In recent weeks, the stablecoin market has not only crossed the impressive threshold of $300 billion but has also showcased remarkable growth, adding over $6 billion in just one week. This expansion highlights the rising importance of stablecoins like USDT and USDC, reflecting their efficacy in providing liquidity within the crypto ecosystem. With Tether’s USDT commanding a significant market cap and contributing substantially to sector growth, the stablecoin landscape appears increasingly dynamic. Investors are closely watching the performance of USDC, particularly as it solidifies its place among the financial stalwarts of the digital currency domain. As the sector continues to evolve, the ongoing crypto market update indicates that stablecoin growth is likely to accelerate, reshaping the future of digital finance.

The world of fiat-pegged cryptocurrencies is witnessing a transformative phase as the sector expands rapidly, underscoring the immense liquidity options available through assets like USDT and USDC. These digital currencies play a pivotal role in bridging traditional finance with blockchain technologies, making them essential components of today’s financial landscape. As stakeholders navigate this evolving arena, innovations in stablecoins are reshaping how value is exchanged and stored. The surge in stablecoin activity indicates a shift towards more stable alternatives within the volatile cryptocurrency market, presenting unique opportunities for traders and investors alike. As we delve deeper into this thriving segment, understanding the dynamics of stable currency performance will be crucial for predicting future trends.

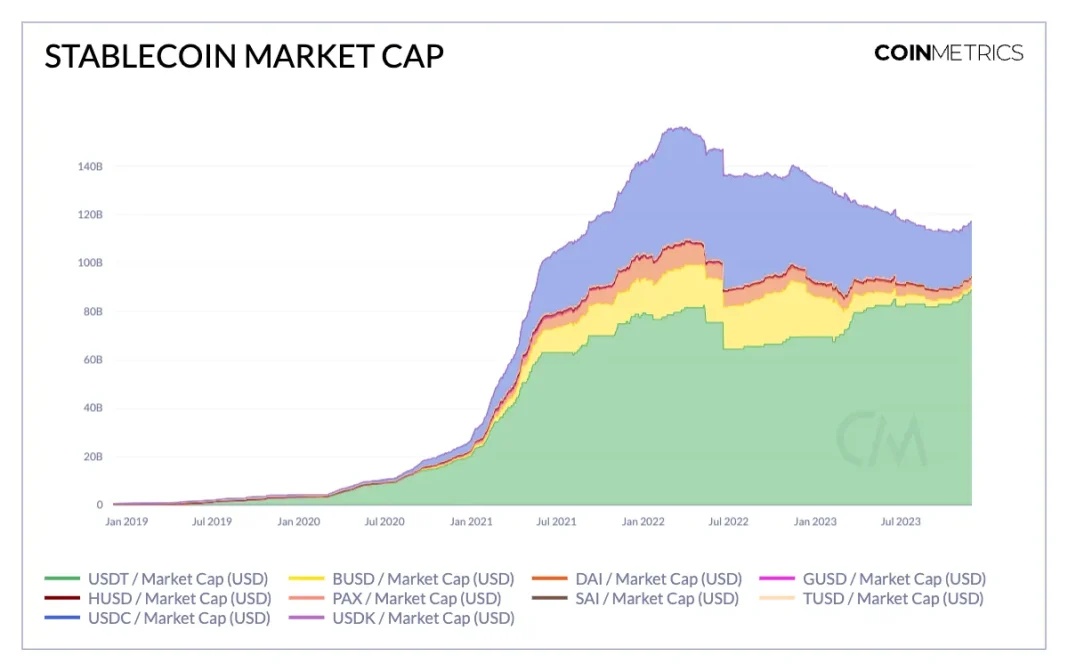

A Weekly Surge in the Stablecoin Market

In a significant development, the stablecoin market has observed a considerable uptick, gaining over $6.1 billion in just one week. This growth is indicative of a robust sector that continues to attract investment, driven primarily by the leading players like Tether’s USDT and Circle’s USDC. The increasing market cap, now exceeding $302 billion, highlights the growing confidence investors have in these digital currencies. Such a notable increase not only reflects the stability offered by fiat-pegged assets but also signifies the increasing adoption of stablecoins in various financial ecosystems.

