Tokenization is transforming the landscape of capital markets by providing a modern approach to securities transactions. The U.S. Securities and Exchange Commission (SEC) is exploring how blockchain technologies can enhance transparency and expedite settlement processes while ensuring investor protections remain intact. As we enter a new era of digital tokens and blockchain securities, discussions around SEC tokenization offer insightful perspectives on evolving market structures. By embracing tokenization, the financial industry aims to streamline operations and address ongoing challenges in shareholder identification and corporate actions. Ultimately, this movement represents a critical step in the capital markets evolution, aligning technology with regulatory oversight to foster a more efficient market ecosystem.

In recent discussions, the concept of digital asset encoding has been spotlighted as a pivotal method for enhancing market infrastructures. This innovative technique, often referred to as asset tokenization, enables the representation of ownership and contractual rights via digital mediums on transparent ledgers. The SEC recognizes that this approach not only modernizes how securities are managed but also preserves essential regulatory frameworks. As the dialogue around blockchain integration intensifies, stakeholders are increasingly aware of the potential benefits such as improved visibility and speed in transactions. By framing the future of securities through a lens of technological advancement, the focus is squarely on the practical application of these groundbreaking tools within established regulatory boundaries.

Understanding SEC’s Vision on Tokenization and Blockchain Securities

The SEC has recognized the potential of tokenization within the evolving landscape of capital markets. Commissioner Mark T. Uyeda articulated a vision of tokenization not merely as a disruption but as a natural progression towards modernizing securities. This perspective emphasizes that regulatory frameworks will still apply, ensuring investor protections are maintained while integrating innovative technologies like blockchain. This approach opens the door for increased investment in blockchain securities, highlighting the need for regulatory clarity in a rapidly changing environment.

This shift towards embracing blockchain acknowledges that traditional methods may be insufficient for the complexities of today’s financial landscape. By framing tokenization as an extension of established practices—rather than a radical departure—Uyeda assures stakeholders that the integrity of the market will not only be preserved but enhanced. As a result, the use of digital tokens to represent securities may lead to a transformative evolution where the benefits of transparency, settlement speed, and market accessibility can be fully realized.

The Impact of Tokenization on Modernizing Securities Markets

Tokenization is set to redefine the structure of securities markets by simplifying the processes of issuing, trading, and settling securities. Uyeda’s remarks stress that encoding ownership rights directly into digital tokens on a blockchain can bring about significant operational efficiencies. This shift could result in faster settlement times and improved transparency in ownership records, which are crucial for investor confidence and market integrity. Moreover, the visibility of ownership can alleviate persistent issues surrounding shareholder identification and corporate actions.

By modernizing the securities markets through tokenization, we may also see a reduction in transaction costs and an increase in accessibility for retail investors. Digital tokens can democratize access to capital markets, allowing more individuals to participate in investments that were previously reserved for institutional players. The SEC’s encouragement of this tokenization approach indicates a long-term commitment to supporting innovation while adhering to regulatory standards, thereby balancing growth and safeguarding investor interests.

Tokenization as a Solution for Capital Markets Evolution

As the landscape of capital markets evolves, tokenization stands as a pivotal solution to existing inefficiencies and challenges. Uyeda’s assertions underline the role of blockchain technology in enhancing security and transparency. For instance, by maintaining immutable records of transactions, tokenized securities can bolster investor trust, a critical component in market operations. The clear documentation of rights and obligations on distributed ledgers can help decrease disputes and enhance overall transaction reliability.

Furthermore, adopting tokenization can lead to a significant transformation in how capital flows through markets. Real-time access to information and faster liquidation of assets can create more fluid market dynamics, benefiting all participants. By suggesting that tokenization can modernize the market infrastructure while ensuring compliance with existing laws, the SEC presents a calculated approach toward embracing innovation within the framework of investor safety.

Regulatory Considerations: The SEC’s Approach to Tokenization

Regulatory considerations play a significant role in how tokenized assets will function within the existing securities market. Commissioner Uyeda has emphasized that, despite the innovative nature of tokenization, these digital tokens remain classified as securities and are thus subject to federal regulations. This ensures that all market participants operate within a well-defined legal framework, which is crucial for maintaining investor confidence and market integrity.

The SEC’s engagement strategies, such as roundtables and public comment sessions, further demonstrate its commitment to an inclusive regulatory process. By incorporating industry feedback and facilitating discussion around on-chain market structures, the SEC aims to create a regulatory environment that fosters innovation while safeguarding regulatory compliance. This proactive stance suggests a future where tokenization can thrive alongside existing laws, ultimately driving the evolution of capital markets.

