Tokenized assets are revolutionizing the landscape of digital finance, presenting a compelling fusion of blockchain technology and traditional banking. As leading financial institutions embrace this innovation, they pave the way for groundbreaking advances in onchain investing, allowing for a seamless blend of physical and digital assets. Recently, Wisdomtree has partnered with BNY Mellon, signaling a transformative shift within blockchain banking that enhances accessibility to tokenized real-world assets. This partnership not only boosts institutional confidence but also integrates stablecoins and other digital instruments into the financial framework, creating new pathways for asset management. With their collaboration, Wisdomtree and BNY are leading the charge toward a more inclusive and streamlined financial system.

In the evolving domain of financial technology, the advent of digitized assets marks a pivotal shift towards a more integrated economic model. By leveraging blockchain infrastructure, businesses can now facilitate transactions involving onchain investments and token conversions in a secure environment. This transformative movement combines the strengths of conventional banking with innovative approaches like those evident in Wisdomtree’s partnership with BNY Mellon. As regulatory frameworks become more adaptable, the reliance on digital currencies, including stablecoins, is set to increase, influencing the future of banking. Through this merging of assets, both businesses and consumers stand to benefit from a more dynamic and efficient financial ecosystem.

The Rise of Onchain Investing and Tokenized Assets

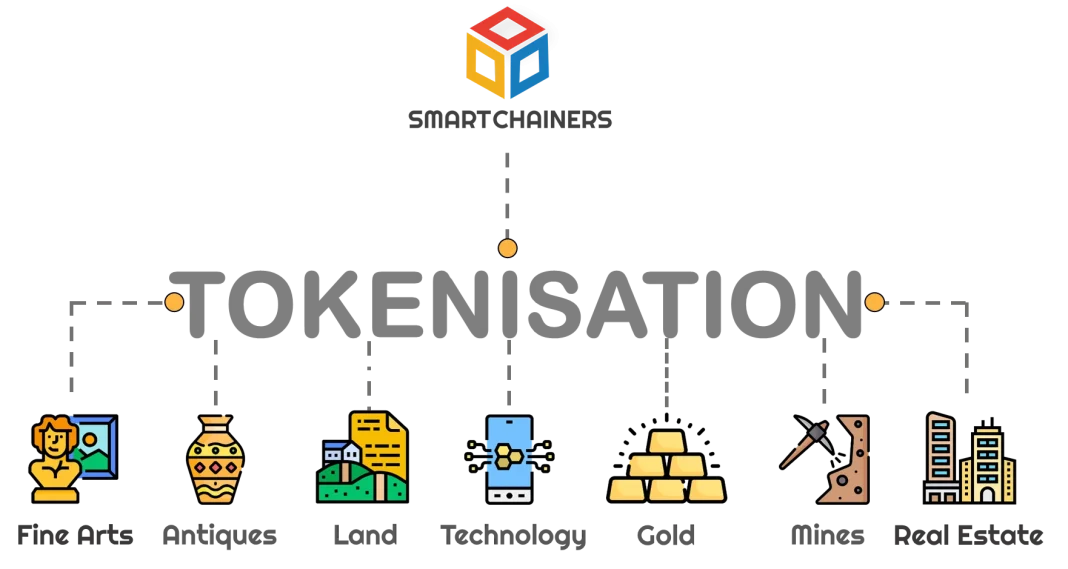

Onchain investing is gaining momentum as more investors recognize the advantages of integrating blockchain technology into their financial strategies. By utilizing tokenized assets, individuals can invest in a variety of real-world financial products through decentralized platforms. These innovations are revolutionizing the way investments are made, offering unparalleled accessibility and transparency for investors. Tokenization not only streamlines the process but also democratizes investment opportunities by providing lower entry barriers for a broader audience.

The strategic partnership between Wisdomtree and BNY Mellon is a clear indicator of the growing significance of tokenized assets in the investment landscape. As they bridge traditional finance with avant-garde technology, these financial powerhouses are setting a precedent for others in the industry. Tokenized assets, such as stablecoins and digital funds, are becoming indispensable components of modern portfolios, reflecting the shift toward embracing digital finance solutions in the ever-evolving market.

Exploring the Wisdomtree and BNY Mellon Blockchain Collaboration

The collaboration between Wisdomtree and BNY Mellon is a seminal move aimed at enhancing the digital finance ecosystem. This partnership allows Wisdomtree to leverage BNY’s proven banking capabilities while venturing into the world of blockchain. By providing access to tokenized real-world assets through the Wisdomtree Prime platform, they are setting the stage for retail investors to engage in onchain investing with ease. This initiative signifies a larger trend of traditional financial institutions adapting to the digital age and integrating established banking practices with blockchain technology.

