In recent years, the landscape of finance has been significantly altered by emerging **stablecoin trends** that are reshaping the fundamentals of currency exchange and transaction processes. Ripple President Monica Long has identified three key developments highlighting the increasing adoption of stablecoins, which have become pivotal to enhancing blockchain adoption and influencing traditional finance methodologies. As financial institutions pivot towards incorporating stablecoin payment networks, the dialogue around these digital assets has reached a fever pitch among industry players and analysts alike. This surge in interest not only underlines the significance of stablecoins in the evolving world of digital currency trends but also emphasizes their role in facilitating seamless and efficient transactions across various payment networks. In essence, the embrace of stablecoins signifies a transformative shift that merges the benefits of blockchain technology with the operational pillars of conventional banking systems.

The evolution of digital currencies, particularly through emerging **stablecoin trends**, is creating a paradigm shift in the financial sector. These shifts not only highlight the intersection between traditional payment methods and innovative blockchain solutions but also spark discussions around the future of monetary systems. As more entities explore the potential of digital assets, financial leaders are closely monitoring the impact of stablecoins on everyday transactions and institutional frameworks. The rise of unique stablecoin initiatives illustrates the fluid nature of the financial ecosystem and calls for a deeper understanding of the implications for global finance. Ultimately, as the financial world continues to embrace these developments, stablecoins are set to play an essential role in bridging the gap between conventional financial practices and the burgeoning world of decentralized finance.

Emerging Trends in Stablecoins

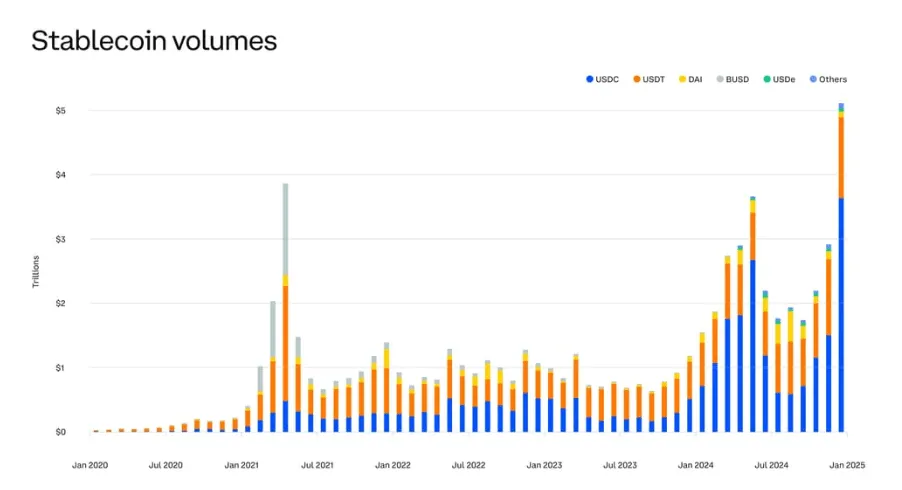

The world of finance is witnessing a remarkable transformation through the adoption of stablecoins. Emerging trends indicate a significant influx of U.S. dollar-pegged tokens entering the market, a phenomenon that bears similarities to the NFT boom witnessed between 2020 and 2021. The Ripple President, Monica Long, has pointed out that while many of these projects may stem from hype, others fulfill crucial functions in the financial ecosystem. For instance, stablecoins facilitate interbank transactions and even support customer loyalty programs, changing the face of how value is conveyed across payment networks.

This flurry of stablecoin activity reflects the growing acceptance of digital currencies within traditional banking structures. As financial institutions begin to leverage blockchain technology, the need for various stablecoin projects becomes increasingly relevant. However, it is essential for stakeholders to critically assess these developments, as too many competing alternatives could dilute market value and innovation.

Stablecoin Payment Networks and Their Impact

The rise of stablecoin payment networks is a compelling narrative in the evolution of digital currencies. These networks, often aligned with prominent brands, are pushing boundaries by linking traditional finance with blockchain adoption. Long cautioned firms to analyze these networks closely to mitigate risks tied to providers lacking the necessary licensing. In essence, organizations must ensure that these innovative solutions do not inadvertently replicate the issues seen in traditional correspondent banking, which often involves delays and high fees.

