Stablecoin innovations are at the forefront of today’s blockchain payments revolution, and the recent shift of Farcaster founders to the startup Tempo underscores this trend. By leveraging stablecoins, Tempo aims to provide a reliable and efficient method for global transactions, reshaping the financial landscape. Following the Neynar acquisition of the Farcaster protocol, co-founders Dan Romero and Varun Srinivasan have redirected their expertise toward enhancing payment infrastructures that utilize stablecoins as a central component. This strategic alliance is poised to bolster Tempo’s efforts to create a low-cost, transparent network for users and businesses alike. As the demand for effective means of transaction continues to grow, stablecoins are intrinsically linked to many of the latest advancements in crypto innovations.

In the digital finance arena, stable assets are becoming crucial for facilitating seamless transactions across various platforms. The latest developments highlight how founders from renowned projects have pivoted, joining forces with emerging blockchain ventures to redefine payment systems. Recently, co-founders from a pioneering decentralized social network transitioned to collaborate with a startup focused on creating infrastructure for stable-value currencies. This shift not only signals the importance of stable-value tokens in global commerce but also reflects a broader movement towards optimizing financial technology. As industry players adapt and innovate, the evolution of payment capabilities is more vital than ever.

The Vision of Tempo: A Stablecoin-Focused Future

Tempo is positioning itself at the cutting edge of blockchain technology by focusing on stablecoin-powered payments. As digital currencies continue to gain traction globally, the demand for reliable and efficient payment solutions is more pressing than ever. Tempo’s creation of a Layer 1 blockchain revolves around the premise that stablecoins can be integrated seamlessly into everyday transactions, making financial services more accessible and more affordable for a broader audience. By streamlining payment processes with their innovative tech, Tempo seeks to elevate stablecoins from mere speculative assets to integral components of the financial ecosystem.

The addition of Farcaster’s co-founders brings a wealth of expertise to Tempo, especially in the realm of decentralized identity and data ownership. The merger of their skills with Tempo’s mission amplifies its potential to harness blockchain payments, propelling the stablecoin infrastructure forward. With significant financial backing and a strategic team, Tempo is not only positioned to revolutionize how consumers and businesses interact with money, but it also aims to foster a more inclusive financial landscape where stablecoins play a pivotal role.

Farcaster’s New Chapter Under Neynar

With Neynar’s acquisition of Farcaster, the platform is poised for a transformation that could redefine decentralized social networking. Under Neynar’s stewardship, the protocol is shifting its focus towards enhancing developer tooling and infrastructure, which is vital for fostering innovation and ensuring that Farcaster remains relevant in the rapidly evolving digital space. This strategic pivot allows Neynar to leverage its longstanding relationship with developers to improve the ecosystem surrounding Farcaster, potentially driving higher adoption rates and better user experiences.

The Farcaster founders’ departure from their original project allows for fresh leadership that prioritizes creating robust tools for developers—an essential step for any platform aiming for significant use cases. As Neynar delves deeper into the development of Farcaster, the project can harness the momentum of the growing interest in decentralized technologies. The renewed focus on developer engagement indicates that Neynar is taking deliberate steps to nurture the ecosystem, suggesting a promising future for Farcaster within the digital domain.

While Neynar and Farcaster pursue distinct pathways, their trajectories reflect a broader trend in the crypto industry towards utility and innovation. In contrast to the earlier years of cryptocurrency, characterized primarily by speculation, today’s market demands practical applications that drive real-world use. This shift illustrates how projects can evolve to meet the demands of users, developers, and investors alike, promoting a sustainable narrative around digital assets.