Market dynamics are shifting, and stablecoins like USDT and USDC are at the forefront of this transformation. Investors are increasingly drawn to stablecoin liquidity, which enables seamless transactions without the volatility typically associated with cryptocurrencies. The latest metrics reveal that USDT, in particular, holds a dominant position, capturing more than 58% of the entire stablecoin market. This growth not only reinforces Tether’s substantial financial footprint but also sets the stage for emerging stablecoins to carve out their niches in a competitive landscape.

Insights into USDT’s Market Cap Dominance

Tether’s USDT has long been recognized as a leading stablecoin, and its current market cap of over $177 billion exemplifies its dominant role in the wider crypto market. This week’s surge of $2.641 billion illustrates that USDT is not only maintaining its position but also expanding its influence, reinforcing investor trust. The overall dominance of USDT in the stablecoin arena raises questions about its sustainability as new competitors emerge, yet its consistent performance highlights its pivotal role in driving stablecoin growth.

With the USDT market cap surpassing $177 billion, the implications for the broader cryptocurrency ecosystem are significant. The stablecoin’s liquidity allows for easy conversions, making it an attractive option for traders and investors alike. As financial applications evolve, the consistent demand for USDT solidifies its potential as a preferred medium of exchange, suggesting a future whereby more businesses might adopt stablecoins for daily transactions, further integrating these assets into the global economy.

USDC Performance and Its Impact on the Crypto Landscape

Circle’s USDC showcases a commendable performance with an increase of $1.676 billion, bringing its market cap to approximately $75 billion. This consistent growth trajectory reinforces USDC’s reputation as a reliable fiat-backed stablecoin, often utilized by investors looking to hedge against market volatility. Its performance reflects both market confidence and the demand for stable assets within an unpredictable crypto landscape, positioning USDC as a valuable player for both institutional and retail investors.

The solid increase in USDC’s value is critical amid ongoing fluctuations in the cryptocurrency market. With increasing liquidity and user adoption, USDC continues to serve as a benchmark for other stablecoins aiming to capture market share. Its performance intertwines with major developments within the crypto market update, where the ongoing shifts in market sentiments can drive further interest in USDC. The sustained growth in USDC positions it strategically not just as a means of value retention but as a catalyst for broader crypto adoption.

Emerging Players in the Stablecoin World

In addition to the longstanding giants like USDT and USDC, newer entrants in the stablecoin market are beginning to gain traction. Ethena’s USDe, for example, added $491 million to its market cap this week, drawing attention with its rising appeal among investors. As competition intensifies, these emerging stablecoins are showcasing their potential to challenge the established order, contributing to the overall $302 billion market with innovative solutions tailored to various use cases.

The rise of new stablecoins like USDe signifies an evolving market ecosystem where diversification is key to sustained growth. As these players innovate, they introduce unique features that cater to specific user needs, enhancing the overall stability and functionality of digital currencies. This competitive landscape encourages existing players to adapt and improve, fostering a more robust stablecoin market that could further boost overall liquidity and transactional efficiency.

Staying Updated on the Crypto Market: What to Watch

As the stablecoin sector continues to evolve, staying updated with the latest crypto market news is crucial for investors. Periodic updates regarding performance metrics and market shifts allow stakeholders to make informed decisions, especially when it comes to choosing between stablecoins like USDT, USDC, and emerging options like Blackrock’s BUIDL. Observing these changes is essential for anyone involved in the cryptocurrency field, as the rapid pace of development might present both opportunities and risks.

Moreover, understanding the interactions between different stablecoins can shed light on future trends within the crypto landscape. For example, the recent spikes seen in PYUSD and BUIDL signify that investor interest is not stagnant; rather, it is dynamic and responsive to market conditions. By keeping a finger on the pulse of these fluctuations, investors can better position themselves to capitalize on forthcoming opportunities, making regular engagement with crypto market updates even more vital.

Market Forces Behind Stablecoin Growth

The underlying forces driving stablecoin growth can be attributed to several factors, including increased adoption by investors, institutional interest, and the burgeoning need for liquidity in various financial markets. As traditional finance increasingly intertwines with the digital economy, the demand for stable assets like USDT and USDC rises. This trend signals a shift in how digital currencies are perceived—moving from speculative assets to essential components of the modern financial ecosystem.

Furthermore, innovative features and robust infrastructures offered by centralized companies enhance the appeal of stablecoins, making them a secure alternative for transactions and value storage. Increased competition among stablecoins also leads to better services and conditions for users, paving the way for even more significant growth in this sector as it continues to address evolving market needs.

