Trump Real Estate Tokenization is reshaping how investors access marquee properties, turning elite portfolios into blockchain-enabled opportunities. Leading the charge, World Liberty Financial WLFI aims to bring assets like Trump Tower Dubai tokenization to a broader audience through secure tokenized shares. By leveraging blockchain real estate tokenization, these tokens can democratize ownership, offering fractional, liquid exposure to tokenized real estate investments. The plan includes premium properties such as Trump Tower Dubai and other tokenized luxury properties, backed by World Liberty Financial WLFI’s stablecoin and secure custody. As momentum builds, this initiative could unlock institutional-grade access for individual investors and spark broader adoption of real-world assets on the blockchain.

Seen from another angle, the trend leverages on-chain property ownership and fractionalized assets to reframe how real estate is funded. This approach translates into token-based exposure to premier developments, allowing smaller investors to participate in tokenized real estate investments without traditional gatekeeping. Using blockchain-enabled property shares, high-value portfolios like luxury towers can be accessed through secure, tradeable digital tokens. The effort is steered by platforms like World Liberty Financial WLFI, signaling a shift toward democratized, data-driven real estate finance.

Trump Real Estate Tokenization: Democratizing Access to Premium Properties

Zach Witkoff, co-founder of World Liberty Financial (WLFI), is exploring tokenization of the Trump family’s premium real estate portfolio, including Trump Tower Dubai. This push toward blockchain-enabled ownership could allow everyday investors to access assets that have historically been reserved for institutions and wealthy buyers.

In envisioning tokenized real estate investments, WLFI frames tokenization as a democratizing step for high-end assets. Blockchain real estate tokenization could transform how ownership is distributed and traded, potentially creating liquidity for properties that have traditionally been illiquid and enhancing transparency through blockchain-based shares.

World Liberty Financial WLFI: Driving the Trump Property Tokenization Initiative

World Liberty Financial (WLFI) is positioned at the center of the initiative, with efforts to bring portions of the Trump family’s real estate portfolio onto the blockchain. The company’s leadership emphasizes building a framework where tokenized shares make premium properties accessible to a broader investor base.

WLFI has already launched a USD1 stablecoin and is expanding into lending and borrowing, highlighting how its broader financial infrastructure can support tokenized assets. This emphasis on a specialized treasury approach, including ALT5 Sigma’s guidance on tokenization across real estate and private funds, signals a concerted move toward integrating crypto finance with traditional property investment.

Trump Tower Dubai Tokenization: A Case Study in Blockchain Real Estate

Among the projects under consideration is the 80-story Trump Tower International Hotel and Tower in Dubai, which could become a flagship example of Trump Tower Dubai Tokenization. The plan envisions tokenized ownership that enables fractional investment in a marquee luxury development with panoramic views of the Burj Khalifa.

As a case study in blockchain real estate tokenization, this project illustrates how tokenized luxury properties can bring high-profile assets into a blockchain-based investment framework. The potential for a broader audience to participate in a globally recognized asset aligns with the momentum seen as institutional players begin to experiment with tokenized funds.

Tokenized Real Estate Investments: Expanding Access Beyond Institutions

Tokenized real estate investments could redefine who participates in premium property markets by converting ownership into blockchain-backed tokens. This approach promises greater accessibility for individual investors who previously faced barriers to entry into elite real estate.

The concept aligns with a wider industry shift toward liquidity and fractional ownership, enabling investors to diversify portfolios across iconic buildings and luxury properties through secure, transparent digital shares.

Tokenized Luxury Properties: Redefining Access to Premium Real Estate

Tokenized luxury properties are at the forefront of the real estate tokenization narrative, offering fractions of appreciation and income streams in blockchain form. Luxury developments, such as those associated with Trump’s portfolio, stand to gain from increased market participation.

Blockchain-enabled ownership models for tokenized luxury properties could enhance transparency, enable faster settlement, and reduce traditional frictions in high-end real estate markets, ultimately broadening the pool of potential investors.

Blockchain Real Estate Tokenization: Navigating Regulation and Adoption

As real estate tokenization moves from concept to practice, regulatory considerations and market adoption remain central. The Trump family property tokenization initiative underscores both the opportunity and the need for clear rules governing ownership, transfers, and custody on blockchain platforms.

Industry participants are watching how institutions, including asset managers and regulators, address compliance, investor protection, and risk management as they test tokenized real estate investments and related products.

WLFI’s Stablecoin and Lending Plans Support Tokenized Assets

World Liberty Financial’s USD1 stablecoin presence signals how a dedicated digital currency can underpin tokenized property markets, enabling smooth on-chain transactions, collateral, and potentially lending against tokenized assets.