Realistically, stablecoin payment networks have the potential to become the backbone of modern financial interactions if implemented correctly. The integration of stablecoin solutions in payment systems can lead to faster transactions and reduced costs, impacting consumer behavior positively. This trend could lead to a systematic shift in how payments are processed globally, paving the way for more efficient cross-border financial operations.

The Role of Proprietary Blockchains in Stablecoin Adoption

Monica Long highlights a concerning trend in the development of proprietary blockchains by companies seeking to capitalize on stablecoin technology. While such initiatives can foster innovation, they often require substantial capital investment and years of rigorous efforts to achieve the desired decentralization and liquidity. Furthermore, the risk of these proprietary networks hindering blockchain adoption must be carefully navigated, as effective interoperability is vital for seamless transactions.

Public blockchains like the XRP Ledger have already established robust infrastructures that facilitate stablecoin transactions. This demonstrates that leveraging existing systems can often provide greater efficiency and accessibility than creating entirely new, proprietary solutions. The future of stablecoin adoption could very well depend on the balance between innovation and leveraging proven frameworks to support fluid and efficient digital payment ecosystems.

Challenges in Stablecoin Regulation

The unprecedented growth of the stablecoin market has brought regulatory challenges to the forefront of the financial industry. As more institutions express interest in stablecoin payment networks, regulators ponder the implications of these digital currencies on financial stability. It is pivotal for regulatory frameworks to adapt rapidly to ensure that innovations in blockchain and stablecoins align with traditional finance regulations.

Without a clear regulatory pathway, the potential for harm increases, particularly for consumer trust and market integrity. Stakeholders across the board, including Ripple, must advocate for sensible regulations that encourage innovation while protecting investors. This balanced approach is essential in fostering a healthy environment for the development of stablecoin technologies.

The Future of Stablecoins in Global Finance

With the current trajectory of stablecoin technology and its integration into the broader financial system, its future appears promising. As more institutions leverage digital currency trends, forecasted developments suggest an increased reliance on stablecoins for real-world applications. Furthermore, as blockchain adoption continues to grow, the importance of having robust stablecoin frameworks will be critical for enhancing efficiency in payment structures.

In addition, global patterns suggest that stablecoins could eliminate many friction points in traditional finance, streamlining processes from remittances to large-scale corporate transactions. Looking ahead, the stability provided by such currencies may play a pivotal role in transforming how money is transferred and stored, marking a significant shift towards a more digitized economy.

Institutional Participation in the Stablecoin Ecosystem

The participation of institutional investors in the stablecoin space signals a maturation of the digital asset industry. As businesses and financial institutions increasingly recognize the benefits of integrating stablecoins into their operations, this trend is critical to enhancing blockchain adoption. Ripple’s insights suggest that institutional engagement is not merely anecdotal, but rather a strategic evolution toward embracing more efficient financial practices.

Moreover, institutional participation can instill greater confidence in stablecoins by underpinning their value with robust governance structures and compliance measures. This collaborative environment between traditional finance and emerging blockchain technologies will likely accelerate the mainstream acceptance of stablecoins in various financial applications.

Comparative Analysis: Stablecoins vs. Traditional Currencies

The essential difference between stablecoins and traditional currencies lies in their backing mechanisms and the technology that powers them. Stablecoins, particularly those pegged to established fiat currencies, offer a unique blend of stability and usability that traditional currencies struggle to provide in digital spaces. Their ability to facilitate instant and borderless transactions is a game-changer, especially for global payment networks.

In contrast, traditional currencies can be cumbersome, often involving delays due to banking hours, cross-border regulations, and intermediary fees. As the digital currency trend continues to flourish, stablecoins are increasingly positioned to challenge traditional financial paradigms and evolve into a preferred medium for transactions in a rapidly digitizing world.