Furthermore, the partnership exemplifies how traditional finance is evolving to accommodate the digital landscape. Through advanced blockchain infrastructures, this collaboration not only facilitates on and off-ramp capabilities for users but also establishes a reliable framework for digital asset management. This convergence is critical in fostering a secure environment for onchain investing, thereby enhancing investor confidence in utilizing tokenized assets.

Stablecoins and Their Importance in Digital Finance

Stablecoins have emerged as a cornerstone of digital finance, offering a much-needed link between traditional currencies and the cryptocurrency markets. They enable seamless transactions and can serve as a stable medium of exchange in the often volatile world of digital assets. Wisdomtree’s focus on integrating stablecoins into their offerings highlights the critical role these assets play in financial innovations. Whether for trading, investing, or providing liquidity, stablecoins are becoming increasingly crucial for both retail investors and institutions alike.

The Wisdomtree and BNY Mellon partnership recognizes the importance of stablecoins in today’s market. By incorporating stablecoin conversions and blockchain transfers into their offerings, they enhance the overall appeal and usability of the Wisdomtree Prime platform. This not only positions them at the forefront of digital asset management but also reassures investors in the stability and reliability of their investments in a world transitioning toward blockchain banking.

The Future of Blockchain Banking and Digital Finance

As the landscape of finance continues to evolve, the future appears bright for blockchain banking. The integration of digital assets into mainstream financial systems promises to revolutionize how people manage money, invest, and conduct transactions. The collaboration between Wisdomtree and BNY Mellon reflects a broader shift towards recognizing the potential of blockchain technology and its impact on established banking practices. This partnership is indicative of a growing trend where traditional institutions are increasingly open to adopting innovative technologies.

Looking ahead, blockchain banking is set to redefine the financial services industry. With the ongoing development of tokenized assets and enhanced security measures, the transition to digital finance will be expedited. The ability for institutions to offer regulated, compliant financial products in a decentralized manner opens up exciting new opportunities for asset management and investment strategies. The collaboration between Wisdomtree and BNY Mellon is just the beginning of a transformative journey towards a more integrated and efficient financial ecosystem.

Understanding the Role of Institutions in Digital Asset Integration

The involvement of institutions like BNY Mellon in digital asset spaces significantly enhances the credibility and institutional acceptance of blockchain technologies. As pioneers in the field, these traditional entities are instrumental in bridging the gap between conventional finance and the inevitable shift toward digital platforms. The Wisdomtree-BNY Mellon partnership underscores how critical institutional support is for fostering confidence in tokenized assets and blockchain innovations. Such collaborations are vital as they provide the necessary infrastructure and regulatory compliance that many potential investors look for.

Moreover, the institutional backing creates a safety net for investors navigating the complexities of onchain investing. With established banks providing custody services and overseeing transactions involving tokenized assets and stablecoins, this ensures greater protection against risks associated with digital investments. As the integration of digital assets deepens, more financial institutions will likely explore similar partnerships, paving the way for a robust system that supports both innovation and security.

Tokenized Assets: A Game Changer for Retail Investors

Tokenized assets represent a groundbreaking advancement in the investment landscape, particularly for retail investors who have often faced barriers to entry in traditional finance. The ability to invest in fractional ownership through digital means allows for a more inclusive approach to wealth-building. The collaboration between Wisdomtree and BNY Mellon highlights the increasing accessibility of these tokenized products, making it easier for a broader audience to participate in onchain investing.

This shift not only empowers retail investors but also enhances market liquidity by widening the pool of participants. As more individuals are able to engage with tokenized assets, the potential for market growth becomes exponential. Partnerships like that of Wisdomtree and BNY Mellon serve to bridge the knowledge gap and offer the necessary resources for investors, ultimately fostering a more vibrant investing ecosystem centered around digital finance.

The Impact of Partnership on Tokenized Funds

The Wisdomtree and BNY Mellon partnership is poised to have a significant impact on the realm of tokenized funds. By combining Wisdomtree’s innovative financial products with BNY’s robust infrastructure, this collaboration stands to enhance the development and implementation of tokenized investment solutions. As traditional finance blends with blockchain technology, the operational efficiencies gained through these tokenized funds can lead to cost reductions and improved accessibility for investors.

Moreover, the potential for stablecoin conversions and the ability to manage diverse assets within a single platform allows investors to diversify their portfolios in ways that were previously not possible. The partnership not only aims to streamline the investment process but also ensures that tokenized funds meet regulatory standards, thus providing reassurance to investors concerning the security and compliance of their investments.