Beyond stablecoins, WLFI’s plans to enter lending and borrowing for tokenized real estate assets illustrate an integrated ecosystem where tokenized ownership pairs with decentralized finance tools to support liquidity and financing options.

ALT5 Sigma and the Push for Real Estate Tokenization

Witkoff chairs ALT5 Sigma, a treasury firm focused on promoting tokenization across real estate and private funds. This leadership ties into a broader strategy to standardize and scale tokenized ownership models for premium properties.

ALT5 Sigma’s role highlights how specialized financial infrastructure can help align governance, custody, and settlement for tokenized real estate investments, further supporting a global shift toward blockchain-enabled asset markets.

Token2049 Spotlight: Crypto Meets Real Estate with Trump-Linked Projects

Witkoff discussed the Trump real estate tokenization initiative at Token2049, a conference known for bridging crypto and traditional finance. The dialogue signals growing interest in integrating blockchain technology with landmark real estate assets.

Events like Token2049 help accelerate the adoption curve for tokenized real estate investments by connecting developers, investors, and technology providers who can build scalable tokenization platforms and governance models.

Strategic Vision: A Global Portfolio on the Blockchain

If successful, the Trump family’s global property portfolio could become a high-visibility test case for blockchain-based ownership across continents. The prospect of tokenized real estate investments on a portfolio of premium assets underscores the potential to unlock international participation.

This strategic vision aims to demonstrate how tokenized luxury properties and iconic landmarks can be represented on a unified blockchain platform, enabling cross-border ownership, faster settlement, and enhanced investor confidence.

Transparency, Security, and Investor Confidence in Tokenized Real Estate

Tokenization emphasizes transparency and security through immutable ledgers, providing investors with clearer visibility into ownership, cash flows, and asset performance. For premium assets like Trump properties, this can strengthen confidence among retail and institutional participants.

As tokenized real estate markets mature, robust custody solutions, regulatory compliance, and standardized disclosures will be essential to sustain investor trust and ensure the long-term viability of blockchain-based property investments.

Future Outlook: From Elite Access to Widespread Participation in Real Estate

The ongoing exploration of Trump real estate tokenization points to a future where blockchain-enabled access to luxury properties could become more mainstream. The combination of tokenized ownership and improved market infrastructure may expand participation beyond traditional gatekeepers.

Ultimately, the integration of blockchain technology with premium real estate aims to create a more liquid, transparent, and inclusive market for real estate investments, where tokenized real estate investments can scale across diverse property types and geographies.

Frequently Asked Questions

What is Trump Real Estate Tokenization and how does Trump Tower Dubai tokenization illustrate this concept?

Trump Real Estate Tokenization is the process of converting ownership in Trump family properties into digital tokens on a blockchain. Trump Tower Dubai tokenization is cited as a flagship example, enabling blockchain real estate tokenization where investors can hold tokenized shares representing a stake in premium real estate. This approach aligns with WLFI’s broader effort to make tokenized real estate investments more accessible.

How does blockchain real estate tokenization enable tokenized real estate investments in Trump properties?

Blockchain real estate tokenization converts real estate ownership into tradable tokens on a secure ledger. For Trump properties, investors would buy tokens that represent ownership or income rights, allowing liquidity, fractional ownership, and easier transfer of interests. This model aims to democratize access to tokenized real estate investments that were once limited to institutions and wealthy buyers.

Who is World Liberty Financial WLFI and what is their role in Trump Real Estate Tokenization?

World Liberty Financial (WLFI) is a treasury-focused firm led by Zach Witkoff that promotes tokenization across real estate and private funds. WLFI is involved in planning the tokenization of Trump family properties, including Trump Tower Dubai, and has signaled broader aims such as issuing a USD1 stablecoin and expanding into lending and borrowing within a tokenized real estate ecosystem.

Which properties could be included in tokenized luxury properties under Trump Real Estate Tokenization?

Initial focus areas include high-profile projects like Trump Tower Dubai, with discussions extending to other premium assets such as the Trump Tower International Hotel and Tower in Dubai. Tokenized luxury properties would leverage blockchain to offer fractional ownership and transparent performance data to investors.

What are the potential benefits and risks of tokenized real estate investments in this Trump project?

Benefits include greater liquidity, broader access to premium assets, transparent ownership records, and the ability to trade tokenized shares on a blockchain. Risks involve regulatory hurdles, valuation challenges, custody of tokens, and market liquidity—factors that have historically slowed adoption in real estate tokenization, though momentum is growing as large players explore tokenized funds.

How might Trump Real Estate Tokenization democratize access to premium assets?