User Adoption and Trust in Stablecoins

User adoption is a critical factor influencing the success of stablecoins within payment ecosystems. Unlike volatile cryptocurrencies, stablecoins offer users the familiar security of value stability akin to traditional currencies. This makes them an attractive choice for consumers who might be apprehensive about cryptocurrency due to price fluctuations. As more users become aware of the advantages stablecoins present, their trust and usage are likely to increase significantly.

Furthermore, the growth of educational initiatives surrounding digital currencies can play a substantial role in bolstering consumer confidence in stablecoins. As individuals understand how these digital assets function and their integration into everyday financial transactions, the barriers to adoption will lower, promoting a more widespread acceptance of stablecoin technologies.

The Interplay Between Stablecoins and Decentralized Finance (DeFi)

Stablecoins have carved a unique niche within the decentralized finance (DeFi) landscape, acting as bridges between traditional financial assets and blockchain-based applications. Their relatively stable value allows users to engage in various DeFi activities, such as lending, borrowing, and yield farming, without the risk of experiencing significant value fluctuations. This adaptability is pivotal for fostering greater innovation within DeFi projects.

The integration of stablecoins into DeFi platforms not only democratizes access to financial tools but also enhances liquidity and efficiency across the ecosystem. As DeFi continues to gain traction, the relationship between stablecoins and these decentralized platforms will likely redefine financial interactions, promoting a sustainable coexistence between traditional finance and innovative blockchain solutions.

Frequently Asked Questions

What are the current trends in stablecoin payment networks impacting traditional finance?

The current trends in stablecoin payment networks are significantly impacting traditional finance by fostering a convergence between blockchain technology and financial institutions. These trends include the increasing adoption of stablecoins by banks, the launching of numerous U.S. dollar-pegged tokens, and the rise of proprietary blockchains aimed at improving transaction efficiency.

How is blockchain adoption influenced by stablecoin trends?

Stablecoin trends are accelerating blockchain adoption by demonstrating practical applications in financial transactions. As institutions recognize stablecoins as viable solutions for interbank transfers and payment processing, the momentum towards integrating blockchain technology within traditional finance continues to grow.

What role does the Ripple President play in shaping knowledge about stablecoin trends?

Ripple President Monica Long plays a pivotal role in shaping knowledge about stablecoin trends by providing insights on how these developments are transforming global finance. Her observations on the implications of stablecoins for payment networks and institutional participation contribute to a better understanding of the evolving digital currency landscape.

Are stablecoin payment networks a sustainable solution for traditional finance?

Stablecoin payment networks offer a promising solution for enhancing the efficiency of traditional finance. However, sustainability depends on regulatory compliance, technological viability, and the ability to address inherent challenges similar to those faced by traditional financial systems, such as correspondent banking issues.

What is the significance of proprietary blockchains in the context of stablecoin trends?

Proprietary blockchains are significant in the context of stablecoin trends as they represent a shift toward customization and control over transaction networks. While they require substantial investment and development time to achieve decentralization and liquidity, they can potentially create more tailored solutions for specific financial applications.

| Trend | Description | Implications |

|---|---|---|

| The Stablecoin Flurry | A surge in projects launching U.S. dollar-pegged stablecoins, raising questions about market saturation. | Potential for both hype-driven releases and real-world use cases in interbank transactions. |

| Rise of Stablecoin Payment Networks | Growth of networks linked to well-known brands, with a caution on licensing limitations. | Risk of replicating traditional banking issues on blockchain if proper licensing isn’t ensured. |

| Development of Proprietary Blockchains | Companies creating their own blockchains, necessitating significant investment and development time. | Success depends on achieving decentralization, liquidity, and payment infrastructure. |

Summary

Stablecoin trends are reshaping global finance in significant ways. As Ripple President Monica Long highlights, these trends signify a deeper integration of blockchain technology within traditional financial systems. The emergence of numerous stablecoins suggests a double-edged sword of innovation and saturation, while the increasing establishment of branded payment networks reflects a paradigm shift in transaction processing. Furthermore, the move towards proprietary blockchains points to a future requiring substantial investment and time to achieve competitive advantages in the blockchain space. Overall, the influence of stablecoin trends is undeniable as they pave the way for a more interconnected and efficient global financial landscape.