The stablecoin market has experienced remarkable growth, boasting a total capitalization of $304.57 billion after adding $2.035 billion in just one week. This surge, accounting for a 0.67% increase, signals a potent shift in the landscape of digital finance instruments. The dominance of Tether (USDT), which holds nearly 59% of the market, highlights the pivotal role stablecoins play in ensuring crypto market stability. With their inherent advantages, such as quick transactions and minimal fees, stablecoins have become indispensable tools for users seeking predictability in an otherwise volatile environment. As demand for these digital assets escalates, the future of the stablecoin market appears poised for even greater expansion and integration into global financial systems.

A broad segment of the digital currency landscape, the realm of pegged cryptocurrencies, continues to flourish and redefine conventional finance. This intriguing market not only provides a safe haven during turbulent times but also serves as a bridge between traditional financial systems and emerging blockchain technologies. The significance of these stable digital assets is underscored by their increasing adoption in retail transactions, remittances, and decentralized finance endeavors. With their unique ability to maintain a steady value, these financial instruments have captivated the attention of both individual investors and institutional players alike. As we witness the evolution of this space, the potential for stablecoins to reshape the very fabric of monetary transactions remains ever more pronounced.

The Surge of Stablecoins: Understanding Their Growth

The global stablecoin market has experienced remarkable growth, with its total capitalization rising to $304.57 billion recently. This surge reflects a growing trust in these digital assets as stable financial instruments amid the volatility that often plagues the broader cryptocurrency market. As more users seek to avoid the unpredictable price swings associated with traditional cryptocurrencies, stablecoins like Tether (USDT) and USDC are becoming the go-to solutions for both everyday transactions and investment strategies.

The impressive growth of stablecoins can be attributed to the increasing acceptance of digital finance instruments as viable alternatives to traditional banking. Many users, especially those in economies with unstable currencies, turn to stablecoins for their reliability and accessibility. With transactions processed at incredible speed and minimal costs, stablecoins are bridging the gap between conventional finance and cryptocurrency, further propelling their widespread adoption and market growth.

