market. In contrast, Circle’s USDC experienced a decline of 1.20%, reflecting the overall bearish trend in the stablecoin sector.

What impact does the stablecoin decline have on crypto capital movement?

The recent stablecoin decline indicates a trend of crypto capital movement away from stablecoins and possibly towards fiat or other asset classes, as investors respond to market instability, thereby affecting overall crypto market dynamics.

What are the implications of the stablecoin decline for investors?

Investors should be cautious in light of the stablecoin decline, as this trend suggests uncertainty in the market. The fluctuations in stablecoin performance, particularly with Tether USDT and Circle USDC, may affect liquidity and the stability of their investments.

Is the stablecoin decline a sign of a larger market trend?

Yes, the stablecoin decline could indicate a larger trend in the crypto ecosystem, as significant amounts of capital are shifting away from stablecoins like Tether USDT and Circle USDC, potentially signaling broader market volatility and investor sentiment.

How does the decline of stablecoins affect their market share?

The decline in stablecoins can impact their market share by weakening the dominance of coins like Tether USDT, which holds approximately 60.44% of the total fiat-pegged token sector, and leading to potential competition from newer entrants in the market.

What are some other notable stablecoins impacted by the recent decline?

Other notable stablecoins that have experienced declines include Circle’s USDC, which dropped by 1.20%, Ethena’s USDe, which fell by 6.10%, and Blackrock’s BUIDL, which saw a staggering decline of 11.62%, illustrating the mixed performance amid the stablecoin decline.

Are the recent fluctuations in stablecoin performance indicative of a recovery?

Given the mixed signals in stablecoin performance during this decline, it is too early to predict a recovery. While some stablecoins have shown slight increases, others have dramatically fallen, indicating that the market is still uncertain about future allocations.

What was the overall market valuation of the stablecoins post-decline?

Post-decline, the total market valuation of stablecoins stands at approximately $304.246 billion, reflecting a reduction after the latest shrinkage in the stablecoin sector.

How can investors navigate the current stablecoin decline?

Investors should stay informed about market trends and consider diversifying their portfolios, as the current stablecoin decline may present both risks and opportunities in the broader crypto landscape.

| Stablecoin | Market Value (in billion $) | Weekly Change (%) | Notes |

|---|---|---|---|

| Tether (USDT) | 183.896 | +0.16 | Dominates sector, 60.44% share |

Summary

The recent trends in stablecoin decline indicate a significant shift within the crypto market. The stablecoin sector is seeing a reduction in total market value as $1.244 billion has left the arena in the last week alone. As capital moves from cryptocurrencies back into fiat or other investment avenues, the stablecoin landscape presents a mixed bag of results with both declines and slight recoveries among different stablecoins. This duality reflects the overall uncertainty in market sentiment, making it essential for traders to navigate cautiously amid these fluctuations.