Tokenization and its Role in Market Integrity and Transparency

Market integrity is a fundamental principle that underpins the effectiveness of any financial system. As Commissioner Uyeda highlighted, tokenization has the potential to enhance this integrity by promoting transparency through the use of blockchain technology. The ability to trace the provenance of digital tokens on a distributed ledger offers a clear audit trail, which not only diminishes the risk of fraud but also empowers investors with information about their holdings and rights.

Moreover, the increased transparency afforded by tokenization can result in better corporate governance. Companies will be able to manage shareholder communications more effectively and fulfill their obligations with improved efficiency. By facilitating easier access to ownership information, tokenization can bridge the communication gaps that often exist between corporations and their investors, ultimately leading to a more robust financial ecosystem.

Challenges in Implementing Tokenization in Securities Markets

Despite its promise, tokenization does come with a host of challenges that must be addressed for successful implementation in securities markets. One primary concern is the need for robust technological infrastructure to support blockchain’s requirements. Ensuring that systems can handle the inherent complexities of digital tokens while remaining compliant with federal securities laws presents a significant hurdle.

Furthermore, the establishment of a cohesive framework that reconciles existing laws with the dynamic nature of transaction processes in tokenization is critical. While the SEC has shown interest in exploring these systems, stakeholders will need to cooperate closely with regulators to create an adaptable regulatory environment that accommodates innovation without compromising investor protections.

The Future of Investment: Embracing Tokenized Securities

As tokenization becomes increasingly integrated into the investment landscape, we can anticipate a future characterized by heightened access and inclusivity in capital markets. By leveraging digital tokens, investors from diverse backgrounds can partake in investment opportunities once limited to traditional avenues. This democratization of access may lead to a broader pool of capital and increased market participation, fostering economic growth and innovation.

Moreover, the rise of tokenized securities may encourage international investment flows, as blockchain facilitates borderless transactions. This could lead to an increase in participation from global investors, impacting liquidity and the overall dynamism of financial markets. As regulatory frameworks evolve to accommodate these changes, the potential for growth in the realm of digital assets presents an exciting frontier for investors and market participants alike.

SEC’s Role in Shaping the Tokenization Discourse

The SEC’s involvement in the conversation around tokenization is crucial for establishing a foundational understanding of how digital tokens will operate in the broader securities market. As the Commission evaluates new technologies and business models, its guidance will influence how companies adopt tokenization strategies while remaining compliant with existing regulations. This leadership role is essential to ensure that the industry develops in a manner that is safe, secure, and beneficial for all stakeholders.

In providing clarity and support for the innovation surrounding blockchain securities, the SEC can encourage the growth of a resilient framework that enhances market integrity and investor confidence. The collaboration between regulators, industry experts, and stakeholders will be vital in shaping the future of tokenization, ensuring it serves as a transformative tool that strengthens the capital markets and benefits society at large.

Innovative Solutions Offered by Tokenization

Tokenization presents innovative solutions to many of the longstanding challenges faced by the traditional securities markets. For example, the ability to create fractional ownership through digital tokens allows smaller investors to participate in high-value assets that they would not typically be able to access. This opens up investment opportunities that were previously available only to wealthier individuals or institutional investors, thereby fostering a more equitable financial landscape.

Additionally, tokenization can streamline administrative tasks such as compliance, reporting, and account management. With the right blockchain infrastructure in place, these procedures can be automated, reducing potential errors and cutting down on resources spent on administrative overhead. As a result, companies can save time and money while ensuring regulatory compliance, reinforcing the argument for the adoption of tokenization as a standard practice in capital markets.

Tokenization: Bridging Traditional and Digital Asset Markets

As markets evolve, tokenization plays a vital role in bridging the gap between traditional finance and the growing digital asset ecosystem. By creating a hybrid model where digital tokens coexist with traditional securities, the industry can provide investors with a broader array of options. This blending of assets can promote innovation and serve the diverse needs of investors, from those seeking stability in traditional equities to the tech-savvy individuals looking for exposure to blockchain-based investments.

The SEC’s cautious approach signals a willingness to explore this integration while maintaining a strong regulatory framework. As tokenization continues to gain traction, it will be essential for regulators to ensure that these new financial instruments operate within the spirit of existing laws, thereby preserving the confidence of investors. In this way, tokenization can pave the way for a more integrated financial market that meets the demands of a modern economy.

Frequently Asked Questions

What is tokenization in the context of blockchain securities?

