The Trump International Hotel Maldives promises to be a groundbreaking destination, set to transform the landscape of luxury travel in the Indian Ocean. Scheduled for completion by the end of 2028, this opulent resort will boast approximately 80 ultra-luxury beach and overwater villas, offering a unique experience just 25 minutes by speedboat from Malé. In a pioneering move, the partners are introducing the world’s first tokenized hotel investment, enabling investors to engage actively during the development phase. This innovative approach, spearheaded by Eric Trump and the Dar Global team, is poised to redefine real estate development in the Maldives and attract attention from savvy investors worldwide. With the Trump International Hotel Maldives, guests can expect an unparalleled blend of elegance, innovation, and investment opportunity in one of the most sought-after destinations on the planet.

The upcoming establishment in the Maldives, known as the Trump International Hotel Maldives, signifies a major advance in ultra-luxury resort development. This project stands out not only for its exquisite accommodations but also for its innovative tokenized hotel investment strategy, allowing early-stage participation in its creation. Led by the collaborative efforts of Eric Trump and Dar Global, this venture aims to elevate the standards of luxury beach villas in the region while reshaping the conventional methods of real estate investment. Positioned uniquely in the thriving real estate sector of the Maldives, the project highlights a strategic blend of luxury and avant-garde investment techniques. With a target opening in 2028, this development signals an exciting new era for both travelers and investors alike.

Trump International Hotel Maldives: A New Era of Luxury

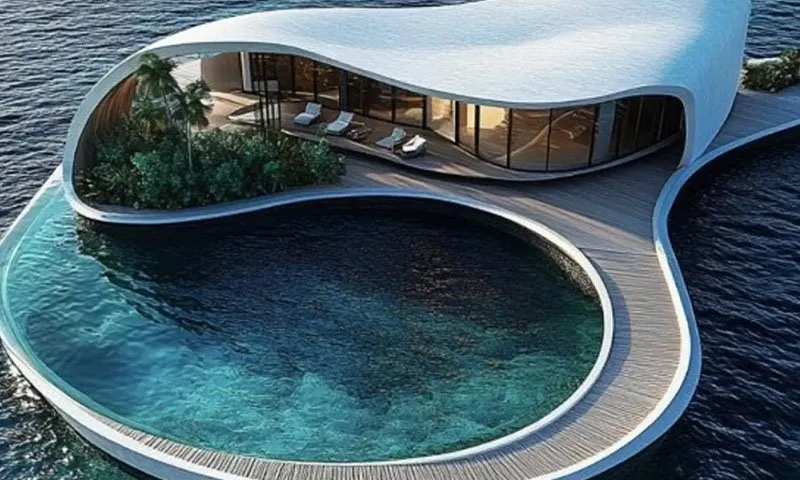

The Trump International Hotel Maldives is set to become a landmark in luxury accommodation in one of the world’s premier travel destinations. This exquisite resort will feature approximately 80 ultra-luxury beach and overwater villas, ensuring a unique experience that combines comfort with majestic views of the Indian Ocean. As travelers seek opulent escapes, the Trump International Hotel Maldives promises to be the ultimate retreat, showcasing bespoke service and exquisite designs that harmonize with the Maldives’ natural beauty.

Located just 25 minutes from Malé by speedboat, accessibility is another feature that makes the Trump International Hotel Maldives particularly appealing to tourists and investors. Each villa will incorporate modern amenities alongside traditional Maldivian elements, creating an intimate atmosphere for guests. This natural blend of luxury and environment is expected to attract high-profile tourists, establishing the hotel as a nexus of luxury beach villas in Maldives.

Frequently Asked Questions

What luxurious amenities will the Trump International Hotel Maldives offer in its beach villas?

The Trump International Hotel Maldives will feature approximately 80 ultra-luxury beach and overwater villas that offer premium amenities. Guests can expect opulent designs, private pools, expansive views, and direct access to the stunning beaches, all designed to provide a world-class experience.

How is the Trump International Hotel Maldives utilizing tokenized hotel investment?

The Trump International Hotel Maldives is pioneering the world’s first tokenized hotel development, enabling investors to participate in the project’s growth during its early development phase rather than waiting until the completion of the project. This innovative approach aims to redefine real estate investment in ultra-luxury resorts.

What is the expected opening date for the Trump International Hotel Maldives?

The expected opening date for the Trump International Hotel Maldives is by the end of 2028, inviting both local and international guests to experience the unmatched luxury it promises.

Who is leading the Eric Trump Maldives project?

The Eric Trump Maldives project is being led by Eric Trump in partnership with Ziad El Chaar. They are collaborating to merge the expertise of Dar Global’s development platform with The Trump Organization’s branding to establish a flagship resort in the Maldives.

What types of villas can guests expect at the Trump International Hotel Maldives?

Guests at the Trump International Hotel Maldives can expect a selection of ultra-luxury beach and overwater villas, each designed to provide an extraordinary experience in one of the world’s most beautiful destinations.

How does the tokenization model at Trump International Hotel Maldives differ from traditional real estate investments?

The tokenization model at Trump International Hotel Maldives focuses on the development phase, allowing early investors to engage with the project from its inception, unlike traditional models that focus on investing in completed assets.

Will potential investors in the Trump International Hotel Maldives receive updates on investment opportunities?

Yes, potential investors will be provided with detailed offering terms and regulatory information by Dar Global, with updates and eligibility criteria subject to local jurisdictional regulations.

What makes the Trump International Hotel Maldives a unique investment opportunity?

The Trump International Hotel Maldives represents a unique investment opportunity due to its combination of luxury in a stunning tropical location, the innovative tokenized investment model, and a strong brand partnership aimed at delivering an unparalleled hospitality experience.

| Key Points | Details |

|---|---|

| Announcement Date | November 17, 2025, in Dubai |

| Location | Maldives, 25 minutes by speedboat from Malé |

| Number of Villas | Approximately 80 ultra-luxury beach and overwater villas |

| Opening Date | Scheduled for the end of 2028 |

| Tokenization Initiative | World’s first tokenized hotel development allowing early investor participation |

| Leadership | Led by Eric Trump and Ziad El Chaar |

| Investment Approach | Focus on the development phase rather than a completed asset |

| Quote from Eric Trump | “Will redefine luxury and establish a new benchmark for innovation in real estate investment.” |

Summary

Trump International Hotel Maldives is set to redefine luxury and innovation in the hospitality sector. Slated to open by the end of 2028, this remarkable resort will feature around 80 ultra-luxury beach and overwater villas located just a short speedboat ride from Malé. Notably, the project introduces a groundbreaking tokenization initiative, allowing investors to engage during the development phase, which distinguishes it from traditional investments in completed properties. Led by Eric Trump and Ziad El Chaar, the project aspires to create a new standard in real estate while providing unique investment opportunities in the expanding Maldivian luxury market. As the launch date approaches, further details on investment terms will be unveiled, promising to attract both local and global investors.