Enhancing Investor Confidence in Digital Finance

Instilling confidence in digital finance and the associated technologies is key to widespread adoption among investors. The strategic partnership between Wisdomtree and BNY Mellon is a significant step in that direction, as it combines the reliability of an established banking institution with the innovative potential of blockchain technology. This collaboration highlights the ongoing commitment of both entities to reinforce investor trust through compliance, security, and robust infrastructure.

By offering accessible platforms for onchain investing and promoting transparent operations, such partnerships strive to alleviate the apprehensions that many investors have regarding digital assets. As institutional entities take the lead in providing trustworthy solutions, the clear pathways for investors will likely catalyze a broader acceptance of digital finance, leading to increased confidence in tokenized assets and their place in modern portfolios.

Future Trends in Blockchain Banking and Digital Transformation

The ongoing evolution of blockchain banking is anticipated to usher in several trends that will shape the future of digital finance. As more institutions like BNY Mellon collaborate with innovative firms like Wisdomtree, the rapid integration of blockchain technology is set to redefine financial products and services. This transformation will enable not only increased efficiency and security in transactions but also pave the way for new asset classes and investment opportunities through tokenized assets.

Additionally, as awareness and knowledge about tokenized assets and stablecoins grow, we can expect a more informed investor base eager to explore onchain investing. Educational initiatives and user-friendly technologies will likely emerge to support this transformation, ensuring that the broader public can engage meaningfully with digital finance. The commitment to enhancing these digital frameworks will inevitably lead to a more interconnected and robust financial landscape, bridging traditional and modern financial practices.

Frequently Asked Questions

How do tokenized assets relate to blockchain banking?

Tokenized assets leverage blockchain banking to represent real-world assets digitally, facilitating secure and efficient transactions. This process enhances liquidity and provides broader access to diverse investment opportunities within traditional finance.

What role do stablecoins play in the adoption of tokenized assets?

Stablecoins serve as a bridge between traditional banking and digital finance, providing stability and facilitating seamless transactions in the tokenized asset market. Their integration enhances confidence among users when engaging in onchain investing.

What are the benefits of onchain investing in tokenized assets?

Onchain investing in tokenized assets offers lower transaction costs, increased transparency, and enhanced accessibility for retail investors, making it easier to diversify portfolios with blockchain-based products.

How does the Wisdomtree BNY partnership enhance access to tokenized real-world assets?

The Wisdomtree and BNY Mellon partnership expands access by utilizing advanced blockchain banking solutions, allowing users to trade and invest in tokenized real-world assets with improved efficiency and security.

What impact will blockchain technology have on digital finance and tokenized assets?

Blockchain technology is poised to revolutionize digital finance by providing a secure, decentralized infrastructure that enables the creation, trading, and management of tokenized assets, ultimately leading to greater financial inclusion.

In what ways can users benefit from using Wisdomtree Prime for tokenized assets?

Users of Wisdomtree Prime can benefit from easy access to diverse tokenized assets, the ability to conduct stablecoin conversions, and participate in efficient onchain investing, all backed by BNY Mellon’s established banking framework.

How will the collaboration between Wisdomtree and BNY Mellon influence the future of financial services?

This collaboration sets the stage for further integration of tokenized assets within regulated financial systems, fostering innovation and encouraging other institutions to explore blockchain banking solutions for modernized financial services.

What are the current trends in tokenized assets and their impact on traditional finance?

Current trends show an increasing adoption of tokenized assets among financial institutions, which is bridging the gap between traditional finance and blockchain, enhancing operational efficiencies and creating new investment opportunities for users.

| Key Aspects | Details |

|---|---|

| Partnership Announcement | Wisdomtree partners with BNY Mellon for onchain banking on October 28. |

| Significance | The partnership integrates traditional banking with blockchain, enhancing access to tokenized assets. |

| Key Features | Provides access to tokenized real-world assets, digital funds, onchain gold, and stablecoin conversions. |

| BNY Mellon’s Role | Acts as the core banking-as-a-service provider, supporting the infrastructure for Wisdomtree’s digital asset platform. |

| Market Impact | Increases institutional confidence in tokenized assets, paving the way for broader adoption in finance. |

Summary

Tokenized assets are at the forefront of transforming digital finance as evidenced by the innovative partnership between Wisdomtree and BNY Mellon. This collaboration not only bridges traditional banking and blockchain technology but also expands access to a diverse range of tokenized real-world assets, reinforcing the significance of these assets in modern financial systems. With the introduction of new functionalities aimed at enhancing user experience on the Wisdomtree Prime platform, this partnership symbolizes a pivotal moment in the evolution of finance, encouraging greater institutional trust and paving the way for future growth in the tokenized assets market.