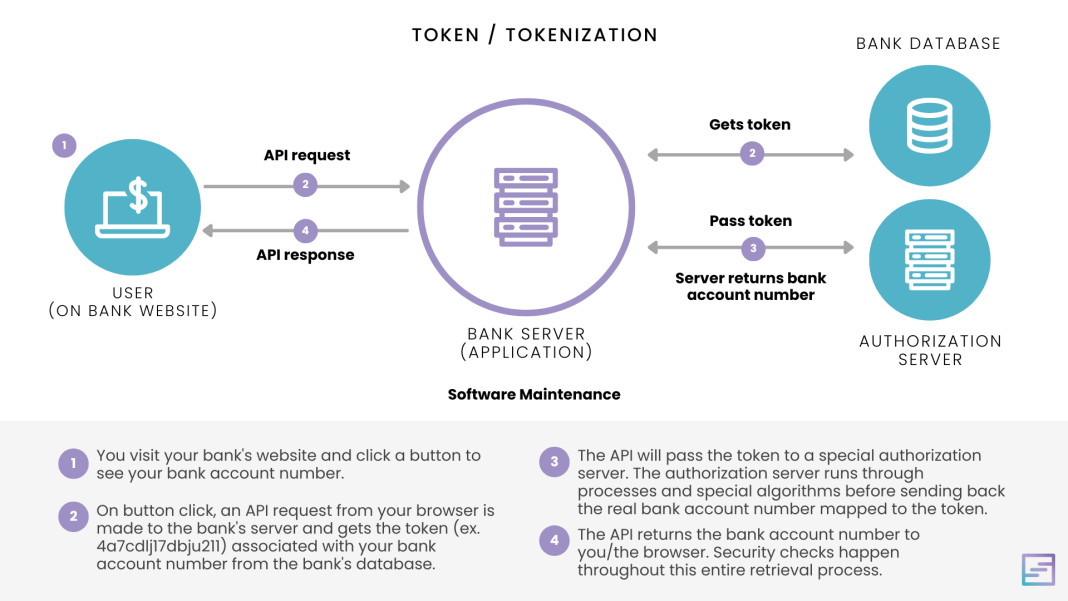

Tokenization refers to the process of converting ownership and contractual rights into digital tokens that are recorded on a blockchain. In the context of blockchain securities, it simplifies the issuance, trading, and post-trade processes, enhancing transparency and security.

How is the SEC approaching the regulation of tokenization for modernizing securities markets?

The SEC is considering tokenization as a way to modernize U.S. securities markets, emphasizing that while adopting blockchain technologies, these innovations must comply with existing federal securities laws to ensure investor protection.

What benefits does tokenization offer in the evolution of capital markets?

Tokenization can enhance the efficiency of capital markets by enabling faster settlement times, improving transparency in ownership, and reducing challenges related to shareholder identification and corporate actions.

Can tokenized instruments be exempt from SEC regulations?

No, according to SEC Commissioner Mark Uyeda, tokenized instruments are still classified as securities and remain subject to all existing regulatory obligations, which includes oversight by the SEC.

Why is the SEC exploring on-chain market structures through tokenization?

The SEC is exploring on-chain market structures to foster innovation while ensuring regulatory compliance. This approach aims to create a more efficient, transparent, and secure capital markets environment through the use of tokenization.

What are the implications of faster settlement cycles in tokenized securities markets?

Faster settlement cycles in tokenized securities markets can lead to reduced friction, greater market integrity, and enhanced transparency, as ownership becomes more visible and readily verifiable on blockchain systems.

How does tokenization align with the SEC’s vision for modernized capital markets?

Tokenization aligns with the SEC’s vision by supporting the evolution of capital markets through advanced technology, allowing for improved security measures and investor protections while increasing operational efficiency.

What is meant by the statement that tokenization is part of market evolution?

Tokenization is framed by the SEC as a natural progression in the ongoing evolution of market infrastructure, driven by technology advancements rather than a disruption to existing processes.

| Key Point | Details |

|---|---|

| SEC’s Perspective on Tokenization | Mark T. Uyeda emphasized that tokenization is part of an evolutionary process in the markets, enhancing current structures rather than disrupting them. |

| Benefits of Tokenization | Tokenization can improve transparency, security, and efficiency in the issuance and trading of securities by recording rights on blockchain. |

| Regulatory Compliance | Tokenized instruments remain under SEC jurisdiction and must comply with existing securities laws. |

| Innovation within Guardrails | The SEC is focused on fostering innovation while ensuring adherence to regulations through public engagement and guidance. |

| Faster Settlement Importance | Advancements from tokenization can lead to faster settlement times, addressing issues in shareholder identification and corporate actions. |

Summary

Tokenization is a significant evolution in the securities market, as highlighted by SEC Commissioner Mark T. Uyeda. This approach not only promises improved efficiency and transparency but also ensures strict adherence to existing regulatory frameworks, which safeguard investor protections. The SEC’s focus on technology-neutral guidelines illustrates a commitment to fostering innovation while upholding market integrity. As tokenization gains momentum, its ability to streamline processes and enhance visibility is crucial for the modernization of capital markets.