Liquidity: The Heart of the Stablecoin Market

Liquidity plays a central role in the stablecoin market, influencing how efficiently these assets can be utilized across various financial platforms. The substantial liquidity provided by leading stablecoins like USDT and USDC allows for instantaneous transactions, crucial for traders who rely on speed and reliability. As the overall market cap of stablecoins rises, so too does their capacity to facilitate larger transactions without price slippage, which is vital for maintaining price stability.

Moreover, the liquidity of stablecoins enhances their viability as a bridge between cryptocurrencies and fiat currencies, fulfilling an essential need in the digital economy. As more users adopt stablecoins, the resulting liquidity strengthens trust in these digital assets, enabling further participation from institutional investors and paving the way for mainstream use in e-commerce and other sectors.

Future Predictions for the Stablecoin Market

Looking ahead, the stablecoin market appears poised for continued growth and innovation. Predictions suggest that as more regulatory clarity comes to light, we may see an influx of institutional investors entering the stablecoin space, bolstered by confidence in the stability and reliability of these assets. The very foundation of stablecoins as fiat-pegged currencies positions them well to serve a wide array of financial needs, making them indispensable tools in a diversifying digital economy.

Moreover, we can anticipate developments in technology that may enhance the mechanisms of issuing and managing stablecoins, leading to improved transparency and trust. With established players innovating and new entrants disrupting the landscape, the future of the stablecoin market seems promising, potentially redefining the landscape of digital and traditional finance as we know it.

The Role of Regulatory Frameworks in Stablecoin Evolution

The regulatory environment surrounding stablecoins is becoming increasingly critical as market participants seek clarity and assurance from governing bodies. As regulators around the world develop frameworks for oversight, the implications for stability and security become more pronounced. These regulations play a key role in shaping the operational requirements for stablecoin issuers, ultimately influencing liquidity and market cap dynamics.

Regulatory measures not only protect consumers but also foster trust among investors, encouraging the mainstream adoption of stablecoins. In a rapidly evolving digital economy, a balanced regulatory approach can support the stablecoin sector’s growth, ensuring its sustainability while mitigating risks associated with volatility. The collaboration between industry stakeholders and regulators will be vital in nurturing an environment conducive to both innovation and security.

Frequently Asked Questions

What factors are contributing to the growth of the stablecoin market?

The stablecoin market is experiencing significant growth due to increased demand for liquidity and stability in cryptocurrency transactions. The recent surge of $6.1 billion added to the market highlights the growing reliance on fiat-pegged digital assets like USDT and USDC, which provide users with a stable store of value amid the volatility in the broader crypto market.

How does USDT dominate the stablecoin market cap?

USDT, issued by Tether, continues to dominate the stablecoin market cap, holding over 58% of the total market value. With a current market cap of approximately $177.018 billion, USDT’s consistent minting and robust usage in trading pairs provide it with unmatched liquidity and a leading position in the stablecoin landscape.

What is the performance of USDC in the stablecoin market?

USDC has shown impressive performance in the stablecoin market, recently adding $1.676 billion to reach a market cap of $75.084 billion. This 2.28% increase reflects the growing trust in Circle’s stablecoin as a reliable medium of exchange and store of value, further contributing to the overall liquidity in the crypto ecosystem.

How significant is stablecoin liquidity for the overall crypto market?

Stablecoin liquidity is crucial for the crypto market as it facilitates seamless trading and investment opportunities. The recent expansion of the stablecoin market, now valued at approximately $302 billion, underscores the vital role stablecoins play in providing liquidity, enabling users to navigate the volatile crypto landscape with greater ease.

What updates should investors look for regarding the stablecoin market?

Investors should keep an eye on market updates regarding the stablecoin landscape, focusing on performance metrics of major players like USDT and USDC. Monitoring changes in market cap, liquidity inflows, and the emergence of new competitors will provide insights into market trends that may impact investment strategies in the evolving crypto environment.

| Stablecoin | Market Cap ($B) | Weekly Change (%) | Weekly Growth Contribution ($B) |

|---|---|---|---|

| USDT (Tether) | 177.018 | 3.77 | 2.641 |

Summary

The stablecoin market has reached a significant milestone, expanding to a total value of approximately $302 billion. This growth is largely attributed to the dominant presence of major players like Tether’s USDT, which significantly contributes to the overall market cap with a strong growth performance this week. As more stablecoins continue to enter circulation, the landscape of the stablecoin market is evolving rapidly, paving the way for new liquidity dynamics and competition among established and emerging tokens.