Tether USDT: The Dominant Force in Stablecoins

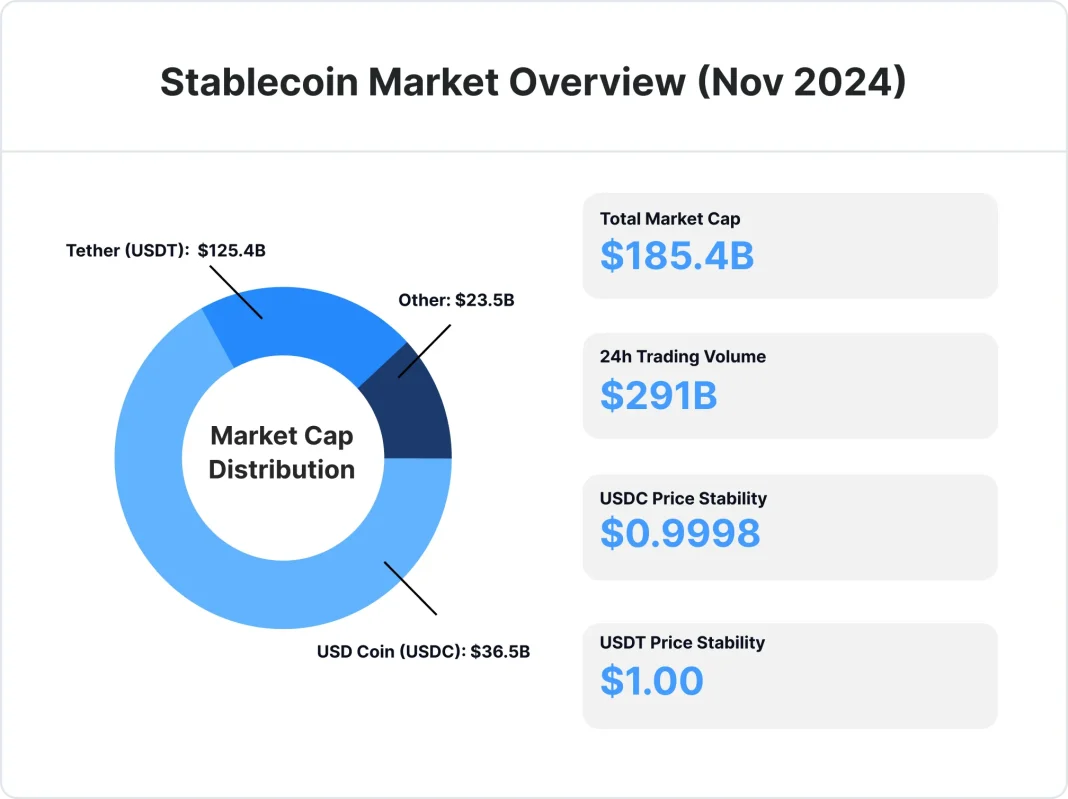

Tether (USDT) currently dominates the stablecoin market, holding a striking 58.87% of the total capitalization valued at approximately $179.3 billion. This preeminence not only underscores Tether’s significance in the crypto ecosystem but also highlights its role in providing market liquidity and stability. As traders and investors flock to USDT, its ability to facilitate swift transactions while maintaining a steady value showcases its advantages as a preferred stablecoin.

However, Tether is not alone in this race, as competitors like Circle’s USDC and Ethena’s USDe also make significant contributions to the market. Together, these stablecoins constitute over 85% of the market’s value, indicating an increasingly competitive landscape where various issuers are vying for market share. As the stablecoin sector evolves, it emphasizes the need for transparency and trust among users, which is vital for fostering confidence in digital finance.

Frequently Asked Questions

What factors contributed to the growth of the stablecoin market?

The stablecoin market has experienced significant growth due to the increasing demand for digital finance instruments that offer stability amid market volatility. The rise of decentralized finance (DeFi) and the need for reliable liquidity solutions have further propelled this growth. Furthermore, users appreciate the fast transaction speeds and low fees that stablecoins, like Tether (USDT), offer, leading to their dominance in the crypto market.

How does Tether USDT maintain its dominance in the stablecoin market?

Tether (USDT) maintains its dominance in the stablecoin market by controlling 58.87% of the total market capitalization, which amounts to around $179.3 billion. Its widespread adoption by exchanges and traders as a reliable digital asset for trading and transferring value makes it the preferred choice, despite growing competition from other stablecoins like USDC and USDe.

What advantages do stablecoins offer compared to traditional cryptocurrencies?

Stablecoins offer several advantages over traditional cryptocurrencies, including enhanced price stability, fast transaction speeds, low fees, and accessibility to global markets. By being pegged to fiat currencies like the U.S. dollar, they provide a secure alternative for users who wish to avoid the market fluctuations associated with cryptocurrencies like Bitcoin and Ethereum.

How do stablecoins influence crypto market stability?

Stablecoins play a significant role in enhancing crypto market stability by providing a safe haven for traders to park their funds during periods of market volatility. As digital assets pegged to stable fiat currencies, they offer a reliable means for value transfer and liquidity, helping to buffer the wider crypto market from severe price swings.

What are the key drivers of the stablecoin advantages in digital finance?

The key drivers of stablecoin advantages in digital finance include their ability to facilitate quick and cost-effective transactions, maintain price stability, and enhance accessibility for users in regions with unstable local currencies. Their use as a bridge between traditional finance and blockchain technology allows them to serve critical functions in the decentralized finance landscape.

What trends are emerging in the stablecoin market?

Emerging trends in the stablecoin market include increasing institutional adoption, the rise of corporate-issued stablecoins like PayPal’s PYUSD, and a more diverse range of fiat-pegged cryptocurrencies. Moreover, as regulatory landscapes evolve, we can expect stablecoins to become further integrated into everyday payment systems and traditional financial frameworks.

| Key Points | Details |

|---|---|

| Recent Market Growth | $2.035 billion added in just seven days; total capitalization at $304.57 billion (0.67% increase) |

| Role of Stablecoins | Stabilizing instrument in digital finance, typically pegged to U.S. dollar for less volatility |

| User Advantages | Fast transactions, low fees, and stability offered compared to volatile cryptocurrencies |

| Leading Stablecoins | Tether (USDT) leads with 58.87% of the market, followed by USDC and USDe; together they comprise over 85% of the market cap |

| Growth History | Rise from under $3 billion in 2018 to over $300 billion in 2025 |

| Future Integration | Expected continued adoption in financial systems, influencing liquidity and infrastructure development |

Summary

The stablecoin market has established itself as a critical component of modern digital finance, now boasting a total capitalization of over $304 billion. This remarkable growth, driven by significant increases in trading volumes and the demand for stable value amidst crypto volatility, highlights the important role stablecoins play as a bridge between traditional finance and the blockchain ecosystem. As the market continues to evolve, with leading players like Tether and USDC dominating the landscape, innovations and regulatory developments will further shape the future of the stablecoin market, making it an essential aspect of everyday finance.