The Role of Stablecoins in Modern Finance

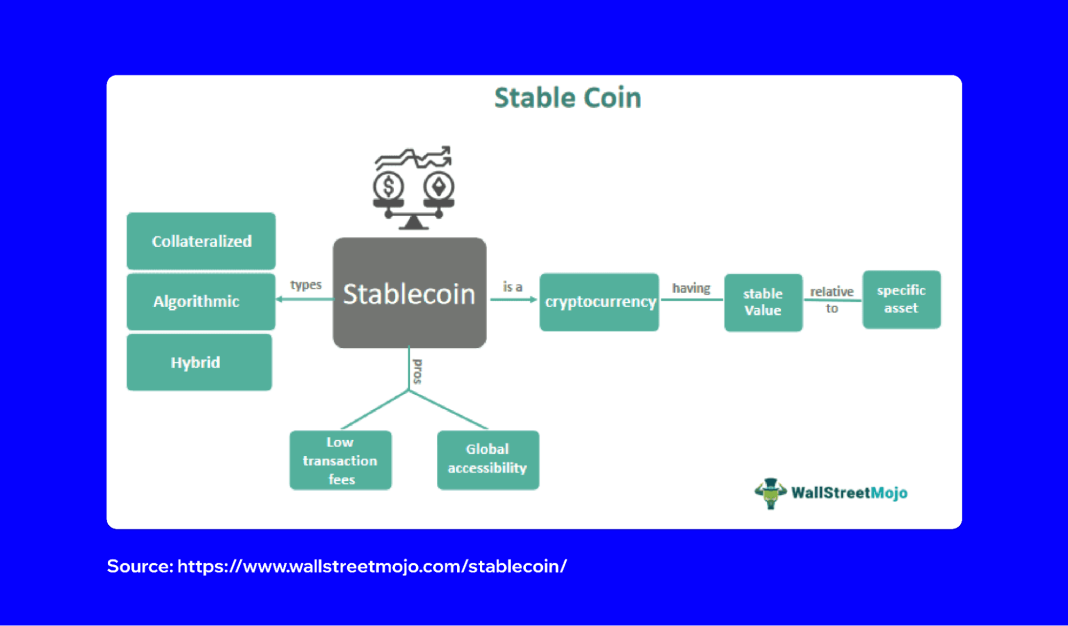

Stablecoins have emerged as a crucial bridge between traditional finance and the innovative world of cryptocurrency. They provide the stability that many investors crave, as fluctuations in value are mitigated by pegging these assets to real-world currencies or commodities. As institutions and individuals seek more reliable means of conducting transactions, stablecoins present an attractive option for a variety of uses, from cross-border payments to online commerce, facilitating smoother and faster transactions worldwide.

Tempo’s focus on establishing a stablecoin-powered payments network further illustrates the growing importance of these digital assets in the global economy. With competitive transaction costs, transparency, and speed, stablecoins are becoming essential to the infrastructure of modern finance. The increasing adoption of stablecoins for payments is not just a trend; it reflects a fundamental transformation where financial transactions become more fluid and inclusive, empowering users to take control of their financial futures.

Innovation in Blockchain Payments: The Tempo Approach

Innovation in blockchain payments is crucial as the financial landscape evolves. Tempo aims to lead this revolution by providing a platform that is specifically designed to facilitate stablecoin transactions. The startup embraces the challenges faced by traditional payment systems—such as speed, cost, and efficiency—by offering a decentralized alternative that leverages the benefits of blockchain technology. Tempo’s Layer 1 network is designed to support a high volume of transactions while minimizing fees, enabling users to send and receive stablecoins across borders with ease.

By prioritizing stablecoins, Tempo sets itself apart from many blockchain projects that focus solely on speculative cryptocurrencies. The strategic development of a payment network dedicated to stablecoins acknowledges the growing demand for practical financial tools that can adapt to users’ needs across diverse economic contexts. As Tempo builds its platform, it will likely attract partnerships with businesses eager to integrate stablecoin payments into their operations, thus amplifying the use and relevance of blockchain in everyday financial transactions.

Future Prospects for Tempo and Farcaster

Looking ahead, both Tempo and Farcaster are navigating dynamic and competitive landscapes within the blockchain space. Tempo’s focus on creating a stablecoin-based payment system positions it favorably as financial institutions and consumers increasingly turn toward digital asset solutions. As more businesses explore the efficiencies offered by stablecoin transactions, Tempo can capitalize on this growing trend, expanding its services while attracting new clientele looking for innovative payment methods.

Conversely, Farcaster under Neynar’s guidance embraces a new direction focused on developer resources and tools. By cultivating a vibrant developer community, Farcaster prepares to enhance its platform and potentially reestablish its relevance in the social networking sphere. As both projects evolve in their unique contexts—one aiming to enhance financial transactions and the other to innovate social connectivity—they collectively contribute to the broader narrative of crypto innovations changing how we perceive and interact with technology.

The Impact of Neynar’s Acquisition on the Blockchain Ecosystem

Neynar’s acquisition of Farcaster marks a significant event in the blockchain ecosystem, emphasizing the ongoing consolidation of talent and technology in the industry. By acquiring a project with a proven track record, Neynar positions itself as a leader in developing decentralized tools that cater to evolving digital needs. This transaction illustrates the potential for synergies that can arise from acquisition, as new leadership can infuse fresh ideas and strategies that enhance the original vision of a project.

As Neynar delves deeper into improving Farcaster, the impact extends beyond just the protocol; it signifies a commitment to fostering innovation within the blockchain ecosystem. By focusing on enhancing the developer experience, Neynar can promote the growth of a more engaged community, thereby increasing the overall utility and adoption of the platform. This acquisition is not just about scale; it’s about creating a robust foundation that encourages collaboration and development in the rapidly evolving blockchain landscape.

Key Innovations from Tempo: Shaping Blockchain Payments

Tempo is leading the charge in creating key innovations that shape the future of blockchain payments. As it develops its Layer 1 blockchain network, the startup aims to integrate various advanced technologies that enhance transaction processing. These innovations are not merely technical upgrades; they reflect a fundamental shift in how transactions are conceptualized within the digital economy. Tempo’s emphasis on transparency and low transactional costs presents a stark contrast to traditional financial systems, marking a pivotal moment in the evolution of payment solutions.

By focusing on stablecoins, Tempo is helping to bridge the gap between digital currencies and everyday commerce. The innovations introduced by Tempo have the potential to streamline not just individual transactions, but also the entire payment infrastructure. As businesses increasingly turn to digital currencies for payments, Tempo’s role in shaping this landscape cannot be overstated, as it champions the use of stablecoins in fostering secure, reliable, and inclusive financial transactions across various industries.