By converting property ownership into tradable tokens, tokenized real estate investments lower barriers to entry for everyday investors, enabling participation in prestigious properties that were once limited to institutions or high-net-worth buyers. This democratizing step is a core aim of blockchain real estate tokenization initiatives led by WLFI and its partners.

What is the role of WLFI’s USD1 stablecoin in tokenized luxury properties and real estate tokens?

WLFI’s USD1 stablecoin is part of the broader platform intended to facilitate transactions, lending, and borrowing within the tokenized real estate ecosystem. A stablecoin can provide price stability for trading tokens tied to luxury properties and support liquidity in tokenized real estate investments.

What regulatory and market considerations should investors understand for Trump Real Estate Tokenization?

Investors should be aware of regulatory hurdles that often accompany real estate tokenization, including securities laws and compliance requirements. While momentum is building as institutional players experiment with tokenized funds and properties, outcomes remain contingent on regulatory developments, investor protections, and market demand surrounding tokenized luxury properties and blockchain real estate tokenization.

| Key Point | Details |

|---|---|

| What is being tokenized | Trump family real estate portfolio is being explored for tokenization on the blockchain, starting with high-profile properties such as Trump Tower Dubai; the goal is to issue blockchain-based ownership shares that make premium real estate accessible to everyday investors. |

| Main actors | World Liberty Financial (WLFI) and co-founder Zach Witkoff are driving the effort; Donald Trump Jr. joined at the Token2049 conference; ALT5 Sigma is a treasury firm promoting real estate tokenization. |

| Target projects | Trump Tower Dubai is the initial focus, with consideration of the 80-story Trump Tower International Hotel and Tower in Dubai, including a members-only club, luxury penthouses, and views of the Burj Khalifa. |

| Technology and instruments | Ownership would be represented by blockchain-based tokens. WLFI has issued a USD1 stablecoin and plans to expand into lending and borrowing. |

| Rationale / democratization | Tokenization is framed as a democratizing step to widen access to premium real estate by converting ownership into tradable tokens; quote highlights the idea of buying a single token of a landmark property. |

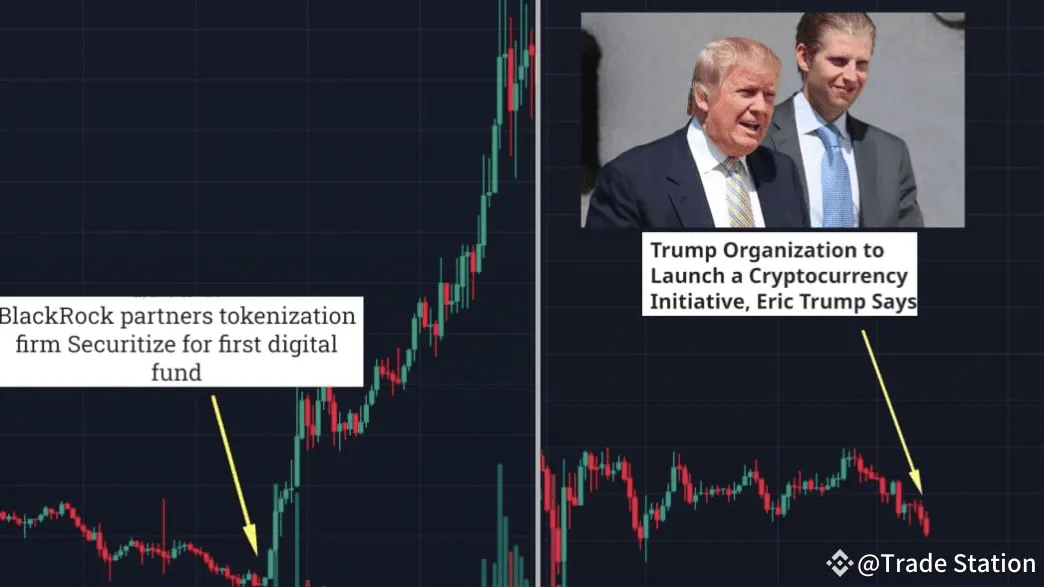

| Regulatory and market context | Real estate tokenization has faced regulatory hurdles, but momentum is building as institutional players (e.g., BlackRock) experiment with tokenized funds. |

| Timeline / next steps | Plans were unveiled at the Token2049 conference; the initiative could begin with high-profile projects like Trump Tower Dubai, with broader rollout to follow depending on regulatory and market conditions. |

| Strategic significance | If successful, this portfolio could become one of the most visible test cases for tokenized, globally accessible real estate. |

| Notable quotes / public statements | Witkoff described tokenization as a democratizing step and posed questions like buying one token of Trump Tower Dubai to illustrate accessibility. |

Summary

End of table.