Neynar’s Strategic Vision for Farcaster Development

Neynar’s strategic vision for Farcaster development revolves around creating an inclusive ecosystem that empowers developers and users alike. By focusing on enhancing the framework and tools available to developers, Neynar aims to cultivate a vibrant community that can foster innovation within decentralized social networking. This alignment with developers ensures that the toolset evolves in tandem with user needs, promoting engagement and retention within the platform.

Furthermore, Neynar is charting a course for Farcaster that emphasizes its role as a foundational technology for decentralized applications. By prioritizing tools and APIs that better serve developers, Neynar ensures that Farcaster can adapt to the fast-paced changes in the blockchain ecosystem. This proactive approach signifies Neynar’s commitment to not just maintaining Farcaster’s relevance, but also positioning it as a leader in reshaping how social protocols interact within the blockchain landscape.

The Transition of Leadership at Farcaster

The transition of leadership at Farcaster is significant, signifying a new beginning for the protocol following its acquisition by Neynar. With co-founders Dan Romero and Varun Srinivasan stepping away from daily operations, Neynar now has the opportunity to implement its vision and refine the platform. This shift not only allows for fresh ideas and strategies to emerge but also invites new leadership dynamics that can foster a renewed focus on utility and user engagement.

As new leaders take the helm, there is an expectation for enhanced growth and development within the Farcaster ecosystem. This transition serves not just to streamline decision-making but also to redirect efforts toward building valuable tools that developers need to create applications that resonate with users. The transformative period ahead holds the promise of reinvigorating Farcaster’s mission while integrating user feedback into its evolution, possibly leading to more substantial adoption rates and community engagement.

Frequently Asked Questions

What role does stablecoin play in Tempo’s blockchain payments approach?

Stablecoins are central to Tempo’s strategy, serving as the foundation for its Layer 1 blockchain designed for global payments. By leveraging stablecoins, Tempo aims to provide a fast, low-cost, and transparent payments network, enhancing financial transactions across borders.

How does the Neynar acquisition impact the future of stablecoin adoption?

The Neynar acquisition of Farcaster signifies a shift towards enhancing developer focus, indirectly supporting stablecoin adoption by prioritizing digital infrastructure that facilitates blockchain payments and cross-border transactions.

What expertise do the Farcaster founders bring to Tempo’s stablecoin initiative?

Dan Romero and Varun Srinivasan, the Farcaster founders, bring valuable experience in protocol design and crypto innovations. Their addition to Tempo strengthens the team’s capabilities in developing impactful stablecoin-powered solutions.

What innovations is Tempo expected to introduce to stablecoin payments?

Tempo is expected to introduce innovative approaches to blockchain payments through its Layer 1 infrastructure, improving transaction speed, reducing costs, and enhancing user experiences with stablecoin transactions.

Why is stablecoin seen as essential financial infrastructure in the digital asset industry?

Stablecoins are considered essential financial infrastructure because they provide stability in volatility-prone markets, enabling reliable blockchain payments, supporting cross-border transactions, and facilitating various crypto innovations.

What is the expected timeline for Tempo’s stablecoin payment services?

Tempo’s testnet for its stablecoin-powered payments went live in December 2025, with the mainnet expected to launch later in 2026, marking a significant milestone in its blockchain payments development.

How does Tempo’s approach to stablecoin payments differ from other crypto solutions?

Tempo focuses specifically on stablecoin-powered global payments, differentiating itself from other crypto solutions by establishing a dedicated Layer 1 blockchain aimed at enhancing payment efficiency and transparency.

| Key Point | Details |

|---|---|

| Acquisition of Farcaster | Neynar acquired the Farcaster social protocol in January 2026, bringing changes to its leadership. |

| Farcaster’s Struggles | Despite raising $150 million in 2024, Farcaster failed to achieve significant user adoption. |

| Founders’ Transition to Tempo | Farcaster co-founders joined Tempo, focusing on stablecoin-powered payments after their departure. |

| Tempo’s Vision | Tempo aims to establish a Layer 1 blockchain designed for fast, low-cost global payments using stablecoins. |

| Funding and Valuation | Tempo raised $500 million at a $5 billion valuation, backed by prominent investors. |

| Launch Plans | Tempo’s testnet went live in December 2025, with the mainnet expected in late 2026. |

| Industry Trends | The digital asset industry is shifting towards utilizing stablecoins for payment infrastructures and financial utility. |

Summary

Stablecoin technology is increasingly crucial in today’s financial landscape, as seen with the transition of Farcaster’s founders to Tempo. This move signifies a commitment to leveraging stablecoins for global payments, especially following Neynar’s acquisition of the Farcaster protocol. Tempo aims to provide a robust Layer 1 blockchain that transforms stablecoins into a primary mechanism for fast and low-cost transactions, aligning with the growing trend of adopting cryptocurrencies for practical financial applications. As the industry evolves, stablecoins are expected to play a pivotal role in enhancing cross-border transactions and establishing new payment infrastructures.